Complaint Review: Key Bank - Geneva Ohio

- Key Bank South Broadway Geneva, Ohio U.S.A.

- Phone:

- Web:

- Category: Banks

Key Bank bank fees ripoff Geneva Ohio

*Consumer Suggestion: comment

*Consumer Comment: It sounds like you are confused

*Author of original report: Funds where there

*Author of original report: Funds where there

*Author of original report: Funds where there

*Author of original report: Funds where there

*Consumer Comment: Dates on checks are meaningless.

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

Key bank is by far the worst bank to deal with. I wrote a check dated for March 1 2008. Key bank cashed that check and it cleared my bank on February 29th? Now that check being cashed set the whole bank fee's in motion. 4 of them so far!! But the killer is on March 1 a Saturday I deposited 2,100.00 in my checking account. That was more then enough needed in my account to cover any transactions. BUT key bank decides that they will only allow 100.00 of that money to be available. Yes they have to put a hold on your money till it clears.

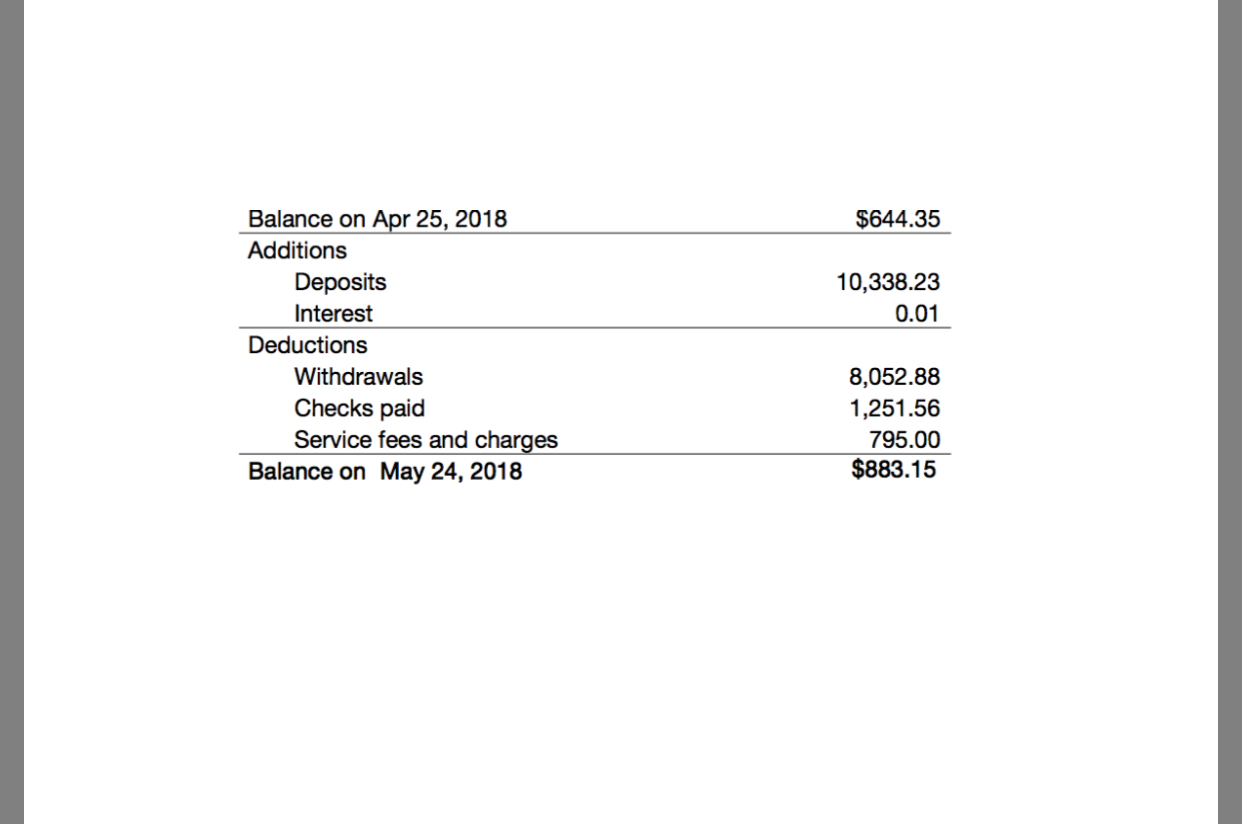

Now i could almost understand that IF I deposited a check, BUT IT WAS CASH! SO no matter how much you deposit in your account (could be millions) you are only allowed 100.00 of that money till they decide to release it. If you look at my statement there is not 1 negative amount but yet they have charged me 38.00 4 times saying that even though i deposited 2,100.00 at the time i used my debit card there was only an "available balance" of 100.00. Please people beware of this bank, read other things about key bank online and do what i am doing banking somewhere where you are not being ripped off!!

