Complaint Review: CashCall - Fountain Valley California

- CashCall www.cashcall.com Fountain Valley, California U.S.A.

- Phone: 877-525-2274

- Web:

- Category: Cash Services

CashCall This company preys on people's weaknesses Fountain Valley California

*Consumer Suggestion: I am filing a class action lawsuit.

*UPDATE EX-employee responds: read the "not so fine" print.

*Consumer Comment: There are no laws against their interest rate

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

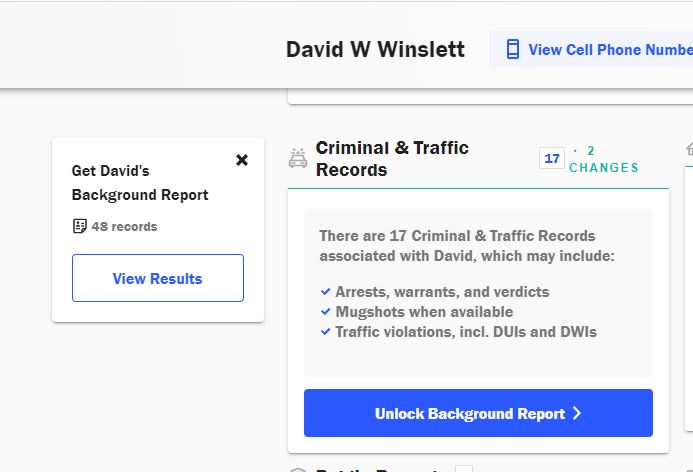

In March of 2007 I stupidly took out a loan with CashCall. I only asked for $1500.00 but they sent me $5000.00. I know I should have paid the $3500.00 immediately, but as most people would do, I used that money for other bills that were less immediate than the bill I had borrowed it for in the first place. I paid all last year, I figure about $2790.00, and my principal is still over the $5000.00.

I had some additional finacial problems earlier this year and needed pay them one month late. I was told that they would wait to put through EFT and all was well. So I thought. Three days later they debited my account for the $254.63, unfortunately, there wasn't that much money in there. My Credit Union paid the EFT and put my account into the negative. I called my Credit Union and they backed out the charge. I put a permanent stop payment on CashCall as over the next two days, they resubmitted the EFT two times, even though I had spoken to two different representatives. The customer service department threatens and calls me names when I talk to them so I stopped answering my phone if it is a number i don't recognize or a "No Name" call. I get the calls 24/7; some of the messages are computer generated and some are very threatening personal messages. I have not tried to work anything out with them as of yet as I don't need their abuse and I can't pay them the $583.06 they say I am past due.

They are now threatening me with litigation and that is how I ended up here. Are there any class action suits against this company for "loan sharking?"

Concerened in SD

San Diego, California

U.S.A.

This report was posted on Ripoff Report on 02/27/2008 03:10 PM and is a permanent record located here: https://www.ripoffreport.com/reports/cashcall/fountain-valley-california-92708/cashcall-this-company-preys-on-peoples-weaknesses-fountain-valley-california-312642. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#3 Consumer Suggestion

I am filing a class action lawsuit.

AUTHOR: Abstractgirl - (U.S.A.)

SUBMITTED: Wednesday, March 05, 2008

The other day I found out Cashcall is sueing me after they had harrassed me for months and literally made my life a living hell. insulting my co workers and made it impossible to work at my job without their calls, the caller ID always comes up UNKNOWN. Anyway I decided to fight back!! My friend just happens to be a powerful lawyer who does these types of cases. I just want to find justice for everyone, I don't want to pay 300% on my loan. I have read many of these stories on here of Cashcall harrassing you all and I have the same experience. I have to do something about this. Anyway I like to thank the ripoffreport.com and everybody who posted similar experiences on here, it made me feel like I was not alone in the struggle. Thanks.

#2 UPDATE EX-employee responds

read the "not so fine" print.

AUTHOR: Tarken - (U.S.A.)

SUBMITTED: Tuesday, March 04, 2008

In the email that Cashcall sent you, at the top of the contract in bold are the terms of the loan. The "Truth in Lending" act states they MUST inform you of these things. If you wanted $1500.00 and they gave you $5,000. then it was at a lower interest rate. Yes, you should have immediately paid back the extra $3500.00. This would have meant the remaining fifteen hundred you kept would need to be paid back at a MUCH lower interest rate.

Also, in the contract it states Cashcall reserves the right to deduct payments from your bank account. If you gave them your e-signature, then they must assume you read the contract.

I know Cashcall does offer certain programs for customers that are having a hard time paying back their loans, call your representative and ask them about it. Or, if you don't want to call them... wait another 10 minutes, if you're delinquent they'll probably call you.

Are they aggresive in their collection techniques? Sure. Do they charge a ridiculously high interest rate? Absolutely. Are they within their rights to try to collect the money they lent you, when clearly no one else would? Well, not always.

They are the original lender, so they do not have to follow the FDCPA (Fair Debt Collection Practices Act), however, each state has specific legislation that is very similar to the FDCPA guidelines (i.e. California has the Rosenthal Act).

In the end, the adage "buyer beware" should ALWAYS be applied, especially when dealing with a company that does the majority of it's business online. I hope this helps.

Good luck in San Diego.

#1 Consumer Comment

There are no laws against their interest rate

AUTHOR: Faron - (U.S.A.)

SUBMITTED: Wednesday, February 27, 2008

Our fine do-nothing for the common folk Congress took care of that. The only thing you can get them on is the phone harrassment, particularly calling all hours. you can file a complaint with the FTC.

Advertisers above have met our

strict standards for business conduct.