Complaint Review: Loan Depot - Irvine California

- Loan Depot 3355 Michelson Drive,Suite 300 Irvine,CA92612-0684 Irvine, California United States of America

- Phone: 1-949-862-8996

- Web: www.loandepot.com

- Category: Brokerage Companies

Loan Depot Amy Nguyen,Esther Lee Loan Depot Lying,cheatting,frauds who need to be stopped. You pay $498.00 for locking and the close don't go through.wait to the last week to tell you they need something removed off your credit. Irvine, California

*Consumer Comment: Learn to spell before you post a report

*Consumer Comment: Loan Depot has Integrity

*Consumer Comment: Similar to QUICKEN LOANS...

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

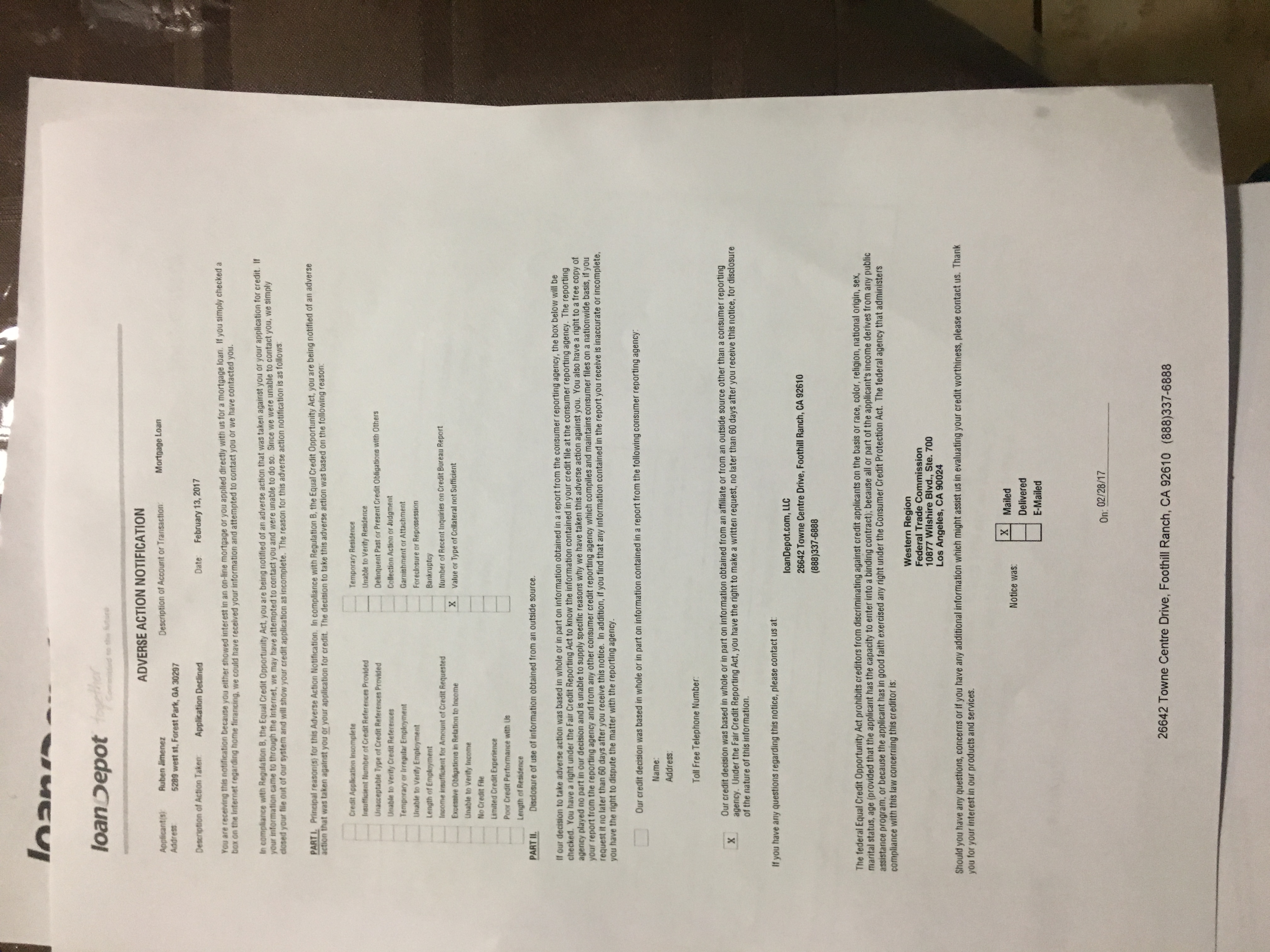

Loandepot, Nothing but a cheatting loan company trying to take everyone broke. Lock in rates that are rediculous and everytime you speak the prices go up. I was told by Amy Nguyen that I paid $498.00 to lock in my rate and when we went to close I get the money back. I was told if the loan did'nt close for some reason I would have to pay $350.00 for the appraisel but get the rest of the deposit back. The very first thing you do when your applying for a loan is the loan company runs your credit. Amy ran my husbands credit and said it was fine he had a 705 that was the middle score. Three weeks later Esther Lee calls and said they needed us to get equifax to remove a medical dispute for $106.00. The report said the dispute was paid in full and closed 2007. That was'nt good enough for Loandepot Esther said the dispute had to be removed I called equifax and paid them $15.95 to update and review his credit which it was removed but the company loandepot uses did'nt have the dispute removed. Now my loan is on week past the close date and the prices keep going up. At first the loan was for $218,000 but they said were going to round it off to $219,000 my appraisel came back under but loandepot said we can still do the loan. My loan right now is $208,000 so they were making $11,000 Ester said it was $7,000 to buy my rate to a 4% so they would still make $4,000 to close the loan. Now since were past the 30 days lock. Ester said its going to take my loan to $222,000 and my monthly payment would be $1,298 when I pay $1,436 now so I'd be saving $138 a month but loandepot making $14,000 for closing my loan."I DON'T THINK SO" This company has to be stopped from ripping and straight up lying to customers.

