Complaint Review: Suntrust Bank - Saint Joseph Missouri

- Suntrust Bank 4315 Picket Road Saint Joseph, Missouri United States of America

- Phone: 1-877-695-3138

- Web: suntrust.com

- Category: Banks

Suntrust Bank SST Inc. Repossession With Proof Of Payment Saint Joseph, Missouri

*Consumer Comment: Really Bad Idea.

*Consumer Comment: Have you gone through the top?

*General Comment: Hope this helps

*Consumer Comment: Here goes suntrust bank ruining another person's life by wrongfully taking their care suntrust should be investgated for bad business practices suntrust and hsbc are horried banks

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

Everyone knows that it is a common practice for banks to sell off individuals loans from time to time. We should demand that loans require consumer consent prior to the sale of loans. This is my own personal horror story from this practice.

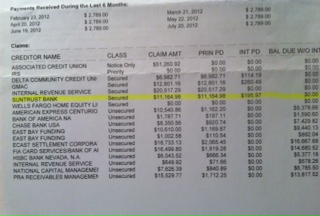

I originally recieved my auto financing through M&I Bank. After about 8 months, I received notification that they had sold my loan to Suntrust. I began making my payments to Suntrust as instructed by M&I bank. Having recieved no communication from Suntrust, everything appears to be seamless. I even have a copy of my credit report from August showing that my car payment was never late, and current.

On September 11th, my car is repossessed. I thought it had been stolen, having made all of my payments, in addition to having electronic copies of the cancelled checks. It turns out that Suntrust claimed to have no record of several payments. This could be believable, but my cancelled checks have their employees handwriting on the checks referrencing my account number. After explaining to their less than helpful repo department that I had copies of the cancelled checks, they informed me that even if it was an error on their part, I was still responsible for the repossession fees, late charges, etc. to the tune of about $2000.

I am about to pay the money to retrieve my vehicle, but cannot wait to see if I have legal recourse against them. Just another example of how we are no longer customers. We, and all of our possesions, are just numbers on an $8/hr employee's computer screen.

This report was posted on Ripoff Report on 09/18/2011 02:46 PM and is a permanent record located here: https://www.ripoffreport.com/reports/suntrust-bank/saint-joseph-missouri-64503-0999/suntrust-bank-sst-inc-repossession-with-proof-of-payment-saint-joseph-missouri-778263. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#4 Consumer Comment

Really Bad Idea.

AUTHOR: Flynrider - (USA)

SUBMITTED: Monday, September 19, 2011

"You're a lso best off in future having such payments taken directly from a bank account so they have no excuse to claim not receiving the checks. "

Here we have a bank that cannot even account for checks it has processed. You advise the OP that the best solution is to give that same bank free access to a bank account? Can you imagine the havoc they could cause with that kind of access. Actually, no need to imagine. Just read Ripoff Report. There are no end of complaints from people who made the mistake of giving a company access to their bank account.

As far as your bank is concerned, you are responsible for any problems/overdrafts/fees that are caused by someone that you allowed into your account. Allowing access to a company that has proven to you that they can't do basic accounting is insane.

To the OP : If you have proof of on-time payments, I recommend that you sue them. The amount in question should be low enough to qualify for small claims court, where you do not need to have a lawyer. I think you should do pretty well.

#3 Consumer Comment

Have you gone through the top?

AUTHOR: voiceofreason - (United States of America)

SUBMITTED: Monday, September 19, 2011

Call their executive corporate offices and demand the CEOs office. You won't get him, but you ought to get a high enough staffer to demand they take this out of customer service's hands and get your car back, and get the payment debacle cleared up.

You're a

lso best off in future having such payments taken directly from a bank account so they have no excuse to claim not receiving the checks. Unless you must have the car back immediately, I'm not sure you should give them anything without first consulting a lawyer. Why the hell should you have to pay a cent for their error? That's utterly insane even for a bank. No wonder Warren Buffett gave them the heave h*o. Once they get that $2k, you'll likely not see it again.

You need a lawyer, unless the car's value and the $2k are less than you think a lawyer will cost. Contact any "action" reporters working your region. Sometimes they help.Try the BBB too. You'd be amazed, they might actually accomplish something here. They do pester even large corporations when complaints are issued.

#2 General Comment

Hope this helps

AUTHOR: EnoughJerks - (USA)

SUBMITTED: Sunday, September 18, 2011

http://www.fair-debt-collection.com/searches/repossession.html

I hope this helps . This is terrible what they did. It can't hurt to check this out and find out if you have a case.

#1 Consumer Comment

Here goes suntrust bank ruining another person's life by wrongfully taking their care suntrust should be investgated for bad business practices suntrust and hsbc are horried banks

AUTHOR: Charles - (USA)

SUBMITTED: Sunday, September 18, 2011

Here goes suntrust bank ruining another person's life, by wrongfully taking their care suntrust should be investgated for bad business practices suntrust and hsbc are horried banks.

Advertisers above have met our

strict standards for business conduct.