Complaint Review: Washington Mutual - Chicago Illinois

- Washington Mutual wamu.com Chicago, Illinois U.S.A.

- Phone:

- Web:

- Category: Banks

Washington Mutual Will go bankrupt with WaMu's "services" Chicago Illinois

*Consumer Comment: Here is the catch...

*Consumer Comment: GROW UP!!!

*Author of original report: Additional comment from author

*Consumer Comment: Fiscal Responsibility

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

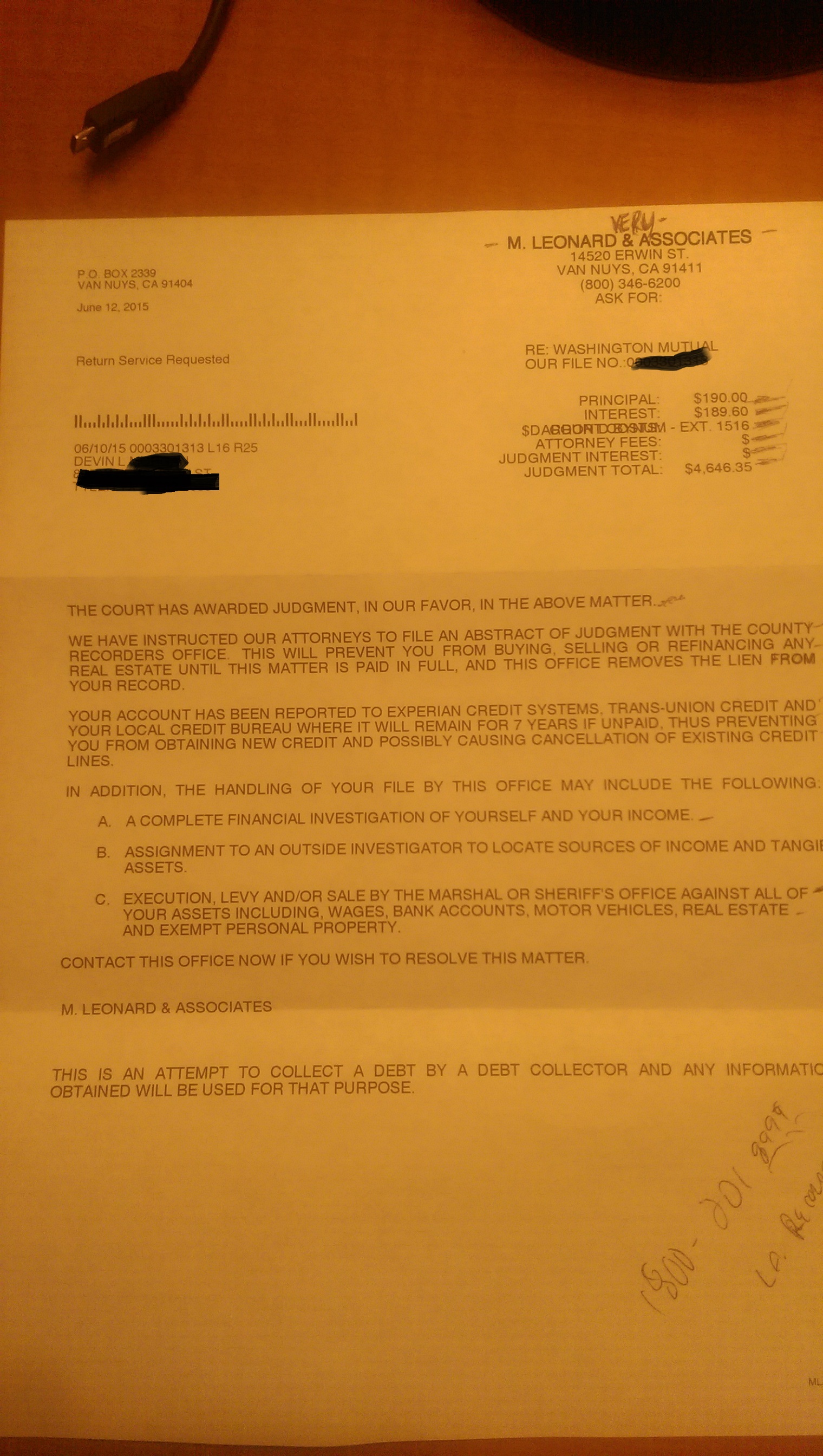

Wiithin about 3 months time, I was charged over $2,000 in "overdraft fees". I put the term "overdraft fee" in quotes because it is not a fee but interest because they are in fact loaning me the money. Sometimes, WaMu loaned me $5 and charged me $32 in interest. That comes out to about 650% in interest. MUCH MORE than a loan shark or the mob would have charged me.

The banks like to throw around terms about financial responsibility and making you feel bad about what you did. Did you know that "overdraft fees" are one of their biggest money makers?

