Complaint Review: capitalone - Internet

- capitalone Internet USA

- Phone:

- Web: capitalone.com

- Category: Credit & Debt Services

capitalone closed account without notice ridiculous wait time for secure deposit wait time demeaning customer service Internet

*Consumer Comment: This is a surprise?

*Consumer Comment: There is one word for you..

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

My credit is very poor so I applied for the secured capital one card. I was approved, I placed the security deposit, received the card in roughly two weeks.

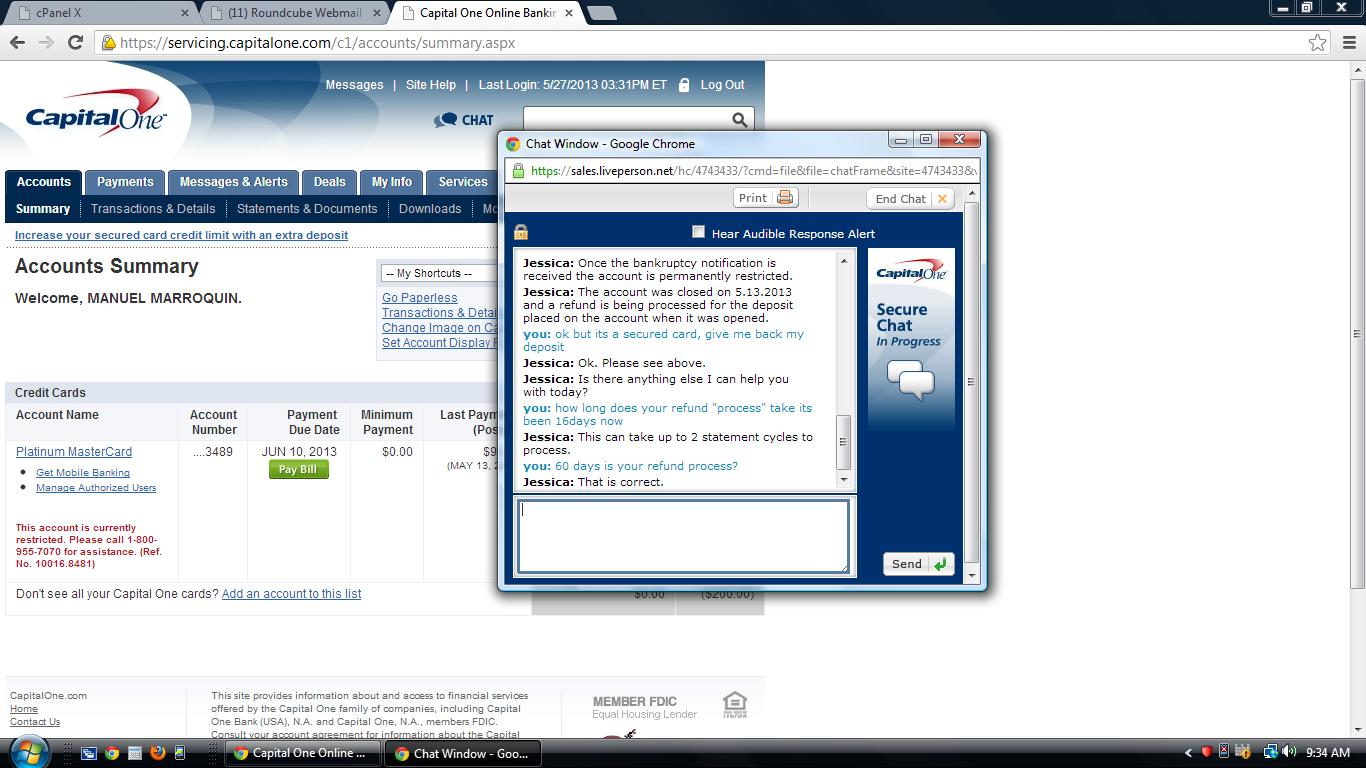

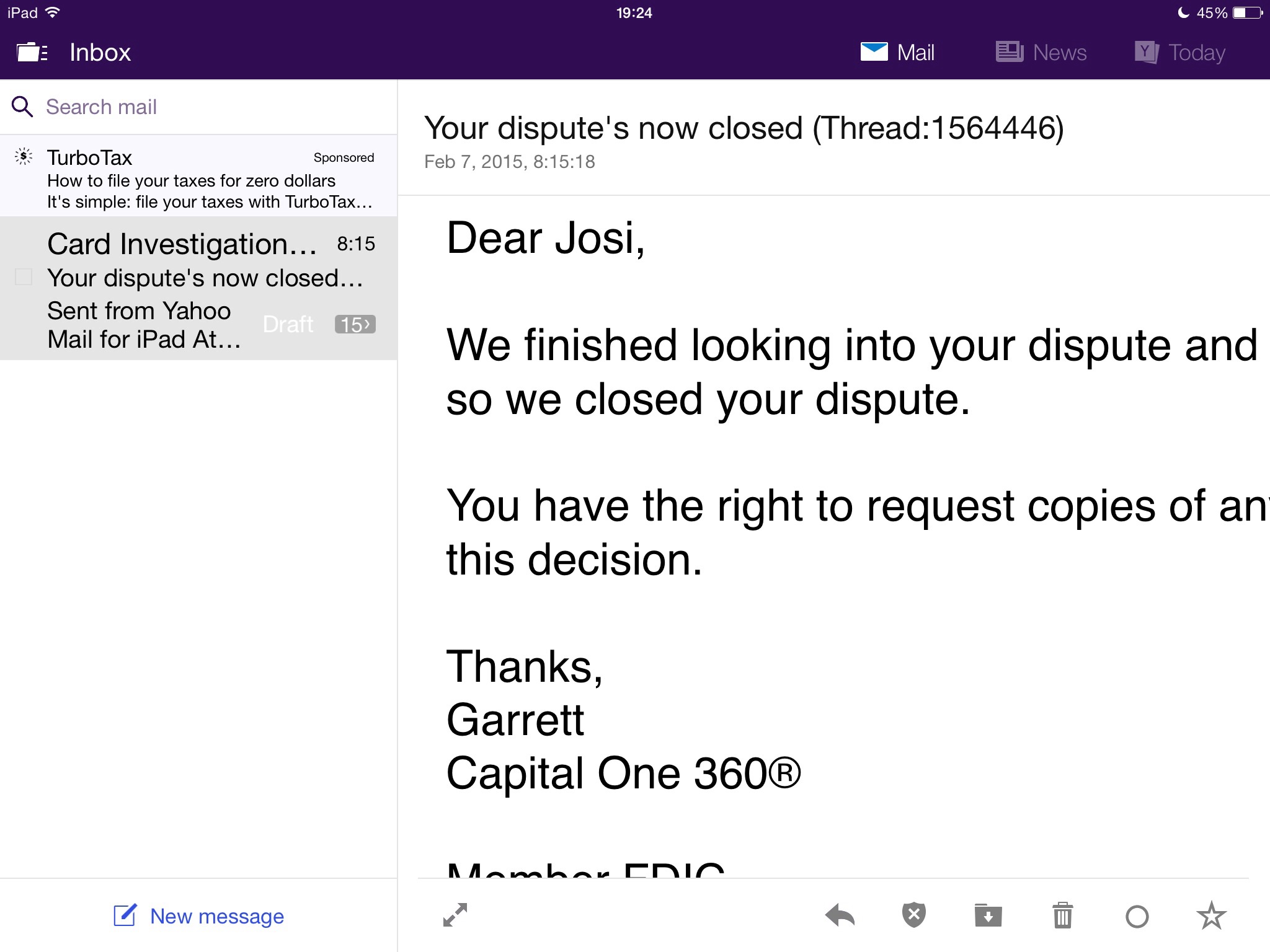

A week later I filed for bankruptcy to officially start over considering I had substantial debt from 4 years prior and capital one canceled my card without notice.They said it takes up to 2 billing cycles for you to receive your deposit back and the sad part is on top of the wait there is a $29 annual fee that I will no longer see all for having the card in my possession for a whopping week.

Every time you contact customer service they are very polite and courteous but give you this feeling of beng less human for having bad credit with their tone of voice.

This report was posted on Ripoff Report on 05/29/2013 10:16 AM and is a permanent record located here: https://www.ripoffreport.com/reports/capitalone/internet/capitalone-closed-account-without-notice-ridiculous-wait-time-for-secure-deposit-wait-tim-1054668. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#2 Consumer Comment

This is a surprise?

AUTHOR: Knightly - ()

SUBMITTED: Wednesday, May 29, 2013

" A week later I filed for bankruptcy to officially start over considering I had substantial debt from 4 years prior and capital one canceled my card without notice. "

Did you really think that you could file for bankruptcy a week later and get to keep the credit card account? Really?