Andreaj40

geneva, Ohio

U.S.A.

This report was posted on Ripoff Report on 03/05/2008 08:28 AM and is a permanent record located here: https://www.ripoffreport.com/reports/key-bank/geneva-ohio-44041/key-bank-bank-fees-ripoff-geneva-ohio-314894. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#7 Consumer Suggestion

comment

AUTHOR: Nancy - (U.S.A.)

SUBMITTED: Wednesday, March 05, 2008

I worked for key bank proof department for 6 years and my daughter still works there. Just an aside, the Cleveland processing center was the worst of the 5 they have) I worked for the Tacoma center. First of all. IF you dated a check for MArch 1 and the pers you gave it to cashed it, that is NOT the banks fault. In fact it is Illeagel to post date a check. If the check is in a group of checks , lets say, and the teller takes it, it is processed. We dod not look at dates or even signatures , there is not enought time, and that is not our job. Secondly, not all debit transactions aree processed the minute or even the day they are made at the store. Thire, if you deposited cash in an ATM HOW is the bank or teh atm supposed to knwo that? They assume the transaction is a check. The law states that they can credit $100 of the transaction untill it clears. Depositing with the teller is a little different. The bank did not do anything wrong. It is not ANY banks fault that you do not have to have a brain or be able to read and you can be math challenged to get a checking account. MOST people (even customer service people at the banks and tellers) do NOT know how things work. ATM deposits from the weekend are processed Monday evening. So you should have allowed that time accordningly in your check register. Illl bet you do not even keep on.

#6 Consumer Comment

It sounds like you are confused

AUTHOR: Ken - (U.S.A.)

SUBMITTED: Wednesday, March 05, 2008

First of all, banks do not and cannot, by law, place a hold on cash. Saturday is not a business day, as someone above noted, so your cash deposit will not be reflected in your account until Monday night.

You wrote a post-dated check. Under the Uniform Commercial Code, which governs all financial transactions (among others) in the U.S., a check which is post-dated but negotiated by the bank is the liability of the drawer, not the bank. It's the law.

If the check cleared on Friday, and you also made a debit transaction on Friday, but didn't deposit until Saturday, (which is really Monday), you played it too close and got burned. Key Bank is overall a pretty crappy bank, but this particular problem seems to be yours, not theirs.

#5 Author of original report

Funds where there

AUTHOR: Andreaj40 - (U.S.A.)

SUBMITTED: Wednesday, March 05, 2008

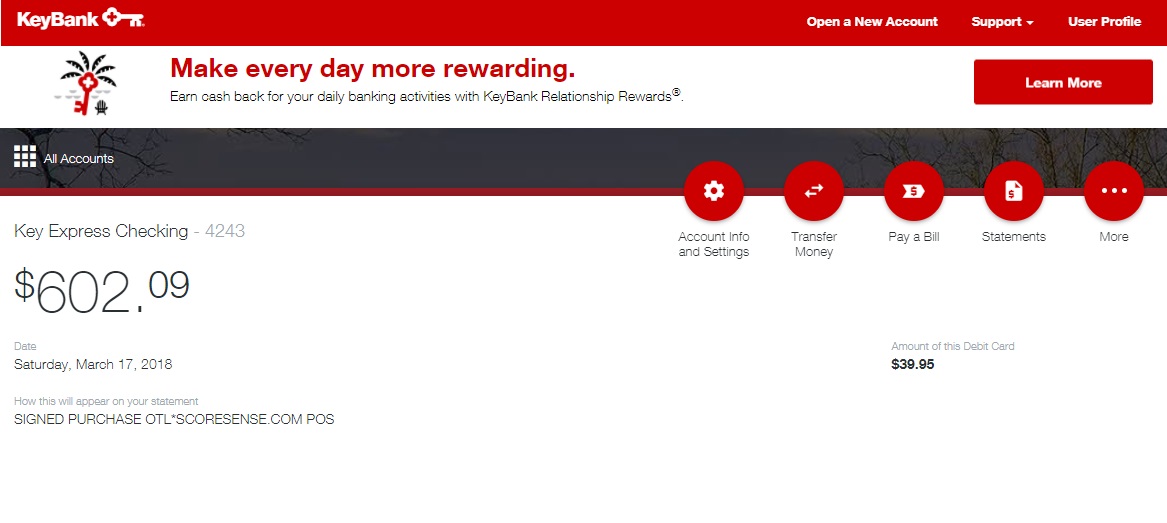

The funds were there to cover the check i wrote, dated March 1. When i checked my online account on Friday February 29th after 5PM i had more then enough, knowing i would be depositing 2,100.00 in cash saturday morning i made a debit purchase. Big mistake. Saturday morning my online statement said the check cleared dated March 1 on the 29th. The deposit of 2,100.00 was held till Monday and even the debit purchase didnt clear till Monday. If i would print out my statement you would see that there was never a time that i had minus money in my account even after they charged the bank fees 4 times. I have read hundreds of posts online about this issue and i know I am not alone in this "new practise" that Key bank has instituted. Consumers all across America are being ripped off by this bank and its "you must balance your checkbook by the minute, not the day" and its "yes, even cash deposits must be put on hold" And what did you say? Dates on checks don't mean anything??? Then why date them? Wonder if my check would get cashed if I stop dating them? We are getting wise to this banks unfair practises and as each of us close our accounts I am sure the employees getting layed off sadly will feel the crunch, maybe next time when a consumer is complaining about unfair and unjust bank fees they may think twice before pointing out "dates on checks are meaningless" and do something to correct the growing problem.

