Complaint Review: First National Bank Texas - Nationwide

- First National Bank Texas Nationwide USA

- Phone:

- Web: http://www.1stnb.com/en/

- Category: Banks

First National Bank Texas First Convenience Bank Deceptive banking, overdraft fees excessive Dallas TX - Texas

*Consumer Comment: You overdrafted your account

*General Comment: Bank processing...

*Consumer Comment: Non-Convience Bank...

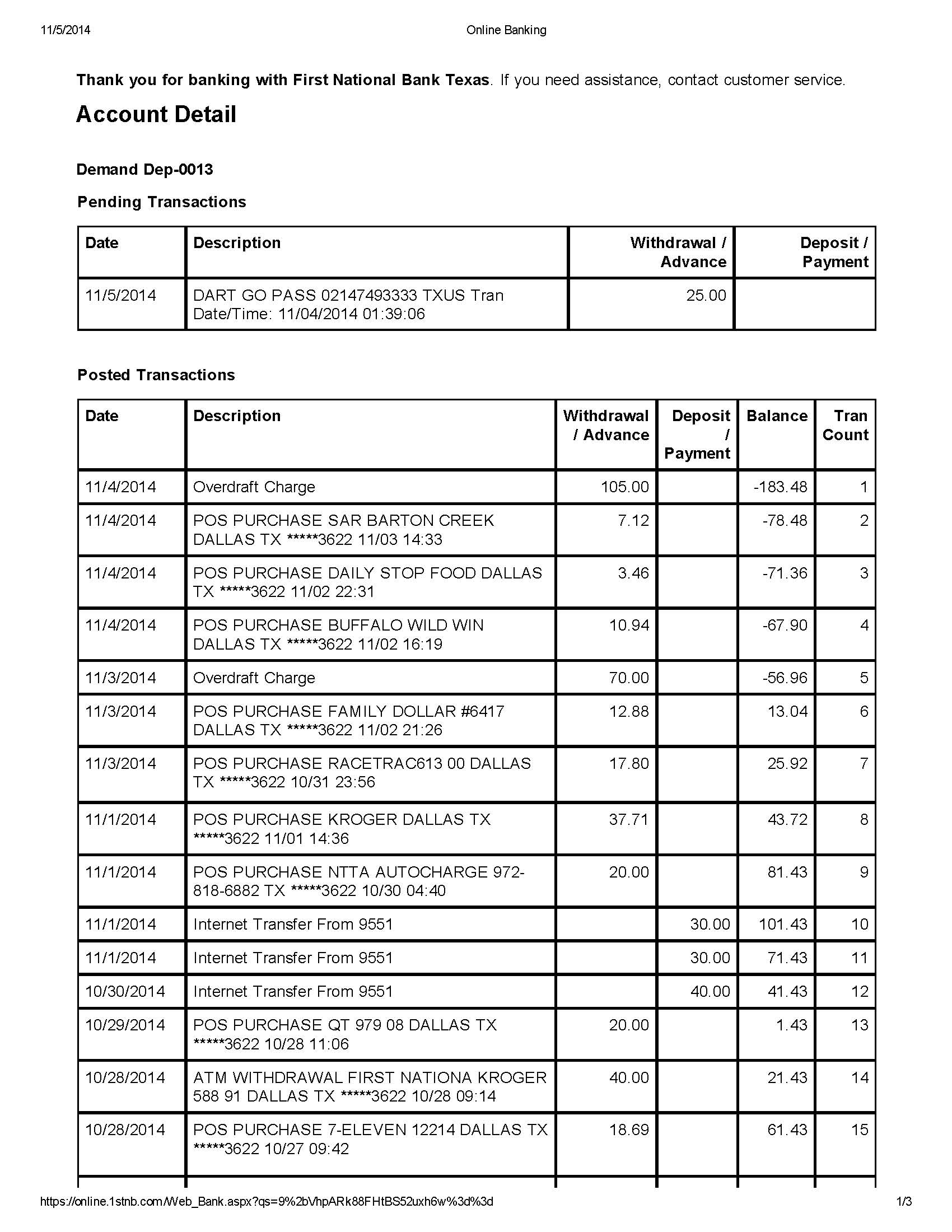

First Convencience bank is practicing unlaw excessive overdraft fees. My account had a balance of $13.04 after posted transactions. Then I get a $70 overdraft fee, so the remaining pending transactions came through the next day and I received another $105 in overdraft fees. This makes no sense at all. I am preparing a class action suit against this bank and if anyone is interested please let me know, I will put you in touch with the firm handling it.

