Complaint Review: NCO Financial Systems - Phoenix Arizona

- NCO Financial Systems 2020 N. Central Ave Suite 300 Phoenix, Arizona U.S.A.

- Phone: 800-933-6736

- Web:

- Category: Collection Agency's

NCO Financial Systems Sent me a letter stating I owed a substantial amount of money from a credit card in 1988! Phoenix Arizona

*Consumer Suggestion: NEVER take advice from someone who says "they CAN'T sue you"

*Consumer Comment: Robert, actually that is not the way it works.

*Consumer Comment: Steve, I usually agree (for the most part)

*Consumer Suggestion: The solution here is very simple!

*Consumer Suggestion: Validate the Debt with NCO

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

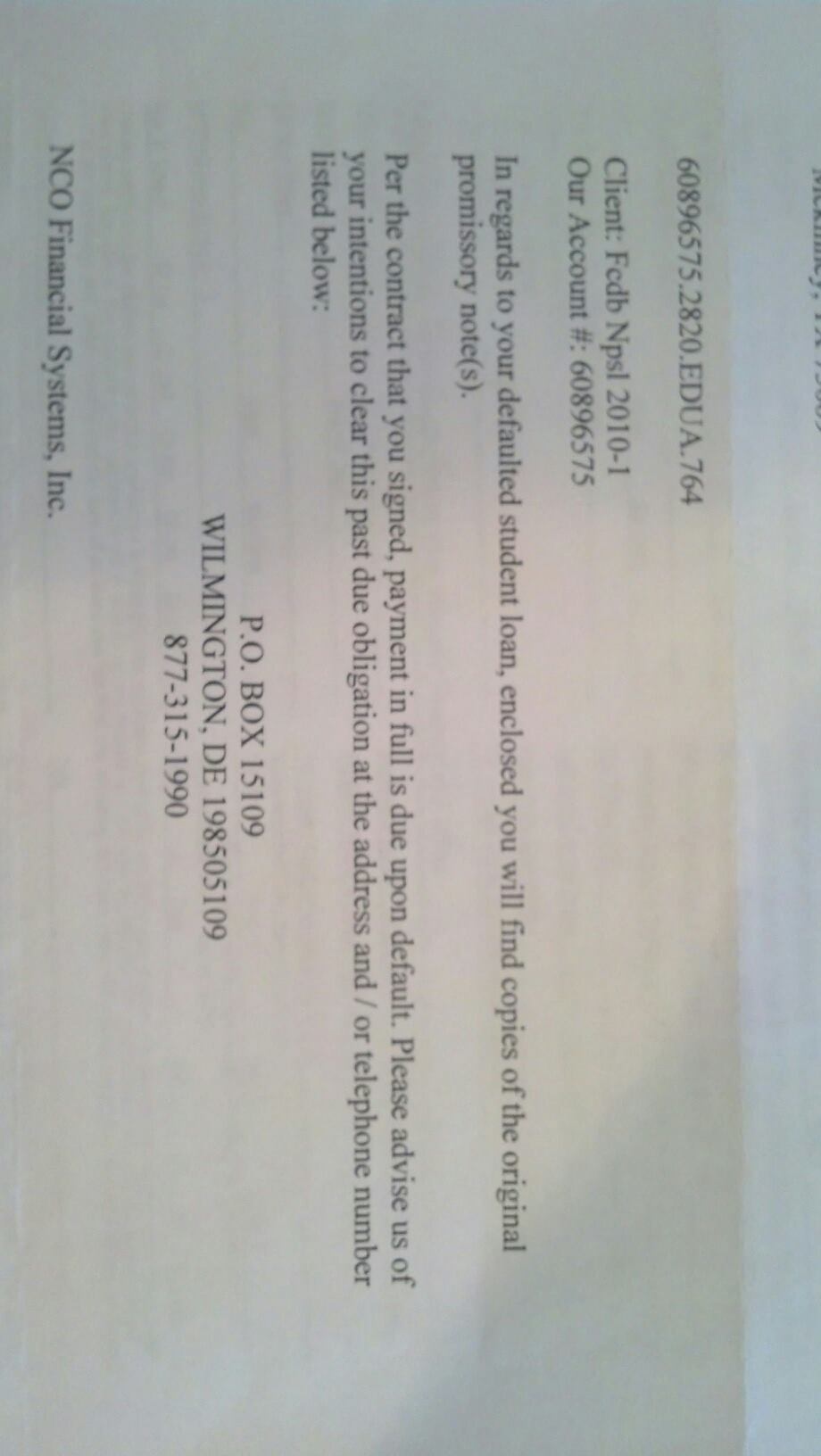

I had a bankruptcy in Feb 1993. 6 months prior to that I had hired a bankruptcy lawyer and was told to cut up all my credit cards which I did in his office. Bankruptcy was discharged on Feb 1993. Last week I had received a letter from a collection agency named: NCO financial systems Inc. The correspondence that indicated I owed 19,397.40. On a original balance of 5,655.08! Is this collection attempt legal after 16 years? Isnt the statue of limitations six years? They have making up false records on the average citizen.

They said my last payment was on July 1992, and the card was opened in 1988. I did not see this credit card (Chase/assignee of Providence)on my bankruptcy discharge papers and I do not remember having this credit card. They do not have any other information on this account other than this last payment I had made prior than my bankruptcy (July of 1992) It was also the only time they had ever contacted me and I live in my home elevan years now. Even other address before that I had never been contacted about this credit card. And the Interest had accrued to 13,742.32! Is this attempt legal? I also ran a credit report from three major credit bureaus and my credit is excellent. No record of the account number was on the report from the statement NCO had sent to me. I believe this fraudulent and should be investigated. I noticed NCO did make an inquiry on 8/22/2007 for some reason and they should'nt have. Something is definitely wrong here. Please investigate! I sent the attorney general a letter certified, and also to NCO of any proof of this account.

