Complaint Review: First Convenience Bank - college station Texas

First Convenience Bank First National Bank Texas Former Employee: Please read to know the TRUTH. Texas, New Mexico, or Arizona Texas

*UPDATE Employee: Eh..... Okay.

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

Hello,

I assume you are reading this because you are curious about First Convenience Bank/ First National Bank Texas. Well, you've come to the right report. I have worked for First Convenience Bank for almost three years, when I first started in Killeen, (the bank's home-base), I was in training. The very FIRST thing they told us in training was that this is a fee-driven bank. That right there should have been a warning sign to me that the job I was here for, which was to help customers with their financial needs, would not be the job I was doing.

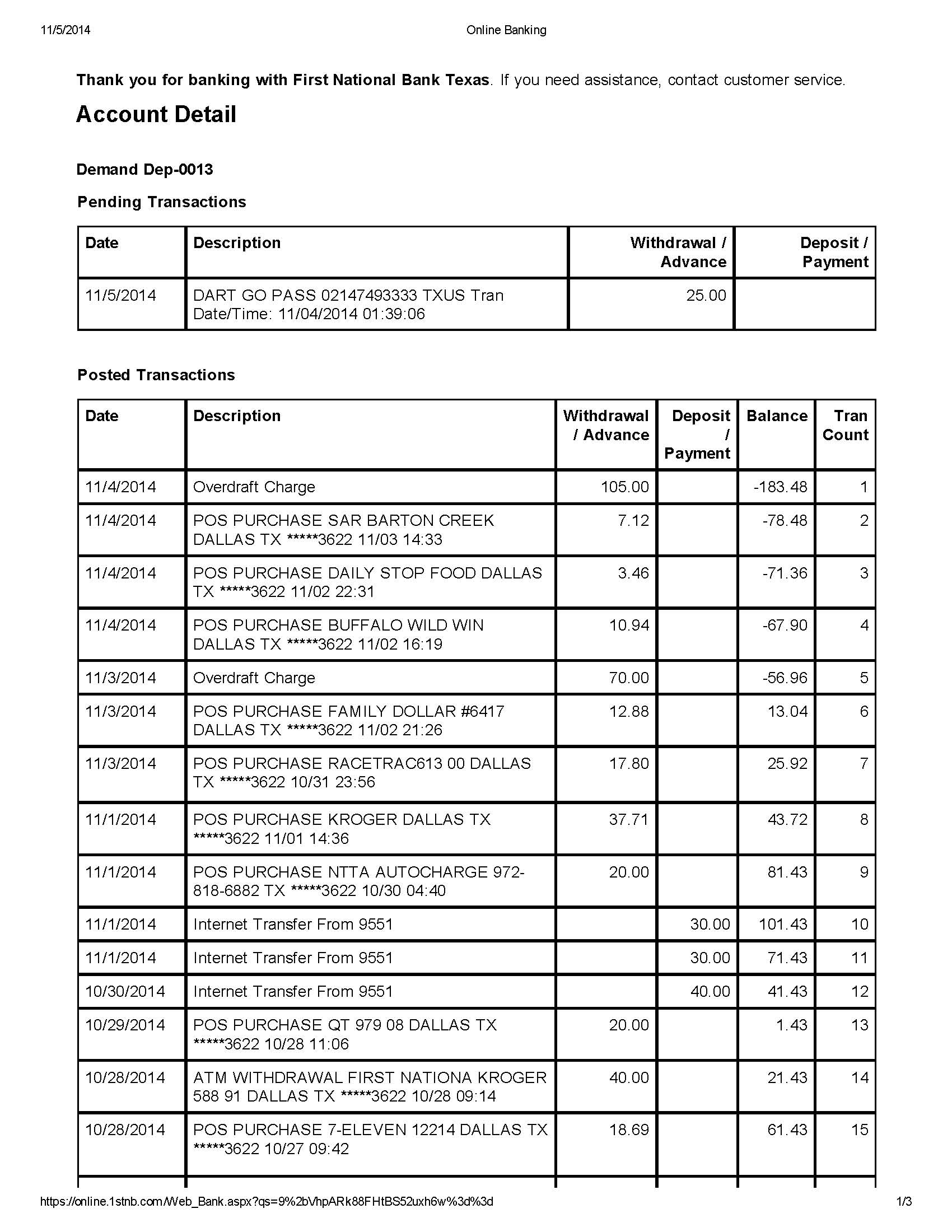

I understand that each and every bank has a sales quota to meet and obviously charge Overdraft fees of around $35 roughly. I'm sure by looking at the other reports about Overdrafts and how they have completely screwed people out of their money, you already know all about that. That is not what I am primarily here to talk about, though.