In my particular case, a simple mistake of "overdrafting" an account by less than a $1 in some instances has pushed me into a corner and possibly filing for bankruptcy. Once I made the very simple mistake, and did not correct it within the first 12 hours of it happening, dozens of charges went through. This caused an onslaught of "overdraft fees" to post to my account. When I put the money in a day later, it was immediately confinscated by WaMu for "overdraft fees" (interest on the money they loaned me). Now, when additional charges came through after I thought I thought I had money in the account, I went back into the dark world of "overdraft fees" once more.

They have charged me so much in interest that there is simply no way for me to pay them as well as my current bills. All because of their loan sharking fees and tactics.

Hatewamu

BURBANK, Illinois

U.S.A.

This report was posted on Ripoff Report on 11/30/2007 02:44 PM and is a permanent record located here: https://www.ripoffreport.com/reports/washington-mutual/chicago-illinois-60056/washington-mutual-will-go-bankrupt-with-wamus-services-chicago-illinois-288027. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#4 Consumer Comment

Here is the catch...

AUTHOR: Nicole - (U.S.A.)

SUBMITTED: Saturday, December 01, 2007

Ok, I will be the first to admit, I have been burned by OD and NSF fees. I used to use strictly online banking, and therefore was charged, over several years, in the hundreds of dollars of fees.

Then I wised up and started tracking my own balance. I wrote down every single little transaction and did not write down deposits until they said "posted" on my online banking (not pending and not added into my available balance, but actually "posted").

That change was two years ago and guess how much I have spent in OD and NSF fees since? $0.00. And I bank with three of the most hated banks in the US...Wells Fargo, Bank of America and Wachovia. (Yes, yes, I have three banks...personal, business, and a separate savings account)

Now, on to the TIL violations. You, as well as I, and Jim, were given a fee schedule when we opened our accounts. In this fee schedule (should you be bothered to read it) it will tell you how much you are charged for NSF fees (and that it is not based on HOW MUCH you overdraw, just the fact THAT you overdraw) OD (also not based on the dollar amount) teller fees (if any), call center fees (if any) wire fees, etc.

That satisfies current legislation under the Truth in Lending Act. Because they are truthful and tell you "if you overdraw $0.01 we WILL CHARGE YOU $20-$35(depending on HOW OFTEN you have overdrawn your account in the last year)"

Hell even when I almost constantly had an account in the red, I KNEW I would get charged. Are the fees a little high? YES. Do they keep me from overdrawing my account now? HELL YES. And that is their purpose. So that responsible customers do not have to pay higher fees on other services.

Christ people, grow up and just start writing your transactions down AND STOP SPENDING MONEY YOU DON'T HAVE. And you'll never pay another fee. If you can't manage that, go the cash only route.

#3 Consumer Comment

GROW UP!!!

AUTHOR: Billcoll01 - (U.S.A.)

SUBMITTED: Saturday, December 01, 2007

THERE IS NO SUCH LAWS IN THE WORKS!!!! GROW UP AND TCB LIKE AN ADULT!!!

#2 Author of original report

Additional comment from author

AUTHOR: Hatewamu - (U.S.A.)

SUBMITTED: Saturday, December 01, 2007

Actually Jim, you are alone. There is legislation in the works to consider the "overdraft fees" a violation of the Truth In Lending because it is a loan. NSF fees are not "overdraft fees". They can charge NSF's all day long. But when you loan money and then charge triple digit interest, that is a violation of TIL.

I'm sure loan sharks were running around claiming "fiscal responsibility" as they broke your knee caps.

#1 Consumer Comment

Fiscal Responsibility

AUTHOR: Jim - (U.S.A.)

SUBMITTED: Friday, November 30, 2007

Fiscal responsibility for your account belongs on you. The fact you happen to make them rich is not relevant to the situation. The amount you overdrafted your account by is not relevant either. It only matters in this situation that you did this and you did it many times. Believe me, if you think the bank made you feel bad, wait until the reactions from the people here; your OP is filled with so many poor rationalizations about why you did it, how it happened, 650% interest, loan sharking, etc.... Face facts - you overdrafted the account so many times that simple mistakes don't account for it. Just accept it and figure out how to move on. You can hate WAMU all you want, but if you end up at another bank, you'll be hating life there as well because their policies for NSF's are either the same or worse - yes worse.

Overdraft fees are NOT interest - the fees are a PENALTY for doing something you should not do. To put a better analogy than the loan shark (which is a really bad example), it's like speeding on the highway - if a cop writes you a ticket for being 10MPH or 30MPH over the speed limit, the fine is the same amount and won't vary.

In the same way, your NSF fee is the same whether the transaction that put you into the negative is for $1 or $100. So when you deposited the money, it was like paying the fine caused by the overdraft in your account. Accordingly, you can take the term overdraft fees out of quotes since it isn't interest; again another rationalization. It is a penalty - plain and simple.

If you are serious about BK, consult a BK attorney to determine cost to file in your area and whether you have the grounds for filing. Owing a bank a couple of thousand dollars may be insufficient (a) grounds, or (b) money, since filing can cost some bucks as well.

Advertisers above have met our

strict standards for business conduct.