Complaint Review: USAA. - San Antonio TX

- USAA. 9800 Fredericksburg Road San Antonio, TX United States

- Phone: 1 (800) 531-8722

- Web: www.usaa.com

- Category: Auto Insurance, Banking, Fraud , Internet Fraud, Suspected fraud, Bait-and-Switch, Bank fraud, Banks, Finance, Financial Services, insurance, Insurance Companies, Rip off, Unauthorized transaction, No service rendered

USAA. How CEO Stuart Parker and his staff defrauded and stole from me. And why a rotting USAA, once the epitome of integrity and customer service, is likely to betray your trust, too. San Antonio TX Texas

*Consumer Comment: Unethical pieces of trash

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

Ostensibly a member-owned association, USAA provides insurance and financial services to current and former US military, as well as their families. I have been a USAA member for more than four decades. Reinforcing the bevy of negative comments at, yelp.com/biz/usaa-san-antonio-4 and https://communities.usaa.com/t5/Banking/Letter-to-CEO-Stuart-Parker/td-p/118008, let me tell you how USAA CEO Stuart Parker and his staff defrauded and stole from me. And why a rotting USAA, once the epitome of integrity and member service, is likely to betray your trust, too

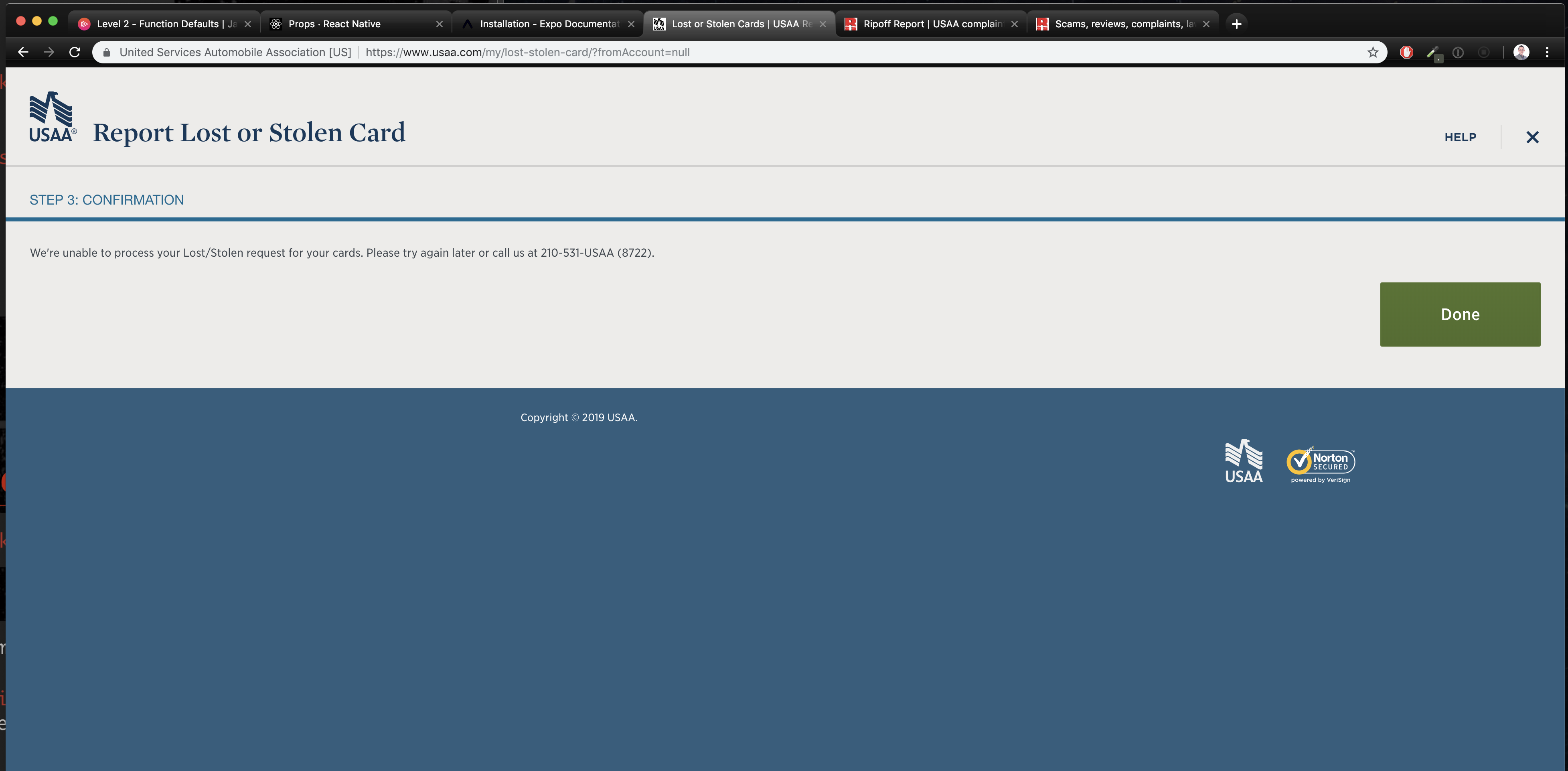

USAA has deprived me of online access to my accounts. Why? Just because I will not answer a survey that begins with these outrageously intrusive questions:

1) What's your annual income?

