Complaint Review: NCO Financial Systems - Phoenix Arizona

- NCO Financial Systems 2020 N. Central Ave Suite 300 Phoenix, Arizona U.S.A.

- Phone: 800-933-6736

- Web:

- Category: Corrupt Companies

NCO Financial Systems Sent me a letter stating I owed a substantial amount of money from a credit card in 1988! Phoenix Arizona

*Consumer Comment: Some clarifications

*Consumer Comment: One more thing re: "cease & desist", and response to Robert.

*Consumer Comment: Kim - small correction

*Consumer Comment: Actually, Kin....

*Consumer Comment: Actually, Kin....

*Consumer Comment: Actually, Kin....

*Author of original report: Account closed!

*Consumer Comment: Steve...

*Consumer Comment: thats great Kim....

*Author of original report: Finally, that "fake" Chase account is closed! Thanks to someone on here..

*Author of original report: Thanks for your help

*Author of original report: Thanks for your help

*Author of original report: Thanks for your help

*Author of original report: Thanks for your help

*Consumer Suggestion: Robert, you are absolutely wrong!

*Consumer Comment: I would also recommend....

*Consumer Comment: I would also recommend....

*Consumer Comment: I would also recommend....

*Consumer Comment: I would also recommend....

*Consumer Comment: Kim, you are not alone.

*Author of original report: My response back to the two rebuttles about this report....

*Consumer Comment: NCO junk debt buyers

*Consumer Comment: NCO junk debt buyers

*Consumer Comment: NCO junk debt buyers

*Consumer Comment: rere

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

I had a bankruptcy in Feb 1993. 6 months prior to that I had hired a bankruptcy lawyer and was told to cut up all my credit cards which I did in his office.

