Complaint Review: First Convenience Bank - Killeen Texas

- First Convenience Bank Killeen, Texas United States of America

- Phone: 8009037490

- Web: www.1stcb.com

- Category: Banks

First Convenience Bank First National Bank Texas Charge OD Fees based on available balance instead of current balance resulting in fees charged to spend my money. Killeen, Texas

*Author of original report: Many opinions and misunderstandings

*Consumer Comment: Wrong Attitude...

*Consumer Comment: comment

*Consumer Comment: Response to the response

*Consumer Comment: Here is where your problem started...

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

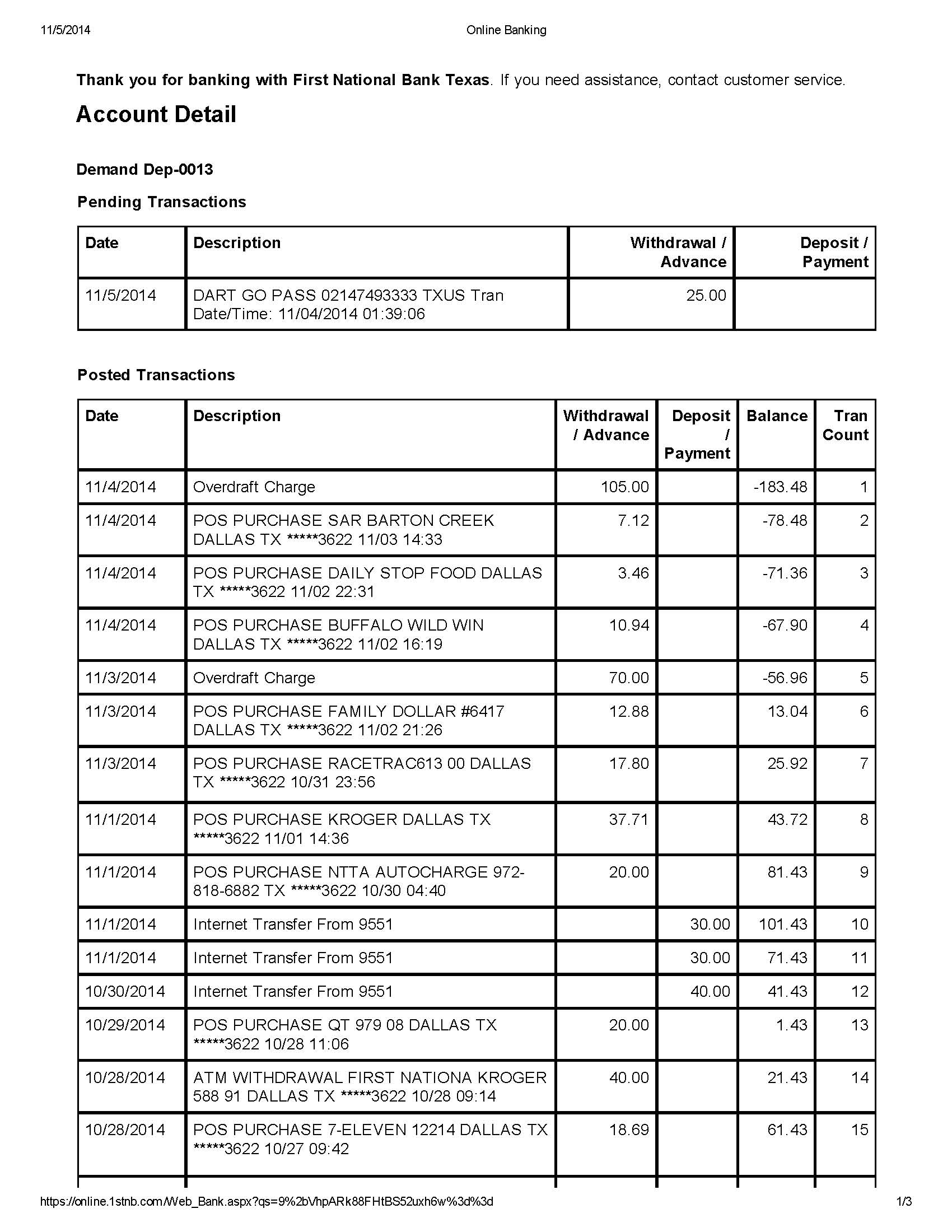

I am a new customer to First Convenience Bank Texas. I was excited about my account at this bank until I found out how they do business. First of all customer service is not on the top of their list until you announce you will do business elsewhere. However that is not my complaint. Did you know that Overdraft Protection to First Convenience is not "Protection" at all as I quote the customer service rep. when I say this, it is" A PRIVILEGE".

Privilege or Protection, call it what you want but the idea remains the same. It is established to cover funds that you do not have in your account. We think of it as a loan until pay day in which like any loan there is a price for using the bank's money, hence the OD Fee. First Convenience Bank has a policy or procedure (although not found in my contract) that they will charge you OD Fees based on the available balance of your account (Current Balance - any pending transactions).