#1 Consumer Comment

There is one word for you..

AUTHOR: Robert - ()

SUBMITTED: Wednesday, May 29, 2013

Idiot...Sorry to be so blunt but what you have done is really idiodic, especially if you think that Capital One is ripping you off.

You have "bad credit" and instead of taking care of your past debts you signed up for a secured card. Not only that but you did this with every intention of filing bankrutcy. Oh and sorry but you can't try and claim that when you signed up for the card you were not even considering Bankruptcy.

So what happens when you file Bankrupty. By Federal Bankruptcy Codes you must declare all of your debts..yes even "secured" debits. All of those companies are notified by the courts. As a result the company will often close the acount out as standard practice. Especially if it is something such as a Credit Card. If your attorney didn't explain this to you perhaps that should be the focus of your next RipOff report.

Since Capital One had zero idea that you were going to delcare bankruptcy 2-3 weeks later this entire event and all of the concequences are on you.

Oh and by the way if you think that some person on the Internet is "tough" on you..just wait until you have your hearing with the Trustee. When you go to your hearing with the Trustee you better have a very good reason why if you are in such bad shape and want to have a "fresh start" did you open up a new credit card account just a couple of weeks before you filed. Because if they don't think you are sincere or are really not in that bad of shape they have every legal right to dismiss your bankruptcy..that is you will be denied.

If you really wanted to open an account, you should have waited and not opened up this account until your BK was discharged.

Advertisers above have met our

strict standards for business conduct.