Complaint Review: Capital One Auto Finance - City of Industry California

- Capital One Auto Finance City of Industry, California United States of America

- Phone: 800 946 0332

- Web: www.capitalone.com/autoloans

- Category: Financial Services

Capital One Auto Finance Federal Government passes HR 1054 1992 formerly Rule 78 [predatory lending] City of Industry, California

*Consumer Comment: Your thinking is most likely incorrect.

*Consumer Comment: Bull!

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

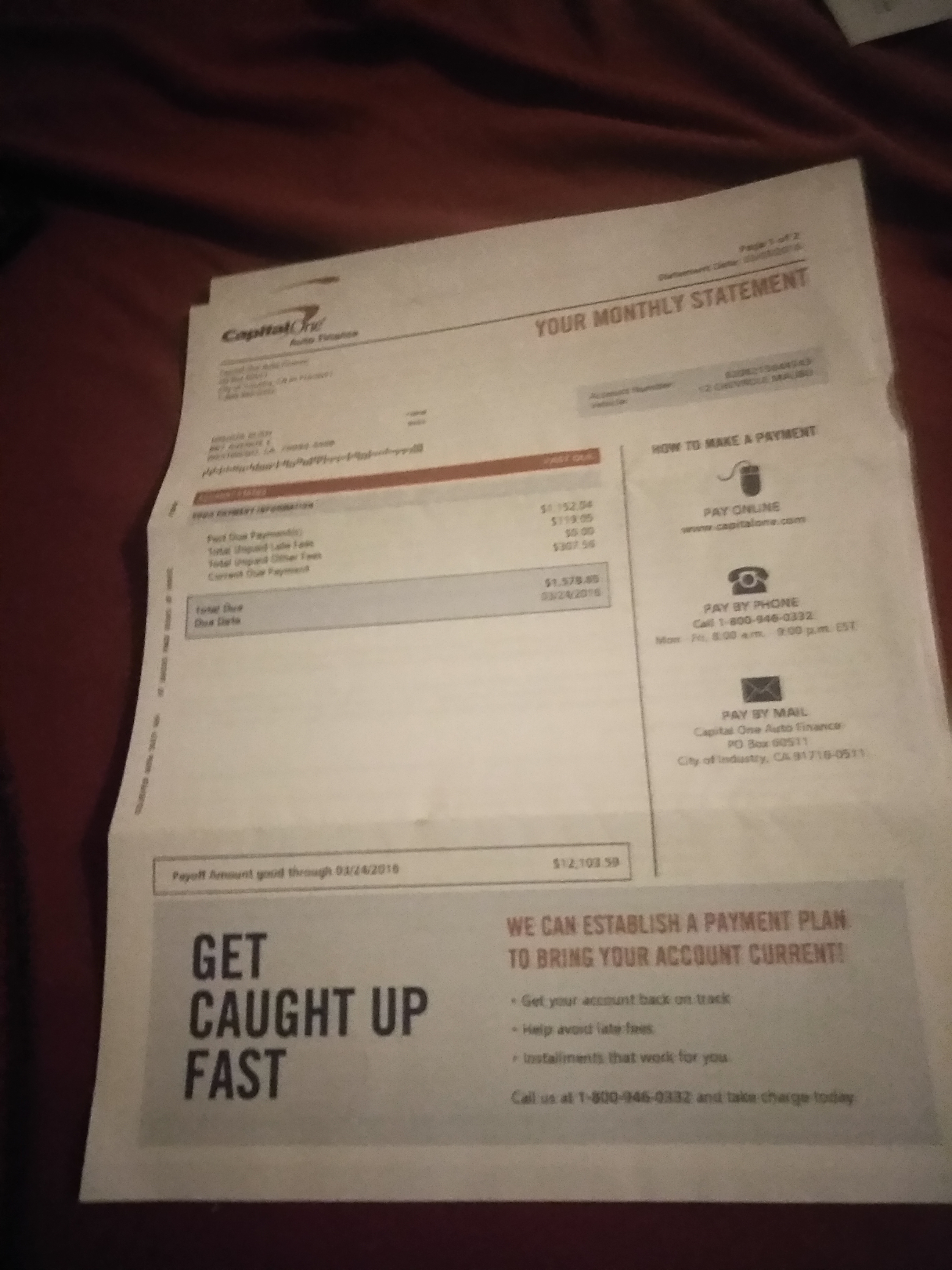

I purchased my car 1/9/08 for $12,149.44 with a 72 mo. simple interest loan? There were a few times I was late or missed a payment but, eventho....year to date I have paid $9,464.54 in interest and $3,434.80 applied toward the principal.

After months of not understanding why my principal wasnt going down I did some research via internet. I found that my loan was a Rule 78 loan where they collect the majority of the interest within the first 2-3 years. Also, 1992 the Federal GOvernment pass HR 1054 which only allows this type of loan on 61 month loans it cannot be applied to a 72 mo. loan of which I have.

I called Cap One and spoke to a Cassy and brought this up to her and after putting me on hold...came back and said they still carried these types of loans she really didn't know what to tell me other than to contact an attorney.

I was informed by another source that back when HR 1054 was passed General Motors almost went bankrupt refunding their clients interest they had paid in full.

If anyone knows of an attorney I may contact.............I anxiously await your reply. I am not going to let this go.

This report was posted on Ripoff Report on 09/27/2011 11:10 AM and is a permanent record located here: https://www.ripoffreport.com/reports/capital-one-auto-finance/city-of-industry-california-91716-051/capital-one-auto-finance-federal-government-passes-hr-1054-1992-formerly-rule-78-pred-781901. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#2 Consumer Comment

Your thinking is most likely incorrect.

AUTHOR: Dave - (USA)

SUBMITTED: Tuesday, September 27, 2011

Using cap one you probably have a higher interest rate. You gave the term (length) of your loan and the amount financed but did not give your interest rate. So assuming several different interest rates I calculated some numbers using an amortization table to show your loan is not a rule 78 type loan but a simple interest loan.

