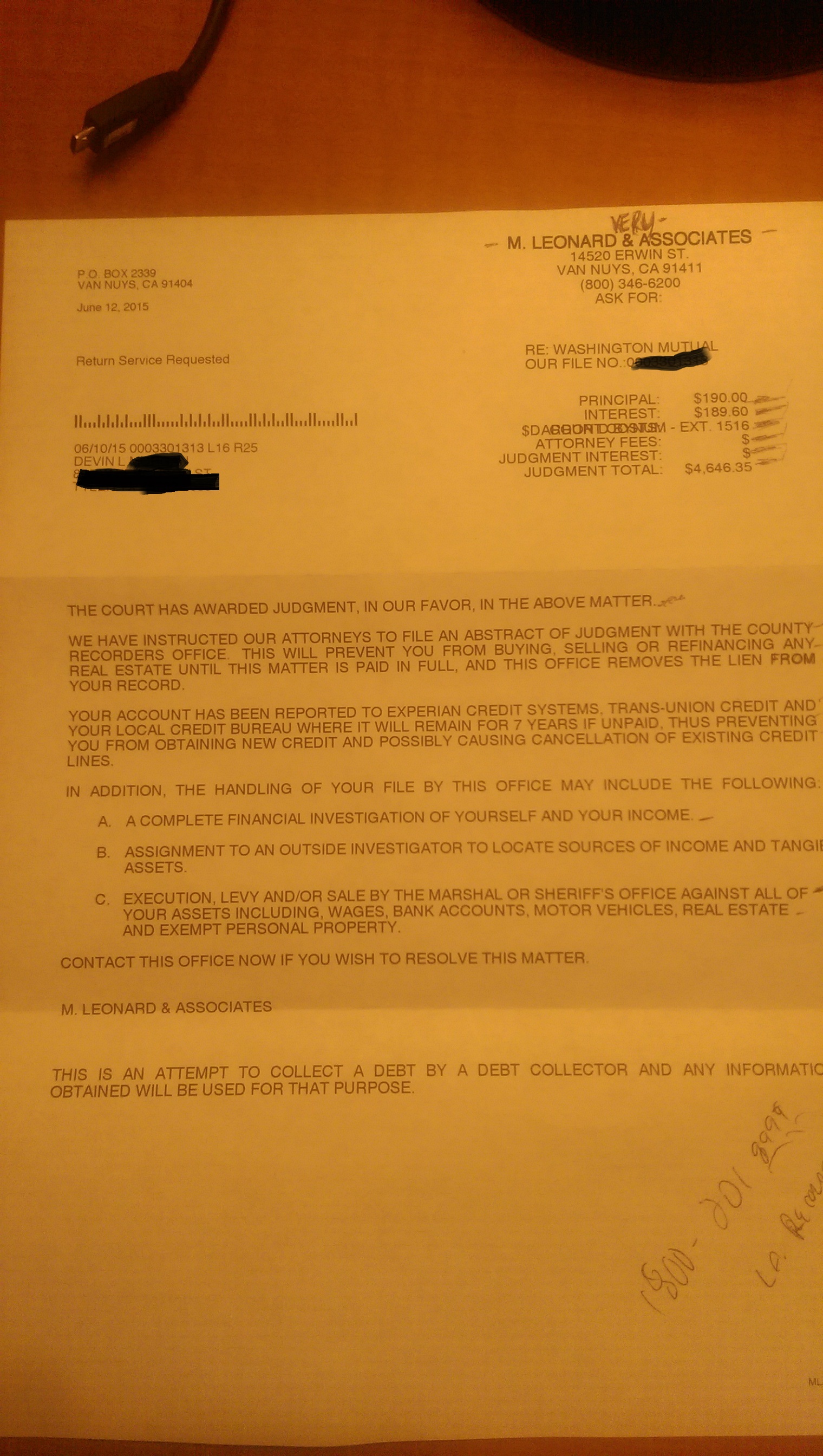

Complaint Review: Washington Mutual - Seattle Washington

- Washington Mutual www.wamu.com Seattle, Washington U.S.A.

- Phone:

- Web:

- Category: Banks

Washington Mutual Overdraft Fees Seattle Washington

*Consumer Comment: Well...

*Consumer Comment: Not a ripoff...