Basically what this means is the minute your available balance reaches a negative number every transaction will post an OD Fee to your account. This occurs even when the funds are in the account and after drafting that transaction your account remains in a positive balance. Am I making since or have I lost you. Lets say that you have $52.00 in your bank as "current balance" you use your debit card 2 times resulting in a pending transaction for $30.00 and one for $10.00. Your "available balance" is $12.00 but until those transactions post your "current balance is still $52.00.

Well knowing you will overdraft you make a 3rd purchase for $15.00 now your "available balance" is (-$3.00) keep in mind that no transactions have posted to your account (been paid out) so your current remains $52.00. The next morning you look at your account you discover a charge of $102.00 in OD Fees resulting in a current balance of (-$105.00) you are now confused and wondering where you miscalculated your bank ledger, right? By your record keeping you should only be in the red (-$37.00) WOW! What a difference. What has happened is that the bank charged 3 OD Fees and feels they have the right to do so.

Regardless of the order in which the transactions posted only 1 transaction would have put you in the negative. Look at it from this light. Look at this as an equation or your ledger, (current balance) $52.00- (transaction 1) $30.00 = $22.00 (remaining current balance) - (transaction 2) $10.00 = $12.00 (remaining current balance). There should have been now OD Fee charged as there was no Over Draft to account for at the time that transaction 1 and 2 were paid out, FUNDS WERE IN THE BANK TO COVER THE EXPENSE.

You where charged $34 for each time there was a transaction paid once the bank "anticipated" you would have a negative balance after all pending transactions posted. YOU PAID THE BANK TO SPEND YOUR OWN MONEY! When you contact the bank with this they claim it is standard practice, if you are persistent about the rip off and speak to enough managers then you can get some of this refunded to you but not all of it. The way I see it is the bank is manipulating the system to get more money from you than they are entitled.

This report was posted on Ripoff Report on 01/11/2012 01:10 PM and is a permanent record located here: https://www.ripoffreport.com/reports/first-convenience-bank/killeen-texas-76540/first-convenience-bank-first-national-bank-texas-charge-od-fees-based-on-available-balanc-821232. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#5 Author of original report

Many opinions and misunderstandings

AUTHOR: danigirl81 - (United States of America)

SUBMITTED: Friday, March 09, 2012

I am the original poster of this rip-off report. I think many of you have valuable complaints and points of view however it sounds to me like those of you with opinions seem to be under the impression that we who have complained are nothing more than careless, irresponsible dimwits that fail to understand budgeting and record keeping in addition to consequence. That is not so, we are merely pointing out that this procedure that 1stcb uses is simply a rip-off, a way to take advantage of the situation. I have since switched back to Woodforest Bank where yes I am obligated to any OD fees that I incur but by a procedure that makes logical since as OD fees are not accessed on the account until all other funds have been removed and further debits actually send your balance below $0. This is not so with 1stcb. Where the misunderstanding is, is in the meaning of BALANCE. There is Available, Ledger, Current; call it what you will but the fact remains money there-money not. What 1stcb does is by their definition of "Balance" legal, but that doesnt make it reputable. Regardless of the amount of money you have as your current balance (actually in the bank) at the time a payment "clears" or otherwise actually paid to merchant they will begin charging OD fees the minute your "Available" balance goes beyond your "Ledger". So If you have a Ledger balance of $5 and an Available balance of $10 and a check clears for $4 your ledger balance is $1 because the debit was covered by the amount actually in the account but 1stcb charges the OD fee of lets say $30 on this transaction because you are presumed in the negative (though not in reality). This procedure then brings you actual account balance to (-$29) so when the other $6 debit and $30 OD fee is assessed your balance is (-$65). If this was at Woodforest your balance would be (-$35) - see the difference. Don't get me wrong, Woodforest has the same policy regarding OD however they hit you at the bottom of the available balance instead of the top, if that makes any sinse. By that I mean if you deposit money into your account with 1stcb to bring your Available balance to a positive number then they do not charge the OD fee on any further transaction to clear where as Woodforest will continue to charge for anything that post negative prior to the pending deposit transferring to your ledger balance. I only concider 1stcb a rip-off because in the scheme of things you end up with more OD fees this way and this policy as it is called is not clearly stated nor explained in the contracted agreement you have with them. However, In the end its about understanding the process in which your bank elects to use and yes management but I must also point out that evedently if everyone stayed out of the negative as some of you have suggested then OD "privilages" would not be necessary in the first place and would most likley not exist for that reason.

#4 Consumer Comment

Wrong Attitude...

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Friday, March 09, 2012

- Okay..I think I see your issue. In this context "Credit" does not mean "On Credit", it just means the way the transaction is processed. The money may not be posted but you have spent it. This is similar to the "old days" where someone would "float" a check. That is they would write a check and hope that they can get the money in the bank before the check comes in. You say that it won't post for 3 days..well that is NOT guaranteed. I have many Gas Stations that post within a day, and I have had a couple that have taken a week to post. So you are just taking a huge gamble that you have a set amount of time before a transaction posts.

