Complaint Review: Compass Bank - Colleyville Texas

- Compass Bank Colleyville Blvd. Colleyville, Texas U.S.A.

- Phone:

- Web:

- Category: Banks

Compass Bank They change their practices to suit their gain... Colleyville Texas

*Consumer Comment: Ken Is Right.....

*Consumer Comment: From the Federal Reserve! Must Read!

*Author of original report: Dear Ken

*Consumer Comment: Do yourself a favor

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

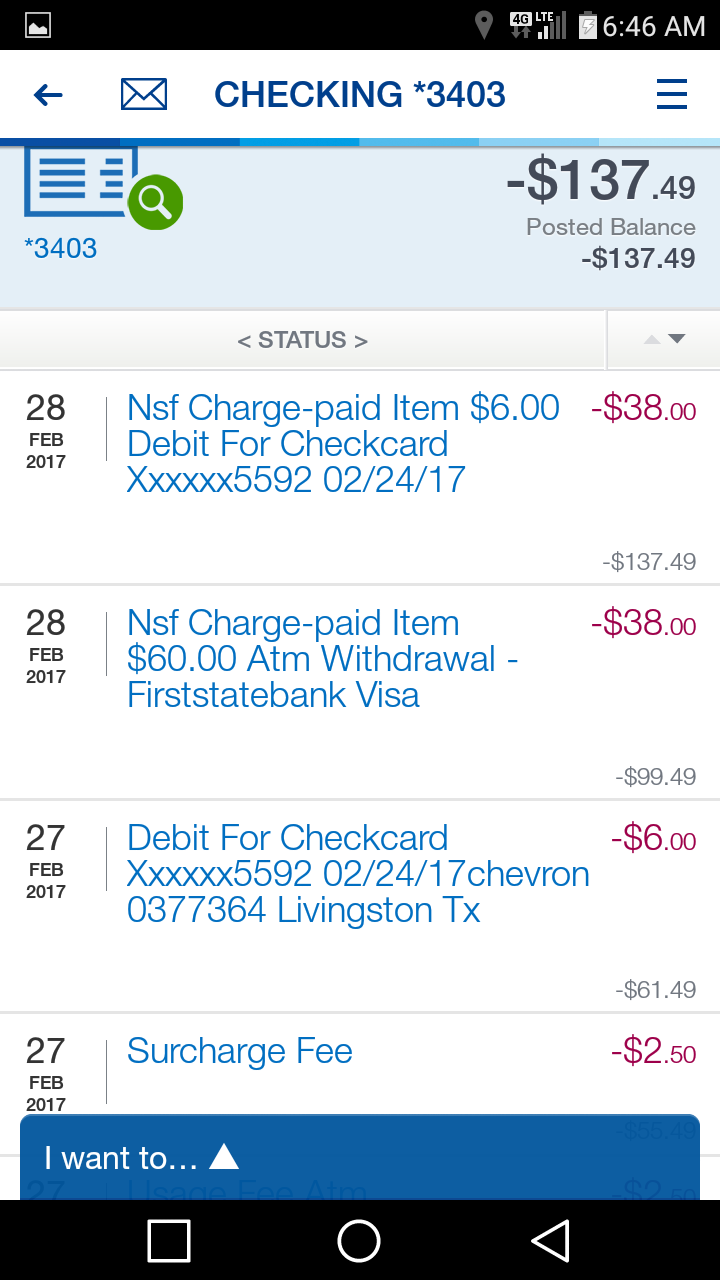

Unlike some may be more willing to admit, I have been aware of when my account was about to be overdrawn and if I made purchases knowing this then I simply "ate" the fees as it was I at fault. However, here lately I have noticed some very malicious practices. They in fact post according to what will benefit them at that time. You may notice that when your account has all funds they simply post the money according to the date it comes through in the order transactions happened that day. Meaning large, small, medium or medium, small, large or small, large and then medium.

