Complaint Review: Washington Mutual - Henderson Nevada

- Washington Mutual wamucards.com Henderson, Nevada U.S.A.

- Phone: 866-892-9268

- Web:

- Category: Credit Card Processing (ACH) Companies

Washington Mutual raised interest rate on both wife's and my cards by about 10% each with no warning Henderson Nevada

*Consumer Suggestion: The solution if you're near judgment-proof: STOP paying!

*Consumer Comment: Sorry to tell you, but it IS a perceived 'risk' factor- WAMU is in deep DooDoo on sumprime loans

*Consumer Comment: Sorry to tell you, but it IS a perceived 'risk' factor- WAMU is in deep DooDoo on sumprime loans

*Consumer Comment: Sorry to tell you, but it IS a perceived 'risk' factor- WAMU is in deep DooDoo on sumprime loans

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

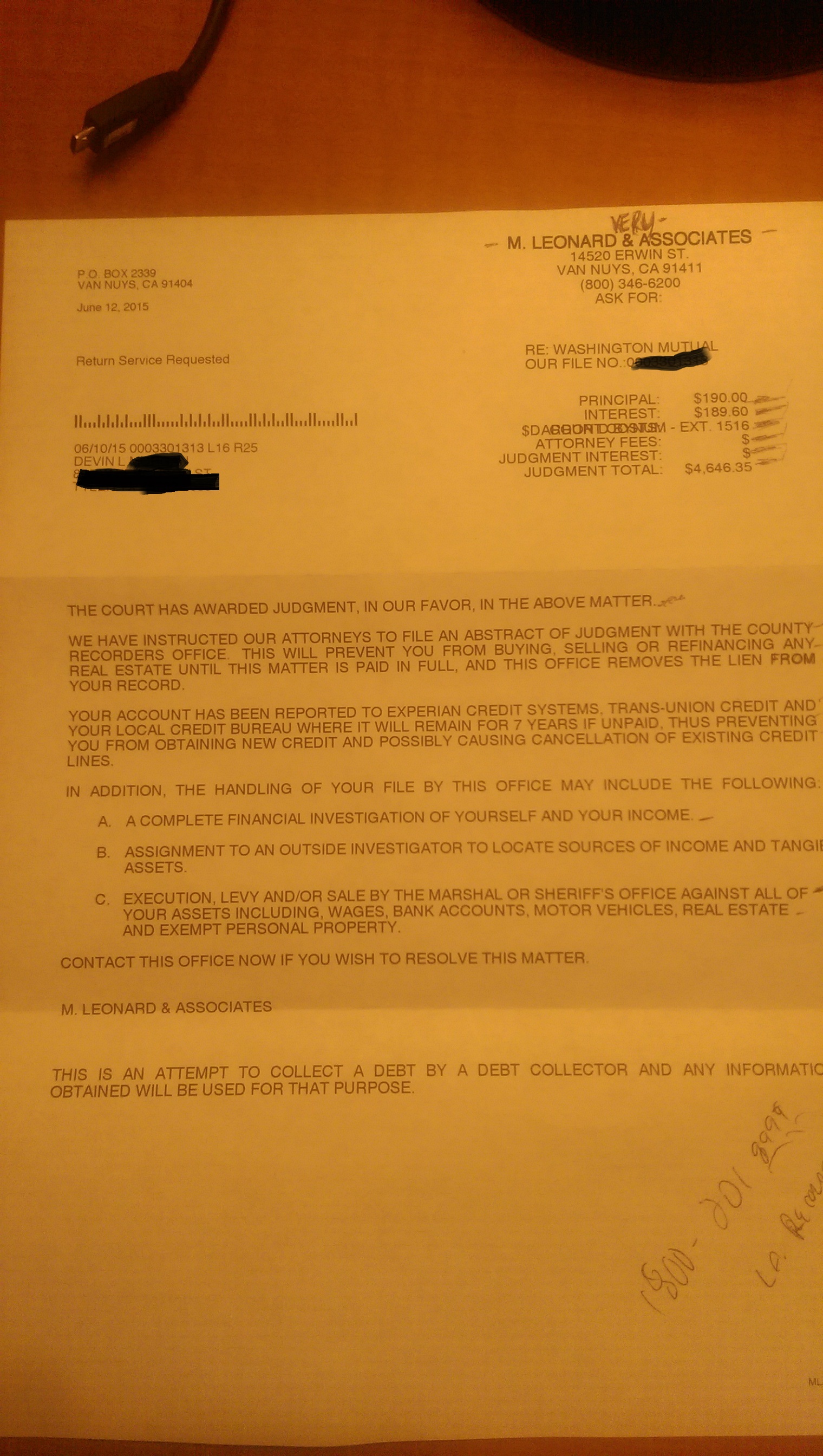

Washington Mutual raised our interest rates from about 16%to about 26% even though we'd been good customers since they were Providian cards, never missing a payment and always paying more than the minimum; but when I emailed and asked why, they said it was a perceived "risk" factor. That makes no sense.

