Complaint Review: HSBC - Internet Internet

- HSBC Internet United States of America

- Phone: 80047710240

- Web: http://www.householdbank.com/

- Category: Credit Card Processing (ACH) Companies

HSBC Household bank PAID OFF MY ENTIRE BALANCE AND WAS PENALIZED!! Internet

*Consumer Suggestion: if you need funds available right away check with them beforehand

*Consumer Comment: Jeanski & Steven

*Consumer Comment: Jeanski

*Consumer Comment: comment to Steven

*Consumer Comment: Why use it

*Consumer Comment: response to Coast

*Consumer Comment: Mea culpa, mama mia!

*Consumer Comment: Karl wrote...

*Consumer Comment: To OP and Pied Piper, you got the company wrong

*Consumer Comment: MASSACHUSETTS MAN, BANKS DO NOT MAKE MONEY.......

*Consumer Comment: Your wrong..

*Consumer Comment: "ONCE A THIEF .... ALWAYS A THIEF".

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

HSBC Credit card with $300 credit limit. I charged $290.00 or so on it.

I paid it in full on line through thier web site using my checking account.

he payment cleared my checking account and bank, and it's now been almost two weeks gone by and still I can't use my credit card because HSBC placed a "payment hold" under recent transactions on the payment. So I called them to see whats up with this? I told them the payment cleared my bank a week and a half ago! They said sometiems it can take up to 14 days to process.

So I did a test; I charged $1.00 on my card and then paid it the same way (on line using checking account) and low and behold the 1.00 was made available to my creidt card the next day and it wasn't even finished processing yet! The $290 payment finished processing according to HSBC back last month!

So I called them back to ask why is it one is available and the other isn't? They said it's because I paid off the whole balance! YES! THEY ADMITTED IT! it's them holding off my available credit for that reason alone!

They are trying to discourage people from paying off my entire balance; they do this legally by tieing up your avilable credit by the amount you paid, they applyu the payment but dont let you use the card! So I paid $50 to have this card as a annual fee and can't use it for two weeks now because I paid off my entire balance, it's been almost two weeks since that payment was made...this may be legal but it is VERY SHADY AND VERY LOW! The user agreement says they can take up to 14 days to process, but we can see what they are doing here. I know it has nothing to do with my checking account bank and has eveyrthing to do with HSBC placing the hold so I wont pay it off like that again.

If you have to use these guys loike I did to create or build credit, be careful they are NO GOOD IN MY BOOK!

This report was posted on Ripoff Report on 10/05/2011 08:18 AM and is a permanent record located here: https://www.ripoffreport.com/reports/hsbc/internet/hsbc-household-bank-paid-off-my-entire-balance-and-was-penalized-internet-784904. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#12 Consumer Suggestion

if you need funds available right away check with them beforehand

AUTHOR: pinkdiamond - (United States of America)

SUBMITTED: Tuesday, November 01, 2011

If you urgently needed funds available for something and you had called and spoke to someone asking about method you should have used to pay it they may have offered a way for you to have wired the money to them so they would not have to run the risk of the payment being returned. A check for $290 has a much larger risk of being returned and would have a significantly detrimental effect to your account if you used the funds it created available credit as well as having the payment come back as returned. A $1 payment being returned means that they only have the possibility of you being $1 over because of the payment coming back.

#11 Consumer Comment

Jeanski & Steven

AUTHOR: coast - (USA)

SUBMITTED: Friday, October 14, 2011

Jeanski--

"The OP clearly stated the payment had cleared"

Yes, he did state that. I wrote, "The credit card company wants to be sure the payment clears." They key words are 'to be sure'. We know he has a credit limit of $300; we don't know if his checks always clear.

Steven--

"If you can afford to pay the full price for something with cash/debit then why use the credit card for a purchase?"

Bonus points add up to freebies.

#10 Consumer Comment

Jeanski

AUTHOR: Steven - (U.S.A.)

SUBMITTED: Friday, October 14, 2011

I was replying to the OP. Just seems kind of counter productive to charge something on a credit card unless you have to. The way lenders are watching what they loan out and for how long is a good reason to just use a credit card when needed or to keep it from being deactivated on you.

#9 Consumer Comment

comment to Steven

AUTHOR: Jeanski - (USA)

SUBMITTED: Friday, October 14, 2011

I'm not sure if you were replying to me or the OP, so I'll answer just in case you meant me. The reason I maxed the card was because an item I was saving for went on sale for a short time. I had planned to purchase it with my next paycheck, but the sale would be over. So I charged it, waited a week to get paid, then paid the whole card off. I don't routinely run up my card. I pay the balance in full every month so I don't incur finance charges.

