Complaint Review: first national bank, texas - Internet

- first national bank, texas 2450 nw loop 338 Internet United States of America

- Phone: 1-800-677-9801

- Web: 1stnbc.com

- Category: Credit & Debt Services

first national bank, texas first convenience bank These people juggle debits to produce major overdraft fees Internet

*General Comment: BUYER BEWARE, EDUCATE YOURSELF AGAINST THESE RIP OFF ARTISTS

*Consumer Comment: margie from phoenix, please read

*Consumer Comment: What a REAL FDIC bank is.

*Consumer Comment: You can tell by the way I have been treated

*Consumer Comment: And Its Wailing Time Again.....

*Consumer Comment: klanie1962 - Houston

*General Comment: this bank is a rip off

*General Comment: this bank is a rip off

*General Comment: Stupid People

*Consumer Suggestion: Accounting 101

*Consumer Comment: F* you Margie

*Consumer Comment: jgasca92 SUCKS TOO

*Consumer Comment: THATS WHAT WE CALL NOT TAKING CARE OF YOUR ACCOUNT

*Consumer Comment: Hey Jim, go take your meds!!!

*Consumer Comment: GREAT Work FCB!

*Consumer Suggestion: How to haggle with First Convenience Bank

*General Comment: HOW ABOUT A USEFULL COMMENT

*Consumer Comment: Time for a change

*Consumer Comment: What did your bank register say?

