Complaint Review: Citi Financial Auto - Columbus Ohio

- Citi Financial Auto P.o.box 183036 Columbus, Ohio U.S.A.

- Phone: 800-486-1750

- Web:

- Category: Car Financing

Citi Financial Auto interest rate rip offs Columbus Ohio

*Consumer Comment: Nikki is correct

*Consumer Comment: Here's a quick lesson.

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

My fiance brought a 2005 chevy impala for 10,070 a car payment of 202.09 for 48 months that would equal 9700.32 with a difference of 369.68. He has good credit so the interest rate would not be high so we thought 10,070 was a good price... So June of 2208 we make the first payment we are on our way or so we think.

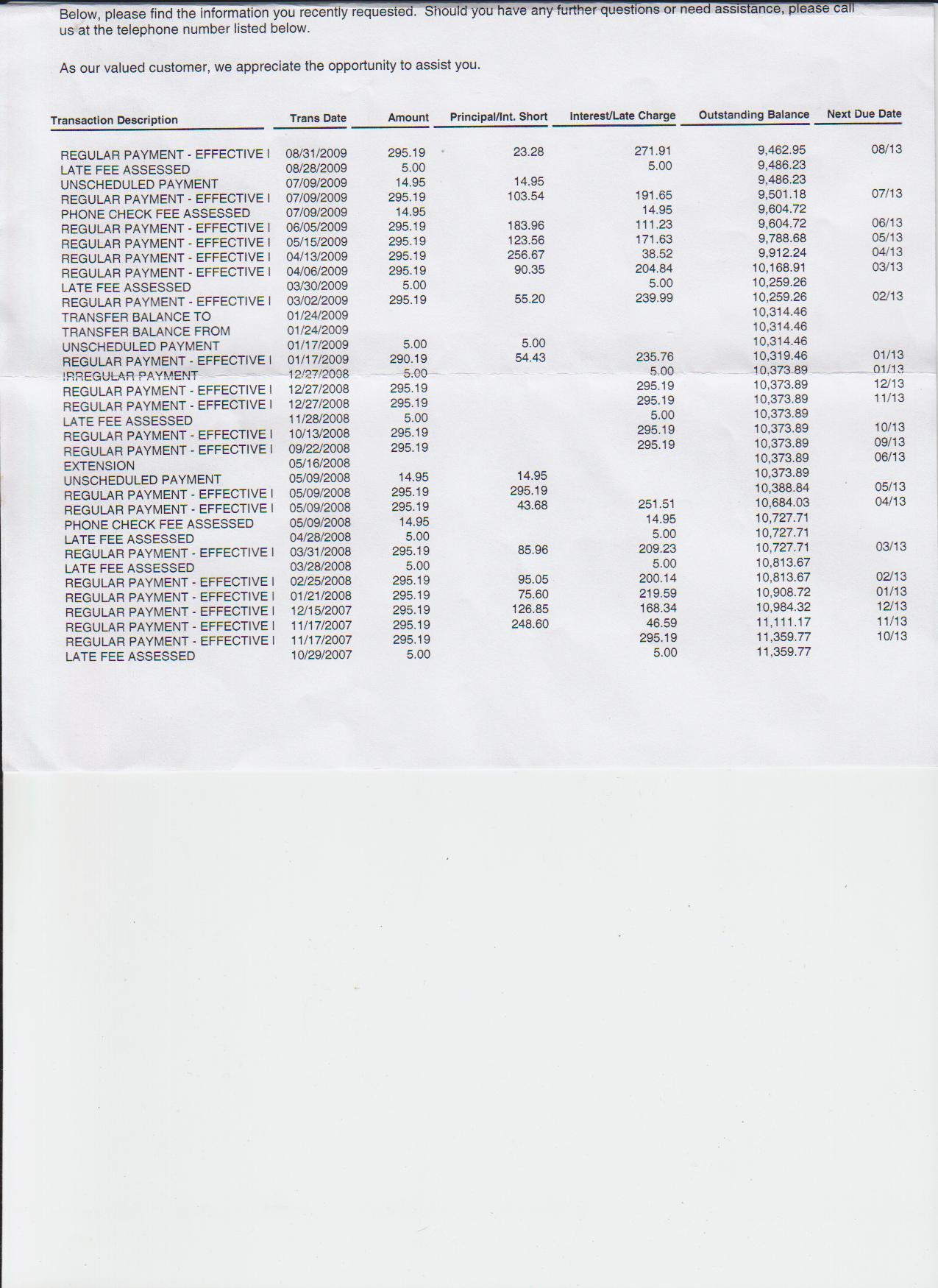

Around Sept we start looking really close to the car statements (citifinancial does not have a book they send a statement in the mail monthly)closely and we notice every month they take a certain amnt of the pymnt and apply to the principal and the rest towards the interest. So we call ask them abt this we get someone who can barely speak english and tells us that it changes every month so ok we continue to pay.