#8 Consumer Comment

Why use it

AUTHOR: Steven - (U.S.A.)

SUBMITTED: Thursday, October 13, 2011

Its great to have a credit card for emergencies but why are you putting yourself in a position where you HAVE to max it out and then pay it off?

If you can afford to pay the full price for something with cash/debit then why use the credit card for a purchase?

Why not just use it for gas or something (say about 30 bucks if your tank can hold that much). Then turn around and pay it when the statement comes. That way you build a history of paying the CC without incurring the interest but you still have money available in case of an emergency.

#7 Consumer Comment

response to Coast

AUTHOR: Jeanski - (USA)

SUBMITTED: Thursday, October 13, 2011

The OP clearly stated the payment had cleared, but HSBC didn't apply it for 14 days. This has happened to me with USAA recently. I used about 80% of my limit for a large purchase. Knowing I would need the card for an upcoming trip, I paid the entire balance in full (online) within about a week of using it. The payment cleared my checking account the next day, but USAA held it for 7 business days. Their reason? Because I used more than 50% of my available credit.

What difference should it make how much I used if I made an immediate payment to pay the entire balance, AND the funds cleared my bank? The answer is "it shouldn"t. They do it so they can invest my money for a week and make $$ on the interest.

It's not illegal, and it's probably spelled out in the terms that they can do it. But I sure didn't like it and will consider using my other card in the future.

#6 Consumer Comment

Mea culpa, mama mia!

AUTHOR: voiceofreason - (United States of America)

SUBMITTED: Wednesday, October 12, 2011

I didn't realize until now that HSBC controls HFC Beneficial. So much for my first rebuttal above.

Toot toot, you're good for more, toot toot!

#5 Consumer Comment

Karl wrote...

AUTHOR: coast - (USA)

SUBMITTED: Wednesday, October 05, 2011

"They make their money on people who make payments on the balance, because of the interest rate that they charge."

I suppose you meant people who make minimum payments. Yes, that is what the loan companies prefer.

"That's WHY our country is collapsing!"

This country is not collapsing.

"file a complaint against the credit card company"

The OP does not have a valid complaint. The credit card company wants to be sure the payment clears. Keep in mind that there is a reason the OP has a $300 credit limit.

