Complaint Review: Credit Acceptance - Southfield Michigan

- Credit Acceptance 25505 West Twelve Mile Road Southfield, Michigan USA

- Phone: 800-634-1506

- Web: www.creditacceptance.com

- Category: Car Financing

Credit Acceptance CORRUPT! MY STORY WITH INFO TO REPORT THEM FOR EVERYONE WITH COMPLAINTS! Southfield Michigan

*Consumer Comment: This was your best proof?

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

At the end of my report is a full list of who to contact to file a formal complaint and what they can offer the consumer!

Post your complaints anywhere you can online because it helps these agencies with similar complaints and can hopefully help us faster.

I see a lot of people who seem to be going through the same struggle that I am and want to help as many people as possible because NO ONE deserves to be treated so poorly by corporations!

PLEASE follow through and file your complaint with at least one of the agencies listed because they can and WILL do a FULL investigation. This not only helps you but also everyone else who is being screwed over by lenders.

Here is just a taste of my story 2 years later!

I purchased a 2012 Dodge Journey on 8/2/2014 that was sold as a "Certified Pre-Owned" from Medved in Castle Rock, CO. The only finance company they said would work with us was Credit Acceptance Corporation with an interest rate of 18.99% but could refinance it after a year.

I don't have enough time to go into all of the fraudulent and horrible things that have been going on with this company but THEY are corrupt and need to be shut down! I needed a car so we did it.

I asked for the Carfax and was told they would give it to me once the finance paperwork came back due to having to update me as a new owner but all Certified cars were 1 owner, never wrecked, and eligible for an extended service contract.

By the time we got the financing done it was about 9:30pm on a Saturday and was told they would have to wait for CAC to write it up but they would give me my Buyers Order which shows the contract.

During this time they told me that CAC required I have a starter interruption device installed in the car due to being high risk which i was told could be removed after 1 year of good payments and I agreed to do it.

I looked everything over and saw that they had charged me a $25.00 emission fee and asked why that was on there. I was told it was an error because the vehicle is emission exempt and they would correct it when I came back for my completed finance paperwork because the lender would not put that on there.

During this time I got a phone call that CAC would only finish the loan if I added GAP insurance and an extended service contract but that I had to sign the form it was my choice.

I was told that I can refuse it but then they would not give me the loan and I would lose my $1500.00 cash down plus mileage on the car so I was left with no choice.

When I finally got my finance paperwork they had charged me for the emission test too! I asked why and was told that I had to call CAC to have them remove it. I contacted CAC who told me that Medved put it on the loan so the charge was valid.

I told them that it was exempt and asked to speak with their legal department. The amount on my finance paperwork is more than the amount on my Buyers Order but they said it's legal.

For over 2 years now I have been fighting the finance company about my loan. I have proof that everything about it is fraudulent including my extended warranty which I canceled and have still not been refunded for.

The mileage on the vehicle is not correct according to all of my docs and would speak with "Nick" at CAC who would give me a few days to come up with the proof he demanded or he would close the case. He closed my case about 10 times over the years.

I finally sent him EVERYTHING and could not get a hold of him for months at a time and was told he was the ONLY person I could speak with. Once I finally spoke with "Nick" he said that he went over everything and there was nothing he could find wrong even though the car doesn't show that I am the owner through Dodge or Carfax etc.

He told me he was closing the case and if I got the proof that the car was exempt to let him know and he would reopen it. He said its only the dealers fault but they have to check the vehicles they lend for! I went to motor vehicle where it shows it was tested on date of purchase but it wasn't so I went to the emissions place to get a VTR report and the ONLY time it ever had emissions was when I was forced to do it on 11/30/2015 since it showed it in the computer through DMV.

It was reported fraudulently and are charging me for items they can't.I have been calling daily begging them to transfer me to the legal dept to speak with Nick about this and was told that there's a note on my file stating they are NOT aloud to transfer me to the legal dept since he closed it! I still faxed the proof with a letter but no return call. I have EVERY conversation on recording as proof too!

I spoke with Motor Vehicle Emissions department who said he would take my vehicle off of the cycle which would make it emission exempt like it was supposed to be.

VERY IMPORTANT! I KNOW IT'S A PAIN BUT DOCUMENT EVERYTHING AND I MEAN EVERYTHING! RECORD EVERY CONVERSATION, TAKE DETAILED NOTES AND MAKE SURE TO GET A NAME OR EMPLOYESS ID NUMBER EVERY TIME, KEEP ALL OF YOUR ORIGINAL DOCUMENTS, AND DO NOT SIGN ANYTHING WITHOUT SPEAKING TO AN ATTORNEY FIRST! THIS WILL SAVE YOU IN THE LONG RUN BECAUSE THE RECORDINGS I HAVE PROVE EVERYTHING THAT THEY HAVE DENIED. ALWAYS EMAIL OR FAX AND KEEP THE FAX AUTHORIZATION FORM. BEING ORGANIZED IS HUGE WHEN IT COMES TO FIGHTING A BATTLE AGAINST CORPORATIONS.

The people here are horrible and I plan on doing another report on here for the dealership who is just as involved.

CAC told me that they no longer do business with the dealership due to their "shady" practices yet they're doing the same thing!

I have seen a lot of complaints on here where people don't seem to know who to call just like me in the beginning so I want to give you all of the resources you need to file formal complaints.

I live in Colorado but these are all Nationwide and some you may have to check into your local offices but those are easy to locate.

