Complaint Review: Woodforest National Bank - Plano Texas

- Woodforest National Bank 425 Coit Road Plano, Texas United States of America

- Phone: 972.985.9400

- Web: www.woodforest.com

- Category: Banks

Woodforest National Bank Oppressive Policies for Consumers Plano, Texas

*Consumer Comment: Woodforest - SSDD

*UPDATE Employee: Woodforest Customer Service

*Consumer Comment: Regulations

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

Woodforest National Bank (aka Woodforest Bank) is a horrible bank to do business with. I deposited a check from a bank just down the street from this Woodforest bank. I should have just gone the extra distance to the bank the check was drawn on, but it was getting late and my kids were still at daycare. When I deposited the check, the teller told me that it would be held for 7 business days. When I asked if some of the amount could be released to me, the Mgr walked over and said their policy didn't allow that. "We have no history with this check" (and remember, the bank it was drawn on was within view of Woodforest). The Mgr did tell me however that it shouldn't take long to clear and when that happened, the funds would be released to me.

I deposited the check 5 business days ago - One Week in Actual time. I just went over to Woodforest and asked if the check had cleared. Now the Mgr tells me that there is no way for them to determine if a check has cleared the other bank or not. I spent a half hour waiting while Mgr called Risk Mgt, other Mgrs, only to get the same double-talk. When asked why I was told that the money would be released before the 7-day hold if the check cleared, the Mgr told me that it was impossible to determine whether the check cleared, so I "couldn't" have been told that by anybody at Woodforest.

I've had this account at Woodforest for over 10 years, never had an overdraft, and have my monthly payroll AND benefit check electronically deposited to this same account. This specific check and Woodforest's "HOLD" on deposits has really made me upset. I'm moving my accounts over to my husband's bank - which is actually a credit union and changing my e-deposits. With less money in his accounts and a shorter account duration, his bank held a check from the same person and same bank for only 2 days before determining it had cleared the bank it was drawn upon.

Woodforest has oppressive policies which penalize clients and the customer service is horrible. Personnel have no authority or knowledge about policies - demonstrated by Mgr. "Frank" when he told me one thing the money would be released when the check "cleared" and then when I went back a week later he told me there wasn't any way to determine if the check had cleared and that I'd just have to wait the extra time. That means - in real terms - that I deposited the check on a Wednesday and the money wasn't available until 11 days later (5 "business" days - which involved two weekends.

Woodforest Board of Directors are banking a nice bonus from holding your collected funds, wouldn't you rather do business with a bank or credit union that gives YOU the benefit of your money?

This is scandalous.

This report was posted on Ripoff Report on 10/26/2011 09:27 AM and is a permanent record located here: https://www.ripoffreport.com/reports/woodforest-national-bank/plano-texas-75075/woodforest-national-bank-oppressive-policies-for-consumers-plano-texas-792315. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#3 Consumer Comment

Woodforest - SSDD

AUTHOR: RMGentry - (United States of America)

SUBMITTED: Wednesday, February 22, 2012

I have been a Woodforest customer for nearly six years. Now I'm a BB&T customer because after my debit card number was scammed by someone in the Phillipes last month, when I reported it to Woodforest HQ on the morning I found out, I was treated like I was the criminal! Then over a week later I receive a new PIN for a new debit card - but 2 weeks after that, I still had no card. I contacted the local branch last week and the very next day, I saw a $10 charge for a replacement debit card - THAT I NEVER RECEIVED. As luck would have it, I had already opened an account with BB&T since my new employer banks there and it's right across the street. I have transferred everything to that new account and I've told Woodforest to pack that $10 fee FOR A CARD I NEVER RECEIVED into whatever place in their office where the sun doesn't shine. I can't close the account with that "out there" and I just don't give a rats' butt!!

The only thing Woodforest has going for it is the fact that when you have a direct deposit, it is posted to your account as soon as the electronic notification comes in - not the next day.

#2 UPDATE Employee

Woodforest Customer Service

AUTHOR: Woodforest Customer Service - (USA)

SUBMITTED: Wednesday, October 26, 2011

Woodforest National Bank is dedicated to providing quality customer service and we would appreciate the opportunity to speak directly with you. Please contact our Customer Care department toll free at 1-888-224-0132 or email your contact information to customerservice@woodforest.com.

#1 Consumer Comment

Regulations

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Wednesday, October 26, 2011

There is a set of regulations known as the Expedited Funds Availability Act, or Regulation CC. These are regulations that every bank and credit union must follow to determine when they must make funds available.

In short there are cases where they can hold a check for an extended period of time. There are several factors that would cause a 7-Day hold. These include the amount of the check, your history with the bank(such as recent overdrafts or being a new customer), or if they suspect they will not being able to collect on the check. Since you say you are an existing customer with no overdrafts it seems to come down to the amount and/or how collectible it is.

