Complaint Review: SNAAC - Nationwide

- SNAAC Nationwide USA

- Phone:

- Web: https://www.snaac.com/

- Category: Car Financing

SNAAC Security National Auto Vehicle was repod after 30 days, cost me almost 6 months of payments 6951 Cintas Blvd, Mason, OH 45040 Nationwide

*UPDATE Employee: SNAAC Response

*Consumer Comment: In Typical Sub-prime Mentality Fashion...

*Consumer Comment: All vehicle loans work that way

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

I had purchased a vehicle about 8 months before I knew i was getting medically released from the military.

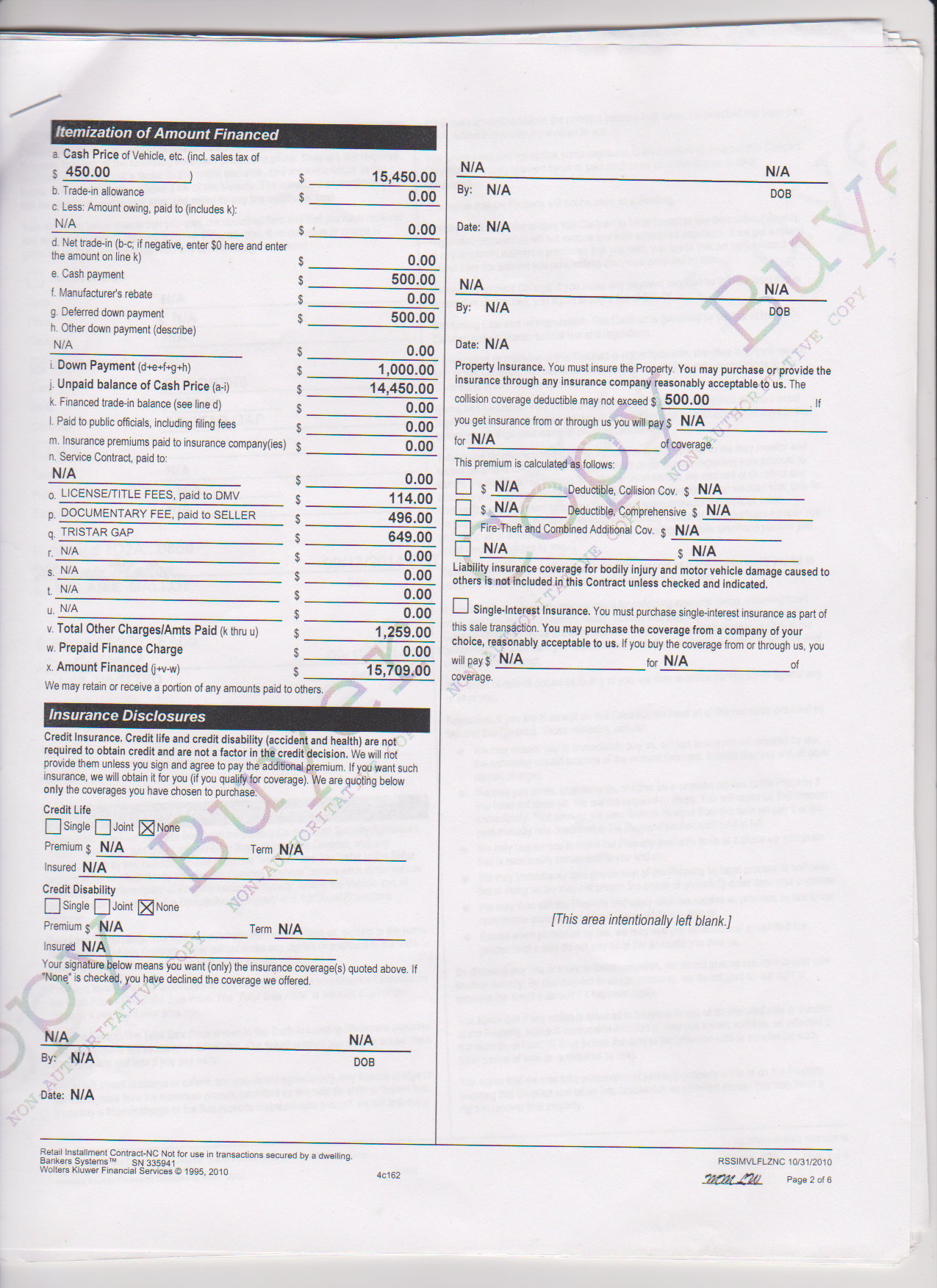

my loan holder is SNAAC. Once out, my alottments had stopped from the military, in which we contacted SNAAC multiple times and told lthem we needed a defered payment with an agreement to pay up the full month behind once pension hit on the 33'd day. It even shows on my credit report it was late for only 30 days, not 50, 60 etc. 30!