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

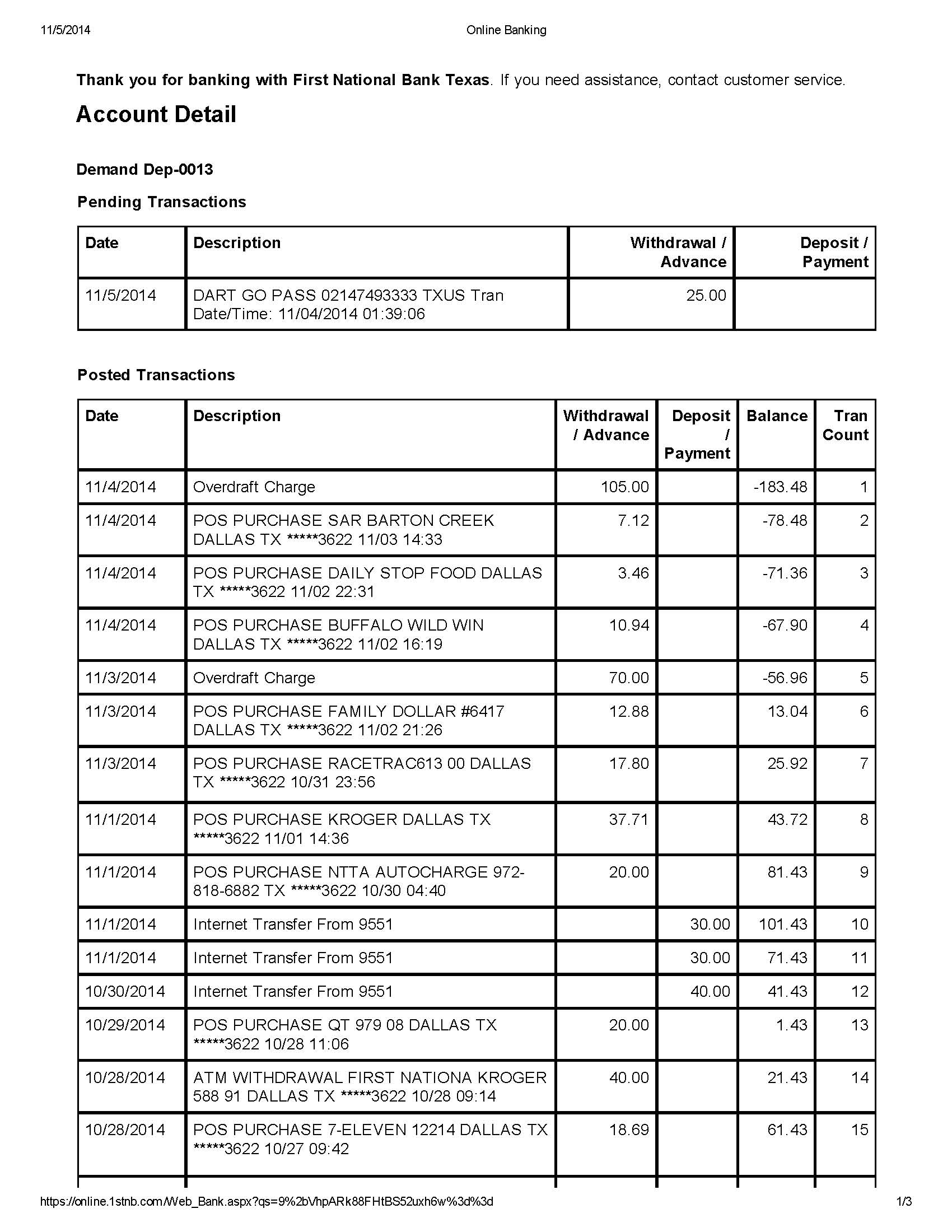

Do Not Use this bank!!!! This Christmas I debited 14.57 and had 357.06 in the bank, another debit of 11.60 and had 345.46 in the bank. these debits were on the 21st and 23rd of December. Along with 7 other small debits when money was in the bank. On the 24th I debited 61.68 which put me -13.46. the bank posted my larger debits first and THEN posted my smaller debits on the 24th which left me with multiple overdraft charges. They automatically took 279.76 in overdraft charges in this one christmas week. I'm scared to look back and see how much money I have actually had stolen from me by this Bank.

I want to know what can be done about this!!! This can't be legal!! If you value your money, do not use this bank. When I called the bank about this I was told, "The way our system works is that we debit your largest debits first" No, when I use my debit card, That is when it should have come out of my account. These people are thieves!!!

This report was posted on Ripoff Report on 01/01/2013 03:59 PM and is a permanent record located here: https://www.ripoffreport.com/reports/first-national-bank-texas/internet/first-national-bank-texas-first-convenience-bank-these-people-juggle-debits-to-produce-ma-989652. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#19 General Comment

BUYER BEWARE, EDUCATE YOURSELF AGAINST THESE RIP OFF ARTISTS

AUTHOR: Jethro - ()

SUBMITTED: Saturday, June 08, 2013

Yes all the information is made available for consumer at the time of opening an account. Let me ask this question. How many people read all that small print and legalizes? FEW. FCB and FNBT take advantage of this fact. Their employees go out into the stores they are located in, attempting to sign up new suckers. They use the idea of "you will be helping me out if you sign up with a new account, you can sign up with only one dollar." All true so far. However things that are not revealed is that the bank employee gets a commission on every checking account opened, nothing on savings accounts or at least much less, some people actually believe they are opening a checking account and savings account, but are actually opening two checking accounts, there by the employee gets credits for two new checking accounts. A bank employee has told me personally that 40,000 accounts are closed monthly, how can a bank stay in business doing this? By opening far more new accounts each month than they lose. How do they do this?? By taking advantage of ignorant people. AS the above writter stated, this is a second chance bank. Which says they didn't know what they were doing with other banks got themselves into trouble, and come on aboard with us so we can screw you like you were never screwed before.

Yes all details are made available, they offer computer training etc, but are any of these thngs actually offered by the person who signs them up? I MEAN by more than the papers given to them> NO or very little.

Yes this behavior is LEGAL, but not very honest and forethright. I will tell you if any one wants to talk to me about this bank i can give you far more information. IE over draft privledge of up to 700.00 this is an invitation to go into debt for the poor uneducated. Each over draft up too 6 per day results in a 34.97 over draft fee. every day with a negative balance results in a 2.49 fee, also there will be a monthly maintance fee if the negative bal is below the account threshold. If you swipe ur card and denied you will get a 2.00 fee. I have been told this bank corp. is a FEE BASED BANK. So i guess this makes it all ok. A person very recently said this to me, working with these people is like working for the devil.