The interst paid shown here would be if you made every payment on time.

At 21% interst you would have paid $7521.18, 23% $8324.72 and at 25% 9140.66.

I would assume your interest rate is between the 23-25% range given the amount of interest you said you paid.

Using the purchase price of $12149.44 at 25% interest the current outstanding principal balance would be $6890.15 Again if every payment was made on time. Here is how interest is calculated

6890.15 X .2500 / 360 = $4.78 per day interest Multiply this number by 30 and you will have the amount of interest you will be paying in your next payment (4.78 X 30 = 143.54)

Keep in mind this $4.78 is per day. If you pay 5 days late you would need to add another $23.90 to the monthly interest charge (also called finance charge) of $143.54 bringing the total interest you would pay in your next payment to $167.44 plus there could be late charges as well.

Your research on the rule of 78 is accurate but you really need to research how interest and principal is paid. In any loan a portion of your payment will always go to interest first. Every month less is applied to interest and more to the principal provided you are paying your loan on time.

The girl Cassy you talked to was probably is just some administration person in the office and really has very little knowledge of finance or even what the Rule of 78 so she wouldn't be able to tell you what she doesn't know.

Basically it comes down to this...you have a simple interest loan and are shocked by the amount of interest you will be paying.

Hope this helps the next time you finance something

#1 Consumer Comment

Bull!

AUTHOR: Jim - (USA)

SUBMITTED: Tuesday, September 27, 2011

HR 1054 has to do with certifying midwives! This has NOTHING to do with interest computation!

But without regard to that, if you have a 72 month loan (way, way too long) and for the sake of discussion the total interest is $5000 then what difference does it make if you pay the interest up front or in the back...it still needs to be paid! The term of 72 months will be 72 months regardless of when the interest is paid.

But as a result of your vast knowledge of finance please tell us what difference it makes?

Advertisers above have met our

strict standards for business conduct.