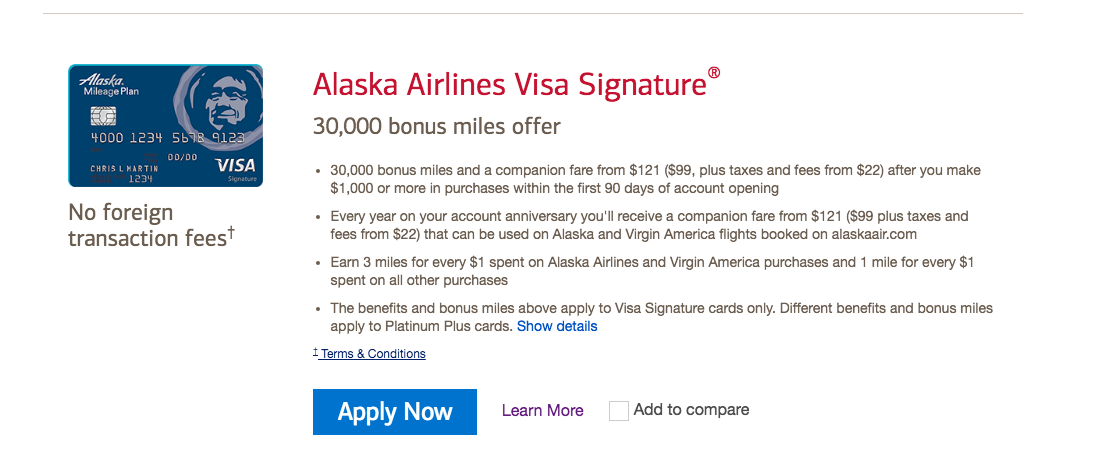

Bank of America is scamming its consumers out of benefits advertised and specified in their terms and conditions. Applied for a Credit Card with BofA to receive the reduced cost Companion Fare on Alaska Airlines March 15, 2016. Receive a Voucher that stated to expired April 16, 2017 (12 months later) (annual $75 fee) Went in in March to verify when it expired and marked my calendar to ensure I bought the tickets I needed. Came back weeks before the expiration date and the vouchers were missing from my account.

Called Alaska Air, they said the Voucher had expired. I was bummed out, but then when I asked when I would receive my next voucher, as it is advertised it should be received on my "Account Anniversary" and was told to call Bank of America, as they would be issuing it.Called BofA and the told me that indeed although I did not receive the voucher until nearly a month after I opened my account, it had been issued March 16 and had expired. I asked about the new Voucher and they said it was issued on March 20 and it would take a billing cycle to show up in my account.

My complaint -

1. I work at an online store and understand the way Vouchers work. If they can remove a voucher on a targeted date, they can issue one on a targeted date. What is the reason for the delay in delivery? I believe it is to save the company money on having to honor the benefit that is advertised.

2. This delay in delivery ensures that the consumer cannot use that voucher for one full month each year. The representatives I have spoken to have stated that the voucher has already been issued to me however, I do not have access to it until after my next billing cycle. Meaning it will expire March 16 however it will not be usable until April 16. If they really wanted to honor this voucher they could easily give me the voucher code via email or over the phone.

3. The advertisement both with Alaska Airlines as well as Bank of America clearly states that "you will receive a new voucher each year on your account anniversary date", however, the terms and conditions state that they have "1-2 billing cycles" to provide the vouchers to the customers Alaska Airlines account. The terms also state that the voucher will be "good for 12 months". If BofA the had the intention to make good on either of their agreements stated in their advertisement or in their terms and conditions they would, but they are not offering the customer any corrections and have explained to me that their process prescribes a violation to the terms and conditions of "making the voucher available to the customer for 12 months".

I have raised this concern with the representative at Bank of America, escalating this up to the Management level. I have been told my complaint would be "noted". I did let them know that I would be making a complaint to the available consumer protection agencies and I plan to file with all of the agencies that are associated with false advertisements related to consumer financial products. I realize that these policies are likely above the manager level pay grade but I wanted to give them every opportunity to make an offer to fix this issue.

I believe that this is a deceptive business practice resulting in reducing the amount of time the bank and the airline would have to honor their advertised agreement and saving the company potentially millions of dollars depending on the number of customers using their product. Think about it, they offer a benefit to the consumer in exchange for paying an annual fee to use their card, but then they create a process that is designed to remove 8-16% of the risk of paying out a benefit worth between ~$300- $800, times the number of customers using their card per year, netting B of A millions in savings.