First Convenience Bank only cares about one thing- getting new accounts. Unlike other banks that try to fit your needs with a checking, savings, CD, IRA, credit card, etc. This bank only wants your checking account. If you come in asking for a Savings account, they will purposely open you a "secondary" checking account so they can make their daily quota. They do NOT care what you want, they only care about their $6 incentive for a new account, even though your "secondary" checking account doesn't even pay them, it just goes toward their numbers. They also opt you in to "Full Overdraft Protection" without asking you for your consent or even explaining what it is.

There is no way to have NO Overdraft unless you personally sign a form saying "customer requests no Overdraft" otherwise, you will be in either FULL or PARTIAL. This bank BRAINWASHES their employees into only getting accounts. They also open accounts for people who do not want them, for people who have not given their consent, and also FORGE SIGNATURES on signature cards. And guess what? They play favorites. Let's say your manager or District Manager likes you, and you break the law by forgining a signature for an account. They aren't going to do crap about it, they let it slide.

They also do not inform their employees on s**t, when you come into the bank you WILL get the run around. If you aren't there to open an account, they do NOT want to help you. You will get passed from department to department, person to person, and be told a lie because they are too lazy to give you the actual true information. Oh, and they play the "NOSE GOES" game. When a customer walks up, no one wants to take them so they play the nose game and last to touch their nose has to help the customer. How is that for GREAT customer service? BUT WORST OF ALL: When a customer overdrafts their account, everything in the negative gets a fee, regardless if you had the money in there at the time of purchase.

Once you go into the negative, they start charging you $2.49 a day until your account charges off (closes with a negative balance of an outrageous number) and goes to Collections. Pretty much every single person who has had an account there has a charge off, it is ridiculous. Then, that customer comes in a couple years later to reopen their account. They have to pay off the negative balance and open a new one, EVEN IF IT'S ALL THE BANKS FEES. Or, the District Manager will refund half as a "courtesy" to the customer. BULLS***. They do not care about you, they do not care about their employees, all they care about is making their goals. Also, I don't know if you have been into a First Convenience Bank or not but they are SO unprofessional.

I actually witnessed a girl with her "flip phone" attatched to her shirt, wearing a big ghetto jacket, and shoes that look like house slippers, standing in front of the bank trying to get accounts. When I told her to remove her phone, she was like "Oh is this not okay?" WELL HELL NO. Duh. She also has her phone, texting behind the teller line, on loud when people call her, in her pocket listening to music. Like what the Hell??? First Convenience Bank will hire ANYONE who is willing to do whatever it takes to sell their precious, s****y bank accounts.

This report was posted on Ripoff Report on 03/21/2014 08:14 AM and is a permanent record located here: https://www.ripoffreport.com/reports/first-convenience-bank/college-station-texas-77802/first-convenience-bank-first-national-bank-texas-former-employee-please-read-to-know-the-1132406. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#1 UPDATE Employee

Eh..... Okay.

AUTHOR: CommonSense - ()

SUBMITTED: Tuesday, June 03, 2014

Hello all negative posters, and positive commentators. Or Vice Versa. Since nothing but negative comments originate from these types of websites, I'll shed some light or further the cause about this case.

Note: I have known the same employee, and have been in the same training class. enjoy =)

Quote "The very FIRST thing they told us in training was that this is a fee-driven bank

Technically the very first thing they told us was "Hi! my name is ___". And the very second thing was said is " The Bank is mostly profitable from Debit Card Usage". Debit cards generate the most income from the bank. I would go into detail, but eh.....

Quote#2 "I understand that each and every bank has a sales quota to meet and obviously charge Overdraft fees of around $35 roughly. I'm sure by looking at the other reports about Overdrafts and how they have completely screwed people out of their money, you already know all about that. That is not what I am primarily here to talk about, though"

Eh..... This bank as well as ALL banks has one goal. Growth and Retention. A quota is set to see how many customers you can grow your bank. In truth many banks such as this one close the same amount of relationships as they open. Also, Ive never seen any bank put a $25, $30, $33.97, $34.97, or $35 fee purposely charged without fault of the customer. If so, I need to buy some lottery tickets.

