Complaint Review: care credit - Internet

- care credit Internet United States of America

- Phone:

- Web: carecredit.com

- Category: Credit Card Fraud

care credit gecapital intrest rates rise nomatter what you pay Internet

*Consumer Comment: A Closing Comment

*Author of original report: SELECTIVE READING

*Consumer Comment: Figured as much....

*Author of original report: opps i goofed

*Author of original report: Intrest rates

*Consumer Comment: Your problem is not the Interest Rates.

*Consumer Comment: GE CAPITAL INTEREST

*Author of original report: Intrest rates

*Consumer Comment: Agree with NOT POSSIBLE

*Consumer Comment: Not possible

*Consumer Comment: Read Responsibly

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

I needed glasses and this sounded like a chance to get them. The appointment went well they also had glasses right there and I picked out the pair I liked then they were over 500 dollars but I could make monthly payments so I got them.I paid around 50 dollars a month and when the 6 months was up they charged me 175 intrest for not paying off in 6 months now they tack on more intrest rates and after paying 50 dollars a month for about 2 years I have paid 1200 for 500 dollar glasses and Last statment is saying i still owe 496.00 this company is bad news they sould good but in the end they keep raising intrest rates. I cant afford to pay it off because I am paying my bills on time and never missed a payment

This report was posted on Ripoff Report on 01/23/2013 04:44 AM and is a permanent record located here: https://www.ripoffreport.com/reports/care-credit/internet/care-credit-gecapital-intrest-rates-rise-nomatter-what-you-pay-internet-1001688. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#11 Consumer Comment

A Closing Comment

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Thursday, January 24, 2013

First of all the way this site posts things there is a delay in having the comments written, so at the time I responded your last post was not displayed yet.

What kind of company charges a late fee for paying it early

- Not a single company..not even GE Care Credit. For a short lesson on credit cards. Credit Cards are considered Open Accounts and as such have a billing period. Any payment received in a specific billing period MUST be applied to that billing period. They are not allowed to "pay ahead", in fact doing that would actually get them in serious trouble. So if you pay before the closing date, the payment is applied to the previous period. Once that period closes you will then owe the minimum payment for the new period. If you review your statements(e-statements or otherwise) you will see that a minimum payment is due and the payment was applied to the previous months balance(this actually is a positive because you are charged less interest because the balance is lower). The only way you would then get a late fee is to ignore this minimum payment due. Oh and before you ask..this is regulations that every single bank must follow.

.I think the goverment should regulate them

- The Government does regulate them, hense the rules on "Open Accounts" as I described above.

I think the goverment should regulate them and only let them charge one rate to everyone nomatter what your credit score 3.99 seems fare nomore no less....

- The higher the risk the more it is going to cost you to borrow the money. So if you actually think this is practical, there is probably no way that you would have been approved for any credit cards. Because banks will just stop lending to people with bad credit. But of course if you want to become the "Interest Rate Superhero" go ahead and talk to your Senators and Congressmen and let us know what they say. I'll tell you one thing they will say..Interest Rates are State Governed..so talk to your State Representatives. Then while you are at it, why not make every car $3,000 or every house $15,000 after all that's only fair too right?

#10 Author of original report

SELECTIVE READING

AUTHOR: Ralphgaston1962 - (United States of America)

SUBMITTED: Thursday, January 24, 2013

I guess you have SELECTIVE reading skills like people with Selective hearing. I did give the interest rates 26.99 and thats ROBBERY.....As far as the statements I have E Statements and can look at them on my computer....and as for my bank paying my bills its called billpayer and I can change the amounts and dates anytime....Fare warning about paying early is if you pay to early it dont count for the next bill.... I got a late charge in march because i paid my bill on 3/5/12 and when I got my tax return on 3/15/12 3 weeks early I decided to pay my april bills with it instead of blowing it and Care Credit charged me a late fee for missing payment in april.....What kind of company charges a late fee for paying it early....These credit card companies are just a bunch of bullies kinda like loan sharks back in the old days, loan you all kinds of money they pretty much know you cant pay back,then make you suffer repayng it.....I think the goverment should regulate them and only let them charge one rate to everyone nomatter what your credit score 3.99 seems fare nomore no less....

#9 Consumer Comment

Figured as much....

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Thursday, January 24, 2013

Yep..finally getting to the actual issue. It isn't their Interest Rates..it is your lack of account management.