All i really want to tell people here is BUYER BEWARE!

#18 Consumer Comment

margie from phoenix, please read

AUTHOR: wreckem2014 - (United States of America)

SUBMITTED: Saturday, March 09, 2013

You are uneducated on this entire topic and therefore should not be allowed to comment..whatsoever. My proof? You argue AGAINST this bank because of FDIC insurance (even though that argument is invalid because FCB IS fdic insured )and say instead that you prefer credit unions. Do you not realize that one of the main differences between banks and credit unions is that banks are FDIC insured and credit unions aren't?!

Please, educate yourself before providing invalid and unintelligent responses.

Furthermore, everyone who has unfortunately believed these nonsensical comments need only to go to any FCB branch and ask for proof of their FDIC insurance. They will gladly do so.

I cannot stand stupid people.

#17 Consumer Comment

What a REAL FDIC bank is.

AUTHOR: Margie - (USA)

SUBMITTED: Saturday, March 09, 2013

or go here.

http://www.youtube.com/watch?v=tRaFyfrTZw8&feature=share&list=SP98FDB6D1FFE4341D

#16 Consumer Comment

You can tell by the way I have been treated

AUTHOR: Margie - (USA)

SUBMITTED: Saturday, March 09, 2013

Abutebaris modo subjunctivo denuo

wow- that about sums it up, doesn't it?

thanks a lot for nothing. that last responder was a real joke roflol! (Ad absurdum)

anyways-

'Carpe diem quam minimum credula postero'~

Some LEGITIMATE BANKS that are out there are FDIC INSURED. those are the ones I would recommend, or no bank at all. you would be better off at a check cashing store.

a legitimate bank will insure your deposits up to 250,000.

FIRST CONVENIENCE BANK is not on this list, and they can and probably will go bankrupt anyday.

(if you are a real bank reading this, please do not make the mistake and corrupt your bank by hiring these weasels!-they pretty much all know they are ripping people off)

http://www.fdic.gov/

probably because they are a fake bank that needs to be closed down.-Actus reus

There are a lot of good banks out there. I personally really like the credit unions, and do business with them, and some of the other larger banks.

I hope there is a solution one day for the people who lack credit and are unable to get a real bank account, I absolutely cannot stand the fact there are predators like THIS BANK mentioned who prey off the weak, it just makes me sick!

Thank goodness Ripoff Report is here to record the outcome, and go ahead and continue your stupidity convenience bank, you are only digging your own grave at this point!

'Absente reo'

as to the point of these defenders of a BAD BANK, "Ad nauseum,Ad nauseum,Ad nauseum" at this point......................BUYER BEWARE!!!!!

#15 Consumer Comment

And Its Wailing Time Again.....

AUTHOR: Jim - (USA)

SUBMITTED: Saturday, March 09, 2013

The respondents who are wailing about their problems with overdraft fees...thanks for being honest and admitting YOU aren't keeping records either! In EACH and EVERY complaint about overdraft fees, the common denominator is the account holder CONTINUES to use the debit card while having absolutely, positively NO KNOWLEDGE of their account balance because they don't keep a RUNNING BALANCE! You can be childish all you wish and even call me whatever name makes you feel good but there's NO trick accounting...there's NO bank fraud...there's NO grand conspiracy. It is YOUR own laziness and YOUR own failure to keep records...YOUR failure to maintain a running balance and YOUR failure to know what YOUR balance is in YOUR account before you use that account! How damned stupid is that? Common sense dictates...its YOUR account...its YOUR money...its YOUR card. Therefore, anybody with EVEN HALF A BRAIN knows YOU should know how much money YOU have in YOUR account before YOU use YOUR account! Even a little child will check to see how much money they have in their pocket before they walk into the candy store! So go ahead whine, wail, call me names because you don't like the response. YOU give YOURSELF overdraft fees because YOU don't keep a running balance and YOU don't check that running balance before YOU use YOUR card. What an incredibly sorry bunch.

