Complaint Review: First Convenience Bank - Nationwide

- First Convenience Bank Nationwide USA

- Phone: 254-554-6699

- Web: www.1stnb.com

- Category: Banks

First Convenience Bank Taking all of college student's money through "legal" non-activity fees Nationwide

*General Comment: I like it when the story changes...

*Consumer Comment: You need a reading comprehension class as well..

*Author of original report: Not everyone is an attorney

*Consumer Comment: Not a very good teacher....

*Consumer Comment: Some Questions Are In Order

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

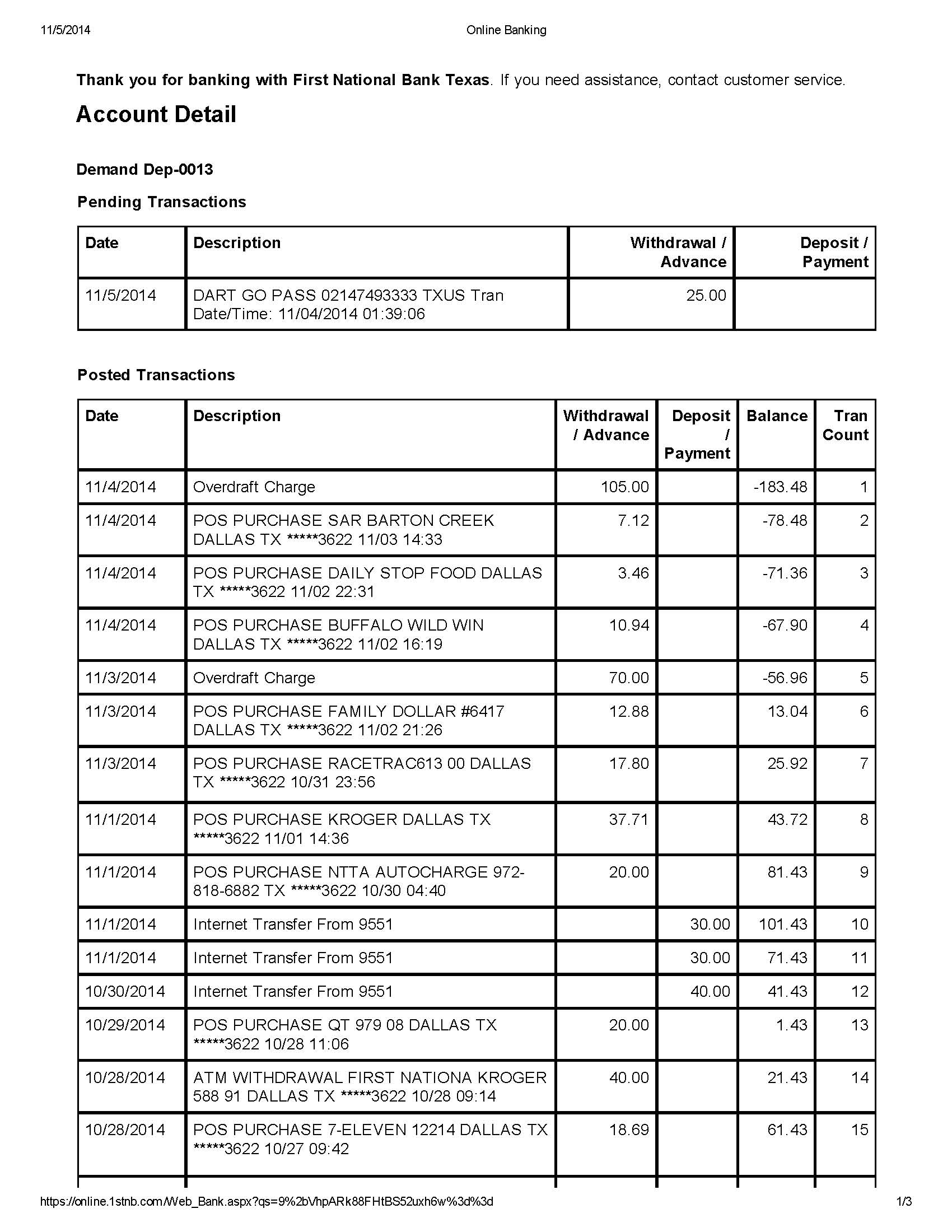

My son is a college student. He opened a small $250 checking account at First Convenience Bank inside WalMart on a whim, a lot of money for a college student. His statements came to our home, not college, so he never opened them.

