Complaint Review: FIRST NATIONAL BANK TEXAS - Greenville Texas

FIRST NATIONAL BANK TEXAS FIRST CONVENIENCE BANK Shows none of overdraft on my online banking account and charged me 4 of overdraft the next day! Greenville Texas

*Consumer Comment: Incorrect logic

*Author of original report: If there is a overdraft on my account TODAY, the online banking shall not hide the info until tomorrow, and say- Sorry, it's too late.

*Consumer Comment: You Should be Aware of Auto-Transactions....

*Consumer Comment: NO

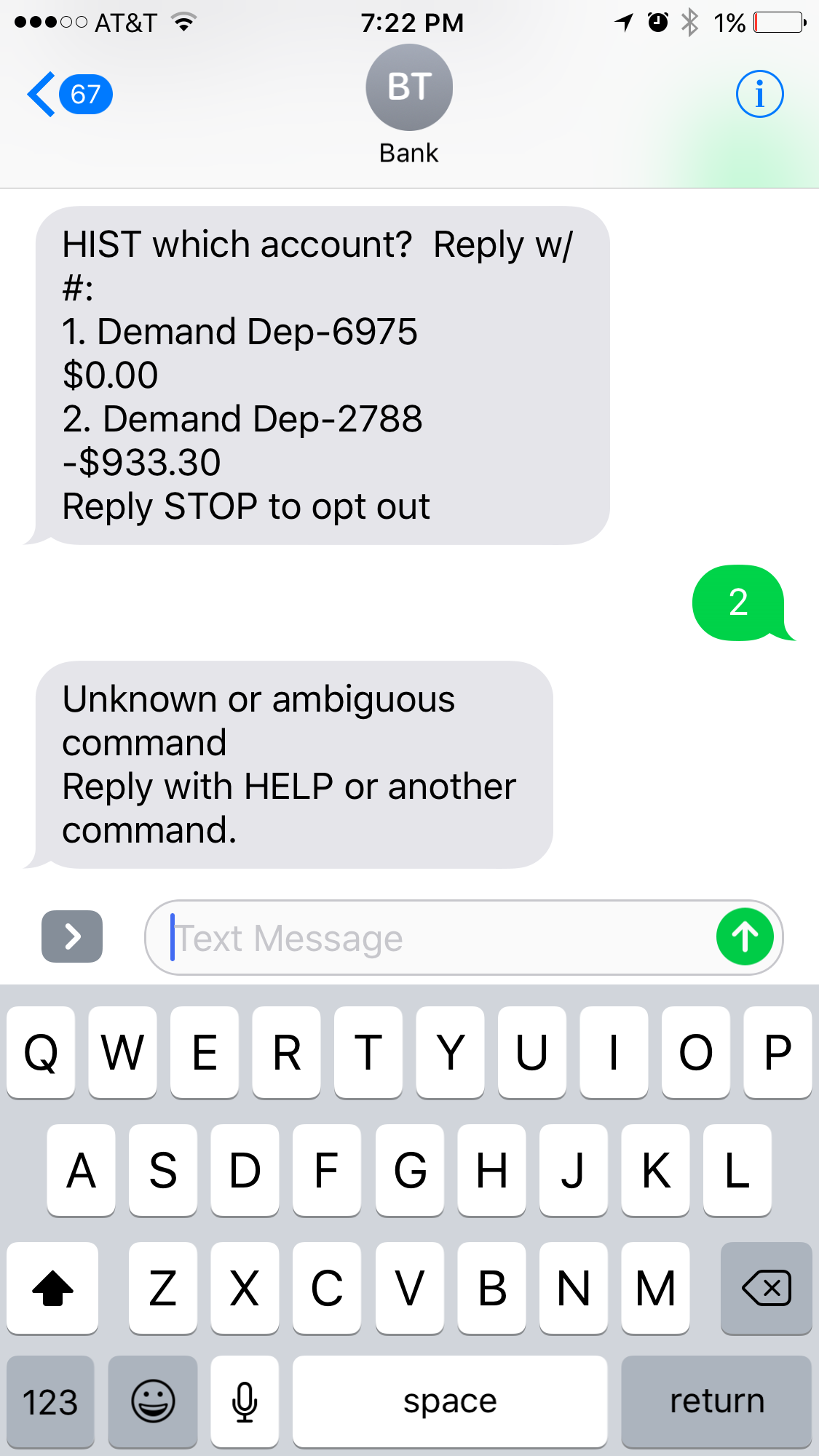

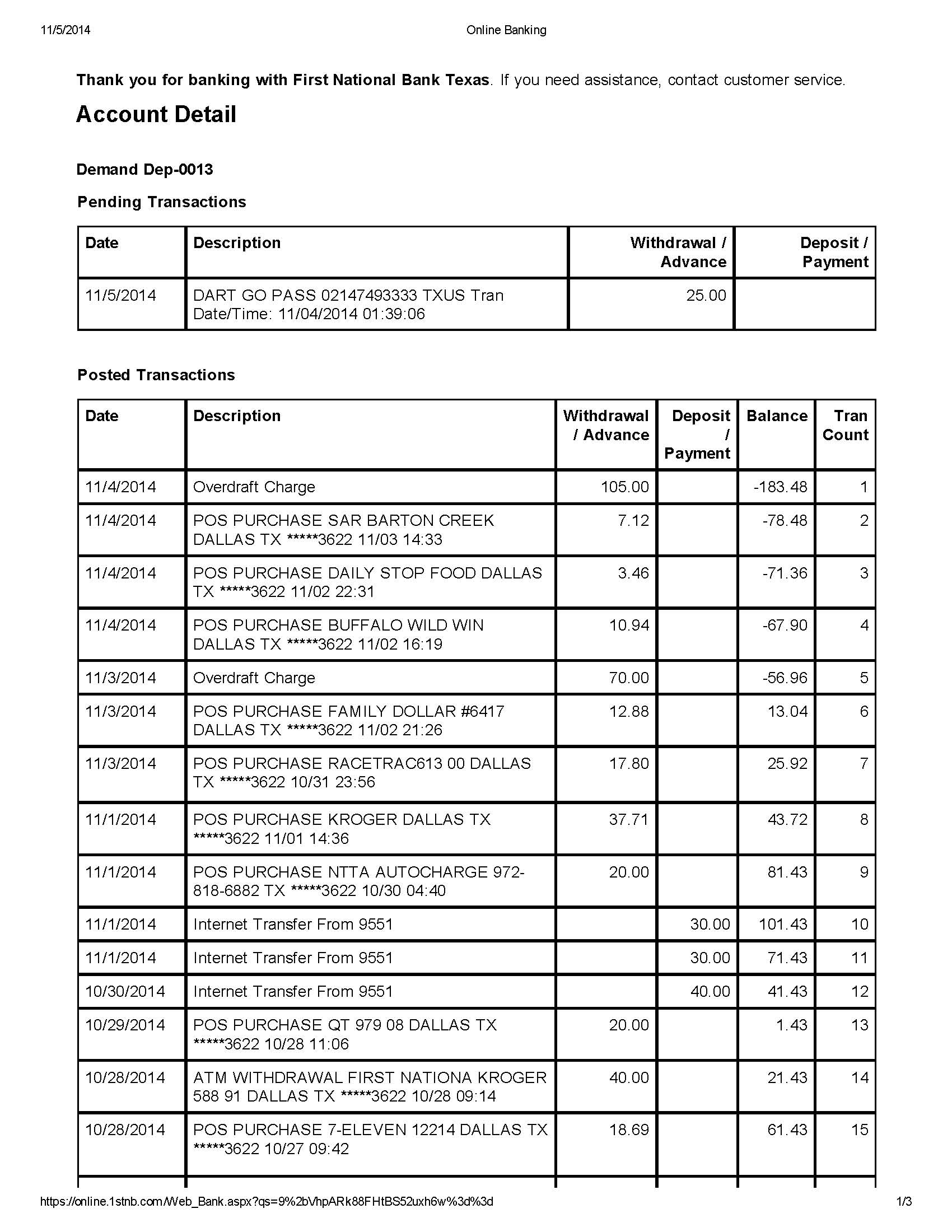

On 11/16 everything looks good on my account. On 11/17 my account shows Four of the overdraft at 11/16 ! Charged me $136!

They said that wes the AUTO transactions. That means this bank don't give you any auto transactions info untill the next day, so they can charge you overdraft fee (before midnight). Of course it would be too late.

There must be a lot of money they have cheated like this. This bank is a SCAMS!