Well in all honestly I dont get statments because I am on paperless and dont have the time to check

- It can't be both. You either don't have time or you don't get statements. I actually think you do get statements and are using the "I don't have time" excuse. Well guess what..that is exactly what it is..an excuse. It takes only about 2 minutes one time per month to review your statement. I bet you spent more time than that yesterday deciding what to eat.

I have made but I know I am not missing any payments ever because its paid through a aotomatic payment through my bank.

- And just how do you know that if you don't look at your statements? Are you really putting all your trust in the bank?

for about a year I was only paying 35 and then I relized the intrest rates were about 15 a month so I bumped up my payment to 50 about 3 months ago

- Oh so it hasn't been $50/month for 2 years(big surprise). So just how did you realize about $15 of that was going to interest. I bet it was by you reading those statements you say you don't get and don't have time to read.

and now looking at my statment the intrest rates are getting higher then prior months and the balance is still close to what I charged

- Are these the same statements you say you don't get and don't have time to read? Even with that you still haven't posted what this interest rate is.

I wish somehow I could pay it in full and close the account

- Then here is what you do. First, READ your statement every month, and verify the minimum payment. Make sure your payment arrives to them ON-TIME. If we use a guess of your Interest rate being 36%, and your minimum payment as the highest you mentioned of $52. Doing this will have your account paid off in just about 12 months.

#8 Author of original report

opps i goofed

AUTHOR: Ralphgaston1962 - (United States of America)

SUBMITTED: Thursday, January 24, 2013

Well after taking a closer look I did miss a few things and didnt see that the glasses were 500 and there was a eye glass exsam fee of 170.00 and I see my payments were not all 50.00 so just to clear things up from what I can see i have paid around 705.00 towards the 770.00 and my balance is 486.00....truth of the matter is I should have just gotten cheeper glasses and paid cash I just didnt have the cash at the time. Its funny I could have just kept waring cheep reading glasses from the dollar store and none of this would have ever happend.....Still intrest rates of 26.99 is robery and shouldnt be acceptable in any company so shame on them. Its funny people with less then perfect credit have to pay higher intrest rates then people with good credit...People like me can never get ahead because of people like you charging outragues rates... I guess I learned a lesson here is if it sounds to good to be true it probley is....

#7 Author of original report

Intrest rates

AUTHOR: Ralphgaston1962 - (United States of America)

SUBMITTED: Thursday, January 24, 2013

Well in all honestly I dont get statments because I am on paperless and dont have the time to check

the statments and I really dont even know how many payments I have made but I know I am not missing any payments ever because its paid through a aotomatic payment through my bank. for about a year I was only paying 35 and then I relized the intrest rates were about 15 a month so I bumped up my payment to 50 about 3 months ago and now looking at my statment the intrest rates are getting higher then prior months and the balance is still close to what I charged.... Its not fare to me and I wish somehow I could pay it in full and close the account.... I work as a manager and am low income I am single and cant even file head of household so even though I only make 30 grand a year are goverment makes me pay taxes around 2500. Bottom line here is thease companies are ripping off people who need help and should be held accountable for it.... Funny all my credit cards the amount goes down every month when I dont use them and I havent used the care credit card and the balance is still about the same. The problem is I trusted them and shouldnt have and areter reading all the complants I see why

#6 Consumer Comment

Your problem is not the Interest Rates.

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Wednesday, January 23, 2013

Interesting how your update titled "Interest Rates" didn't even list what your interest rate is. It is also interesting how you can't even keep your numbers straight from posting to posting.

Just a few hours before you said they assessed $175 in Interest for not paying it off in 6 months. In your last posting it increased to $198. You don't even know how many payments you have made. In your original post you paid for almost 2 years, but now it is at least 12 months. You originally stated you have paid $1200 so have you really paid $1200 or is that just a guess on your part?

In your original report you say your latest statement shows you owe $496(or is it $486), so we can figure you get statements. Yet you then complain that they didn't call you to tell you your minimum payment increased. Well guess what NO company will call you because your minimum due is on your statement..which from how you wrote your original report you obviously get..now whether you read it is another matter.

But even taking this and figuring that you have truly paid for 24 months, even with the two late payment fees(probably less than $100 total) it still would be paid off or at least very close to being paid off and not at the original balance.