We traded one vehicle for another (which we couldn't have done if our credit was truly bad,) approxomately the same payment and have added about $650 in income. The only risk is their higher interest making it nearly impossible to pay off these credit cards! We did have an autistic grandchild left with us to raise, and my wife nearly had a nervous breakdown from it all, and with all the trips to therapies for the child and the price of gas going sky high, we have been using the card more. She nearly ran out of gas on the way home from a therapy in another town, and had gotten so wrapped up in the busines of getting this child what he needed that she lost track and went over her limit by just a few dollars She immediately emailed them, expalining the situation, and they were downright nasty to her. As soon as we are able, we will be paying off both cards and NEVER going back to any Washington Mutual services.

Capital One has been the best company we've ever dealt with, and I'm sorry we fell for the bait with Wamu. IF anyone can offer any help and relief, please respond! If there is an attorney out there looking int oa class action suit, count us in! This complaint should count for two complaints, mine and wife's, as we do almost everything together.

Hondatech

Durant, Oklahoma

U.S.A.

This report was posted on Ripoff Report on 07/26/2008 07:52 AM and is a permanent record located here: https://www.ripoffreport.com/reports/washington-mutual/henderson-nevada/washington-mutual-raised-interest-rate-on-both-wifes-and-my-cards-by-about-10-each-with-355849. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#4 Consumer Suggestion

The solution if you're near judgment-proof: STOP paying!

AUTHOR: Christine - (U.S.A.)

SUBMITTED: Sunday, August 24, 2008

Google "Open letter Wamu 26% interest" and you can't miss my open letter to Washington Mutual.

As long as people REWARD this outrageous conduct with PAYMENTS, the bankers would be idiots if they didn't charge you 26% interest.

Most Americans are brainwashed into complete submission to the government and corporations, ready to jump as often and as high as they're told.

STOP being SLAVES!

#3 Consumer Comment

Sorry to tell you, but it IS a perceived 'risk' factor- WAMU is in deep DooDoo on sumprime loans

AUTHOR: Friendly Help - (U.S.A.)

SUBMITTED: Saturday, July 26, 2008

Maybe you have not been following the news? Subprime mortgage forclosures are driving BOTH mortgage forclosures and mortgage delinquincy notices to all-time highs. House resale prices are going into the toilet. And so on.

WAMU and Bank of America have significant subprime mortgage losses, and they need to generate some fat profits somewhere.

Your only real solution is to pay down & pay off those cards, any way you can.

Everybody who wanders into these situations screams ''class action lawsuit'' but these only make the lawyers rich. See the J.K. Harris class action lawsuit. Or see the Charter CALS where the lawyers got millions while the plaintiffs each got $5.

Furthermore, the T&C for most CC allow the issuing bank to raise the interest rate on your balance for any reason, or even for no reason. Only recently did one bank forgo ''universal default'' which ment if you were late paying the paperboy, your CC bank could raise your interest rate sky-high.

#2 Consumer Comment

Sorry to tell you, but it IS a perceived 'risk' factor- WAMU is in deep DooDoo on sumprime loans

AUTHOR: Friendly Help - (U.S.A.)

SUBMITTED: Saturday, July 26, 2008

Maybe you have not been following the news? Subprime mortgage forclosures are driving BOTH mortgage forclosures and mortgage delinquincy notices to all-time highs. House resale prices are going into the toilet. And so on.

WAMU and Bank of America have significant subprime mortgage losses, and they need to generate some fat profits somewhere.

Your only real solution is to pay down & pay off those cards, any way you can.

Everybody who wanders into these situations screams ''class action lawsuit'' but these only make the lawyers rich. See the J.K. Harris class action lawsuit. Or see the Charter CALS where the lawyers got millions while the plaintiffs each got $5.

Furthermore, the T&C for most CC allow the issuing bank to raise the interest rate on your balance for any reason, or even for no reason. Only recently did one bank forgo ''universal default'' which ment if you were late paying the paperboy, your CC bank could raise your interest rate sky-high.

#1 Consumer Comment

Sorry to tell you, but it IS a perceived 'risk' factor- WAMU is in deep DooDoo on sumprime loans

AUTHOR: Friendly Help - (U.S.A.)

SUBMITTED: Saturday, July 26, 2008

Maybe you have not been following the news? Subprime mortgage forclosures are driving BOTH mortgage forclosures and mortgage delinquincy notices to all-time highs. House resale prices are going into the toilet. And so on.

WAMU and Bank of America have significant subprime mortgage losses, and they need to generate some fat profits somewhere.

Your only real solution is to pay down & pay off those cards, any way you can.

Everybody who wanders into these situations screams ''class action lawsuit'' but these only make the lawyers rich. See the J.K. Harris class action lawsuit. Or see the Charter CALS where the lawyers got millions while the plaintiffs each got $5.

Furthermore, the T&C for most CC allow the issuing bank to raise the interest rate on your balance for any reason, or even for no reason. Only recently did one bank forgo ''universal default'' which ment if you were late paying the paperboy, your CC bank could raise your interest rate sky-high.

Advertisers above have met our

strict standards for business conduct.