This report was posted on Ripoff Report on 11/05/2014 10:48 AM and is a permanent record located here: https://www.ripoffreport.com/reports/first-national-bank-texas/nationwide/first-national-bank-texas-first-convenience-bank-deceptive-banking-overdraft-fees-excess-1186965. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#3 Consumer Comment

You overdrafted your account

AUTHOR: Robert - ()

SUBMITTED: Wednesday, November 05, 2014

Just to restate the very clear process striderq put as to how bank processes debits/credits, I will add a few things.

On-Line banking was NEVER meant to be the sole or even primary method for account management. On-Line banking is only a snapshot of your transactions and due to how they are processed they are not always in the order they were posted. So no you did NOT have $13.04 in your account when you were charged the overdraft fees. You should be using an written register, and if you do not have one or know how to use one do you know who will help you? The bank. That's right you can go into the branch and ask them how to keep a register. Not only will they probably show you, but they will also probably give you one to use.

If the firm that is "handling" this is telling you just based on this screen shot that you have a valid Class Action Lawsuit all I can say is I hope they are not charging you a single dime, or you will be back here in a few months writing another RipOff report.

Now, one final thing...if you add up your transactions even without the OD fees you did overdraft your account.

After all of your deposits you had a balance of $101.43. But if you take all of your debits that posted on or after the 1st you spent $109.91. Meaning you spent $8.48 more than you had, and if you go back in and read your account agreement you will find that they have the right to charge you overdraft fees. Where because of how they post you got hit with a lot of fees. I also have bad news for you, it is very likey that unless you were able to make the balance positive by at least $25 the pending transaction displayed will turn into another Overdraft fee as well.

No I do not now or have I ever worked for any bank, and regardless of the bank you posted I would have said the exact same thing.

#2 General Comment

Bank processing...

AUTHOR: Striderq - ()

SUBMITTED: Wednesday, November 05, 2014

The way banks process/post transactions is pretty standard. The only real difference is whether they post credits before debits or debits before credits. Either way is legal as long as customers are informed. The process goes like this:

1) Last business day's balance, money physically in your account at the end of processing for the previous day.

2) Subtract all debit card transactions that are on hold/pending. This gives you your avaialble balance. This is the amount of money available to pay debits without having an overdraft fee accessed.

3a) If credits go first, any credits for the day are added to your available balance. Then debits are subtracted in the order established by the bank, usually largest to smallest, legal if the customer has been told. Any item(s) that post to a negative balance will be accessed an OD fee.

3b)If debits go first, all debits posting for the day are subtracted in the order set by the bank. Any item(s) post to a negative available balance, you will be charged an OD fee for each item. Then credits for the day are added.

4) this balance is your closing balance. It's the amount that tomorrow's processing will begin with.

If you are charged an NSF fee, it means Non Sufficient Funds. A check or ACH presented and there was not enough available money to cover it. The item was returned unpaid. Usually will be re-presented in a day or two. OD fee will post on the day the account balance goes into the negative. NSF fees usually post the next business day during processing.

You had a balance of $13.04 after processing but how much was on hold, your pending transactions? Enough that two items posted to the negative the first day and then three items the next day. Keep an accurate check register. Subtract ALL debits when you approve them (write the check, swipe your card, authorize the ACH, etc) and add deposits after they are available in the account. If you do this and keep your check register balance in the positive you not not be charged any OD/NSF fees.

#1 Consumer Comment

Non-Convience Bank...

AUTHOR: bean4832 - ()

SUBMITTED: Wednesday, November 05, 2014

I have had the same thing happen to me mulitple times --- I have plenty of money in my account - and some how end up with tons of fees, and then fees charged because of the fees THEY charged!

I got a NSF fee for something (it never tells you what online) even though I had enough money in my account, the fee made me go into the negative, and then they charged me account negative fees!

This bank sucks.

Advertisers above have met our

strict standards for business conduct.