The only true way is to carry a ledger around and write down every purchase to the penny, but who does that?

- Yep that is the only true way, and the people that do this are people who don't want to pay Overdraft fees.

In essence, if I am paying for mobile banking, I should be able to trust that it is accurate.

- It is accurate....as far as the bank is concerned. Because it reports to you what they show you have at the time you requested the information. The issue is that they only know what has been submitted to them. So if a merchant does not submit a debit they have ZERO idea that you have spent the money. Which is why a written register is very important.

Now, if you can come up with a system that will guarantee that no matter what merchant you use your card at, or whenever you write a check that the bank will instantly know you have spent the money 100% of the time..I suggest you immediately file a Patent on that process and watch the money roll in.

First Convenience Bank preys on a certain socioeconomic class in America.

- Your socioeconomic status has NOTHING to do with this. If you are at a level where you have $10 in your account and you don't spend more than $10 you will not get an overdraft fee. But if you keep $10,000 in your account an spend $10,001 you will get overdraft fees.

#3 Consumer Comment

comment

AUTHOR: Jeanski - (USA)

SUBMITTED: Friday, March 09, 2012

Question: The only true way is to carry a ledger around and write down every purchase to the penny, but who does that?

Answer: Mature, responsible adults who don't want to pay overdraft fees.

#2 Consumer Comment

Response to the response

AUTHOR: lmbrtcdy - (United States of America)

SUBMITTED: Thursday, March 08, 2012

I have been in the same boat as the original poster of this report. While what first convenience bank does, as far as I can tell, is legal, its certainly unscrupulous.

I am moreover responding to the response to the original article. Yes. The only true way to prevent overdrafting is to not spend money that isn't in your acct. To that end, however, 1stCB has both an online banking feature, and a mobile banking app to help you keep track of your finances. Neither of these work. Purchases won't show on one and will on the other, charges will appear and disappear seemingly at random, or won't show at all. This will lead you to believe that your balance is more than it is, or that something has gone through when it hasn't, which will slam you later.

And pending transactions are pending transactions. If I use my debit card at the pump as credit, knowing that I get paid tomorrow and the purchase won't post for three days, then the money is not gone from my account, therefore I'm not negative, but I get OD fees all the same. The only true way is to carry a ledger around and write down every purchase to the penny, but who does that? Debit cards, online banking, and banking apps have all come about for the convenience of it all. Banking costs me money, which in turn should be funding these operations. In essence, if I am paying for mobile banking, I should be able to trust that it is accurate. Because right now, its random behavior leads me to believe that I'm being led on to encourage me to spend more than I have and incur hundreds of dollars in fees. Sounds like a conspiracy theory, but with this bank, its not altogether unbelievable. Bearing all this in mind, I got tired of the fees and cancelled my overdraft protection. My debit will no longer work if I swipe it and the money isn't there. Here's the kicker. When a purchase is denied, I get a 2$ denial fee. If I don't have two dollars in my acct, I get an overdraft charge. So, with overdraft protection, users of this bank still get overdraft fees. How does that work? The simple fact is this. First Convenience Bank preys on a certain socioeconomic class in America. In the spirit of "buy here, pay here" auto sales that mark up sub-standard vehicles but don't check credit, they make it easy for people with low income or bad credit to get and maintain a bank acct. The days of stuffing our money under a mattress are over. Most reputable employers these days require direct deposit, which requires a bank account. First Convenience understands this and uses this leverage to hammer us with ridiculous fees and fines every time we turn around. They know what they're doing. They're intentionally taking money from hardworking American people because they know we have limited other banking options

#1 Consumer Comment

Here is where your problem started...

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Wednesday, January 11, 2012

- You are INTENTIONALLY overdrafted your account and don't want to accept the consequences of the terms you agreed to.

Going back a bit the only reason the amount is "pending" is because you attempted to make a purchase. So as far as the bank is concerned it is "on-hold" and unavailable to you(hence your posted vs. available balance). But by you basically trying to say that because the amount hasn't "posted" you think you should be allowed to "float" the funds. Well there is NO longer any "float".

You can complain all you want, but the fact is that this is basically standard with all banks and you would NOT have had this issue if you had not INTENTIONALLY overdrafted your account.

There is a way to eliminate getting any Overdraft fees, and I think you already know the answer. That is to NOT treat your bank account as a line of credit thinking you can just get a loan when ever you want.

There is one more thing, you can "opt-out" of Overdraft protection on your Debit/ATM card. What that will do is that when you attempt to use your Debit Card at a Point of Sale or ATM, if there is not enough currently AVAILABLE in your account for the amount of the purchase it will be declined. A bit embarrassing but at least you don't get any fees. Now, this is only for Debit Cards, it does not apply to Checks or ACH transactions which the bank still has the right to either pay or return the transaction unpaid.

Oh and no I am not now or have ever been an employee of this or any other bank.

Advertisers above have met our

strict standards for business conduct.