Complaint Review: Amerisave - Internet

- Amerisave Internet United States of America

- Phone:

- Web: www.amerisave.com

- Category: Loan Modification

Amerisave I agree with Report: #582*** Internet

*UPDATE EX-employee responds: Typical Amerisave Blame the client

*UPDATE EX-employee responds: Lock Cancellation Fee...

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

I have read Report: #582***, and have to wholeheartedly agree with Bob. His coments:

Submitted: Thursday, March 18, 2010

Posted: Thursday, March 18, 2010

They will drag out the process and then say your credit has been denied due to incomplete credit information, in my case, the bank listed above.

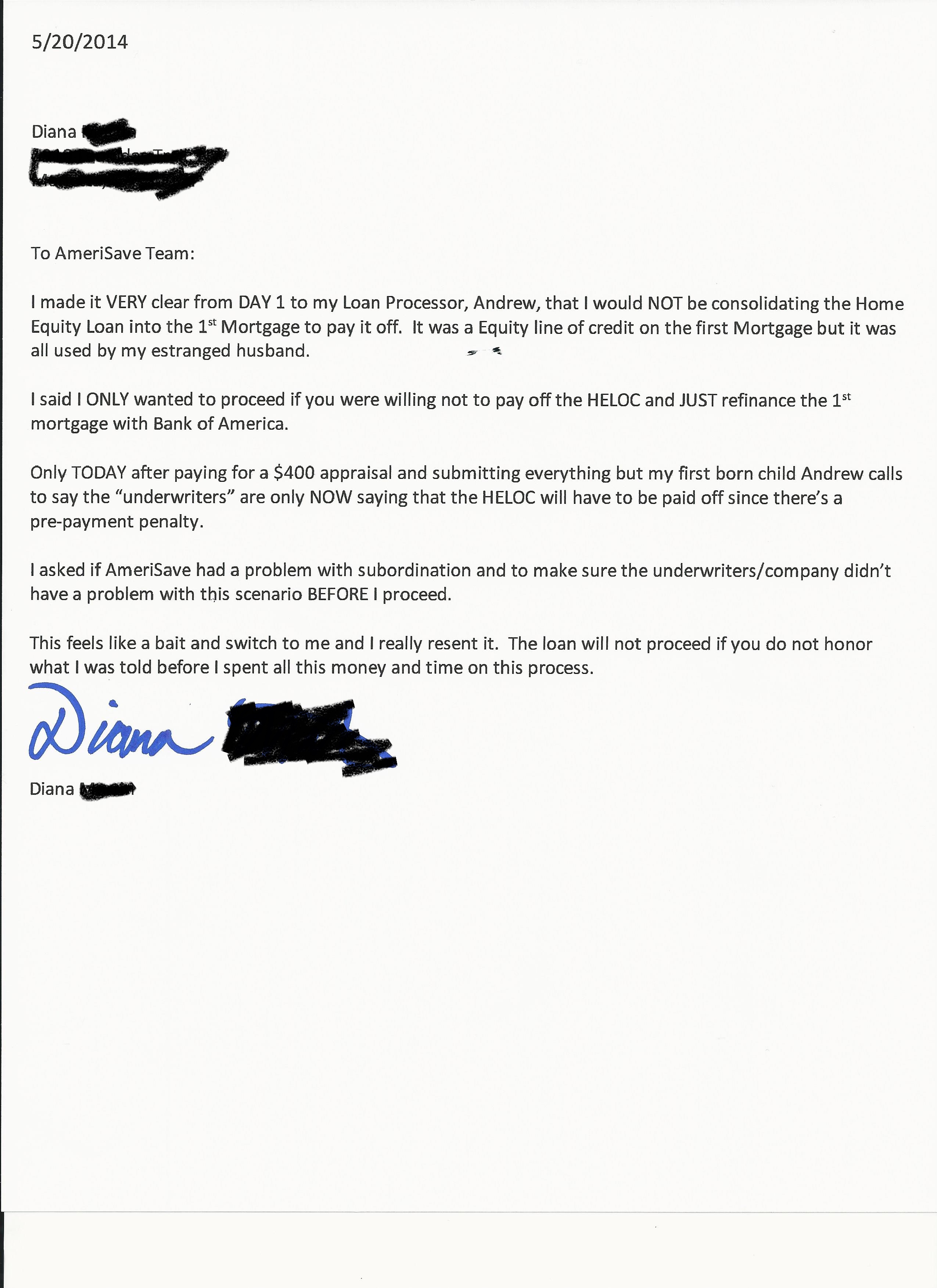

The real shocker to me was when I received a $500 fee on my credit card today and am unable to reach customer service to find out why. My loan officer doesn't know. This may be a long drawn out struggle but I have already called American Express and told them I am disputing this charge.

I thought with a credit score of ~800 and a LTV of 57% This would be a "no-brainer".

This report was posted on Ripoff Report on 10/05/2010 12:26 AM and is a permanent record located here: https://www.ripoffreport.com/reports/amerisave/internet/amerisave-i-agree-with-report-582-internet-647649. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#2 UPDATE EX-employee responds

Typical Amerisave Blame the client

AUTHOR: Former Amerisave Employee - (United States of America)

SUBMITTED: Monday, June 13, 2011

First and formost x employee is clearly an Amerisave Employee.

As a former employee I can tell you that this company is a sham. Online disclosures that you cant even read. Once you click it rushes past everything you need to read. Communication NONE. I lost a ton of business due to managers that take 2 weeks to get back to you. There idea of customer service is passing you along to SMP Senior Mortgage Processer ( Unlicesend Loan Officer ). And with as little as these guys make if they are not making money off of you the SMP wants nothing to do with you.

Now I wonder why clients get confused and dont understand the terms of what they are signing. Oh ya when you call in, you are speaking to an Unlicesned Loan Officer. ( SMP) Legaly they cant quote a rate, payment or fees.They cant take an application. You the customer are sopposed to know everything and do your own loan. There is a reason for Licensing loan officers. A licesnsed loan officer Knows the rules and regulations for lending in the states they are licesned in. They are held accountable. The managers at Amerisave are licesned but they dont handle your transaction. Ex Employee, you got some nerve blaming the customer. Everyone should contact their State Department of Banking. If Amerisave wants to pretend to be mortgage professionals thay should Abide by the same standards as True Mortgage Professionals and adhere to The Federal and State Laws. Stop hiding behind Loop Holes.

If you are trying to get a mortgage ask for your loan officers NMLS #. Then look them up. You wouldn't let an unlicsend doctor treat you. Why would you let an unlicensed mortgage rep handle your most important investment. Your Home!

#1 UPDATE EX-employee responds

Lock Cancellation Fee...

AUTHOR: marketleader - (USA)

SUBMITTED: Saturday, June 11, 2011

The $500 you are referring to is a "Lock Cancellation Fee." You would know this if you read the agreement that they had you sign. When signing that you agreed to allow them to charge that if you voluntarily canceled your loan. So obviously you told them to cancel your loan. Also, we know that you need to stop signing agreements without reading them. This agreement is only 1 paragraph long. The "real shocker" as you put it is that you manage to get through 3 different checkpoints they have in place where they explain this to you in great detail and you managed to somehow miss it. Unbelievable!

Also, you can't blame them for dragging the loan process out if they are trying to acquire informatio from your current lender of National City Bank. In this case you should have contacted National City Bank in order to communicate to them what you and Amerisave need and how that is important and time sensitve to the loan process.

You as the customer is at fault here. Make sure you do your homework and educate yourself. This will save you from wasting your money and everybody else's time in the future.

Advertisers above have met our

strict standards for business conduct.