Complaint Review: DRIVETIME - Nationwide

- DRIVETIME Nationwide USA

- Phone: 18882900148

- Web: WWW.DRIVETIME.COM

- Category: Car Financing

DRIVETIME (DT FINANCE CORP.) SCAM INTEREST PREDATORY LOANS DESPERATE SITUATIONS SHADY SALES TACTICS PHOENIX ARIZONA, (WEST PALM BEACH, Florida) Nationwide

*Consumer Comment: Serial Deadbeats

*Consumer Comment: Typical SERIAL Deadbeat

*Consumer Comment: Subprime lender

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

On March 18th of 2015 I went into a DriveTime dealership. They advertise being able to assist with low credit situations in which they GUARANTEE vehicle approval based on income. I feel that ever since I set foot into the dealership I was steered the wrong way due to a desperate situation.

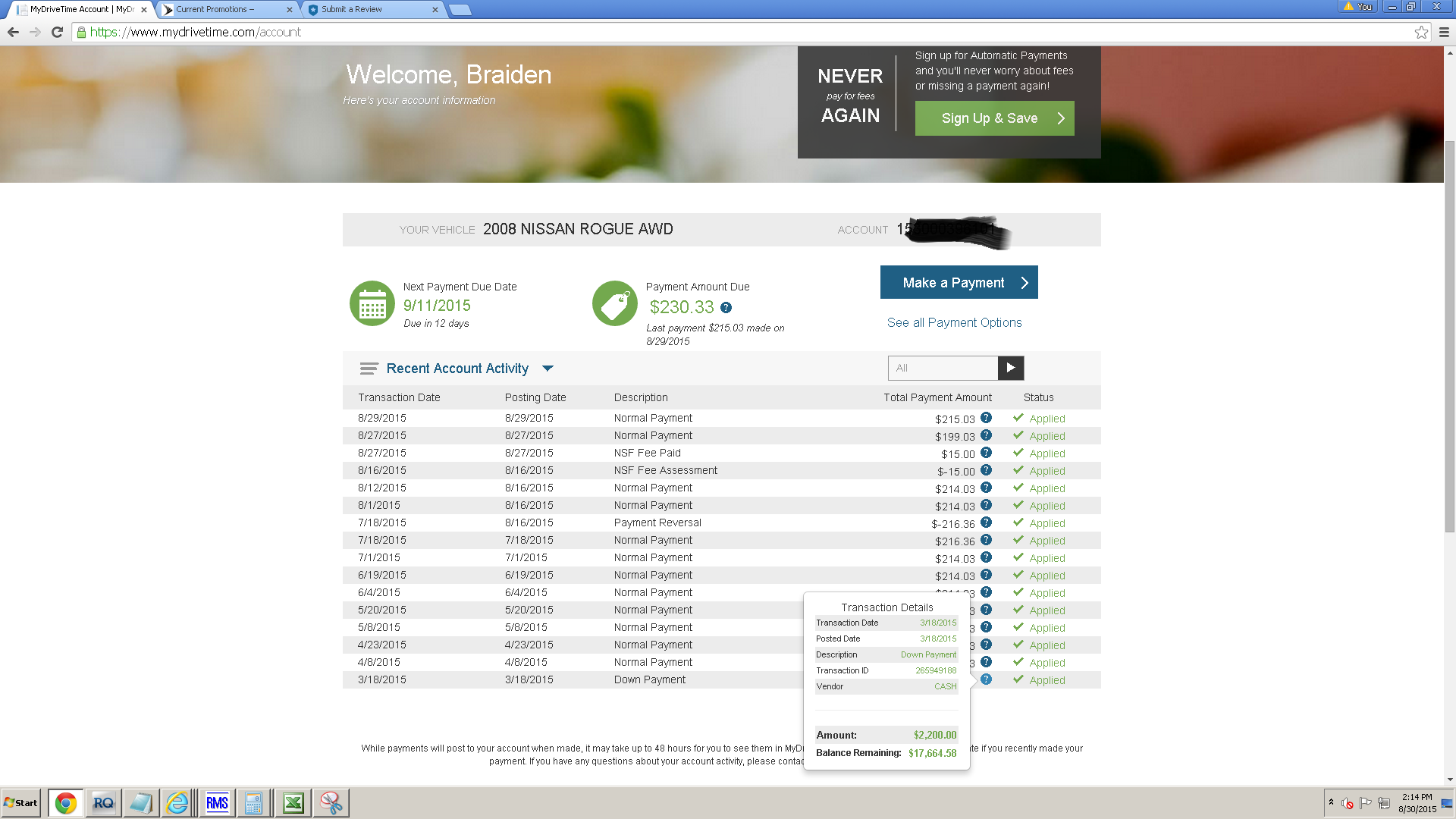

I am a new father with a 5 week old newborn.We needed a safe vehicle prior to delivery of our newborn. They preyed on me in this situation and gave me like a 28% interest rate on a 2008 nissan rogue. Prior to purchase KBB stated vehicle was valued at about $10,000 which drivetime purchased at auction. Vehicle had previous accidents in which the AUTOCHECK report was designed to not tell you all about the accidents. LONG STORY SHORT, I was sold a vehicle at around 22% interest but only after providing $2200 cash down. The payments are costing me a WHOPPING $430 PER MONTH ON A 2008 NISSAN ROGUE!!!!