#14 Consumer Comment

klanie1962 - Houston

AUTHOR: coast - (USA)

SUBMITTED: Saturday, March 09, 2013

"I too have had problems with over drafts"

If the funds are available when you authorize the debits, the order they are processed will not have any negative effect. You already knew that, right?

#13 General Comment

this bank is a rip off

AUTHOR: klanie1962 - (United States of America)

SUBMITTED: Saturday, March 09, 2013

I too have had problems with over drafts . I will have a balance that is positive. I will have small debits that would be covered but they dont put that through they hold and put larger ones through and once over drawn put smaller ones through so they can jack you up with over draft on each and every smll charge. This bank needs to be stopped

#12 General Comment

this bank is a rip off

AUTHOR: klanie1962 - (United States of America)

SUBMITTED: Saturday, March 09, 2013

I too have had problems with over drafts . I will have a balance that is positive. I will have small debits that would be covered but they dont put that through they hold and put larger ones through and once over drawn put smaller ones through so they can jack you up with over draft on each and every smll charge. This bank needs to be stopped

#11 General Comment

Stupid People

AUTHOR: wreckem2014 - (United States of America)

SUBMITTED: Sunday, January 27, 2013

If there is one thing that really gets on my nerves, it is situations where people let their lack of education flow from their mouths like vomit when they try to make a point or argument. Margie, you are ridiculous. FCB is most definitely FDIC insured and what's more, has NO debt. That's right. So let me guess...you think banks like Bank of America and Wells Fargo are the places to be? Wrong. Both of these financial institutions have had to pay incredible sums of money to customers whom they have illegally charged fees to. Has FCB? No. Because this doesn't occur. They have no reason to because they have no debt. They purchase new locations with cash and will never have to be bought out by another banking institution.

What's more, the posting of items from largest to smallest is not specific to FCB but is common with all banks. Why? Because your larger items are usually your more important ones. The bottom line is, if you have enough money to cover all of your purchases, it does not matter how your items post. You should have enough to cover ALL items. If you do not, it is your OWN fault. Not the bank's. Why should the bank have to take responsibility for your mistakes? What's more, this particular bank actually offers a FREE cbt (computer based training) for all of their customers in case they are not knowledgeable of banks, bank accounts, how to manage them, etc.

So, in conclusion, please do your research next time. And, by the way, that entails more than just saying "I did my research."

Otherwise, you will continue to screw yourself over with your account, and will also continue to get owned by knowledgeable people when you post idiotic comments like the one I am currently replying to.

#10 Consumer Suggestion

Accounting 101

AUTHOR: Common Sense - (United States of America)

SUBMITTED: Saturday, January 26, 2013

nice job jgasca. Some people just cant handle the truth. And yes, FCB is an FDIC bank. I actually love how people make comments that they did their research. I tried to find truth in Margie's statement. Unfortunately where she said to look did not back up her proof. Anger causes many delusions of the mind.

Now people lets try to help you in your future in banking relations. Yes this bank has many, many fees.

Not one fee is not listed in the Banking Statement of Fees. When you open your account you get a Deposit Agreement. When you do business with many companies, you will receive a contract, terms and conditions or something to that sort. In this case it is the Deposit Agreement which you have to sign. Your signature serves as notice of all bank operations which are listed within. If you dont want to feel "ripped off", i would suggest you read into all contract you do with any business for that matter. Everything is disclosed within the legal rights of this banking institution. FDIC-Federal Deposit Insurance Corporation. For those that do not know what the previous means, just google FDIC.

Also if you feel like you have been ripped off and want to contact a lawyer or the BBB, please take copies of your deposit agreement and Banking Statement of Fees with you. This will only save the agent helping you some time by letting you know that what you think is wrong is actually stated in the paperwork provided to you.