Examples of Banking Practices

October 2008: I receive excess overdraft fees. I ask why I recieved the extra fees. I am told that the bank doesn't post according to the date of transaction but post according to the day it goes through. Which is odd because when I previously had things that didn't come through until the day after I banked money I was told they didn't post according to the day it goes through but accoring to the transaction date. In addition to this practice they "post the largest amount first as it is usually the most important item."

August 2008: 1) I had an issue with a credit card being lost so I cancelled that one and waited for my new card. I was charged the $5.00 fee to replace my card and was then charged $38 for being overdrawn by, you guessed it, $5. When I asked why wasn't I told that I would have to wait to receive a new card or why did they not consider simply canceling my card and then telling me I didn't have enough funds to order a new one and to simply call back? Well it seems that the left hand is unaware of the right and they are simply two different departments.

2) Before I recieved my new card I cancelled a membership with a gym and let them know that the old card wouldn't work as it had been lost and I hadn't recieved m new card as of yet and I would not be updating my information. Low and behold I receive two (2) charges from that gym on my new card. I went to the location in Colleyville to file my dispute and have them fax it back to a 205 area code number.

They never faxed it in (turns out Branch manager was leaving and is now no longer with the company) and I have 6-8 overdraft fees (totatl gym took was about $47 but small transactions of $5-7 are sprinkled in with this). I resubmit my dispute stating that I never authorized charges for gym on new CC number and had cancelled my membership. I am told that if any company has had previous authorization on an account for 6 months or more that the funds can be debited from any new account. I stated this account is under 5 months. The new reason becomes that I gave them the account number.

Last update according to the gym was in July a full month before I lost my card. The new reason is now I didn't cancel my membership properly. I fully believe that the bank inaccurately allowed a transaction to go through in order to give me fees.

March 2008:I closed an account and opened a new one. Three to five days later that account receives charges and I'm hit with fees. I am told that the account was closed i should not have recieved any fees to simply pay the amount paid and I would be refunded the fees and anything over. I am still waiting for $167 refund from that account.

Krys

Colleyville, Texas

U.S.A.

This report was posted on Ripoff Report on 10/23/2008 01:29 PM and is a permanent record located here: https://www.ripoffreport.com/reports/compass-bank/colleyville-texas-76034/compass-bank-they-change-their-practices-to-suit-their-gain-colleyville-texas-384191. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#4 Consumer Comment

Ken Is Right.....

AUTHOR: Jim - (U.S.A.)

SUBMITTED: Sunday, November 02, 2008

You keep referring to transactions going through your account as a cc; in fact you used a cc to abbreviate credit card. Since credit cards do NOT go through your bank account, the only card you could only be referencing is your debit card - something you should not have anyway. Debit cards are the quickest way to incur overdraft fees and if you want to keep more of your money, you'll stop using one.

And that action by the FED will never happen..... accounts are no more complex than they were 15-20 years ago.

#3 Consumer Comment

From the Federal Reserve! Must Read!

AUTHOR: Jessica - (U.S.A.)

SUBMITTED: Sunday, November 02, 2008

http://www.federalreserve.gov/newsevents/press/bcreg/bernankecredit20080502.htm

#2 Author of original report

Dear Ken

AUTHOR: Krys - (U.S.A.)

SUBMITTED: Wednesday, October 29, 2008

I referred to it as a cc because they refer to it as a cc. They have cc and dc transactions as well as seperate cards either or both can be attached to your account. If you would have read past the cc I guess you would have seen that I talked to the branch managers in person. Compass Bank does not handle in branch they send all request to "Client Care" which handles any disputes or fees. A branch may request that funds be returned but ultimately Clent Care gives the nod or the dismissal. Please, in future, try to advise based on information provided.

#1 Consumer Comment

Do yourself a favor

AUTHOR: Ken - (U.S.A.)

SUBMITTED: Friday, October 24, 2008

You will save yourself a lot of grief if you make some time and go into your branch and sit with someone and ask them to explain to you how it all works. By virtue of the fact that you keep referring to it as a credit card, it is clear that you don't have the familiarity that you need. Knowledge is your best defense.

Advertisers above have met our

strict standards for business conduct.