X-mas comes around we are late on the payment they hound us for a 8.98 late fee they wanted us to pay it over the phone which would cost $14.95 and that wasnt happening so Jan we send enough to cover the car payment and the last fee. My fiance got a money order for more then he was suppossed they took the remainder and applied it to the principal. Feb comes in make a payment notice that the balance of the car is not coming down at all. Feb 17, 2009 we get a statement in the mail it says that we owe a car payment of 202.09 (nothing new there) and the entire balance is 9177.05.

Now how can this be lets retrack car payment 202.09 have made 9 pymnts for a total of 1818.81 subract that from 10,070 and you have a balance of 8251.19 or so I thought. We call to citifinancial again and we still cant get anyone who speaks good english and they tell us come bull crap abt they do not decide how much goes toward the principal and how much goes toward the interest it is decided by someone somewhere and it goes by the date the car pymnt is made. My concern was where was the other $900 going to no matter how much goes toward principal and how much goes toward interest the total amnt for the car (including interest was $10,070.00) so any pymnt sent should be subtracted from that price. But they give me some bulls**t story abt the interest and the principal so I ask what if I wanted to pay it off early she then tells me that there is a penalty to pay it off early but.. i save on the interest rate now how is that possible. I have been trying to talk to someone regarding this and I keep getting the run around I am going to look to get my car refinanced through someone else b/c times are to hard for this.

These people should be ashamed of theirselves trying to get over on people as bad as the economy is but they will not be getting over on us we are going to find out where the other money as went to and either they are going to apply it to my acct to lower my balance or give me a refund or wish they had of I dont have a problem with going to the attorney general abt this

Trixie

charlotte, North Carolina

U.S.A.

This report was posted on Ripoff Report on 02/18/2009 01:30 PM and is a permanent record located here: https://www.ripoffreport.com/reports/citi-financial-auto/columbus-ohio-43218/citi-financial-auto-interest-rate-rip-offs-columbus-ohio-425667. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#2 Consumer Comment

Nikki is correct

AUTHOR: Dave - (U.S.A.)

SUBMITTED: Saturday, February 21, 2009

Nikki is correct on how interest is applied. I would also like to add that when payments are made money is applied to finance charges (interest) and late fees first then towards principal.

If you would like to save on some interest pay on your account bi-weekly

#1 Consumer Comment

Here's a quick lesson.

AUTHOR: Nikki - (U.S.A.)

SUBMITTED: Wednesday, February 18, 2009

First, go online to a loan amortization spreadsheet and plug in your loan amt, the interest rate, and the terms. You will see your payment. Ask the website to give to the breakdown and you will see how much you should owe after 9 payments and about what your daily interest should be. This only works if you have made every payment on exactly the date it is due, but it will give you a general idea if you haven't.

On most auto loans, interest is figured daily, but compounded monthly. For example, say based on what you owe and your interest rate, this month's interest is $5 per day. Your made your last payment on January 20, and are now making this payment February 20. That is a total of 31 days. 31 days x $5 per day = $155. So, out of your payment, $155 goes to interest and the rest to principal. Say you make your next payment March 15. February 20 - March 15 = 23 days. So out of your March payment, $115 goes to interest and the rest to principal. Then say you make your next payment April 25. March 15 - April 25 = 41 days x $5 per day = $205 to interest and the rest to principal. Say the next month you are 20 days late to = 51 days since your last payment. 51 x $5 = $255, plus maybe a $20 late fee. If your payment is $200 and the money charged to that payment is $275, you are in the hole for the next month by $75. These numbers I have used are just examples, but I hope you get the drift. Take a deferment and it really gets screwy.

So, it all depends on the date of your previous payment how much goes to principal and how much goes to interest. Plus, if you have any late fees attached, you may see some payments don't go to principal at all, only to interest and late fees.

They probably wanted you to pay the interest for the days you were late. I like to call it "late interest" rather than "late fee". An actual late fee is usually assessed when you are 10 days late and does not go to interest or principal. Merely into the pocket of your finance company. Your payment less interest and late fee was probably $8 short with nothing going to principal. Next time you are late, you need to figure out the approximate daily interest and add that to your payment x the number of days you are late, plus any actual late fee.

Based on your loan amt and payment, it looks like you got a really good interest rate. You need to pull out that financing paperwork to make sure it really is only 48 months.

Advertisers above have met our

strict standards for business conduct.