Complaint Review: Synchrony Bank - Draper, Utah,

- Synchrony Bank 170 West Election Draper, , Utah, United States

- Phone: 866-226-5638

- Web: synchronybank.com

- Category: Banking

Synchrony Bank Kep't my cash rewards that I had earned. Draper, Utah,

*Consumer Comment: You Should NOT Have Closed the Account

*Consumer Comment: You would have been wrong...

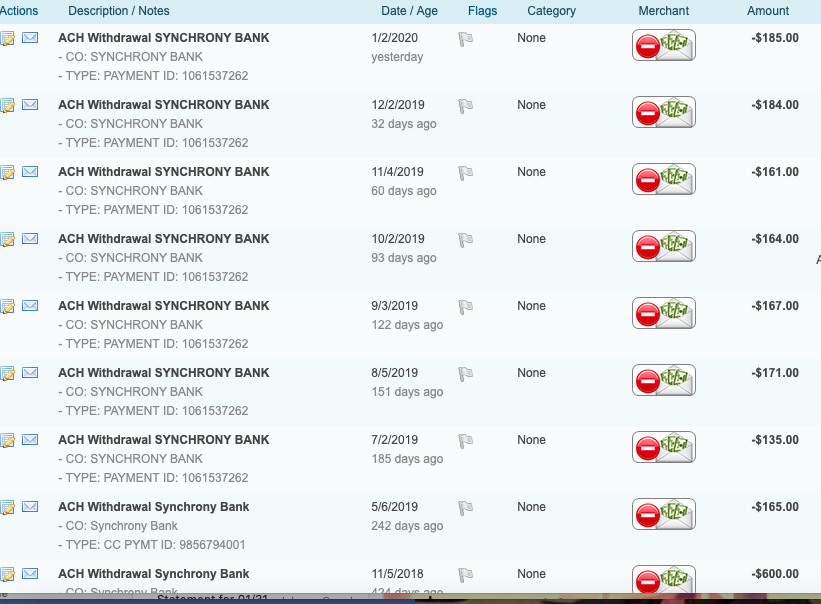

First they mislead me into thinking that they paid 3% cash back rewards and when I found out later that it was only 2%, I closed my credit card account. When I asked for my $220 back from the cash back rewards, they would not give it to me.

I could have easily transferred the cash back to my checking account before I closed the account but did not think it would be an issue. I was wrong (with this bank).

I will never do business with them again and will spread the word.

This report was posted on Ripoff Report on 03/07/2019 09:24 AM and is a permanent record located here: https://www.ripoffreport.com/reports/synchrony-bank/draper-utah-84020/synchrony-bank-kept-my-cash-rewards-that-i-had-earned-draper-utah-1474882. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#2 Consumer Comment

You Should NOT Have Closed the Account

AUTHOR: Jim - (United States)

SUBMITTED: Thursday, March 07, 2019

First they mislead me into thinking that they paid 3% cash back rewards and when I found out later that it was only 2%, I closed my credit card account. When I asked for my $220 back from the cash back rewards, they would not give it to me. If you earn cash rewards through the use of a credit card, and then cancel the CC, you lose the rewards earned. Rewards are not something that you get to collect after you decide to cancel the card; that's pretty clear in the agreement you signed. In fact, it's a part of every credit card agreement and is standard practice. If you lost the rewards, then that's on you for cancelling before using the rewards.

If you accrue rewards and desire to cancel the card, then you MUST either need to wait until the date in which the CC company makes their reward payment, or apply the rewards against your outstanding balance - BEFORE you cancel the card. Once you cancel the card - that's it. Next time, when you find out something isn't what you think it is, don't get mad and do something silly. You should have gone out, bought $220 of groceries, apply the rewards, and then cancel the card when the application of rewards is complete.

I was wrong (with this bank) You would have been wrong with any bank or any credit card that offered rewards, miles, or similar. If it were accruable income that you would not lose, then you can bet the IRS would be able to effectively tax you for the income earned.

#1 Consumer Comment

You would have been wrong...

AUTHOR: Robert - (United States)

SUBMITTED: Thursday, March 07, 2019

You stated that you were wrong with this bank thinking you could pull your reward dollars out after you closed the account. However, you would have been wrong with just about every other bank or reward program. As one of the main requirements they all have is that the account must be active(and in good standing) to be able to use any rewards.

In fact you can search and will see many complaints about Credit Card companies that have closed out "reward" cards of people that had thousands of dollars in rewards.

Advertisers above have met our

strict standards for business conduct.