Kim

Levittown, New York

U.S.A.

This report was posted on Ripoff Report on 12/27/2007 11:07 AM and is a permanent record located here: https://www.ripoffreport.com/reports/nco-financial-systems/phoenix-arizona-85004/nco-financial-systems-sent-me-a-letter-stating-i-owed-a-substantial-amount-of-money-from-a-294809. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#5 Consumer Suggestion

NEVER take advice from someone who says "they CAN'T sue you"

AUTHOR: Tim - (U.S.A.)

SUBMITTED: Wednesday, May 07, 2008

Steve,

That IS the way it works. You are correct that it is illegal for a debt collector to file a lawsuit on a debt that is past the SOL. But while that illegality is a defense to a claim and a claim in and of itself, it is NOT a lock on the courthouse doors. The "they can't sue you" line is Bud Hibbs advice and, believe me, Bud Hibbs doesn't know as much as Bud Hibbs thinks he knows.

Now, I would NEVER place my license to practice law on the line to file a lawsuit where I know the debt is past the SOL. But my partner is a debt collector and I can tell you first hand that the default judgment rate in collections matters is close to 90%. So the vast majority of alleged debtors never even bother to defend themselves, even when they have a solid defense such as the SOL. Out of the remaining 10%, few will actually hire a lawyer or effectively defend themselves. And out of that few, even fewer will actually pursue the sanctions available under the FDCPA or any other applicable laws.

So some lawyers might be willing to play the odds, and there is nothing other than their own concern for their professional well-being preventing them from filing suit on a time-barred claim. And even if they do get called out, the probability of any kind of serious penalties is rather slim, probably too slim to outweigh the profitability of skirting the law.

And FYI, filing suit on a time-barred debt is a civil infraction. There is no criminal liability associated with it. And even the civil liability, including the effect it may have on an attorney's good standing, can be rather minimal if the attorney can convince the powers-that-be that he was acting negligently and without knowledge that the debt was time-barred.

But filing suit on a debt that was discharged in bankruptcy IS a criminal offense, and an attorney who knowingly files such a suit could actually face some jail time and will likely be suspended from practice, if not disbarred.

#4 Consumer Comment

Robert, actually that is not the way it works.

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Sunday, May 04, 2008

When a debt is actually past SOL, it is actually ILLEGAL to file a lawsuit on it.

That is the whole purpose of the SOL.

Anyone filing a lawsuit on an expired SOL debt opens themselves up for civil and punitive damages for both the FDCPA violations, various state laws, and most of all damages arising from the filing of a frivolous lawsuit.

And, most important, the "attorney" who would file such a frivolous/illegal lawsuit could easily be disbarred for the blatant ethics violation.

I have been down this road.

#3 Consumer Comment

Steve, I usually agree (for the most part)

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Saturday, May 03, 2008

But your statement that the "cannot sue" is not true. Of course they can sue, anyone can sue. Hell, I can sue you. Will they win? Maybe. They could file suit and get a default judgment if Kim doesn't respond. If Kim responded in court, as well as filing a counter suit, she would win simply on the SOL issue.

NCO sent out thousands of these "Chase/Assignee of Providian" letters. Hell, I got one. A simple letter demanding they validate the debt ended the whole thing when the sent me a letter "closing this matter."

You are right, however, they they are bottom feeder, junk debt buyers.

Kim, do NOT talk to them on the phone. Do everything by mail. Stand up to them, they will go away.

#2 Consumer Suggestion

The solution here is very simple!

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Saturday, May 03, 2008

The advice on the validation request is simply bad advice.

This debt being 16+ years old is obviously past statute of limitations for collections, therefore they can do nothing to you. They cannot sue. They cannot win. They don't get paid unless you agree to pay them.

Also uncollectable due to your bankruptcy.

FYI..NCO does not only do medical debt. They are junk debt buyers of the worst kind...every kind! They pay approx 1/10th of a penny on the dollar for this old worthless debt and then harass people into paying.

At this point, simply send a CEASE COMMUNICATIONS request to them as per the provisions of the FDCPA. Send this by certified mail, return reciept requested, and be sure to put the certified# on the letter itself and keep a copy for your records.

If they made any entries on your credit report, you have the right to sue, as a debt that is past statute of limitations cannot be legally collected upon, and therefore they do not have "permissible purpose" to even pull your credit.

Don't get mad, GET PAID!!

#1 Consumer Suggestion

Validate the Debt with NCO

AUTHOR: Phillip - (U.S.A.)

SUBMITTED: Friday, May 02, 2008

NCO is a company who buys noncollectable debts from medical providers for pennies on the dollar. NCO uses intimidation tactics to convince consumers to agree to pay a bill that is legally dead. Once you agree to pay the debt, it is now legally collectible.

1. Do not talk to a debt collector on the phone, the results are never in your favor.

2. Send a certified letter requiring that NCO validate the debt before agreeing to pay or sending them any money. Include in you letter that NCO is not to telephone your home, work or any third party and if NCO fails to comply it is considered harassment.

3. Keep meticulous records of your communications with NCO in the event a problem arises or if the company tries to reiterate the debt at a later date.

Sample letters can be found at Budd Hibbs website, click in the red banner 'first time dealing with a creditor?' There is another download by clicking on the green book... I prefer the sample letters and information available from creditinfocenter and there is some free information including sample letters.

Good luck dealing with this bad debt collector.

Advertisers above have met our

strict standards for business conduct.