#4 Consumer Comment

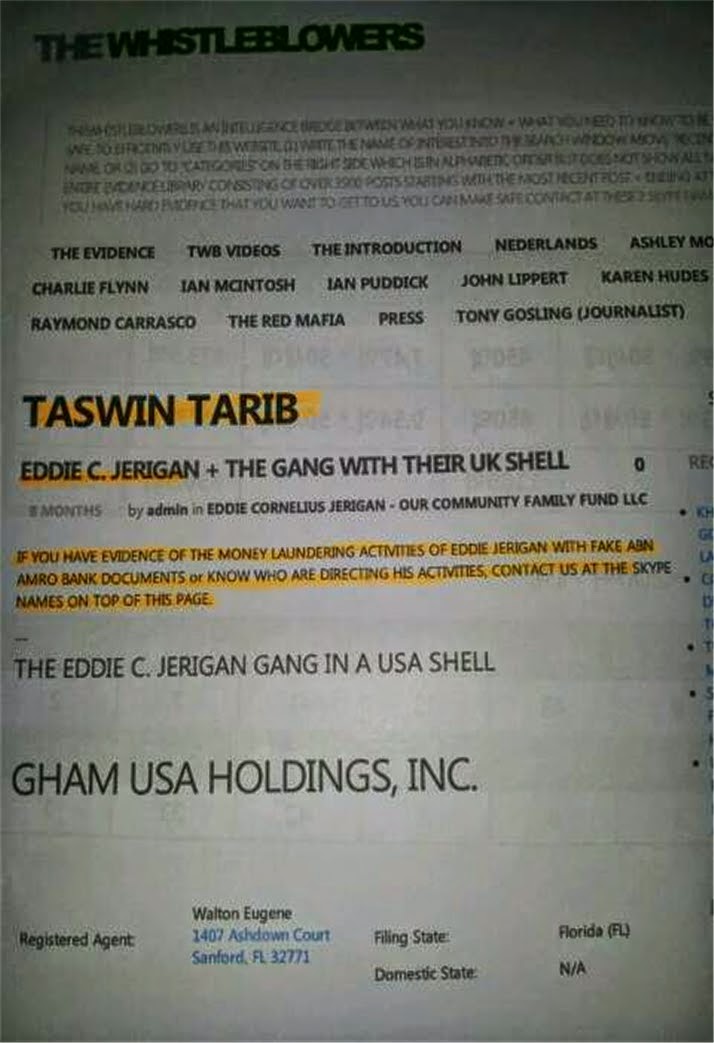

To OP and Pied Piper, you got the company wrong

AUTHOR: voiceofreason - (United States of America)

SUBMITTED: Wednesday, October 05, 2011

HSBC is a British/Hong Kong based bank. What used to be Household Finance merged with Beneficial to become HFC Beneficial (At Beneficial, toot toot, you're good for more. toot toot!). They have nothing whatsoever to do with HSBC.

#3 Consumer Comment

MASSACHUSETTS MAN, BANKS DO NOT MAKE MONEY.......

AUTHOR: Karl - (USA)

SUBMITTED: Wednesday, October 05, 2011

from people who payoff their entire balance each month. If everyone paid off their balance at the end of the month, the banks would not make their much needed profits. They make their money on people who make payments on the balance, because of the interest rate that they charge.

The banks would like to see all of their customers simply making payments on ALL types of loans, including mortgages. That's WHY our country is collapsing!

Americans (most of them) are in deep, deep, debt. And now that the economy has slowed and millions upon millions of people have lost their jobs, the banks are in deep, deep, trouble, because millions of people are not able to make their payments on- school loans, mortgages, second mortgages, car loans, boat loans, fifth-wheel loans, wave-runner loans, vacation loans, jewelry loans.............and credit cards.

Contact your your Attorney General's office and file a complaint against the credit card company. Who knows, maybe something will be done to protect consumers in this country before we go into a Depression.

Good luck.

***BANK ALERT: Don't forget to type in all of the following at this site and read the Ripoff Reports for valuable information if you have a CD, credit card, checking account, or a mortgage with any of the banks in the USA-

WELLS FARGO

GM CREDIT CARD SERVICES

BANK OF AMERICA

CHASE

CITIBANK

WACHOVIA

US BANK

MERRILL LYNCH

ALLY

GMAC

COUNTRYWIDE

INDYMAC

ONE WEST BANK

LITTON LOAN

MORGAN STANLEY

PHH MORTGAGE

GOLDMAN SACHS

MODIFICATION

MORTGAGE

#2 Consumer Comment

Your wrong..

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Wednesday, October 05, 2011

- Well stop the presses, a credit card company admits that they don't want you to have access to the credit line until they make sure that the payment you made clears.

There are some "basics" about credit cards that you probably should know. A credit line is NOT your money. It is an amount that a Credit Card company is willing to let you borrow at their terms. As such they have every right to not allow you to have access until they are sure that your payment processed.

The reason they do this is because they deal with Sub-Prime borrowers who either have had credit issues in the past or haven't shown that they can handle credit. There are people who would make the payment to pay off the account and then immediately want to charge up the card again, which by the way is exactly what you are doing. But then the payment would come back as bad and instead of having a $300 balance they now have a $600 balance and over the credit limit. The previous history of the borrower shows them that the chances of them getting this paid back is not good. So because of other people you are lumped into this group and are going to have to wait for them to allow you access to THEIR money again. And yes you are going to go off on the "well my payment cleared". Well it sure may have but again this is their rules and if they want to wait 14 days they can.

Even though you are probably going to ignore this, here it goes anyways. A Credit Line is what they are allowing you to borrow, but to show that you can handle credit you should never be using more than about 1/2 of the credit line, where ideally you are under 30%. If you follow that rule then not only will it show that you can be responsible in not always trying to "max out" your credit. But when you do pay it off it doesn't matter if they hold the funds or not because you will not go over your credit limit with new purchases.

#1 Consumer Comment

"ONCE A THIEF .... ALWAYS A THIEF".

AUTHOR: Pied Piper - (USA)

SUBMITTED: Wednesday, October 05, 2011

Way back when .... they operated out of retail store fronts. Then they were known as, HOUSEHOLD FINANCE. They made high interest loans.

"ONCE A THIEF .... ALWAYS A THIEF".

Advertisers above have met our

strict standards for business conduct.