Complaint Review: wholesale merchant processing - beaverton Oregon

- wholesale merchant processing 11000 sw stratus ts. ste 150 beaverton, Oregon United States of America

- Phone: 800-953-6764

- Web:

- Category: Credit Card Processing (ACH) Companies

wholesale merchant processing withholds funds yet continues to draw charges. beaverton, Oregon

*Consumer Comment: Want to shut down WMS? Here's how!

*Consumer Suggestion: I can help you

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

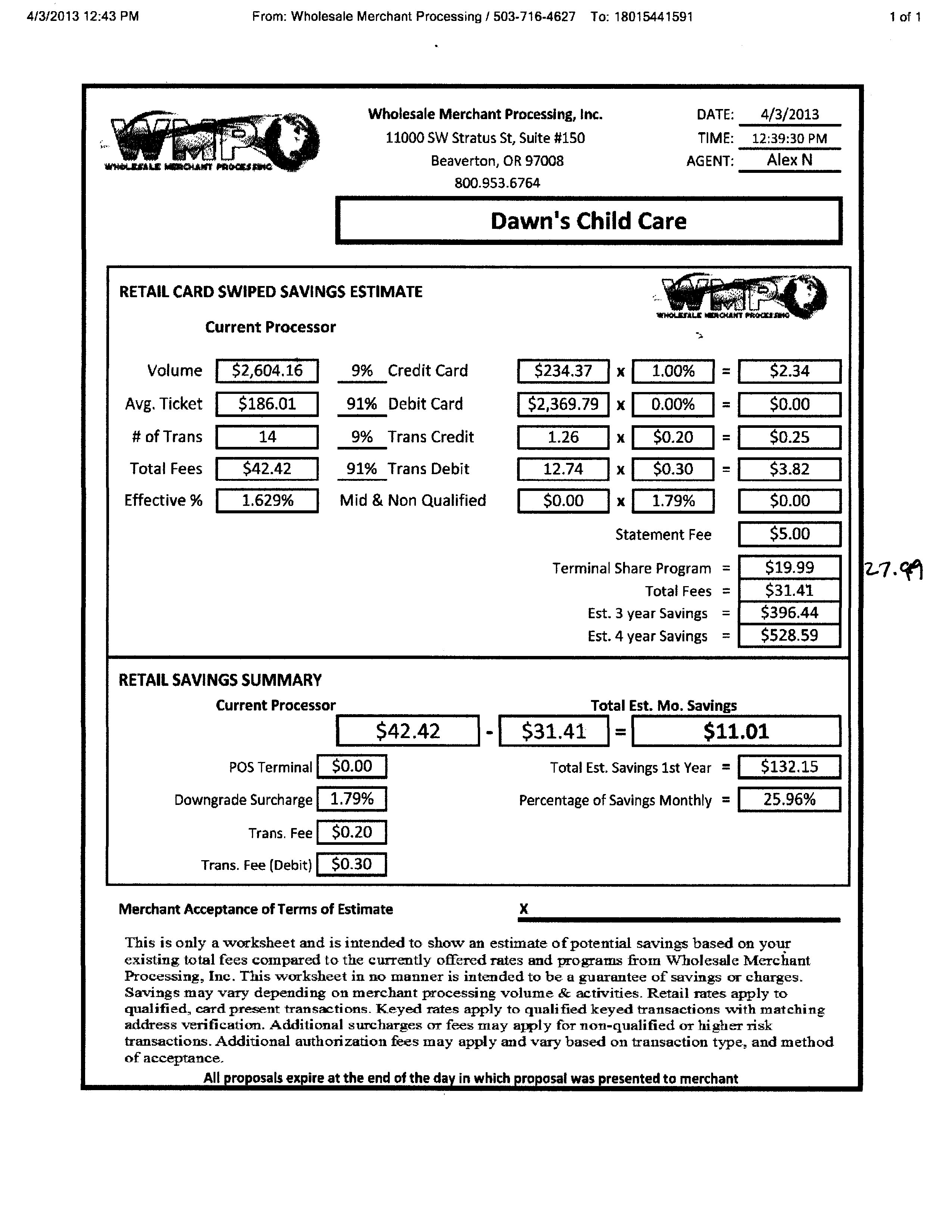

WMP failed to deposit over $5000 from sales they collected into my account. When I contacted them they told me my account had been frozen due to chargebacks. The chargebacks have already been deducted from my checking account, no money has been deposited.

I have called them repeatedly to inquire when the funds will be deposited, they refer me to another number, someone who processes for them. When I ask who put the hold on my account and why, no one seems to know. The next contact tells me that they do not know when the funds will be released, just wait.

I have been waiting approx 2 months, still no funds. I have been told again, wait but no one can tell me when. I call twice weekly.

I am a small business, my husband passed away in August due to cancer and I can not afford to keep waiting. This is alot of money to me.