I found out that specific agencies deal with specific issues so here are the ones you can report to.

I really hope everyone on here takes the time to submit a complaint with at least one agency because this is absolutely ridiculous.

They think they're protected because the Auto Industry doesn't deal with lenders but they're NOT!

I'm new to this site so am not sure if you can contact me but PLEASE feel free to do so if you can and I will help you as much as I can.

I have spent 2 years dealing with this crap and am permanentley disabled but they don't care. Missing specialist appointments because they have me running all over trying to get documents that they have easier access to than I do just to be told that they closed me case!

I can NOT get through to their legal department and it really doesn't matter because they won't do anything but for them to notate my account that no one is to transfer me to them is BOGUS!

Also make sure to look over your finance paperwork very carefully for discrepencies and contact you Motor Vehicle and Emissions Agencies if you suspect anything.

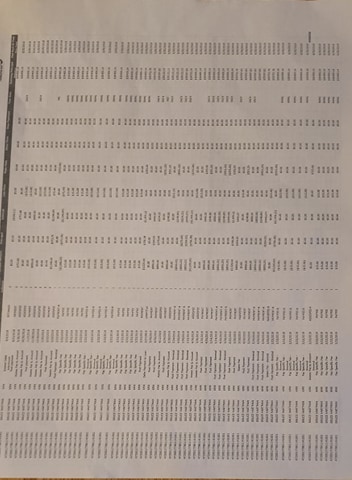

HERE IS A LIST OF EACH AGENCY AND CONTACT INFORMATION AS WELL AS A DESCRIPTION OF WHAT THEY CAN OFFER THE CONSUMER:

US General Services Administration (GSA)

Government agency that provides consumers with the resources to protect ourselves when it comes to any financial concerns. They have a complete handbook stating all of the Rules and Regulations that you can either order for free or download a pdf file to your computer and print it if you choose. You can order up to 10 copies but if you need more there is an area for you to explain your request for a larger order. You can call, email, and chat for assistance.

*Agency you can file a consumer complaint

Website usa.gov

Phone 844-872-4681

Consumer Financial Protection Bureau

This agency is for financial lenders ONLY. They also work in areas like mortgage lenders, payday loans, credit cards, etc.

They can NOT do anything about a dealership but it starts the process and they have great resources for your state if needed.

The easiest way to start your process is by going to the link below which sends you directly to the complaint screen. They give you a report number that you can track the process the entire time.

They send your complaint to the lender and they are given 15 calender days from the date sent to them (which was the next day for me) to respond to the complaint.

"If they do NOT respond then CFPB will alert the company that their response is passed due and that a response is still required. They will update the complaint in their complaint database at consumerfinance.gov/database alerting the public that the company did NOT respond to your complaint on time. They will use the information and feedback from the public consumers to help make decissions to what areas to investigate.They wil then share your complaint with the Federal Trade Commission which will add your complaint to a database for State and Federal Law Enforcement Agencies."

Phone 855-411-2372

Fax 855-237-2392

help.consumerfinance.gov/app/vehicleconsumerloan/ask

*Agency you can file a consumer complaint

FEDERAL TRADE COMMISSION

Headquarters

600 Pennsylvania Avenue, NW

Washington, DC 20580

Telephone: (202) 326-2222

ftc.gov/faq/consumer-protection/submit-consumer-complaint-ftc

*Agency you can file a consumer complaint

ATTORNEY GENERAL (Locate your local State Attorney General)

Department Comment Line: 202-353-1555

Department of Justice Main Switchboard: 202-514-2000

U.S. Department of Justice

950 Pennsylvania Avenue, NW

Washington, DC 20530-0001

*Agency you can file a consumer complaint

BETTER BUSINESS BUREAU

P 703-276-0100

*Agency you can file a consumer complaint

LEGAL SERVICES CORPORATION

Legal Aid website

NATIONAL INSURANCE CRIME BUREAU

800-835-6422

*Agency you can file a consumer complaint

This report was posted on Ripoff Report on 08/11/2016 01:42 PM and is a permanent record located here: https://www.ripoffreport.com/reports/credit-acceptance/southfield-michigan-48034/credit-acceptance-corrupt-my-story-with-info-to-report-them-for-everyone-with-complaints-1321996. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#1 Consumer Comment

This was your best proof?

AUTHOR: Robert - (USA)

SUBMITTED: Thursday, August 11, 2016

You say you don't have time to go over all of the fraudlent things the finance company did......well if this is the best you got nothing you showed here shows that the finance company did anything wrong.

The fact is that you are a sub-prime borrower because you have failed to show you can handle credit. Now, is this a blank check for you to get ripped off..of course not. But it is also not an excuse for you to not use your common sense.

Everything you listed here is either your fault for continuing with the deal when you should have walked away or letting the dealer talk you into things you may not have really needed. Because a finance company does ONE thing. They FINANCE a car. They don't negotiate the price, they don't add extra services. And the only thing extra that they require is for you to have FULL coverage insurance, and some do require the GPS devices. But if the dealer claimed you could get it off in a year....

Unless you have these promises or claims from the dealer in writing, you are pretty much SOL as for any claim you have. Too bad you didn't follow your own advice about talking to an attorney first because if you did it is very likely the attorney would have told you that posting a report on the finance company may not be the best idea.

Oh and no I am not now or have I ever been an employee of this or any other fianance company or dealer.

Advertisers above have met our

strict standards for business conduct.