DO NOT GO WITH THIS COMPANY! IF DRIVETIME WOULD LIKE TO ACTUALLY ASSIST ME IN RESOLVING THIS MATTER THAN I WILL GLADLY MARK CASE RESOLVED. OTHERWISE STAY AWAY EVERYONE! THEY WILL TAKE ADVANTAGE OF YOU AND YOUR SITUATION. THEY'RE QUICK TO REPOSSESS TOO AND THEY WILL CALL YOU A MILLION TIMES THE DAY AFTER A PAYMENT DUE DATE. THEY HAVE ALSO VIOLATED DO NOT CALL LISTS MULTIPLE TIMES IN WHICH I COULD SUE FOR.

This report was posted on Ripoff Report on 08/30/2015 11:28 AM and is a permanent record located here: https://www.ripoffreport.com/reports/drivetime/nationwide/drivetime-dt-finance-corp-scam-interest-predatory-loans-desperate-situations-shady-sal-1251845. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#3 Consumer Comment

Serial Deadbeats

AUTHOR: American Dream - (USA)

SUBMITTED: Friday, September 30, 2016

To the user who opined on being a serial deadbeat: While I am certain this is the case for many subprime borrowers, this is not the case for all. I pay through the nose to maintain my DriveTime/Bridgecrest loan. I'm not very happy about it, either. I'm not happy that they were my only option. They were my only option because my credit sucked. I bet you can't guess why it sucked, though - because you, like most lenders, have already predetermined that one with bad credit must, in some way, be a deadbeat who chooses not to pay bills. One size doesn't fit all. I resent the heck out of this country's credit scoring system/game. Specifically, because people with poor credit, by no actual fault of their own, are treated like criminals and spoken to with so much contempt, just as your response to the OP indicates. As an American Born abroad, I didn't get a social security number until I moved to the U.S well into adulthood. I don't have the benefits of claiming immigrant status for leniency: I just have to deal with the consequences of being an adult with the credit file of an infant. Serial deadbeat? Why, yes - to a creditor with a one formula fits all scoring system, it would appear so.

#2 Consumer Comment

Typical SERIAL Deadbeat

AUTHOR: Jim - (USA)

SUBMITTED: Sunday, August 30, 2015

You went to a subprime (deadbeat) lender because it was YOU who destroyed YOUR credit. (I know, in typical deadbeat fashion, its probably everybody else's fault, right?) Because YOU destroyed YOUR credit, YOU took yourself out of the running for a much lower APR bank loan at a prime dealership. Because YOU can't handle credit, YOU aren't ENTITLED to lower interest rates for people who pay their bills on time. Lets move up to now. You say they call you for payment and they are quick to repo. What you're saying is YOU destroyed YOUR own credit by NOT paying your bills on time and they take a chance on you, but what happens? YOU continue to NOT pay your bills on time and they do a repo. Yes sir...all the traits of a SERIAL DEADBEAT. If you want to be a good provider, why not pay your bills on time, every time?

Let me save you some trouble. Don't bother writing back claiming I must work for them, because I don't!

#1 Consumer Comment

Subprime lender

AUTHOR: Robert - (USA)

SUBMITTED: Sunday, August 30, 2015

Drivetime is a Subprime lender. Meaning that they provide loans to people who can not get fianced through more "regular" banks. As a result when you have high risk borrowers, you are charged more Interest, Fees, don't always have access to the best cars, and they are a lot stricter than they would be with people with better credit.

The reason you went with a Sub-Prime lender doesn't matter, so forget trying to give excuses such as "It wasn't my fault" or "I had other bills", or the dozens of other ones that people who have screwed up credit give in trying to justify why they think they are entitled to better terms. You get better terms by EARNING them.

Of course you think this is rough and unfair, but it is reality.

When you went to them you were under no obligation to pay the 28% interest rate, or even the 22% interest rate. Why? Because as part of the human body you have these wonderful features called legs, and they make it very easy to get up and walk out without signing anything. If you didn't like the purchase price, again...either negotiate a better price or leave. Because contrary to your claims no one is desparate enough that they MUST have a car. It may not have been more convienient to have a car and "nicer" to have a car. But what would you have done if even they turned you down? In other words you would have gotten by.

As for them reposessing the car. Yes, again they are a Sub-Prime borrower and are going to keep the people(who don't have a proven history of making payments) on a much shorter leash.

But you don't stop there, you even admit that you are late and they have the nerve to call you...your exact words were a million times a day. That works out to about 11 times a second...exaggerate much?

By the way the "Do Not Call" list doesn't apply to companies you have a relationship with and they are calling you in the attempt to collect payment.

Advertisers above have met our

strict standards for business conduct.