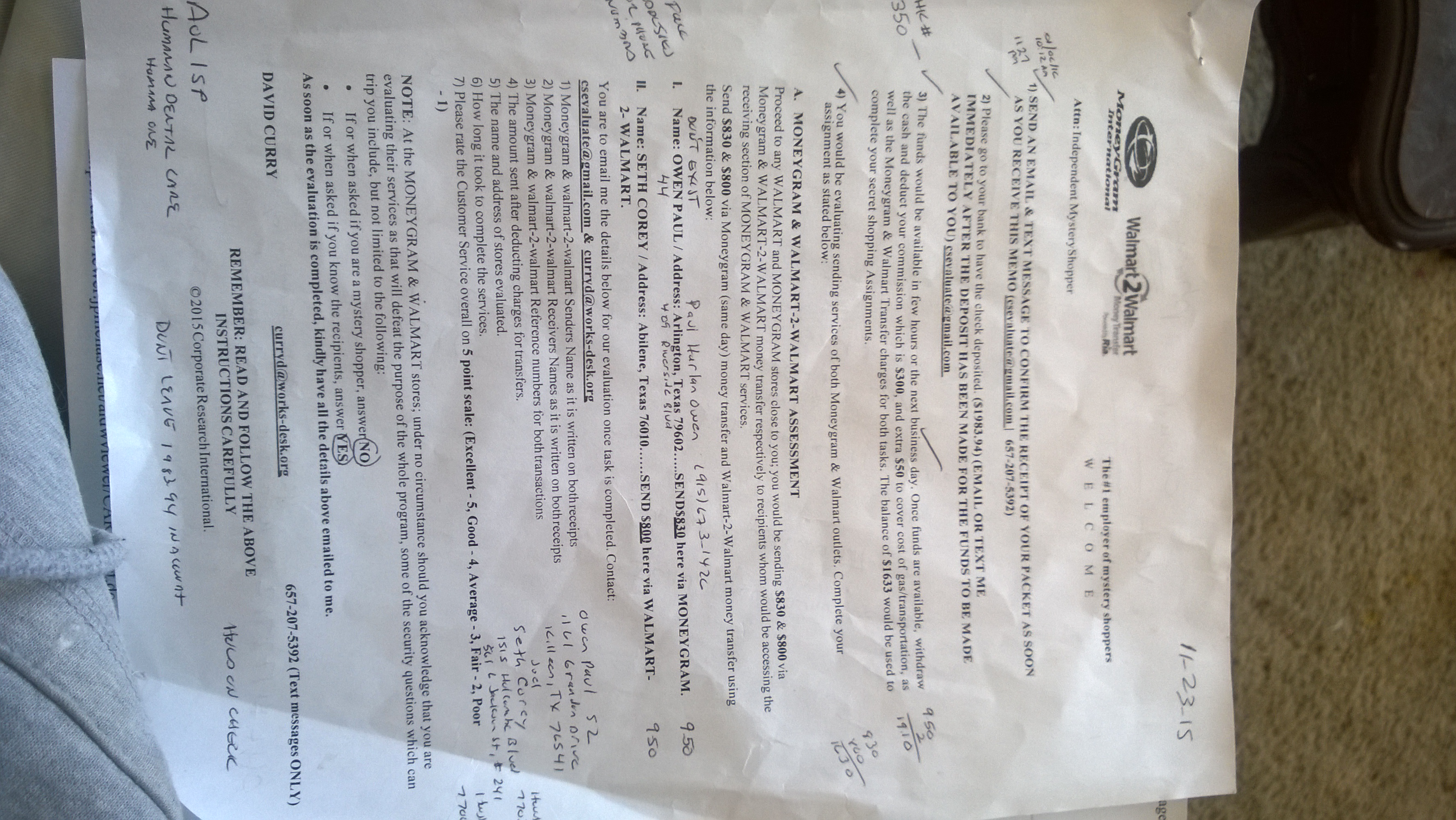

Now, one reason for these regulations is that there are many scams that send checks asking people to cash the check and send them back money(for some reason) by MoneyGram or other untraceable source. Unfortunately if the bank releases the funds before it clears the other bank, the person usually sends the money off. Only to find out a few days later that the check was either stolen or counterfeit. This leaves the account holder "holding the bag" and is the one who has to pay back the bank. So I hope this is not your case.

I would suggest you read over Regulation CC and if they are not following the regulation and you are 100% positive the check is good, print the following page out and take it down to the manager to get them to explain why they are still holding your funds.

http://www.federalreserve.gov/pubs/regcc/regcc.htm

Advertisers above have met our

strict standards for business conduct.