2) What's your primary source of income?

3) What's your estimated net worth?

4) Are you or is anyone in your family a senior foreign political figure or the associate of one?

USAA has no right to block online account access just because a member declines to answer (1 – 4). Not only did USAA do exactly that, USAA failed to remedy its wrongdoing, despite my multiple requests to fix things. It's a saga that reeks rot smacking of Wells Fargo.

To preview USAA's tailspin, visit , foxbusiness.com/financials/wells-fargo-refunding-tens-of-millions-of-dollars-to-customers-for-add-on-products-report and www.foxbusiness.com/features/wells-fargo-hit-with-2-billion-fine-over-faulty-mortgages. Wells Fargo shafted throngs of customers. Chances are USAA will shaft you. Facts (a – e) evidence how USAA has wronged all members; (f – m) chronicle USAA's rot in response to my attempts to get USAA to fix things. The totality of (a – m) foretell why USAA is likely to betray your trust.

a) USAA.com allows a logged-in member to bypass its intrusive survey three times, after which

b) USAA.com blocks the member from online access to his or her insurance and banking accounts

c) The survey does not permit the USAA member to bypass or decline to answer questions (1 – 4)

d) To access his or her accounts online, a member must either truthfully answer questions (1 – 4), or answer them untruthfully. If truthful, the member divulges very personal information that USAA never required as a condition of online access to accounts (see (e), below). If untruthful, the member has lied. In either case, USAA is coercing members to answer (1 – 4), when USAA has no legitimate business coercing such answers (see (i), below).

e) USAA failed to give advance notice that answering coercive survey (1 – 4) would be a condition of online access. Ex-post facto, USAA holds hostage online access to a member's accounts.

f) To try to get USAA to fix (a – e), I placed a 24-Jul-2018 telephone call to USAA. Representative Jaritza identified herself as being in charge of the intrusive survey, and admitted forcing members to respond to it. Jaritza not only refused to make answering the survey optional, she denied my request to connect me with her manager. Nor would Jaritza even identify her manager. Jaritza stated that since Jaritza was in charge of the survey, her manager would simply refer the matter back to Jaritza. In bad faith, that is, USAA's Jaritza failed to redress the wrong (a – e) that Jaritza had imposed. Worse, Jaritza obstructed my attempts to escalate the matter. Danger, fellow and prospective USAA members: it's not about you, it's all about Jaritza the Shaft. Rotten.

g) In light of Jaritza's refusals, I redialed USAA at 11:20 PT on 24-Jul-2018. Although representative Tikwana tried to be helpful, she was, alas, not empowered to effect a remedy. While Tikwana could not connect me directly with Jaritza's manager, Tikwana did give me the manager's name: Samantha Patton. Via email, Tikwana asked Samantha to contact me; Tikwana assured me that Samantha would call me with 24 hours. This proved to be a bait-and-switch.

h) Twenty-fours later, and still no communication from Samantha Patton. By this writing, more than ten days later, Samantha still had not reached out to me. Her failure exacerbates Jaritza's intransigence, and underscores the rot for which USAA CEO Stuart Parker is culpable.

i) In our 24-Jul-2018 conversation, Tikwana at first gave the impression that coercive survey (1 – 4) was justified by regulation or statute. At my behest, Tikwana looked up the underlying reason, per USAA internal files. Here's what she read to me: "customer diligence". In other words, USAA has no regulatory or statutory basis for coercing survey (1 – 4). If there were such a basis, then USAA would have given written advance notice, citing the relevant regulations or statutes; to be consistent, USAA would furthermore coerce answers to survey questions (1 – 4) as a condition for other-than-online access to USAA accounts. Busted: USAA has not blocked other-than-online access to my insurance and banking accounts. By telephone, for example, I have managed to file a homeowner's insurance claim, and to wire from my Federal Savings Bank account. Customer diligence is a disingenuous excuse: it doesn't even come close to passing the sniff test. Self-reporting is unreliable, and can hardly be deemed diligence. Other institutions, (e.g., Bank of the West) do not coerce answers to questions such as (1 – 4). Inescapable conclusion: USAA's coercive survey is fraudulent. Under CEO Stuart Parker, USAA fraudsters Jaritza and Samantha Patton have stolen services from me. Chances are they will steal from you.

j) Runaround rot: USAA rebuffed my repeated attempts to escalate and resolve the problem. On 25-Jul-2018 I reached Cynthia in USAA's fraud department. I cited Samantha Patton's failure to contact me, and explained to Cynthia why coercive survey (1 – 4) is tantamount to USAA committing fraud and theft of services. Instead of seeing to it that the coercive survey (1 – 4) no longer blocked online access to my insurance and bank accounts, Cynthia asked me whether someone in CEO Relations had contacted me. I told her that, on this matter, I had heard from no one at USAA. Cynthia said she would expedite CEO Relations getting in touch with me, soon. News flash: soon is fungible when dealing with Stuart Parker's rotting USAA. Two hours after my call with Cynthia, I re-dialed USAA. Representative Alex said that I should expect a call from a CEO Relations representative … after the CEO Relations representative had reviewed my case, within two to three days. Unacceptable: an additional two to three days, during which USAA.com would continue to block online access to my insurance and banking accounts. Alex mentioned that my case had been referred to a certain Julian Sapien (14+ years with USAA, see , linkedin.com/in/julian-sapien-969a7662). Remember that name: Julian Sapien, pitiful poster child for the putrescence permeating USAA. And USAA CEO Stuart Parker is to blame.

