Complaint Review: Capital One Auto Finance -

- Capital One Auto Finance USA

- Phone:

- Web: www.capitalone.com

- Category: Car Financing

Capital One Auto Finance auto repod in 2008 but they claim I made a payment in 10/09 www.capitalone.com Internet

*Consumer Comment: You seem to be a bit confused...

*Author of original report: ?

*Consumer Comment: Wrong!

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

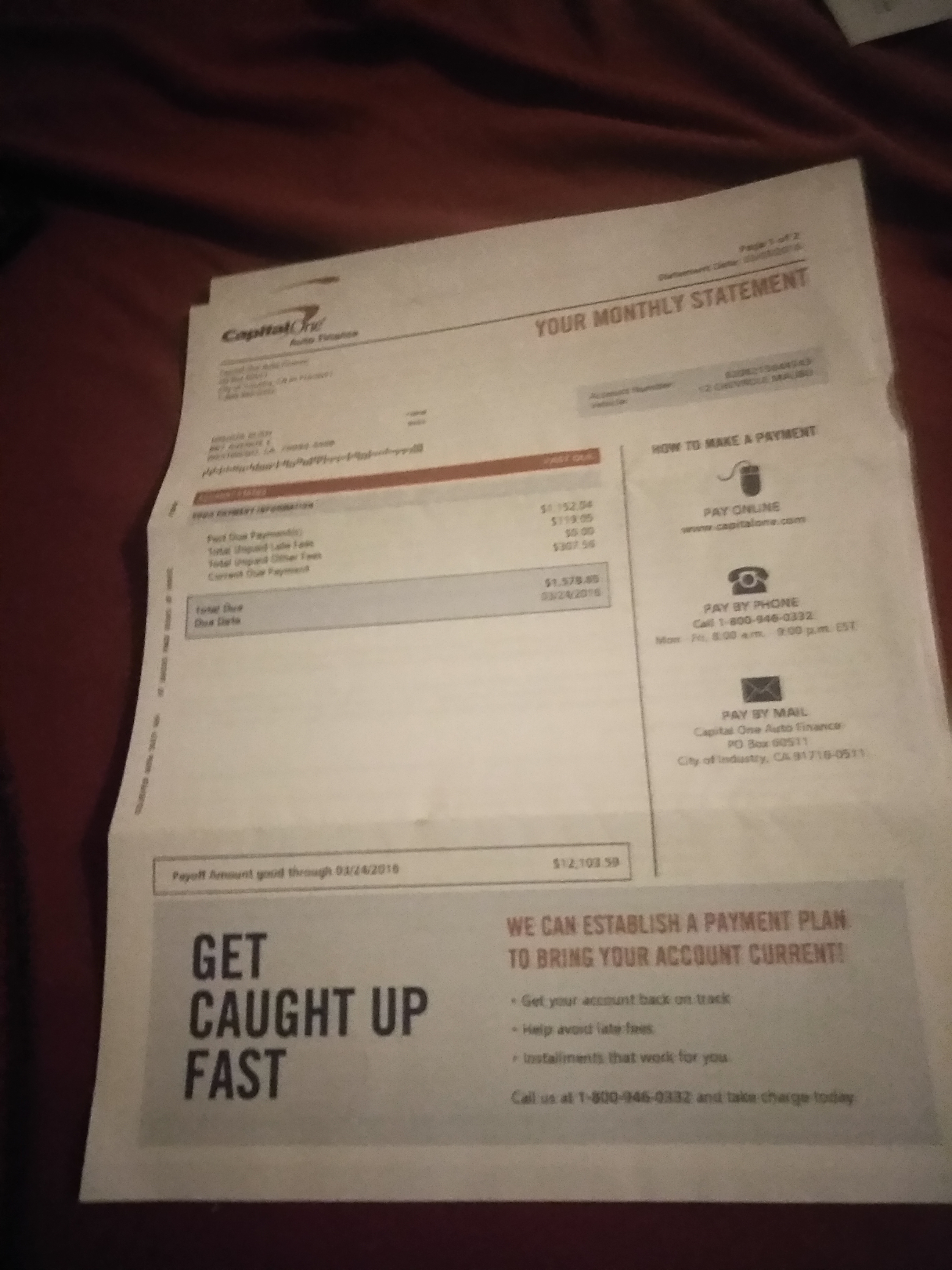

I had an auto loan through Capital One Auto, and in March of 2008 the car was repossessed. In October of 2009 I started receiving calls from Portfolio Recovery trying to get me to arrange payment of my balance after the car was sold. Eventually I stopped working with them because there simply was no way I was ever going to be able to come up with the money to repay the balance.

