Complaint Review: ESPER LAW - Internet

- ESPER LAW Internet United States

- Phone:

- Web:

- Category: Fake Payday Loan, Pay Day Loans , Payday loan scam

ESPER LAW Gary Streeter Sent me an email about me owing on a Quick Payday Loan, Which I never had a loan of any kind.

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

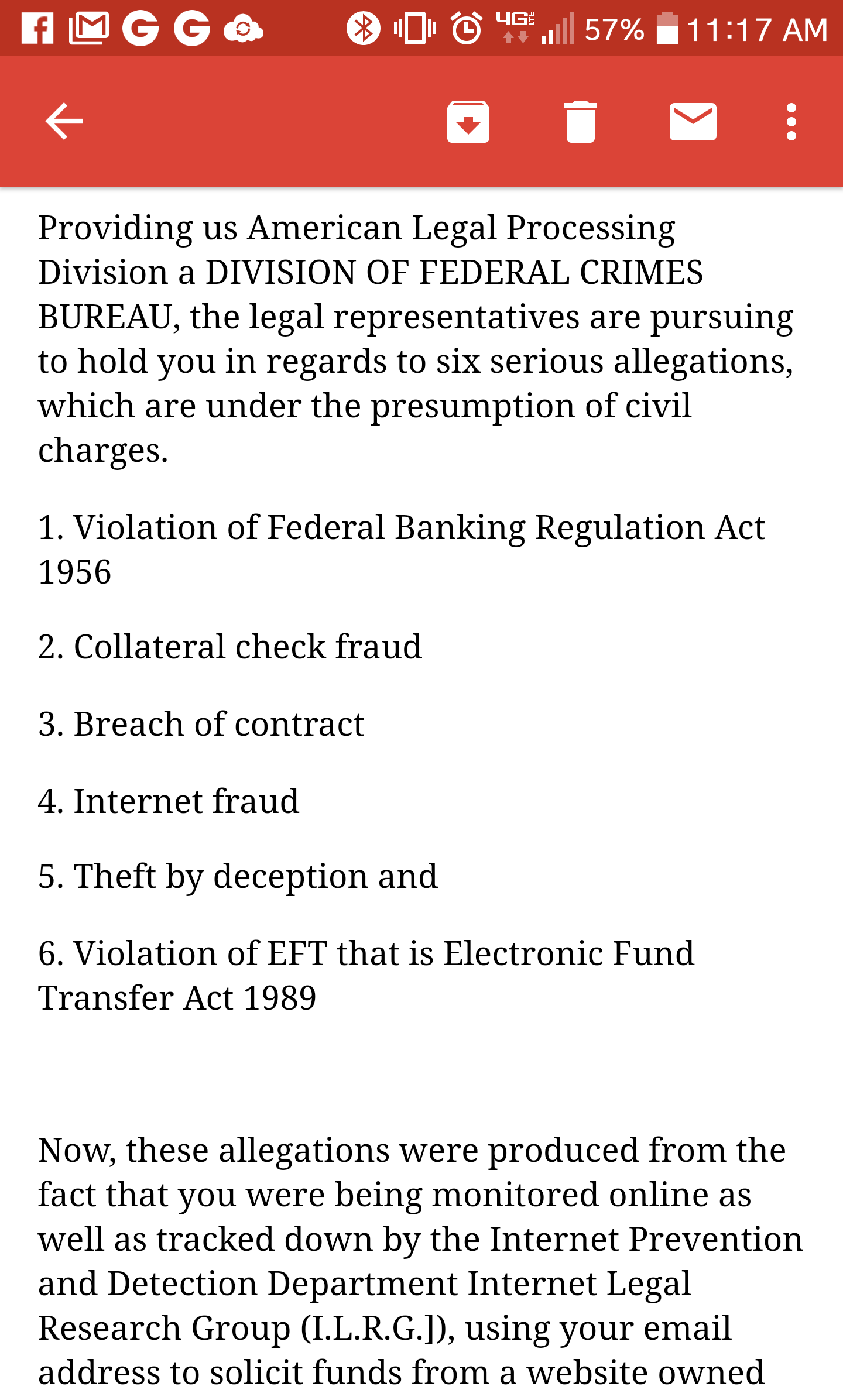

They have emailed me on numerous occasions stating that I owed money for a loan I never received. I requested documentation to prove this was valid but did not send any but got the below response which lets me know this is a scam. Companies when you owe them money they have to provide you documentation to prove the account is real, they have to. I see that this scammer is using different names but same company, there is no contact information or address for the company, which also tells me this is fake.

