Complaint Review: Care Credit - Draper Utah

- Care Credit 170 Election Road, Suite 125 Draper, Utah USA

- Phone:

- Web: financing@email.gogecapital.com

- Category: Financial Services

Care Credit GE Capital Retail Bank, CareCredit, LLC DECEPTIVE PRACTICES Draper Utah

*Consumer Comment: This isn't scam

*Consumer Comment: Claim Address

*Consumer Comment: Not a scam

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

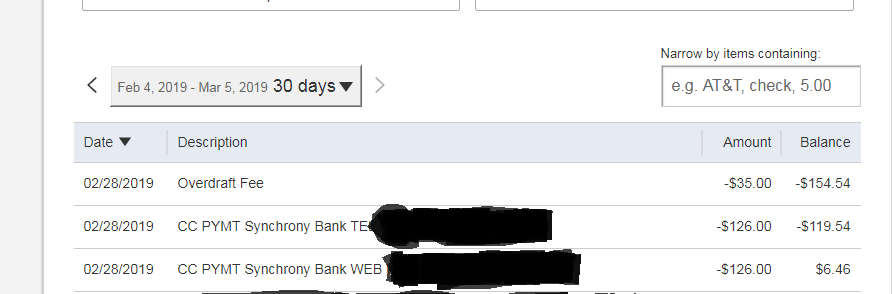

I needed dental work and paid for most of it out of pocket, but needed $7,000 extra. I qualified for a loan through Care Credit. I filled out the paperwork at my dentists office and was approved. I chose a 12 month promotional offer. I paid $1,000 /month and all was fine until the economy tanked. I only had two payments to go.

I called Care Credit and asked if I could extend my "promotional period" to 18 months - NO. I had not been told that interest would accrue on the total approved. Not only was my interest rate 27.99%, but it was on all $7,000. I did without and it still took two years to pay off as the interest rate made the balance so much higher.

I paid off everything and vowed never to use the card again. I haven't closed it out - never say never.

I received an email and need to know if this is real or a scam:

This is an unmonitored email box. Please do not reply to this email. Head off identity theft before it happens. For more information about identity theft, please visit the Federal Trade Commission's (FTC) consumer website at www.ftc.gov/idtheft/.

This report was posted on Ripoff Report on 03/26/2014 06:33 PM and is a permanent record located here: https://www.ripoffreport.com/reports/care-credit/draper-utah-84020/care-credit-ge-capital-retail-bank-carecredit-llc-deceptive-practices-draper-utah-1133995. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#3 Consumer Comment

This isn't scam

AUTHOR: JustMike - (USA)

SUBMITTED: Friday, November 04, 2016

I understand this is a 2-yr old pot but it's not a scam

#2 Consumer Comment

Claim Address

AUTHOR: Anonymous - ()

SUBMITTED: Thursday, June 19, 2014

I received the same notice from CareCredit and have a legitimate claim. I have lost the prepaid envelope and what I find interesting is no where on any of the paperwork I was sent is the address to send the claim to! I have tried everything I can think of to get that address and no luck. If I don't get my claim in soon I am out of luck. If anyone has that address and could post it I would be most appreciative.

#1 Consumer Comment

Not a scam

AUTHOR: Anonymous - ()

SUBMITTED: Wednesday, April 23, 2014

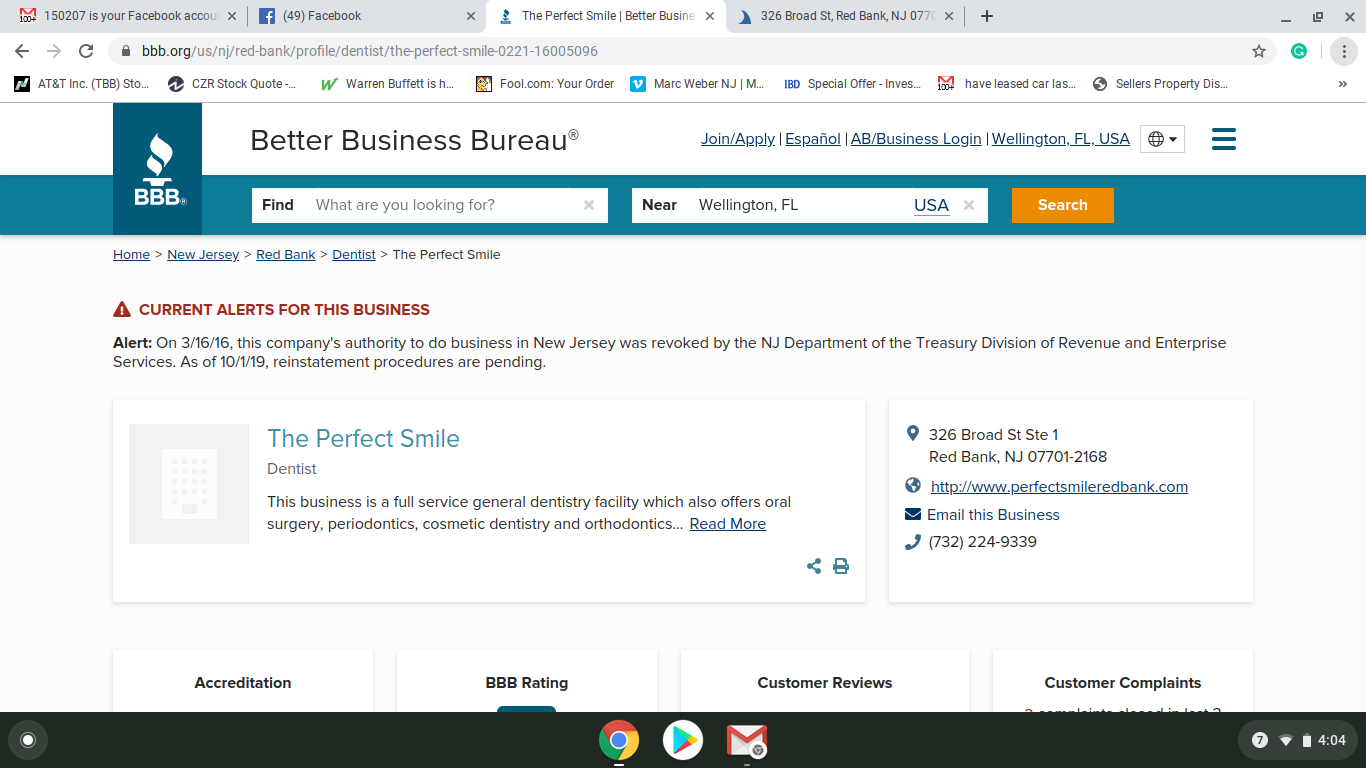

http://www.consumerfinance.gov/newsroom/cfpb-orders-ge-carecredit-to-refund-34-1-million-for-deceptive-health-care-credit-card-enrollment/

Advertisers above have met our

strict standards for business conduct.