Complaint Review: Capital One Auto Finance - Plano Texas

- Capital One Auto Finance Plano, Texas United States of America

- Phone:

- Web: www.capitalone.com

- Category: Loans

Capital One Auto Finance Unethical Practices Plano, Texas

*Consumer Comment: once again bob from irvine strikes

*Consumer Comment: Not how it works

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

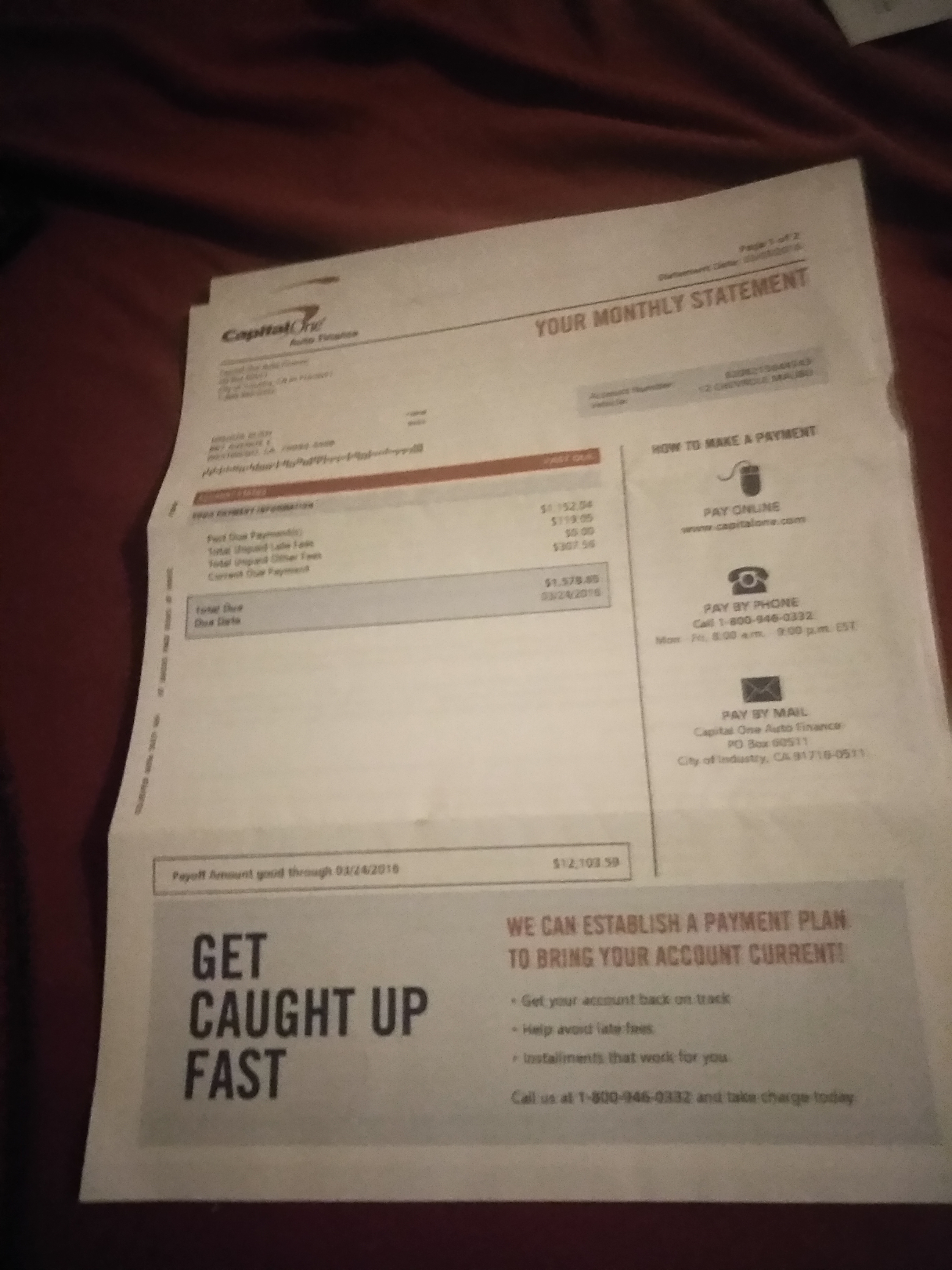

I obtained an auto loan from Capital One Auto Finance in 2008, and all was well - until I lost my job and replaced it with a job at a drastically reduced salary. I kept up with the payments as best I could until I woke up one morning in 2011 to find that my car had been repossessed. Thankfully, I was able to come up with the cash to get the car back. However, Capital One had arranged to have the car delivered immediately to an auto auction over 200 miles away. As I had no transportation, I used the money for my next car payment to buy a cheap plane ticket and fly to the repo lot to retrieve my car before they could sell it. I paid the tow yard's fine and drove my car home. From then on, I made payments as regularly as I could. (If I couldn't meet an entire payment for one month, I would make partial payments each week just to keep up.) In 2012, the car was totaled in an accident when another motorist ran a stop sign. The other driver's insurance company paid off all but about 2,000. (accrued interest and late fees had been piling up during the tough financial times.) When I went to find a replacement, imagine my surprise when I discovered that Capital One never removed the repossession from my credit report. I showed the paperwork to the new dealer proving that I had gotten the car back. Eventually, Capital One charged off the remaining balance, then sold my account to a collection agency that conducted a hard inquiry on my credit report without my permission. What's in your wallet?

This report was posted on Ripoff Report on 01/14/2013 07:32 AM and is a permanent record located here: https://www.ripoffreport.com/reports/capital-one-auto-finance/plano-texas-/capital-one-auto-finance-unethical-practices-plano-texas-996437. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#2 Consumer Comment

once again bob from irvine strikes

AUTHOR: The Outlaw Josey Wales - (United States of America)

SUBMITTED: Monday, January 14, 2013

mr copy and paste just can't control himself, must rebutt anyone with problems. if I could I would copy and paste the fine print on ROR which states that bob from irvine can and must rebutt. Butt can't find no such print. no I don't work for kenny or stacie, by the way bob from irvine are you the one using movingforward????

#1 Consumer Comment

Not how it works

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Monday, January 14, 2013

Even though you have other issues, let's just pick this up at the Credit Report and Charge-Off.

When I went to find a replacement, imagine my surprise when I discovered that Capital One never removed the repossession from my credit report.

- Repossession is not just having your car taken and not returned. Even if you are able to get your car back it is still considered Repossessed. So the credit listing is correct and valid...sorry.

Eventually, Capital One charged off the remaining balance, then sold my account to a collection agency that conducted a hard inquiry on my credit report without my permission.

- Regardless of what happened to the car, you still owe the balance of the loan. While it is too late now, you should have fought a little harder with the other insurance company to pay the entire balance, not just what the car is worth. But since you still have a balance, you are still legally responsible for that $2,000. Since you did not pay that balance they have the legal right to sell your account to a 3rd party collection agency. That agency also has the right to do inquiries on your credit report. Oh and who gave them this permission..you did when you originally signed for the loan.

One other thing. The "Charge-Off" doesn't mean you don't owe the money, you just owe it to the collection agency. If you fail to pay it they have the right to sue you for the money. Where if they do, and are able to prevail you would not only be on the hook for the balance, but court and legal fees as well. If they get a judgment and you fail to pay it, they may have the legal right to garnish your wages and/or attach your bank accounts.

One final thing. If you think you would have been treated any different with other lenders. Think again as they would have all done the same thing. As nothing you have mentioned is anything out of the ordinary.

Advertisers above have met our

strict standards for business conduct.