This is a second chance bank, meaning if you have already messed up at other banks this bank will not hold that against you and still give you an account. You live, you learn. Or atleast we hope you would learn. I too, have been with this bank for some time. I have never had one OD fee, neg bal fee, NSF or any issues at all. Guess how i learned? I actually messed up bank accounts in the past. When i came to FCB i read all documentation and learned how to avoid the OD, NSF fees and learned how the bank operates. So i suggest you do the same if you open an account here and your future banking relationship with FCB shall run smoothly. If not, the other banks you have messed up with will not take you back so i suggest that you take responsibility and start learning now. Till next time. Good luck to all and God Bless

#9 Consumer Comment

F* you Margie

AUTHOR: jgasca92 - (United States of America)

SUBMITTED: Wednesday, January 23, 2013

its so sad again that people like Margie has nothing else to do but blame other people for her own mistakes you may have not banked with first convenience bank before other than you stupid husband when again it doesnt matter the length of time that i have been with this bank i have two other banks and two credit unions who also i have a great relationship as a customer the bank or credit unions dont still you cheat the bank im not saying this because i have a romantic relationship omg i cant believe you even say that. this is nothing personal and never was. its our money and if you all new how to take care of it you wouldnt be on this page complaining. i have never hated first conveience bank i understand there policy its about patience and learning as for them belonging to fdic they do and i have researched it i have verified them before wondering after i got the account on other customer reviews of this bank . to me its just the matter of no one reading the deposit agreement. or contract how ever you want to call the F$%@# thing. but i do agree that it is long that that rep assisted your husband yes but yet why dont you complain when the cashier at walmart or albertsons, heb, kroger, pros ranch market any story when theres a stupid long line there is no stealing from a bank whether its wells fargo or chase bank. all fees accessed are on the stupid contract. its not the matter that i love the bank i dont specifically love the bank i like first light credit union better but i still understand First convenience bank policy and respect it its fair for a second chance bank that is trying to teach your low f$#%#n life responsibility and is advantage that its open 7 days a week. remember all those times you f%#$@ up your credit and no one would take you well thats where first convenience takes you in like a broken winged bird.

#8 Consumer Comment

jgasca92 SUCKS TOO

AUTHOR: Margie - (USA)

SUBMITTED: Monday, January 21, 2013

Comment to; jgasca92

I must apologize, HOWEVER after the first three sentences of laughable nonsense you posted about how you assume the world revolves around you, because of your 'expert opinion' with dealing with the same bank for 9 years- my answer to that is-(HA HA LOL HA HA!!!) and

REALLY!?! If this bank folds tomorrow, any money in your account is GONE. BTW...

Do you think that a bank would tamper with their older accounts and let consumers know this knowing that the accounts that they have had a business relationship/transactions with in the past-could make them fold?

I did a little bit more research on this bank, and GASP! they are NOT FDIC insured. check it out yourself. Don't think YOUR bank can fold? think again! goto FDIC in the GOV section and check for yourself- check and see just how many banks folded in your state too, while you are at it. not impressed? check out California, Arizona, Texas! You think this bank is going to care about you when they close up like a clam? They will probably be laughing as hard at you, as I am right now...Only they will be doing it while sitting on the sandy beaches of jamaica sipping their mai tai's you helped them pay for, with your money.

To those who don't know what FDIC is, to sum it up the Gov't assures that everyone banking with them is covered up to 250,000 for every depositer. that way, if it folds, they are rest assured they will get their money back up to this amount. This is something that is readily available to anyone seeking this info, btw-maybe one day this bank will actually be legitimate.( maybe not.) thing is, I don't want to find out the hard way!

Luckily, I have never banked with this 'fake bank', however, my husband did. I have 3 great banks I do business with, all of them are insured and have banked with a few since I was a kid, so you develop a 'knack' for knowing which banks seem a bit off, like this one does.

I remember one day when my husband was trying to make a deposit, and these people who had been sent around Walmart to recruit other victims, and get them to bank with this place kept placing

these new 'converts' in front of us -increasing the line time. In a hurry, my husband grew impatient after waiting for them to sign these people up! "Did you forget about me, your customer?" he exclaimed.

by the time I was done purchasing what I needed at the store, I still found him in line.