This report was posted on Ripoff Report on 11/17/2017 11:17 AM and is a permanent record located here: https://www.ripoffreport.com/reports/first-national-bank-texas/greenville-texas-75402/first-national-bank-texas-first-convenience-bank-shows-none-of-overdraft-on-my-online-ba-1412393. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#4 Consumer Comment

Incorrect logic

AUTHOR: Robert - (United States)

SUBMITTED: Saturday, November 18, 2017

An overdraft is an overdraft, it means that you have spent more than you have available in your account. It doesn't matter what day it happens on.

Without going through an entire course of Banking 101, and trying to explain exactly what happened. It comes down to the fact that the way Auto-Debits are submitted they may not show up in any transaction listing until they are posted. So when they were actually posted you are charged overdrafts based on that. If your bank posts debits before credits then even if you put money in to "cover" them it may have been too late.

This is why the previous advice is the best advice. If you are having issues with the Auto-Debits and the posting YOU need to cancel them ASAP. If for some reason you can't stop them, then you MUST account for them using a written register. Even if it is something as simple as putting in the Auto-Debit as soon as you get the paycheck that will cover that debit so you don't have to worry when it actually gets posted.

For example if you get paid on the 1st and 15th, and have an Auto Debit come out on the 10th. Subtract the amount on the 1st from your register. Then you know it is accounted for and you don't spend that money. If this is causing you to run "short" of money, then that is not a banking issue..that is an issue with your finances that you need to work out.

Let me say one other thing. Many times banks will "forgive" your first couple of Overdraft fees. So if you have not had a history of OD fees you may want to give them a call, explain why you think it is a mistake and they may actually credit you back a couple of them. This doesn't always work but it would be worth a try. But as I said..if you have a history of Overdrafts the chance of this is very slim.

#3 Author of original report

If there is a overdraft on my account TODAY, the online banking shall not hide the info until tomorrow, and say- Sorry, it's too late.

AUTHOR: KAIMEI - (United States)

SUBMITTED: Friday, November 17, 2017

Many banks can do much better than this.

The FIRST CONVENIENCE BANK will only let Customers know their account is overdraft at the NEXT DAY.

A "FIRST CONVENIENCE TO CHARGE OVERDRAFT FEE BANK".

Everyone should know about this.

#2 Consumer Comment

NO

AUTHOR: Robert - (United States)

SUBMITTED: Friday, November 17, 2017

The only one who is ripping you off is YOU. Banks can not tell you what is going to be submitted until the company submits it. As much as you may want to think so, they are NOT mind readers.

The fact is you are relying on the online banking to tell you when you are out of money. Instead you should be relying on YOUR written check register. If you don't know what a written register is or how to use one, that is your first problem you need to solve. But it is an easy one. You can find many sites that can provide you a tutorial how to use them, in fact you may even find if you go into the bank and ask them they would be willing to give you one for free and even show you how to use it.

If you have auto debits coming out of your account YOU should be aware of them and make sure you have plenty of money in the account to cover the debits. If you don't know what auto debits you have coming out or when they are coming out, then that is your second problem.

So before you do anything else you need to find out what you have set up to auto debit on your account. Once you find out what you have as auto debits you need to IMMEDIATLY contact each company and cancel it. Then you just need to remember to actually go into your account to make sure they are paid when you want to pay them.

Yes, this is going to be a bit more work, but if you can not be responsible enough to manage your account with the auto debits, this is what you need to do. Your other choice..keep doing what you are doing and continue to be hit with overdraft fees...regardless of the bank you are with.

#1 Consumer Comment

You Should be Aware of Auto-Transactions....

AUTHOR: Jim - (United States)

SUBMITTED: Friday, November 17, 2017

I mean I'm sorry this happened, but generally speaking the bank has no idea about when an auto post is going to hit your account until the entity with whom you setup auto pay with puts in a request for payment. Blaming the bank for something they won't know anything is an odd report to file. The other important point is auto transactions happen at your request and they generally happen on or around the same time each month. I mean these auto posts should not have been a complete surprise to you, right? Maybe you hoped it would happen on Monday 11/20 instead of 11/16 when the money might be in your account? If so, I can understand how you might be upset about something like that. I mean it's still your fault and your responsibility this happened, but I understand. You should also be aware - all banks work the same way. They won't know either until the request for payment is put through.

I would seriously consider removing all auto transactions from your bank account if there is even the remote possibility you might overdraft and transfer your auto pay to your credit card. If the entity won't allow you to put on your CC, perhaps just remove the auto pay and write a check. If removing auto-pay is not an option, you should make sure there's enough money to cover your auto-pay mid-month transactions.

Advertisers above have met our

strict standards for business conduct.