Date: April 4th, 2018

Dear: Jasmine S.

SSN: I removed the information

Bank Account#: I removed the information

Routing#: I removed the information

Claimant: Quick Payday

Reference: CJ15224

Plaintiff has given you more than ample time and notices regarding your long overdue balance of $ 1,331.16 for the settlement of the legal matter outside the courthouse. Numerous attempts to resolve your long overdue account have been unsuccessful. As you know, your overdue balance now equals $ 1,331.16 (which includes interest on the overdue account). Interest will continue to accrue on this past due account.

You are requested to appear in the court to defend the action of which particulars appeared earlier and now. If you do not appear and defend the proceedings, there is no hearing so it is highly likely judgment may be given in your absence.

If the court rules in favor of the Plaintiff/ creditor (Quick Payday), you have to pay up when the order tells you to. If you don’t pay up as ordered, the Plaintiff may then take steps to collect on the judgment under Enforcement Action.

As per the enforcement action, your Plaintiff has some other options to make you pay -

1. Garnishment from your wages to pay the debt under an attachment of earnings order.

2. Take the money that you are owed by someone else from your bank account. It is called a third-party debt law.

3. The Plaintiff can take steps to receive the money it is owed by asking for a lien on an un-exempted real estate owned by the debtor, the sale of the debtor’s property secure the debt against your home or other assets you own. It is called a charging order and means that you could lose your home if you don't keep up the repayments.

After a judgment, you may be summoned to answer questions about your finances. Fail to meet the summons it is remotely possible that you will be picked up by police for disobeying a court order.

Enforcement mechanisms

The following are the main ways of enforcing judgments:

1. Execution against goods (order from the court which directs the Sheriff or County Registrar to seize your goods and sell them to raise the amount of money which you owe plus costs.).

2. Installment orders, followed (if necessary) by committal orders.

3. Earnings Attachment.

4. Judgment mortgage.

We would like to draw your attention to the fact that in most states, judgments are good for ten years, so if the Plaintiff has a judgment against you, any property you acquire within ten years of the judgment could be seized, as long as the loan has not been paid.

Even though a payday lender can sue you civilly to collect the balance of the loan, failing to pay a payday loan is not a crime while some collectors threaten borrowers with criminal action, you cannot be sent to jail unless you intentionally took out the loan not planning to pay it back as a fraud.

It will be your final opportunity to resolve this matter on your overdue balance account within five working days without the expenses of court proceedings.

You will stop this going to court if, before the date given above, you pay the sum of $ 1,331.16 being: -

The amount claimed, interest and the court rate up to the specified date, Fixed costs and Stamp duty is included for $ 1,331.16.

Under section 88 of the National Credit Code, I have briefed you up with the affidavit and done my part; now the best is up to you.

Sincerely,

Gary Streeter

Legislation Department

Esper Law Firm

*** If you have any doubts about the credibility of this email please refer to the Terms and conditions under the breach of the contract via the online application filled up by you. ***

____________________________________________________________________________________________________________________________________________________________

Copyright © 2015 FCI | Privacy | Terms of use

This report was posted on Ripoff Report on 04/04/2018 08:07 AM and is a permanent record located here: https://www.ripoffreport.com/reports/esper-law/internet/esper-law-gary-streeter-sent-me-an-email-about-me-owing-on-a-quick-payday-loan-which-i-n-1437206. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

Advertisers above have met our

strict standards for business conduct.