They claimed they don't usually recruit customers like this, and apologized.

they did help him, but only after I got assertive and asked them all in a generally loud voice- "Do you actually help your customers, or are you just to busy recruiting new victims to care about those you have already snagged? "

at the realization of their S.N.A.F.U, -they applied a 10$ credit to his account. Something we told them was not necessary, we just needed to conduct our business and leave-but something they insisted upon doing as a courtesy to their loyal customer. Stranger things have happened, so we accepted it, not knowing they were going to steal from him later that month.

Here's something they could have done, KEPT THEIR OWN MONEY. because maybe they wouldn't have felt compelled to really mess up my husband's account with their accounting errors.That was the bank who screwed up, on their side, and still ended up punishing my husband because they could get away with it, by telling him he erred, even when I pointed out their errors on paper that were NOT caused by my husband!

SO-jgasca92, don't be telling me, or anyone else your GARBAGE LOVE STORY about how great this bank is, because you two have sucked up to each other for 9 years, and you have to romanticize your perfectly deranged and lunatical fantasies about how 'just and perfect' this insane fake bank is because you have been h!@#*ing them for 9 years! !@#$% you both.

There are decent banks out there. To the people who can't find them, I'd suggest check cashing until you find a decent bank who will work for you, it's better than getting ripped off by this predatory bank! good luck!

#7 Consumer Comment

THATS WHAT WE CALL NOT TAKING CARE OF YOUR ACCOUNT

AUTHOR: jgasca92 - (United States of America)

SUBMITTED: Monday, January 21, 2013

The whole sad part is that every single one of you that call customer support dont know how to take care of your own accounts those who ask for overdraft refunds are cheating the bank, and also stealing you guys say that those bank reps or supervisors or president, managers, customer support people are stealing from you . i think you all who say that should shut the @$%#% up because first off you fight about whats going on with your account because of negative balances or this and that dont take good care of your account i should know how its done i read the deposit agreement have friends and family who have an accounts with First National Bank Texas or First Convience Bank that has been with them for over 9 years and have not once recieved a overdraft fee Non Sufficient fees we may have but we dont call for a refund we take responsiblity of what we do and pay the bank for what we owe. you all dumb @%$& should too. if you all do take care of your account and still ask why you recieve overdraft fees you should see that on your stupid contract aka deposit agreement that they give you when opening the account gives you all the information about fees which i have in my hand is also listed banking services, if you truely take care of your account you would still have this thick copy that explains you everything about the account no bank will sit with you and go over of hours of paperwork for you to understand my personal banker did not even sit with me or tell me but if everyone knows if you dont your stupid, if your given a contract or sign up with a bank your accepting their terms and conditions and policy also known as the deposit agreement if you sign you agree if you sign your saying you acknowledge everything processing and fees, READ YOU DAM F$%#& contract, we arent just talking about transactions and fees a bank account is more than that, we are talking cut off times that every bank has fees that every bank gives their customers take care of your account and you would even be on this page take responsiblity for what you do and dont blaim the bank for you do , if you read the deposit agreement which yall signed, it states that they do post from largest to smallest why which has also been explained to me and my family is if you want to your rent paid its gonna post first then your tiny transacations last , what would you preferr would you prefer your small transactions post and your biggest more necassary transaction left unpaid because thats how you wanted it well your left with no roof over your head your car getting repoed your electric shutting off your water and gas cut off well if thats the kind of bank you want you might as well have a bank that does it just the way you want that doesnt give you overdraft privilege that doesnt exist in their world or have what first convience calls it a fresh start loan your stuck and f$%# over even more when you have to file bank rupt, because you wanted that way, what bank doesnt have over draft protection privilege how ever that also them to pay what you couldnt; just take care of your dam accounts and read your F%$# contract before you complain or create lawsuit that you will always lose

#6 Consumer Comment

Hey Jim, go take your meds!!!

AUTHOR: Margie - (USA)

SUBMITTED: Saturday, January 05, 2013

Hey Jim!