Day 30 I look out my bedroom window and notice my parking spot was empty... they had come and towed the car, while I was asleep, even though SNAAC had agreed to the deferment and the 2 months of pay once pension hit. That being said it cost 1800 to get my vehicle back, which at the time was towed almost 100 miles north of where I was stationed and living once i got out. (thanks for being so spread out, Arizona). At first, no one could find my vehicle to tell me where it was. It was a 2 day game and I had contacted multiple tow companies trying to locate my vehicle. I was told then, early day 2 that it was sitting and waiting for auction and I needed to pay everything up front or else. Or else what?! I would be stuck with a 13000+ auto loan?! I've never taken a loan out before. I didnt know they had the rights to do what they did. After begging and pleading family members to help, I was able to also find a ride for the 100 mile trip to get the vehicle once it was located.

Well, heres a kicker.. the vehicle i was purchasing has an alarm sensor that goes off once it is between 3-5 miles away from the key fob! great to know (after it was towed) because when i showed up to get the vehicle back, automotive issues started happening. My battery cables were off, the battery was fried which meant i still had to go spend even more money to get my car right. Finally I was abel to get my car out of the towing compoud and the issues have just been adding up on the vehicle ever since.

My issue is now, 2 years later, due to the safety of the vehicle, making the monthly automatic payments from my account, I still have a repo/redeem on my credit report. Okay, yes, it was both, however shouldnt it taken off since we did call and tell them we needed a deferment etc? Every time i've called during that time period, no notes were entered so apparently no one knew what i was talking about, including all the managers i had spoken with about the issue who agreed on the deferment to begin with!

The auto repairs have been so extensive since the tow happened that due to safety reasons of my family, we had to go pull yet ANOTHER loan at even HIGHER rate just to make sure the vehicle we had would be safe, but more importantly safe for both my infant children to be in.

I did some research and found that with the interesst rate of the vehicle, the payments etc, that the trade in value is actually over half as less than what i need to make the payoff of the vehicle, which I also read that if the dealership came and repod the vehicle and it didnt match the amount still owed, I would be responsible for the rest of the payment on the loan! Are you kidding me?! I want AWAY from SNAAC! SNAAC has certainly made me become a weary loan user of any lender!

This report was posted on Ripoff Report on 10/16/2016 05:19 PM and is a permanent record located here: https://www.ripoffreport.com/reports/snaac/nationwide/snaac-security-national-auto-vehicle-was-repod-after-30-days-cost-me-almost-6-months-of-1333473. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#3 UPDATE Employee

SNAAC Response

AUTHOR: Snaac - (U.S.A.)

SUBMITTED: Friday, October 28, 2016

We are sorry for your recent experience with Security National Automotive and would like to address your concerns. We’re committed to continuously improving our services and processes. In order to better understand your concerns, we need to review the account details. Please call our Consumer Experience Advocate at 513-459-8118, ext 509 to discuss further. We look forward to hearing from you.

#2 Consumer Comment

In Typical Sub-prime Mentality Fashion...

AUTHOR: Jim - (USA)

SUBMITTED: Monday, October 17, 2016

.....Its all THEIR fault, right??? Of course, this sort of thing is not new to you, is it? You are with a subprime deadbeat lender because YOU developed a reputation for NOT paying your bills on time. I guess everyone of those late payments and subsequent collection activities were the fault of those creditors too! Of course, you come here to whine and wail about the APR and other financial terms of the deal in a feeble/immature attempt to discredit the lender when it was Y-O-U who agreed to those terms in the first place! Oh yes, the whining and wailing about your already crappy credit report. Guess what, if YOU would have managed YOUR money, YOU would not have caused the repo! Therefore, that CORRECT information about the repo has a right to be there as well as the pending lawsuit YOU brought upon YOURSELF because YOU decided to not keep YOUR promise of paying on time when YOU signed the contract! You sorry, serial deadbeats with your blame game and excuse making make decent people want the throw up!

NO RIPOFF HERE -- Complainer FAILED to make payment(s) on time thus causing a repo and possible lawsuit!

#1 Consumer Comment

All vehicle loans work that way

AUTHOR: FloridaNative - (USA)

SUBMITTED: Monday, October 17, 2016

If you fail to pay, then the vehicle will be taken by the lender and sold at auction. The proceeds will be applied to the loan and you owe the rest, including late fees, penalties, and repo fees. This is how all vehicle loans work. The idea behind it is to dissuade you from making late payments.

As to the vehicle not being worth what you owe, that is common when you put down small down payments and have a high-interest rate on your vehicle loan. The way to avoid this is to put down a much larger down payment, get a lower interest rate and pay on time. To get a lower interest rate, you have to show responsibility for your loan by making the payments on time every time. Paying late 30 days is late. In your post you made it sound like 30 days is not a long time - it is in the credit world. This is something you need to research so you have a better handle on what you need to do to get good credit. Good credit will change your life. In short, none of this is the fault of the lender.

Advertisers above have met our

strict standards for business conduct.