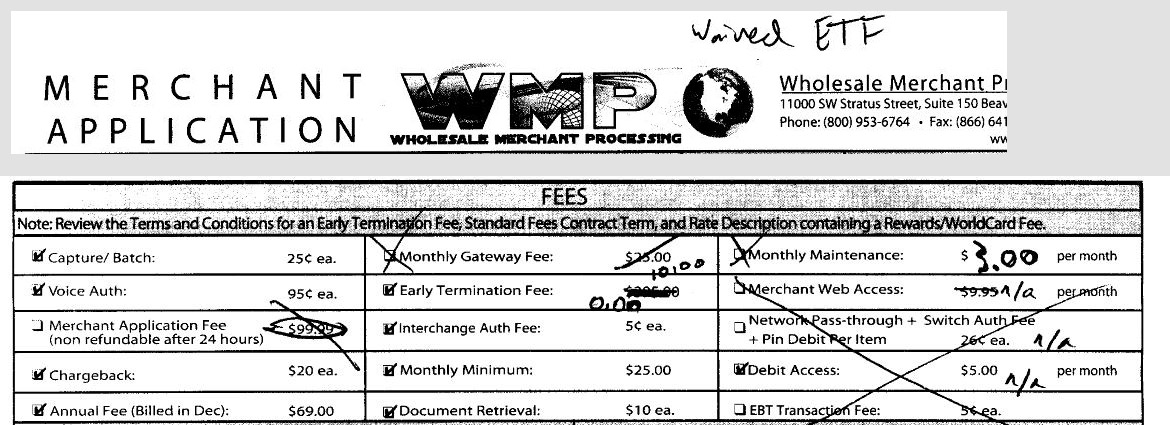

In the meantime, I can not use my credit card terminal fo fear the funds will not be deposited. WMP also continues to draw monthly fees from my checking account. Also I have been using them for 3 years, and have had occasional chargebacks that were not handled in this manner. My contract ends in December, is this a coincidence?

This report was posted on Ripoff Report on 11/12/2011 12:52 PM and is a permanent record located here: https://www.ripoffreport.com/reports/wholesale-merchant-processing/beaverton-oregon-97008/wholesale-merchant-processing-withholds-funds-yet-continues-to-draw-charges-beaverton-o-797351. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#2 Consumer Comment

Want to shut down WMS? Here's how!

AUTHOR: We are Anonymous - (United States of America)

SUBMITTED: Thursday, February 02, 2012

This company is a fraud, and conveniently scams its clients out of thousands, even millions of dollars.

You want to get rid of them, here's how you do it. email this address and ill explain what we can do.

jacksonrivner@mail.com

#1 Consumer Suggestion

I can help you

AUTHOR: tiffanyg@centurybankcard.com - (United States of America)