This report was posted on Ripoff Report on 09/21/2010 04:12 PM and is a permanent record located here: https://www.ripoffreport.com/reports/loan-depot/irvine-california-92612-0684/loan-depot-amy-nguyenesther-lee-loan-depot-lyingcheattingfrauds-who-need-to-be-stopped-642965. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#3 Consumer Comment

Learn to spell before you post a report

AUTHOR: Loan Officer - (United States of America)

SUBMITTED: Tuesday, January 17, 2012

I cannot count on two hands the number of spelling mistakes that were posted in this debacle. You are also incorrect stating the amount of the "application fee" that LoanDepot charges.

These mistakes and negligence question the legitimacy and amount of detail and accuracy included in your report.

Have you heard about the 250 billion dollar bailout that taxpayers have contributed to bail out federal mortgage lending agencies? With this being said you are suprised that a federally certified mortgage underwriter is requiring documentation to prove satisfaction of a collection account that is still reporting on your credit?

Pay your bills on time and it wont delay your next mortgage.

#2 Consumer Comment

Loan Depot has Integrity

AUTHOR: claibst - (United States of America)

SUBMITTED: Wednesday, November 10, 2010

Loan Depot closed my refinance loan in 21 days at rates better than Bank of America or Guaranteed Rate. I was able to provide all of the requested documents within one day of loanDepot's request. They did exactly what they said they would do, close my loan in less than thirty days. They did it in 21 days, that is way better than Bank of America who said it may take up to four months due to a backlog.

#1 Consumer Comment

Similar to QUICKEN LOANS...

AUTHOR: Bman - (United States of America)

SUBMITTED: Tuesday, September 21, 2010

Check out some of the stories about this huge business enterprise! Then please report your experience to this agency:

http://www.ftc.gov/reports/index.htm

Advertisers above have met our

strict standards for business conduct.