Complaint Review: Citi Financial Auto - Coppell Texas

- Citi Financial Auto www.citifinancialauto.com Coppell, Texas United States of America

- Phone: 8004861750

- Web:

- Category: Car Financing

Citi Financial Auto CitiBank CITI Financial Auto Falsely Reports to Credit Bureaus! Hours have been spent to get this corrected but still nobody can correct their error! Coppell, Texas

*General Comment: your credit is hosed anyway

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

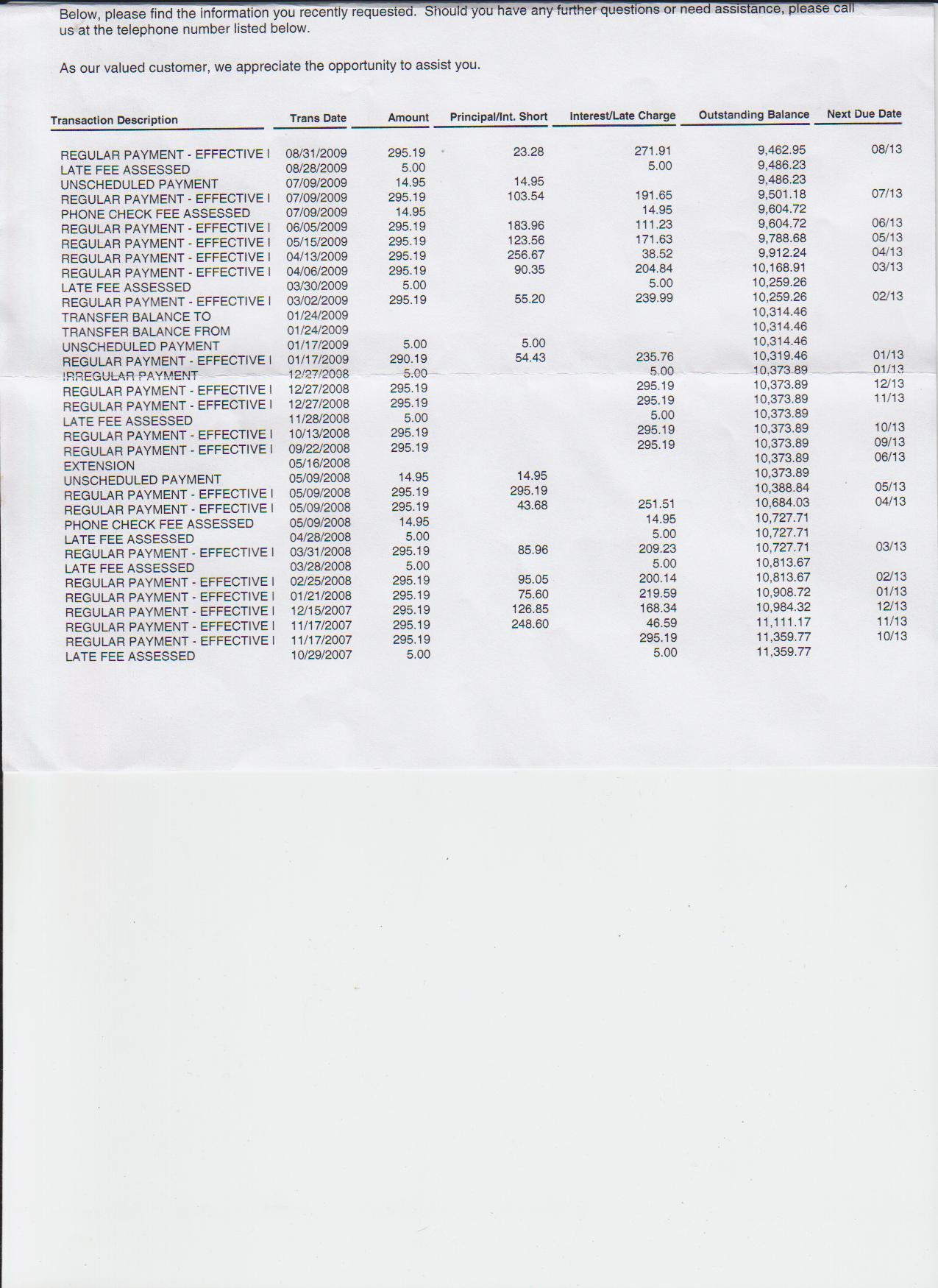

We have a loan with Citi Financial Auto that has a very high payment and interest. The loan was taken in Sept. 2005 and has been paid on time since then. During that time, we filed a Chapter 13 Bankruptcy but chose to pay the auto loans separate from the bankruptcy payment. All payments were paid on time and Citi reports this to the bureaus correctly. However, when the Chapter 13 was discharged after all payments were made to our creditors on time, Citi has neglected to report this correctly to the credit bureaus. So, I have spent countless hours on the telephone with their customer service departments in various locations speaking to various individuals and supervisos to get a letter that the credit bureaus will accept that tells them to remove the bankruptcy code "7" from our file and report all payments have been made on time.

Nobody at CITI seems to be able to generate such a document and in fact they have been unwilling to admit the are reporting it incorrectly stating that even though their file says "discharged" several times on our account, it also says "dismissed" which means to them that we are in a Chapter 13 still. The Bankruptcy Court has sent them all required documentation stating our case was discharged and one of the customer service representatives, Jacqueline, read from the notes on her screen that it was discharged, but she says she cannot report that to the credit bureaus.

Essentially, CITI is allowed to falsely report my credit data to the three credit bureaus and there isn't one thing I can do about it. The credit bureaus will not accept the documentation from the United States Bankruptcy Courts. I need help!! Do not use CITI Financial Auto for a car loan as if you have struggles, lose your job, etc. and need to seek protection like we did through the courts, you may as well use Chapter 7 and discharge all debts because when you do the right thing and pay your bills on time to better your credit history it doesn't help at all, especially if you are dealing with CITI Financial Auto!

This report was posted on Ripoff Report on 10/07/2009 09:52 AM and is a permanent record located here: https://www.ripoffreport.com/reports/citi-financial-auto/coppell-texas-75019/citi-financial-auto-citibank-citi-financial-auto-falsely-reports-to-credit-bureaus-hours-505693. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#1 General Comment

your credit is hosed anyway

AUTHOR: IamGood - (USA)

SUBMITTED: Wednesday, October 07, 2009

What is the problem here?

Your credit is hosed, you will not be able to get credit for 10+ years. No one will ever trust you. Even Car Credit will be hard to get.

Sorry, you decided to get relief from the courts. This relief worked, creditor stopped calling you, but you paid a HIGH Price for this peace of mind.

Just live with it.

Advertisers above have met our

strict standards for business conduct.