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

I want to start by saying I have been using a debit card for 19 years and am ware of how to use a debit card(bank of america). I have never incurred an overdraft fee with bank of america in those 19 years.

I recently opened a Washington Mutual Account in order to take advantage of a $75 promo AMEX certificate. I used my account for debit purchases only, checking my account at the beginning of each day and after each purchase as to make sure I did not spend more than I had. I did not use my "checkbook"register as I did not write checks.

After each purchase my account seemed to have been reduced by the amount of the purchase. My last purchase I made brought my account to just a few cents, which is where I wanted it since I wasn't really goint to use the account anymore.

Well, three days later, I get a notice that my account is overdrawn by $230. I contacted WAMU(Washington Mutual) and asked what happened? How is it that when I used my card last at Subway for $20.30, I still had $20.67 left in my account and haven't used my card since.

WAMU advised me that since that purchase several other creditors submitted an authorization code for payment and since WAMU gave me (unwilling) a $200 overdraft credit they paid them.

I advised WAMU that they would have been responsible to pay them anyway since they were the ones who gave the authorization code. I asked them why they gave an authorization code or why they allowed these purchases to go through even though there was no money in the account to pay the merchant?

They once again said it was because of the $200 credit limit they automatically gave me. WAMU tells me that the creditor has 3 days to submit an authorization code or it drops off and that while WAMU is waiting the 3 days they do not reduce my balance? Who would this benefit? This does not benefit the consumer. Why would WAMU let me spend more money than I have, or better yet, after a purchase is made with a debit visa/mc, the bank should automatically reduce the amount in your checking account. They should have the responsiblity to do this. Bank of America works this way, this is why I have never had a problem in 19 years. WAMU is trying to tell me that this is the norm. They refuse to reverse the charges and tell me if I don't pay I will go to collections. Of the five charges that came through three were from starbucks for $3, costing me $38 for each cup of coffee. $38x3=$104!

Now do you see why WAMU had no problem allowing the $3 charge to happen, even though I apparently had no funds. I say apparently, because I was calling the 800# each time to check my balance. This is what they call a "convienience charge". What ever happened to "DECLINED". I had cash in my pocket and lot's of cash in my Bank of America account. I jsut wanted to clean out my WAMU account and bring it as close to zero as possible. So, I am warning you, if you are going to take advange of a promotion, such as $75 gift check, fine, just take out the cash, don't use any checks or debit cards, it may cost you more than you want.

Saynotowamu

yakiima, Washington

U.S.A.

This report was posted on Ripoff Report on 09/13/2008 08:42 AM and is a permanent record located here: https://www.ripoffreport.com/reports/washington-mutual/seattle-washington/washington-mutual-overdraft-fees-seattle-washington-372542. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#2 Consumer Comment

Not a ripoff...

AUTHOR: Edgeman - (U.S.A.)

SUBMITTED: Saturday, September 13, 2008

It looks like you tried to get a $75 bonus and didn't read the terms and conditions of your new account. Take a look at them now. Does it say that you will be charged overdraft fees if you overdraft your account?

You should record every transaction on your register, not just checks. The fees that you were charged is the reason why.

#1 Consumer Comment

Well...

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Saturday, September 13, 2008

You may have been using an ATM card for 19 years but not a DEBIT Card. A DEBIT card is a card that is attached to your checking account that has a VISA/MC logo on it and can be processed similar to a CREDIT card. These have only been around for about 5/6 years. An ATM card is processed through a different network and requires a PIN number.

Just because you don't write checks does not mean that you don't need to use a Checkbook Register. This is the only method that you can guarantee the amount of money in your account. Checking your balance at the beginning of each day and after each purchase does not work. Are we to believe that you get a $3 cup of coffee and immediatly go on-line or call to find out your balance...VERY DOUBTFULL. Even if you did that is a lot more work than you need to do for something that can be inaccurate.

What if a purchase you made didn't post yet? Your register would have showed you made a purchase. You can not rely on the on-line or automated balance because that can only show what has been submitted. If a store has not sent in the charge it is impossible for the bank to read your mind and know you made another purchase.

Oh and if you think BofA is any different read the other reports on this site about those people who also failed to take responsiblity for their accounts are in the same situation as you.

So in short.

1. ALWAYS keep a check register

2. NEVER use your debit card for small purchases especially if you don't follow #1.

Advertisers above have met our

strict standards for business conduct.