Complaint Review: 2checkout - Nairobi Internet

- 2checkout Nairobi, Kenya Internet United States of America

- Phone: 254722709800

- Web:

- Category: Internet Fraud

2checkout Forced forfeiture under the guise of TOS Violation Nairobi, Internet

*Author of original report: Ambiguity in your TOS

*UPDATE Employee: Response

*Author of original report: Pre-set responses not enough

*UPDATE Employee: Response

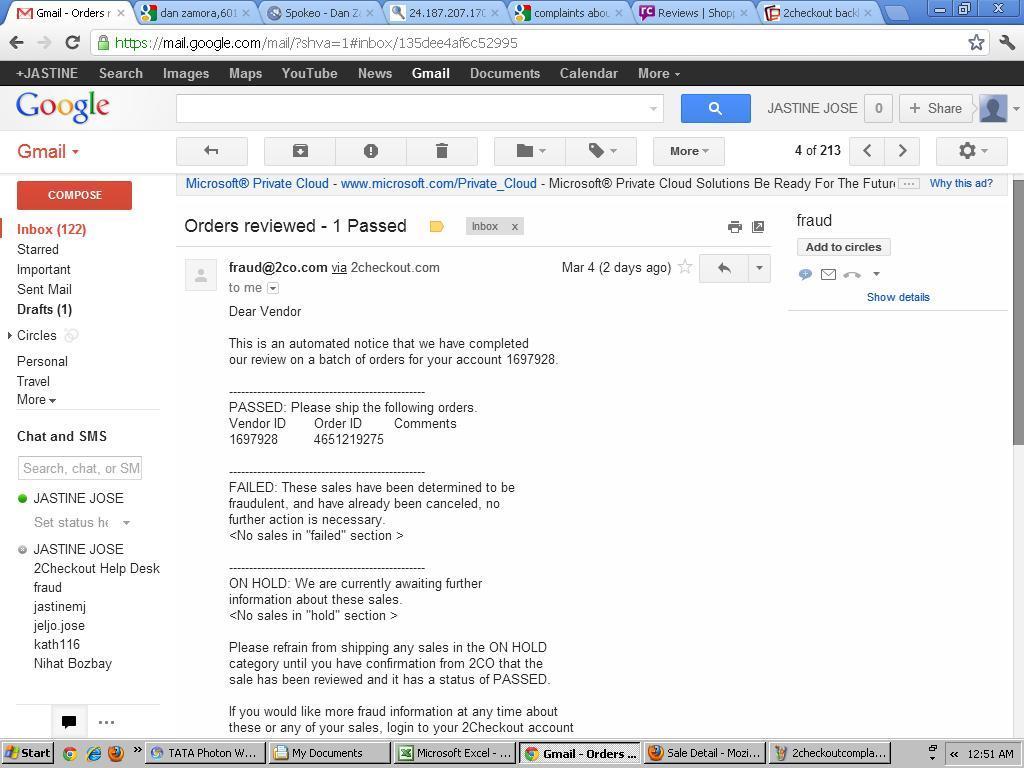

2Checkout has 'ripoffs' as part of their growth strategy. They feature forfeiture as one of their top revenue channel as in most cases, there is no cost, meaning their revenue is their net profit. Forfeiture is an outdated strategy as it has been outlawed in many parts of the world unless there is proof that the money was used to offset costs attributed to the violation which led to the 'forced forfeiture'. That is why paypal will always ensure that you have your withheld money within a period of 180 days irrespective of the nature of violation. 2checkout must also follow suit by stopping to enrich themselves with money they have not earned.

This report was posted on Ripoff Report on 04/23/2013 10:58 PM and is a permanent record located here: https://www.ripoffreport.com/reports/2checkout/internet/2checkout-forced-forfeiture-under-the-guise-of-tos-violation-nairobi-internet-1045722. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#4 Author of original report

Ambiguity in your TOS

AUTHOR: cza - ()

SUBMITTED: Friday, April 26, 2013

This is exactly my point. When you use the word 'may', in your TOS, it leaves room for uncertainty as your interpretation can swing for or against the violator. What you should explain is the criteria you use to determine cases befitting forfeiture and those which qualify for remittance. Forfeiture can also be partial or whole, again not specified in your TOS. Petty as this may sound, your TOS is ambiguous and deceptive. Having had a lengthy conversation with Nathan Butler of your Risk Department, he made it clear that the forfeiture is to protect yourselves against refunds or fines by credit card companies. I have stated that I do not mind 2checkout extending the holding period for my money (over and above the 90 days) just to be sure that there will be no further refunds or fines and in case there are any, I would demand to see a proof that indeed my reserve money was used to cover direct costs related to my account. Short of that, I expect you to remit my money and not to use it to cover costs related to others or to strengthen your bottom line. You mention Payment Industry standards in some of your communication but having done a wide research, the Payment Industry Standard does not subscribe to the doctrine of forfeiture. Have your legal team revise the clause of forfeiture for clarity and certainty moving forward but in the meantime, remit my money or keep it for another three months if you wish and release it when the dust (if any) has settled on your side.

#3 UPDATE Employee

Response

AUTHOR: 2Checkout - ()

SUBMITTED: Friday, April 26, 2013

In our terms of services that you agreed to when you opened the account, it states that if you do something illegal and/or prohibited 2Checkout may close your account and forfeit your funds. This is clearly stated in the terms and should leave no uncertainty to anyone who read it.