k) Three days came and went, and still Julian Sapien had not contacted me. At 7:05 PT on Saturday, 28-Jul-2018, I telephoned USAA to ask why Julian had failed to reach out to me. Eventually, I was connected to Victoria D., who confirmed Julian's name, but who added that by "two to three business days" USAA really meant that it would take two to three business days for Julian to follow up with me. Victoria said that since "we don't work Saturdays", Julian really had until close of business on Monday, 30-Jul-2018, to honor the timeline that USAA had pledged. It was evidently lost on Victoria that she was working on Saturday. For the record, I noted that USAA representative Alex had not specified business days (see (j), above). Victoria furthermore asserted regulatory or statutory justification for USAA's coercing answers to survey questions (1 – 4). Citing Tikwana's refreshing candor (see (i), above), I disabused Victoria of this notion. That Victoria would defend the illegitimate survey (1 – 4) without first checking facts paints a tragic face on CEO Stuart Parker's leadership failures.

l) 30-Jul-2018 through 1-Aug-2018: Monday through Wednesday came and went, and still Julian Sapien had not contacted me. In light of USAA's bad faith, regulatory and legal avenues loomed increasingly probable. At 8:45 PT on 2-Aug-2018, I rang USAA's general number, +1.800.531.8722, and asked USAA representative Tony to pass me over to the company's Office for Legal Affairs. Instead, Tony connected me with Jerry, a financial advisor whom I (again) asked to pass me over to USAA's Office for Legal Affairs. Jerry asked what this was about. I summarized that I was trying to obtain the address for service of legal process for USAA's businesses in Washoe County, and that I wanted the legal basis for USAA blocking online access to my accounts. Instead of honoring my request, Jerry connected me with a representative named Janae. She could not (or would not) tell me why Julian Sapien had failed to ring me up on or before 30-Jul-2018 – nor why Julian had failed to phone me in the three days since 30-Jul-2018. Janae added that it would now take an additional two to three days, starting from 31-Jul-2018, for a CEO Relations representative (other than Julian Sapien) to get back to me. I declared this unacceptable, at which point Janae connected me with (wait for it) Julian Sapien.

m) Julian Sapien asked he how could help me. I said that he could start by telling me why he had not gotten back to me no later than close of business, Monday, 30-Jul-2018, as he was supposed to have done, and why I was forced to phone him. Julian Sapien replied that he had no answer for me. I requested to speak with his boss. He refused, "That's not what we do here; we don't pass the buck." The buck? Julian then asked me what this was about. I repeated my question first posed to Janae, "What is the address for service of legal process corresponding to USAA's operations in Washoe County?" Julian responded (incorrectly) that USAA no longer has a place of business in the county. I pointed out that that USAA has ATMs and at least one USAA-employed claims adjuster in Washoe County, so must have an address for service of legal process. Unresponsive to my request, Julian instead asked me to recount the problem from the beginning. At that point it became clear that Julian had no clue why we talking, and that he had never reviewed my case at all. The buck? Wantonly breaching his duty, Julian Sapien proved himself an untrustworthy buck. Evasive, lazy, refusing to own his poor performance, Julian obstructed dispute resolution. In so doing Julian Sapien aided and abetted USAA's fraud and theft of services. Julian Sapien: pitiful poster child for the putrescence permeating USAA.

That's how USAA CEO Stuart Parker and his staff defrauded and stole from me. And why a rotting USAA, once the epitome of integrity and customer service, is likely to betray your trust, too. USAA's refusal to connect me with its Office of Legal Affairs underscores how, in bad faith, USAA mistreats members.

This debacle would not have happened under USAA CEOs Robert McDermott or Josue Robles. For decades, USAA honorably lived up to its slogan, "We know what it means to serve". Revise that to reflect the ugly reality: "Under Stuart Parker, USAA knows what it means to shaft you".

This report was posted on Ripoff Report on 08/02/2018 07:57 AM and is a permanent record located here: https://www.ripoffreport.com/reports/usaa/san-antonio-tx-78288/usaa-how-ceo-stuart-parker-and-his-staff-defrauded-and-stole-from-me-and-why-a-rotting-u-1454626. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#1 Consumer Comment

Unethical pieces of trash

AUTHOR: JD - (Ecuador)

SUBMITTED: Saturday, January 12, 2019

Basically nearly excatly what you said happened to me. DO NOT TRUST THESE PEOPLE! They are trash, they are scum, they are pathetic, they will steal, they will do ANYTHING to benefit their corporation. PURE EVIL SH*T, trying to hide behind the military. WHAT A JOKE!!!!

Advertisers above have met our

strict standards for business conduct.