Quote#3 "This bank only wants your checking account."

True, yet untrue. Let me rephrase your statement. "Tellers, that are not trained, or are mainly driven by their incentive or promotion wants your checking account. The bank wants your business" I dont think i need to comment any further down. if so Eh...

Quote #4 "They also opt you in to "Full Overdraft Protection" without asking you for your consent or even explaining what it is."

Simply said. ALL employees that do this are subject to termination. And post on this wall as such.

Quote #5 "There is no way to have NO Overdraft unless you personally sign a form saying "customer requests no Overdraft" otherwise, you will be in either FULL or PARTIAL"

Since I'm reading this as a banker, I know what this person is saying. But as a non banker "Eh...." Overdarft Privlage is the ability to purposely overdraft you account, literally. It will not work if:

1. You dont not have an Active Direct Deposit or Regular Deposit

2. You dont sign up for it.

Now. The easiest way to avoid this all together is to say "no". And the employee will have you sign a form, which should be easy to access on the bank's internet. "untrained" tellers have no idea about that.

Quote #Ehh.... "This bank BRAINWASHES their employees into only getting accounts. They also open accounts for people who do not want them, for people who have not given their consent, and also FORGE SIGNATURES on signature cards."

Simply said. ALL employees that do this are subject to termination. And post on this wall as such.

Also, since most banks offer incentives(money), teller's that are only about "incentives" are subject to this.

Quote # I lost count "They play favorites. Let's say your manager or District Manager likes you, and you break the law by forgining a signature for an account. They aren't going to do crap about it, they let it slide."

Fast forwarding to now. They are not with the company anymore.

Quote 6 "They also do not inform their employees on s**t, when you come into the bank you WILL get the run around."

All Employee information is sent via internal email. And as such, its the teller's repsonability to read it, prior to working. "I'm just plain lazy" would be implated your forehead if you resond with "I dont know".

Quote seven "If you aren't there to open an account, they do NOT want to help you. You will get passed from department to department, person to person, and be told a lie because they are too lazy to give you the actual true information."

I never knew that there was a company that doesnt want to help you? eh..... nevermind its the teller that doesnt. better.

Quote of Quotes "BUT WORST OF ALL: When a customer overdrafts their account, everything in the negative gets a fee, regardless if you had the money in there at the time of purchase"

The only way you get an Overdraft fee is when you spend more than what's available. Common Sense? or Ignorance?

"Once you go into the negative, they start charging you $2.49 a day until your account charges off (closes with a negative balance of an outrageous number) and goes to Collections. Pretty much every single person who has had an account there has a charge off, it is ridiculous."

It is ridiculos, I mean why am I working if every single customer I help, owes us money. I need to change my tittle then to volunteer debt collector. When some one comes to withdraw or depoist, ill simply say, 'You owe me 5 dollars'.

"Then, that customer comes in a couple years later to reopen their account. They have to pay off the negative balance and open a new one, EVEN IF IT'S ALL THE BANKS FEES"

Oh, My title has changed. Im a banker again. Jokes aside. A bank charges a fee when the customer is at fault. Any/All Bank errors get refunded immediately.

"Also, I don't know if you have been into a First Convenience Bank or not but they are SO unprofessional."

No. They haven't. MON-FRI Business Dress Code. SAT-SUN Jeans/ Bank Polo.

Qoute Last "First Convenience Bank will hire ANYONE who is willing to do whatever it takes to sell their precious, s****y bank accounts."

I guess silly is a very bad word to say. But the message is this: " First Convenience Bank will hire ANYONE who is willing to promote growth in the community around that are with the business." Accounts are secondary.

Actual Rebutal:

Eh........ if you listen to all the negative reports about anything. We'd all be in home, scared, watching the same news channel. But if you read your own research, are responsible about your own lifestlye, value integrity and honetsty, actually have common sense, are not lazy, You can laugh at this reply. Or at leat smile. Or grin. Or simply ignore and move on.

Signed

Common Sense

Advertisers above have met our

strict standards for business conduct.