#4 Author of original report

Funds where there

AUTHOR: Andreaj40 - (U.S.A.)

SUBMITTED: Wednesday, March 05, 2008

The funds were there to cover the check i wrote, dated March 1. When i checked my online account on Friday February 29th after 5PM i had more then enough, knowing i would be depositing 2,100.00 in cash saturday morning i made a debit purchase. Big mistake. Saturday morning my online statement said the check cleared dated March 1 on the 29th. The deposit of 2,100.00 was held till Monday and even the debit purchase didnt clear till Monday. If i would print out my statement you would see that there was never a time that i had minus money in my account even after they charged the bank fees 4 times. I have read hundreds of posts online about this issue and i know I am not alone in this "new practise" that Key bank has instituted. Consumers all across America are being ripped off by this bank and its "you must balance your checkbook by the minute, not the day" and its "yes, even cash deposits must be put on hold" And what did you say? Dates on checks don't mean anything??? Then why date them? Wonder if my check would get cashed if I stop dating them? We are getting wise to this banks unfair practises and as each of us close our accounts I am sure the employees getting layed off sadly will feel the crunch, maybe next time when a consumer is complaining about unfair and unjust bank fees they may think twice before pointing out "dates on checks are meaningless" and do something to correct the growing problem.

#3 Author of original report

Funds where there

AUTHOR: Andreaj40 - (U.S.A.)

SUBMITTED: Wednesday, March 05, 2008

The funds were there to cover the check i wrote, dated March 1. When i checked my online account on Friday February 29th after 5PM i had more then enough, knowing i would be depositing 2,100.00 in cash saturday morning i made a debit purchase. Big mistake. Saturday morning my online statement said the check cleared dated March 1 on the 29th. The deposit of 2,100.00 was held till Monday and even the debit purchase didnt clear till Monday. If i would print out my statement you would see that there was never a time that i had minus money in my account even after they charged the bank fees 4 times. I have read hundreds of posts online about this issue and i know I am not alone in this "new practise" that Key bank has instituted. Consumers all across America are being ripped off by this bank and its "you must balance your checkbook by the minute, not the day" and its "yes, even cash deposits must be put on hold" And what did you say? Dates on checks don't mean anything??? Then why date them? Wonder if my check would get cashed if I stop dating them? We are getting wise to this banks unfair practises and as each of us close our accounts I am sure the employees getting layed off sadly will feel the crunch, maybe next time when a consumer is complaining about unfair and unjust bank fees they may think twice before pointing out "dates on checks are meaningless" and do something to correct the growing problem.

#2 Author of original report

Funds where there

AUTHOR: Andreaj40 - (U.S.A.)

SUBMITTED: Wednesday, March 05, 2008

The funds were there to cover the check i wrote, dated March 1. When i checked my online account on Friday February 29th after 5PM i had more then enough, knowing i would be depositing 2,100.00 in cash saturday morning i made a debit purchase. Big mistake. Saturday morning my online statement said the check cleared dated March 1 on the 29th. The deposit of 2,100.00 was held till Monday and even the debit purchase didnt clear till Monday. If i would print out my statement you would see that there was never a time that i had minus money in my account even after they charged the bank fees 4 times. I have read hundreds of posts online about this issue and i know I am not alone in this "new practise" that Key bank has instituted. Consumers all across America are being ripped off by this bank and its "you must balance your checkbook by the minute, not the day" and its "yes, even cash deposits must be put on hold" And what did you say? Dates on checks don't mean anything??? Then why date them? Wonder if my check would get cashed if I stop dating them? We are getting wise to this banks unfair practises and as each of us close our accounts I am sure the employees getting layed off sadly will feel the crunch, maybe next time when a consumer is complaining about unfair and unjust bank fees they may think twice before pointing out "dates on checks are meaningless" and do something to correct the growing problem.

#1 Consumer Comment

Dates on checks are meaningless.

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Wednesday, March 05, 2008

Why did you write a check when you didn't have the funds to cover it. If you didn't want the check cashed until the first of March you shouldn't have writen it untill then.

Saturday is not considered a business day. They didn't have to make any of it available until the next business day.

You ripped yourself off.

Advertisers above have met our

strict standards for business conduct.