He never used the checking account and never dreamed they'd charge him to NOT use it. Over time they took every cent through $15 monthly non-use fees, actually put him into the negative -$3, then charged an overdraft fee of $40 bringing him to -$43 now.

That made my blood boil, but that’s not the worst part. They would NOT let him close the account unless he paid the $43, which if he couldn’t afford, they would keep tacking on $40 overdraft fees every month!!!!! How long would that take before he owed them $10,000? All for opening a $250 account he never touched.

I had always heard that banks are known to "fee" people out of their deposits and lose everything they put in. What I didn't know - and perhaps this bank just lied - was that it's legal for them to go past that and put people in debt with unending "overdraft" fees once they've taken all the principle.

Is it legal to put people in debt with unending "overdraft" fees once they've taken all the principle?

This report was posted on Ripoff Report on 12/11/2015 06:05 PM and is a permanent record located here: https://www.ripoffreport.com/reports/first-convenience-bank/nationwide/first-convenience-bank-taking-all-of-college-students-money-through-legal-non-activity-1273695. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#5 General Comment

I like it when the story changes...

AUTHOR: Striderq - (USA)

SUBMITTED: Saturday, December 12, 2015

Original post was about an account that was never used and eaten up by inactivity fees. However, when the OP responds to other posts, they now mention NSF fees. Meaning that something was authorized against the account and when there wasn't enough money it was returned unpaid causing the fee. It's impossible to get NSF fees on an account that isn't used.

#4 Consumer Comment

You need a reading comprehension class as well..

AUTHOR: Robert - (USA)

SUBMITTED: Saturday, December 12, 2015

Looks like in addition to a basic finance class, you need a class in reading comprehension.

As not once did I say I agree with the fee. I didn't say what way or the other what I feel about these fees. I am not going to go into what is and what isn't legal, what is or isn't considered "right". I will restate though that the only reason your son lost $250+ is because he failed to take even a basic responsibility of his account by failing to review his statement. Not only did not not review it every month, he didn't even review it in a year. Now, had he reviewed his statement the first month and noticed the $15 and you had a complaint I may have been right there with you..but after so much time has passed..not so much.

Another new failure is that apparently you son doesn't know the difference between a Savings Account as he thought that when he opened a Checking Account was the same thing.

Regardless of the type of account it is, you need to review this every month. I have a couple of savings accounts and review them monthly to make sure that they are okay. After all, just as easily as fraud can occur on a Checking Account, it can occur with a Savings Account.

As for the numerous complaints. Guess what...that is the biggest complaint with most banks. Because even you stated that banks are known for fees. But you will also find that most of the "complaints" are by people who don't understand that you can't spend more than you have available. Or they failed to read what they were agreeing to.

Finally, realize that just about every major bank has the same policies. There was a time when Credit Unions were a good place to go, but even many of them are now figuring out you need to implement various fees to survive. So be sure to tell him that when ever he opens another account that he is FULLY aware of the fees by asking the bank for the fee schedule. If he does not agree with the fees then don't sign up....He should also ask for their funds availability policy as this tells you how they handle deposits, as well as their posting order for debits and credits.

#3 Author of original report

Not everyone is an attorney

AUTHOR: - ()

SUBMITTED: Friday, December 11, 2015

Sorry to see my relating this story to the public upset you so much. Although IMO your blistering objection to my parenting skills and my son's "stupidity" for being so trusting comes across a little "grinch-like" so close to Christmas.