Believe it or not I am actually trying to help you figure out where your issue is. But with your posting that is basically all over the place this is impossible.

So do you want to try again?

#5 Consumer Comment

GE CAPITAL INTEREST

AUTHOR: Steven - (USA)

SUBMITTED: Wednesday, January 23, 2013

The program that GE CAPITAL has with consumer products gives you 6 months interest free as long as you pay at least the minimum payment and defers the interest for the 6 months if you pay off the ENTIRE balance prior to the expiration of the promotional NO INTEREST PERIOD.

Should you fail to make your monthly minimum payment or not pay off the balance prior to the 6 months, then interest is charged on your purchase from day 1.

This should have been explained to you at the time of purchase.

Unfortunately I too needed to use CARE CREDIT to pay for dental work that I needed and did not have the funds to pay for the work using regular credit cards so I took the opportunity to use CARE CREDIT'S 6 month interest free credit card and now I have to pay for the item to avoid what you have been burdened with, which is a larger that life bill including the interest charged at a rate that seems illegal.

Good luck and remember the rules of ALL THESE INTEREST FREE PROGRAMS. They are only good if you can pay them off prior to the end of the promotional trial period.

#4 Author of original report

Intrest rates

AUTHOR: Ralphgaston1962 - (United States of America)

SUBMITTED: Wednesday, January 23, 2013

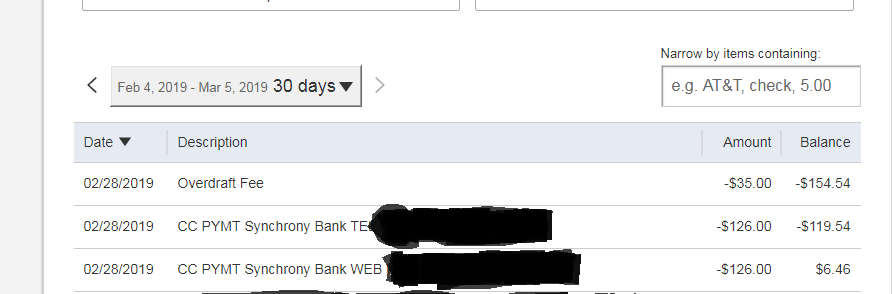

True I didnt pay off the balance in 6 months because I could only afford 50.00 a month but at 181 days they added 198.00 intrest and the 300.00 I had paid somehow now I cant even see the payments and then they raised the min due ( With out Calling me ) to 52.00 so then they tacked on a late fee for 2 months ( with out calling me ) 35.00 for my 50.00 payment being not the min due keep in mind they got my 50.00 payment...... I know I should have known better but I cant afford all the rates