SUBMITTED: Wednesday, November 30, 2011

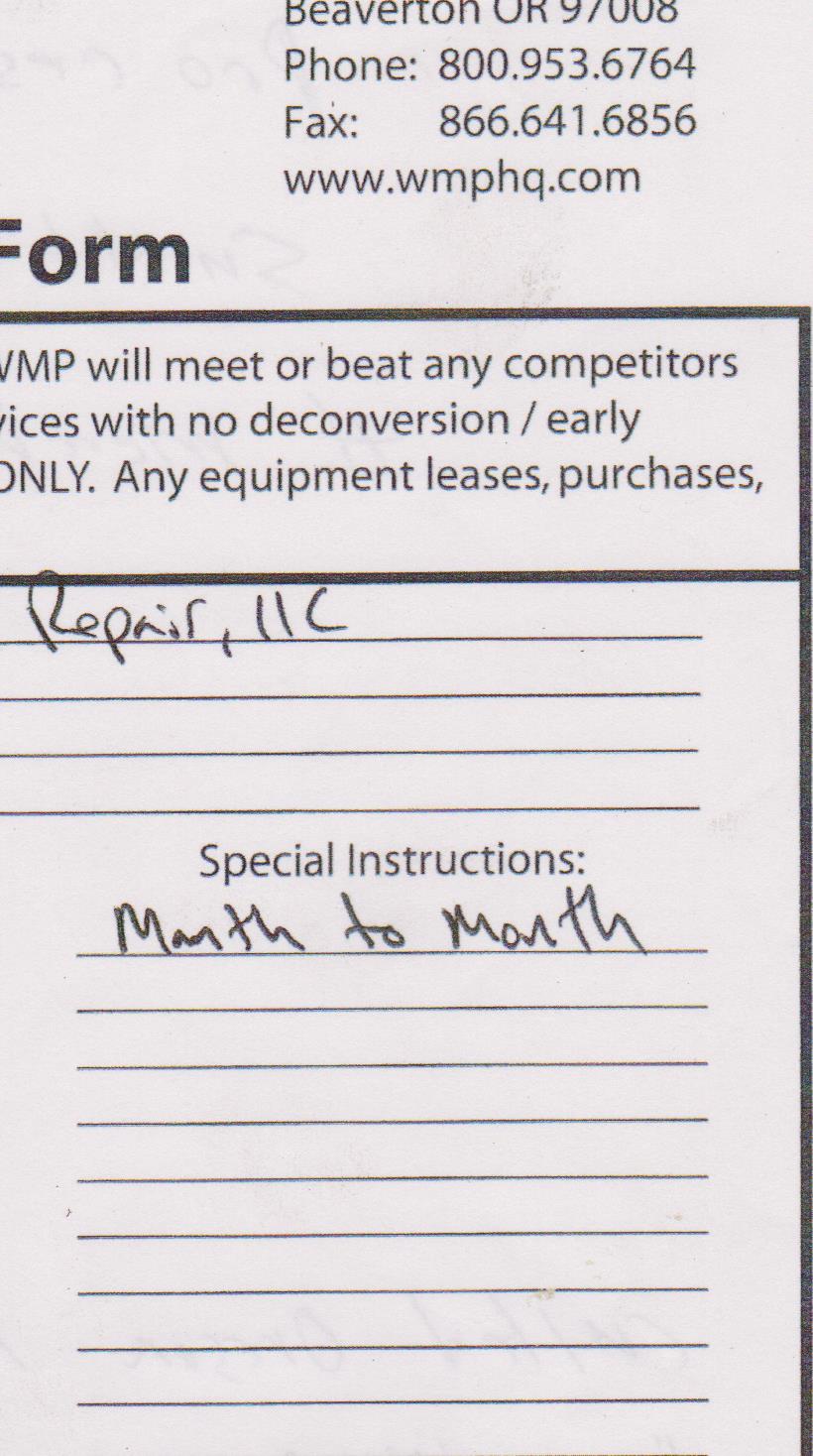

Let me first state not all processors do this.

When starting a business, there is always that risk of something not going entirely as planned. For this reason, Merchant Account Providers and Acquiring Banks retain a non-interest-bearing reserve fund to protect themselves and issuing banks from financial catastrophes suffered by merchants. Some merchants may be unaware of this reserve and become unsettled when a reserve deposit is required or their processing funds are being withheld. This can be especially true of new businesses that are operating entirely on the previous month's profits. In this article, we will discuss exactly what this reserve fund is, how it is used and why it is important, as well as how it benefits Merchant Account Providers and merchants alike. Bottom line....all consumers have up to 180 days or 6 months to dispute a charge. In some cases, up to 18 months. If there are excessive chargebacks, the merchant must have enough $$ in their account to take care of these. When merchants get paid from the processor, they are being paid by the bank; not the consumer. All because the consumer has 6 months for dispute. In essence, the processsor is loaning you the $$ until the 6 months (18 in some cases) expires.

The reserve fund works fundamentally the same way as a security deposit on an apartment. In case something goes wrong and the tenant is unable to pay for certain damages, that money is used to pay those expenses. In the business world, the same is true; if a Merchant Account Provider is facing financial losses due to undesirable events surrounding a merchant, the reserve fund is used to cover those costs.

It should be stated, for the record, that reserve funds are by no means a sign of mistrust between Merchant Account Providers and merchants. They are simply a guarantee of security for the fulfillment of a merchant's individual obligations to the Merchant Account Provider and the Acquiring Bank. There are many unforeseen circumstances in the business world excessive chargebacks, unexpected expenses, mismanagement, sudden drops in sales, natural disasters, non-delivery exposure and the like.

The Some Merchant Account Providers may allow a rolling reserve, where a certain percentage will be taken from the merchant's transaction activity until the reserve fund has reached an amount predetermined in the agreement. The actual amount of the reserve varies by merchant, as well as the amount of risk the Merchant Account Provider carries with processing credit card transactions for this merchant. In most cases the amount of the reserve is related to specific industry return percentages, chargebacks, current volume and anticipated volume. At any time, the Merchant Account Provider or the Acquiring Bank may increase the reserve amount required based on exposure and risk of the individual account.

Merchant Account Providers and Acquiring Banks are not the only ones who benefit from requiring a reserve account. Reserve funds create a security bond between merchants and Merchant Account Providers so that when financial troubles do arise, there is no uncertainty as to who pays for what, and there are no bills to collect. The reserve fund has already been collected, so the Merchant Account Provider does not run the risk of taking a financial hit as the result of merchant losses.

If a merchant's processing agreement is terminated by either party, the remaining amount of the reserve is returned to the merchant. Typically, the Merchant Account Provider will hold the reserve funds for a period of 3-6 months. Most banks will not retain reserves more than one year after the last transaction, except in cases where goods or services are obtained beyond the one year period. This is to allow chargebacks and refunds to be processed for the merchant's most recent transaction activity. Once the risk is no longer a liability, the reserve funds are returned.

In summary, merchant reserves act as a fallback mechanism for Merchant Account Providers and Acquiring Banks, to be used when merchants encounter a worst-case scenario and are unable to pay the amounts due as described in their Merchant Processing Agreement. This process carries extra security to the merchant agreement and protects all parties involved from losing money due to merchants' inability to cover processing expenses. Merchants can have peace of mind knowing that in most scenarios their ending debt to the Merchant Account Provider is already paid off. For everyone involved, the merchant reserve fund is something that is kept with very good justification.

This should have been explained to you from the beginning.

Advertisers above have met our

strict standards for business conduct.