Fact is - you got me counselor. Just like this bank gets a lot of people I'm sure. Bury fees and disclosures in pages of microscopically printed legal gibberish that you sign out of trust. If someone is foolish enough to sign a contract without reading all the fine print, shame on them they deserve what they get. Tons of unethical companies and attorneys thrive on this.

The point of this post is to make people who don't read the fine print - and perhaps don't read their statements on a $250 account they never use and naively thought was like a savings account - aware that this can also happen to them, and if they're smart they'll close their account before they start incurring NSF charges, and worse.

Apparently you are totally comfortable that a bank can zero out a balance in an account by charging monthly fees when you never use it ... because it's in the contract. I get it. It's legal. Moral? That's another question, but we'll let our do-nothing congress wrestle with not doing anything about that.

But why not stop once you've taken all the money? As a reputable bank, once you've zeroed out the balance, why not just close down the account and be happy you made a lot of money doing absolutely nothing? Why get out the whip and start charging NSF fees that are only there because of your maintenance fees, not overwriting checks?

BTW check out other complaint boards on the internet on First Convenience Bank - it's LOADED with complaints about this bank's fees and policies.

Merry Christmas - and have some egg nog!

#2 Consumer Comment

Not a very good teacher....

AUTHOR: Robert - (USA)

SUBMITTED: Friday, December 11, 2015

I am sorry to say but a lot of these issues fall on the shoulders of ONE person, and to find that person all you need to do is look in the mirror. You had the perfect opportunity to teach, and instead you are teaching your son that when you do something wrong the first thing you need to do is blame someone else.

First of all your son opened the account, perhaps he was never taught that before you sign a legal contract, even on a whim, that you need to read and understand what you are signing. As I can just about guarantee you that the "inactivity" fees were disclosed when he signed up...he just failed to read(or understand them).

Next, you come off here with your violin story about how that $250 was a lot for a college student. Really? So was this the same $250 that your son just put into a checking account and "forgot" about for well over a year? Wouldn't something that important be something he may pay more attention to?

But you know what, for the heck of it let's just say that they didn't disclose the fee in the beginning. He still got a statement EVERY month that you as the parent failed to send him, and he was too lazy to put in a change of address. Yes, I did call him lazy...as I worked 2 full time jobs, went to school full time, commuted 1-3 hours every day and still had time to manage may day to day business and finances as a struggling college student. If he can't spend 5 minutes one time a month to look at a statement then he needs to do some serious re-thinking of his priorities.

As if someone cared enough to open it they would have seen the $15 the first month it was taken out....not over 16 months later. Again, where was your parenting to actually help your son by telling him that he needs to review all of his accounts every month to make sure that they are correct. After all, what if intead of inactivity fees there was a fraudlent purchase? Who would you blame then?

While we are on that subject, I bet you haven't even told your son how to use a register to record all of his purchases. On the plus side, hopefully this lesson he learned while costing him some money now, will save him in the future when he realizes that mom and dad may not know best and he needs to take responsibility over his own money. Am I being rough on you...yep. But perhaps you needed a bit of a lesson as well.

#1 Consumer Comment

Some Questions Are In Order

AUTHOR: Jim - (USA)

SUBMITTED: Friday, December 11, 2015

You act surprised they have this account inactivity fee, as if you've never heard of it. Why is it I was able to find the fee structure on their website within 90 seconds and I'm not even an account holder??? You say he received these statements and never opened them. As a parent, do you not think he should have been keeping track of that account??? So then, here's what we have...he doesn't bother to read the fee disclosure schedule prior to opening the account AND he gets statements in the mail and doesn't even bother to read them either. The account gets regularly charged this fee and its all THEIR fault??? As a parent, you come here and blame the bank for this when as a parent, YOU should have been educating him as to how to properly manage his own account! Of course, in all likelihood, your failure to educate him is directly indicative of your own inability to manage an account, since you failed to instruct him of these important matters!

Advertisers above have met our

strict standards for business conduct.