Why don't you stop being lazy, get off the couch, and go do your homework before your momma whips your butt for your nonsense comments on the computer?I know you are only 12 (you sure act like it) but why don't you grow up first, work a job, grow a family, and flex those two brain cells you have in your thick head before making assumptions or hyping up nonsense suggestions about what you THINK you know, instead of what is actually going on in a situation? After I have personally dealt with this bank, and an actual customer in the situation, I have found your gibberish to be so off the mark it is unbelievable. why don't you crawl back into the hole you came out of, and wait for the second coming. make sure to take plenty of tuna fish with you, so we don't have to see you blocking our light of day for awhile as well.

#5 Consumer Comment

GREAT Work FCB!

AUTHOR: Jim - (USA)

SUBMITTED: Saturday, January 05, 2013

As you can see FCB, there is gold in those checking accounts because there are so many people who are too damned lazy to keep an account register and check their RUNNING BALANCE before using the account! That's ok FCB, its more money for you. May I suggest to take advantage of this gold mine of people who are NOT willing to learn how to manage their accounts? Why not boost those NSF fees to $50 each March 1. Then, come July 1, up to $75. Finally, just in time for Christmas spending, up to $100 per overdraft! Just think of the effect on your bottom line!

You'll have no shortage of paying "customers" as these people will never learn how to manage a checking account! They'd rather be lazy, not maintain records, use money they don't have then blame FCB when THEY cause an overdraft! You can weather the storm. Just instruct your CSR's to agree with the callers that its a big government/bank conspiracy. There's money in those accounts, CSR! These people will NEVER learn! Why not take advantage and up that bottom line! Its as easy as taking candy from an infant...as you can see!

#4 Consumer Suggestion

How to haggle with First Convenience Bank

AUTHOR: Margie - (USA)

SUBMITTED: Thursday, January 03, 2013

I dealt with this today at First Convenience bank. they do not make it easy to recoup any fees that they feel you owe them, even if it seems unethical to you. I finally went to corporate, and when I didn't like what I heard, I asked to speak to their Manager/Supervisor and reminded each one of them that I had already filed a complaint with Ripoff Report.com, and I was their only source to having that complaint resolved, so I used it as leverage. I also used the fact I had nothing better to do with my time besides bringing crooks to their knees to see justice prevail. A bit extreme, but it worked, I finally received a refund, and I updated my Ripoff report as I promised I would do. I would suggest that if you take this route that you have some time on your hands, account numbers ready, and a list of the CEO and other important people of the company and work your way through the chain of command to the top if necessary, explaining to each one of them what you have resolved, what you want to resolve, and take whatever you can when offered, even if it is a fraction of what you actually want or think you deserve. I was able to recoup 115$ out of a total of around 150$ for my husband this way. However, please only haggle if you know they are in the wrong! nothing like screwing up the system to make nothing work. the other option? well remember cash is king! no charges for that.

#3 General Comment

HOW ABOUT A USEFULL COMMENT

AUTHOR: Bubba Lee - (Canada)

SUBMITTED: Wednesday, January 02, 2013

All US banks do this because it is legal and by abusing you they get two things, more money in fees and they make you close your account with them making them look better because they end up with less "problem Customers" to report to the share holders.

Until the law is changed they will continue this system.

Strangely enough Canadian banks don't do this in Canada but they do in the USA. Hmmm, Not allowed in Canada?

#2 Consumer Comment

Time for a change

AUTHOR: coast - (USA)

SUBMITTED: Tuesday, January 01, 2013

You may want to consider a New Year's resolution of avoiding overdrafts.

#1 Consumer Comment

What did your bank register say?

AUTHOR: MovingForward - (USA)

SUBMITTED: Tuesday, January 01, 2013

It has nothing to do with this bank. The fees are as a result of not logging your transactions timely. The best way to keep track of your account is to log it in your bank register. Log every deposit, debit, ACH transfer or check (if you use them). The bank has no way to know what you are spending until you actually swipe the card. Some debits come through instantly some take several hours to nearly a day. If you don't want any fees, then don't spend more than what is in your account.

No, I don't work for any bank or financial institution. But I keep my register current and I never get any of these fees (OD or NSF).

Advertisers above have met our

strict standards for business conduct.