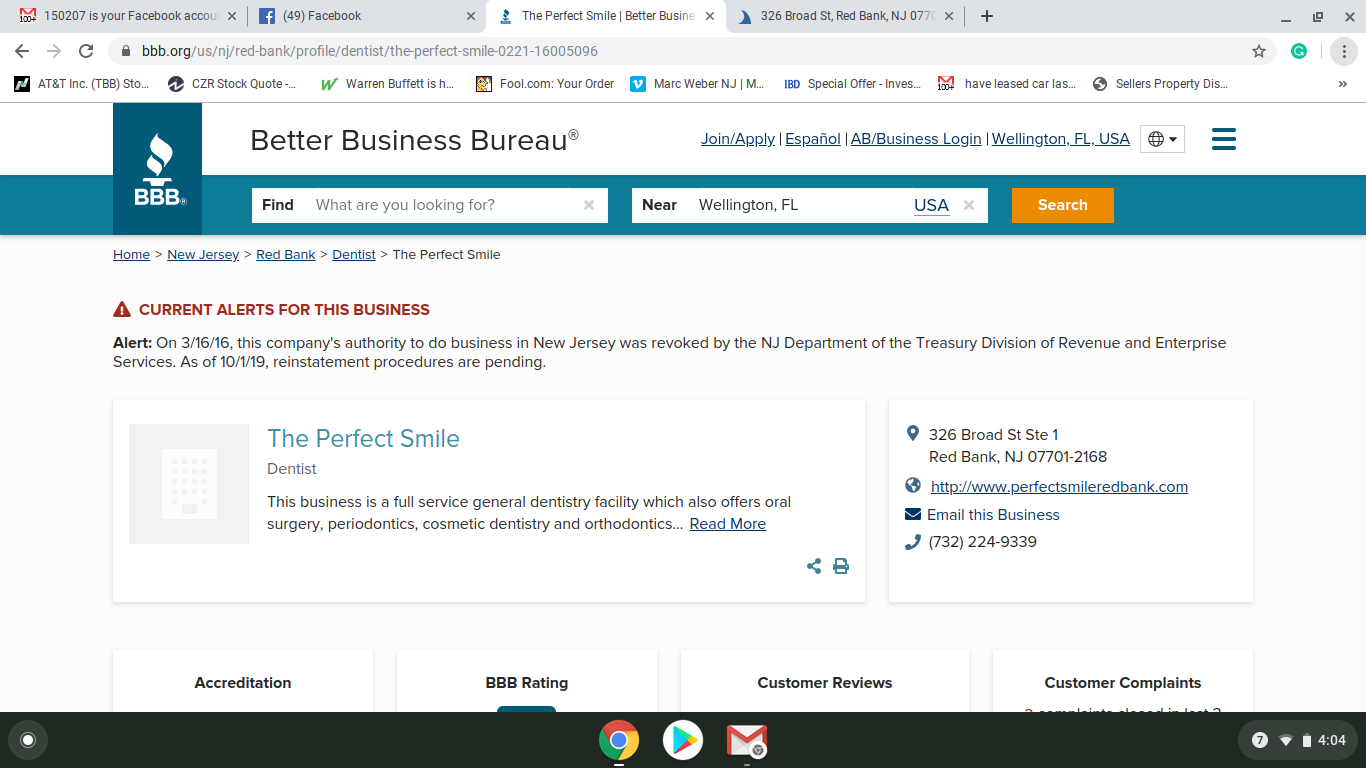

now here I am still owing them 486.00 even after paying 50 a month for at least 12 months and never late its paid by my bill payer account the interest rates are going even higher each month I have also filed a complant with the BBB someone needs to stop thease people from racatering good people out of hard earned money

#3 Consumer Comment

Agree with NOT POSSIBLE

AUTHOR: Steven - (USA)

SUBMITTED: Wednesday, January 23, 2013

I have been a CARE CREDIT customer for many years and know exactly how the system works. I leave myself 1 week notice on my calendar to pay off the amount due prior to the promotional NO INTEREST period is up. Sure they make their money on customers who pay the minimum monthly payments and DO NOT pay off the balance prior to the NO INTEREST period expires.

Care Credit is not the only company that has that program. Firestone Credit cards offer the same 6 month free interest if it is paid off prior to the end of the INTEREST FREE PERIOD. You just have to know and be certain that you pay it off prior to the end of that period and there is NO INTEREST charged to your account.

I have confirmation that I had satisfied my last CARE CREDIT bill after paying it off on time.

Consumers sometimes do not charge responsibly knowing what they are doing and what the agree to when they sign up for these NO INTEREST CREDIT CARDS.

HAPPY INTEREST FREE CUSTOME

#2 Consumer Comment

Not possible

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Wednesday, January 23, 2013

Unless you are leaving some very key information out, what you are saying is actually impossible.

With a payment of $50 ON-TIME, even with a 36% Interest Rate(and yours is most likely less), $35 of that would go to the principal. Over time you would then have more going to the Principal and less to Interest.

So unless you are not actually paying $50 a month, somehow skipped a few months, not paying it on time, have added to the balance through additional purchases, or the $50 is less than the minimum due there is no way after 2 years you would still be at $496. In fact you should actually have paid it off by now. So what are you leaving out?

Of course if you are being 100% truthful and not leaving anything out, it should be a very simple case that I am sure your local news media would love to see how they just magically add amounts to your balance so you can never pay it off.

#1 Consumer Comment

Read Responsibly

AUTHOR: Steven - (USA)

SUBMITTED: Wednesday, January 23, 2013

I have been using Care Credit for unexpected dental work that totaled over $3,000. Prior to that I bought 2 mattresses from Sleepys on the Sleepys credit card which is also with GE Capital. It clearly states that you need to make monthly payments and PRIOR to the expiration of the promotional NO INTEREST period, you have to pay in full.

If you follow the simple program rules you would have only paid $500 for your glasses.

It is not fair to chastise a company for your failure to comply with the rules of the program.

Happy GE Capital Customer

Advertisers above have met our

strict standards for business conduct.