#2 Author of original report

Pre-set responses not enough

AUTHOR: cza - ()

SUBMITTED: Friday, April 26, 2013

2checkout, please wake up and address the real issues instead of copy pasting pre-set system answers. Has your legal team made any attempt to define the forfeiture clause in your TOS document? Which violations are eligible for refunds and which ones are eligible for forfeitures? Is it such a complicated task for your legal team? I guess not, but since you like wading in the pool of uncertainty so that you can have the last word, you have deliberately failed to address this issue. Even paypal reimburses violators after 180 days of account limitation.

It is clear that you are using the forfeiture clause to steal money from unsuspecting users of your system. To all who have been forced to forfeit their hard earned cash by 2checkout under the guise of TOS violation, I encourage you to sue 2checkout and demand for a release of your funds. I would also propose that you visit our facebook page named as 2checkout, petition against on the following URL, like the page and comment about your tribulations. We intend to use this petition for further legal action against 2checkout.

https://www.facebook.com/pages/2Checkout-Petition-against/163689147127102?fref=ts

#1 UPDATE Employee

Response

AUTHOR: 2Checkout - ()

SUBMITTED: Friday, April 26, 2013

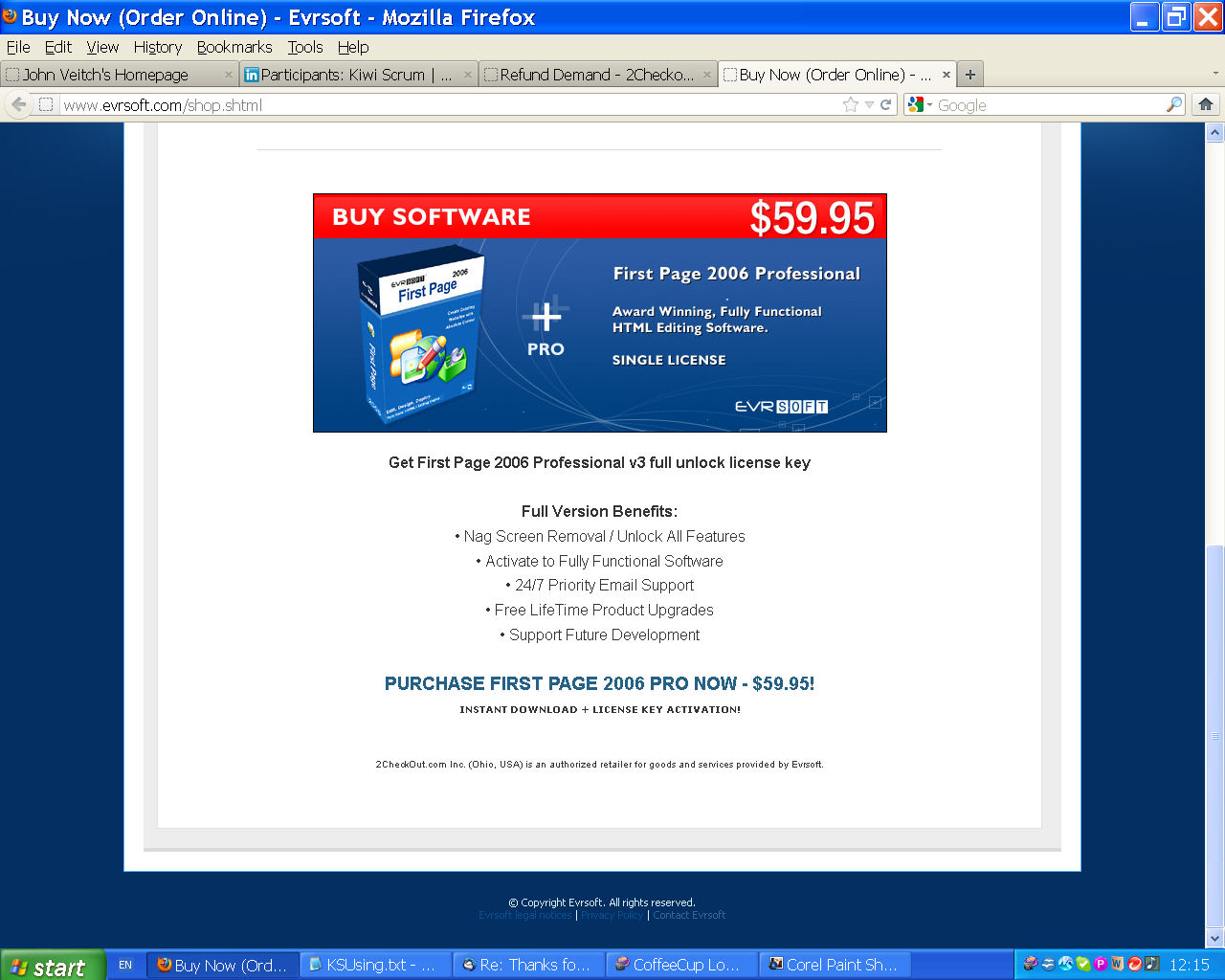

If your business is following the rules both within your contract with 2Checkout and within the payments industry, you should never have a problem receiving your reserves after 90 days from account closure. Some examples of a clear violation could include: selling counterfeit goods, using the account as a payment transfer service, or have any connection to gambling or pornography, to name a few examples.

Advertisers above have met our

strict standards for business conduct.