Complaint Review: Washington Mutual - Milwaukee Wisconsin

- Washington Mutual 11200 W. Parkland Ave Milwaukee, Wisconsin U.S.A.

- Phone: 414-353-3841

- Web:

- Category: Mortgage Companies

Washington Mutual Mortgage 6 months Delinquent on Property Tax Payments in NJ Township Milwaukee Wisconsin

*Consumer Suggestion: Be very careful dealing with Washington Mutual and keep very good records.

*Consumer Suggestion: Withold Property Taxes from Your Mortgage Payment

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

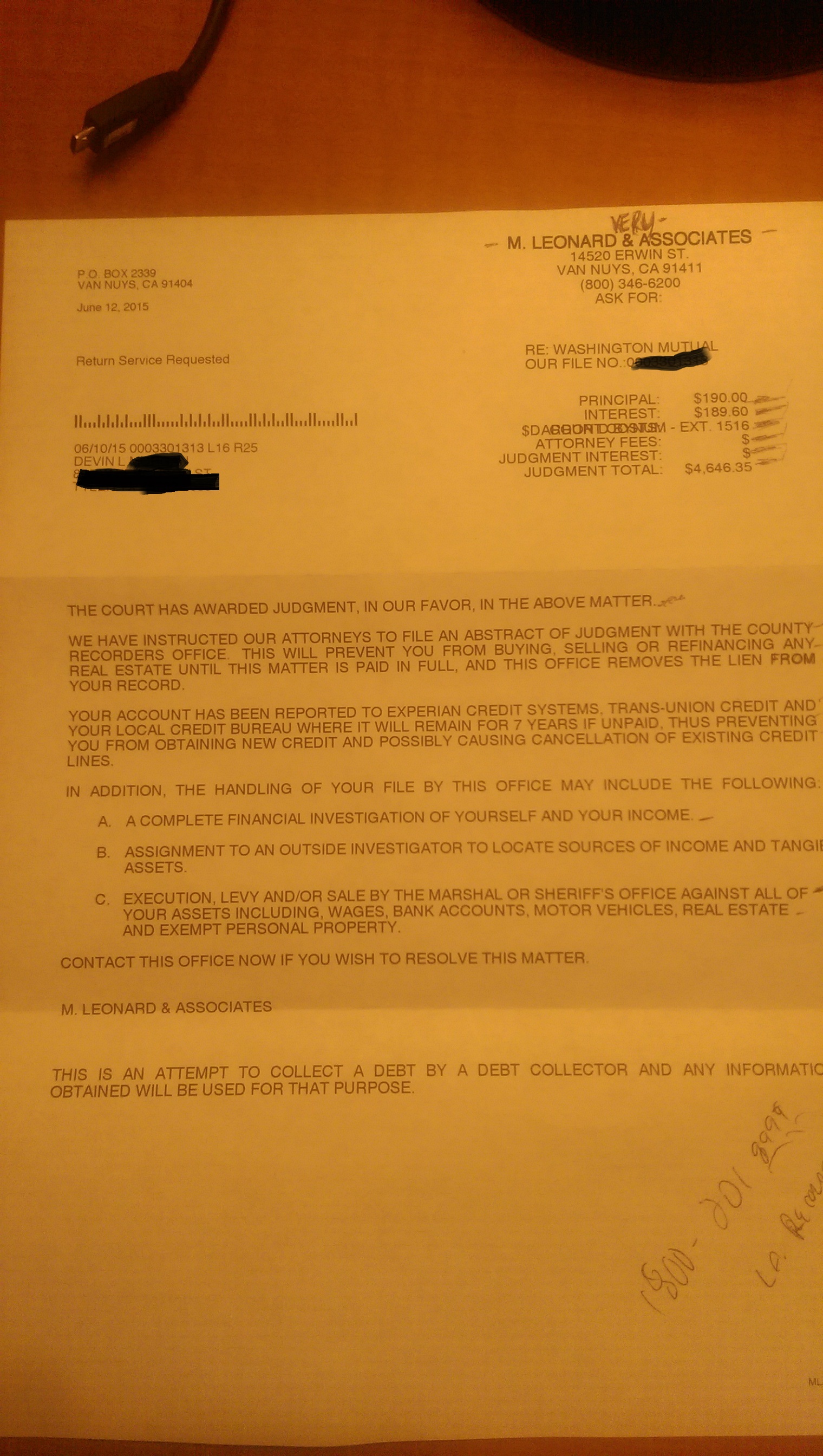

I bought my first home in late September, 2002. By December, Washington Mutual had assumed my mortgage. Soon, I began getting notices from Township of Woodbridge Tax Collector's Office saying my property tax was delinquent.

I called WaMu who told me they "show that a payment was made" to the division which will send it to the Township. A month later, another delinquency notice arrived, now threatening to charge a high APR on my debt balance.

I went ahead and paid $985. out of my checking account when the Tax Collector informed me that WaMu has a history of paying late. This way when their payment came through, I would be overpaid and could get a reimbursement check. Its going on half a year now. Woodbridge never received anything from WaMu even though I always paid my mortgage on time.

Now I'm told the tax bill was underpaid by $11.00,I've been fined $65.00 more for that, my property will be listed in the local paper as delinquent and a lien may be put on it in 7 days. I'll pay the $76.00 to save my home. Now I just need WaMu to reimburse me the $1,061.00 I had to pay due to my own bad judgement in trusting their well marketed establishment.

Ron

Colonia, New Jersey

U.S.A.

This report was posted on Ripoff Report on 06/13/2003 03:04 PM and is a permanent record located here: https://www.ripoffreport.com/reports/washington-mutual/milwaukee-wisconsin-53224/washington-mutual-mortgage-6-months-delinquent-on-property-tax-payments-in-nj-township-mil-60622. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#2 Consumer Suggestion

Be very careful dealing with Washington Mutual and keep very good records.

AUTHOR: Jeff - (U.S.A.)

SUBMITTED: Saturday, December 27, 2003

We recently refinanced a mortgage away from them. Our closing papers said that we did not have a pre payment penalty, yet when our credit unions loan officer called wamu for the pay off, it was $18,000 more than the original amount borrowed.

Our loan officer said that in her 20 years at her job, she had never heard of most of the charges that they added onto our payoff amount.. she also said that every time she called, she was put on hold, hung up on, or given incorrect information.

We sent every payment to them western union and are having a mortgage auditing company audit the mortgage.

They are notoriose for putting payments into suspence accounts, paying your escrow payment to someone elses account,, or in our case, putting part of our payment into an escrow account that we didnt have!!

Please see the site "Wamu Sucks"

If I was you I would refi as soon as possible before they make even more of a mess of your life.

#1 Consumer Suggestion

Withold Property Taxes from Your Mortgage Payment

AUTHOR: Jim - (U.S.A.)

SUBMITTED: Friday, June 13, 2003

Ron, if I was in your position I would write

Washington Mutual and inform them that due to

their failure to pay your property taxes on time,

you will no longer include the amount scheduled

for property tax escrow in your monthly mortgage

payment.

Ask them to provide you a breakdown of your

monthly payment for PITI (principal, interest,

taxes and insurance). You ought to consider just

paying them the principal and interest each

month, and make arrangements to pay your

property taxes and insurance yourself. There is

no reason why you should have to put up with

this situation.

I invest in tax lien certificates, and this is

the first I have heard of such a ridiculous situation. Good luck to you.

Advertisers above have met our

strict standards for business conduct.