Less than a year later I was attempting to purchase something and my credit report was run. I was told I was turned down for credit because I had a repo within the last year. It turns out that during the time I was working with Portfolio Capital One reported that I had made a payment on the car in October of 2009. I wrote two letters to Capital One asking them to please fix the problem and show that I did not make the payment as they said I did. I sent these registered with delivery confirmation. I did not get a response from them.

Eventually I forgot about the incident and didn't give it much more thought. Time went on and after anothet year it was no longer causing me problems getting credit.

Fast forward four years. Today I received a call from Portfolio requesting payment on the balance on the car. I told them the SOL ran out a year ago, and she said that because I made a payment in 2009 the SOL had actually not run out.

So, what do I have to do to get Capital One to fix this problem? And is this Capital One's mess up, or Portfolio's? My credit has gone down the tubes since I became disabled, which is why I had to let the car go back in the first place, but I have recently managed to make arrangements with all my creditors and all the nasty phone calls have stopped, a nd I don't want these people starting to call me.

Please help.

This report was posted on Ripoff Report on 10/15/2013 03:35 PM and is a permanent record located here: https://www.ripoffreport.com/reports/capital-one-auto-finance/internet/capital-one-auto-finance-auto-repod-in-2008-but-they-claim-i-made-a-payment-in-1009-www-1092169. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#3 Consumer Comment

You seem to be a bit confused...

AUTHOR: Robert - ()

SUBMITTED: Sunday, October 27, 2013

Any negative information can remain on your credit report for 7 years(well it is actually about 7 1/2 years due to timing). So that means that the Repo will actually remain on your credit report until late 2015. Until then you will find few if any creditors willing to take a risk on you. Then if you do, you will be paying a higher interest rate due to the higher risk.

Now, you are talking about the legal SOL. That is the period of time they can take legal action against you in the attempt to collect on a debt. It does not mean that a credit has to stop attempting to complain. If you want them to stop contacting you then you must send them "Cease communication" letter by certified mail with return receipt. You can search the Internet for many examples. But again..this won't remove it from your credit report.

As for this "disputed" date. You said you started receiving calls in October 2009 and eventually stoped "working" with them. So what does that mean? Did you make a payment, did you send them any sort of an agreement that was a promise to pay? If so you may have legally reset the SOL and made the new date October 2009. Which since VT actually has Statute of Limitations of 5 or 6 years you MAY still be legally responsible for the loan. Of course if they do get to the point of suing you, you need to require them to provide proof of the action that would have reset the SOL.

As a side note...based on the rest of your report it is very unlikey that it is just this single Repo with a disputed "payment" that is causing you to get denied.

#2 Author of original report

?

AUTHOR: ledev68 - ()

SUBMITTED: Friday, October 25, 2013

It breaks my heart to see people like you who take great joy in insulting others. Do you scan different web sites to find your next victim? Take a suggestion, go out and get some fresh air, visit your mom, or go for a nice walk. Get up from that computer chair, your legs are probably atrophying from sitting there so long. The rebuttal section of this particular web site is for giving constructive advice, not for saying stupid things that don't help anybody. While you're at it, do everybody else a favor and delete this website from your history.

#1 Consumer Comment

Wrong!

AUTHOR: ramjet - ()

SUBMITTED: Wednesday, October 23, 2013

Actually this is not their 'mess up' it's yours. You didn't pay your bill but stiffed them for what you owe them. You should be ashamed of yourself.

The solution is to pay what you owe and quit being a dead beat.

Advertisers above have met our

strict standards for business conduct.