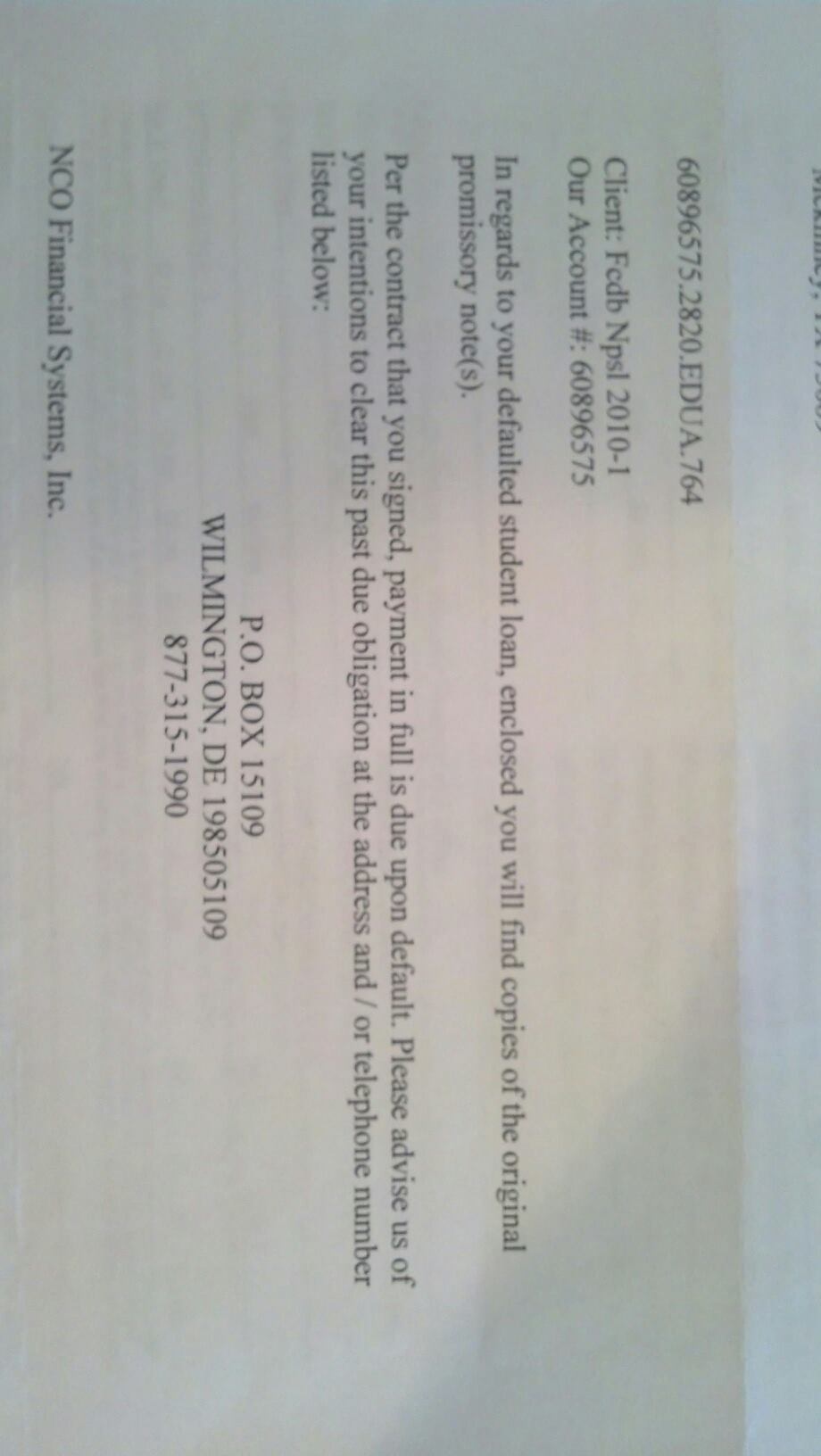

Bankruptcy was discharged on Feb 1993. Last week I had received a letter from a collection agency named: NCO financial systems Inc. The correspondence that indicated I owed 19,397.40. On a original balance of 5,655.08! Is this collection attempt legal after 16 years? They said my last payment was on July 1992, and the card was opened in 1988. I do not remember having this credit card. They do not have any other information on this account other than this last payment I had made prior than my bankruptcy. It was also the only time they had contacted me and I live in my home 11 years now. Even other address before that I had never been contacted about this credit card. And the Interest accrued to 13,742.32! Is this attempt legal? Any help would be greatly appreciated. I also ran a credit report from three major credit bureaus and my credit is excellent. No record of the account number was on the report from the statement NCO had sent to me.

I believe this fraudulent and should be investigated. Also a letter that they had faxed us the original amount stated on the original statement is 19,397.40 and on the faxed letter the amt owed states 19,414.75 showing that the account is accruing interest within days of the letter I was sent! Something is definitely wrong here. Please investigate!

Kim

Levittown, New York

U.S.A.

This report was posted on Ripoff Report on 12/27/2007 06:00 PM and is a permanent record located here: https://www.ripoffreport.com/reports/nco-financial-systems/phoenix-arizona-85004/nco-financial-systems-sent-me-a-letter-stating-i-owed-a-substantial-amount-of-money-from-a-294981. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#25 Consumer Comment

Some clarifications

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Monday, January 14, 2008

Just to clarify an point on the Credit Report. Items can only be reported on your credit report for 7 years from the date of the FIRST default, it actually works out to be 7 years + 180 days with the way they are allowed to report it. If this debt was defaulted in 1988 then it can no longer be put on your credit report. Which is why it is not and will not be put back on your report.

But I also just wanted to comment on your response that said checking your credit report lowers your score. This is 100% FALSE, that is considered as consumer inquiry and does not harm your score in the least. The only time your score would be effected is if you applied for new credit.

#24 Consumer Comment

Kim - small correction

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Monday, January 14, 2008

""I will keep an eye out, but at the same time checking your credit report out, lowers your score. ""

If you are checking credit reports on yourself, that does NOT lower your credit score.

Just thought you should know.

#23 Consumer Comment

One more thing re: "cease & desist", and response to Robert.

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Monday, January 14, 2008

First, I would like to clarify this "cease and desist" thing. There is no such provision under any part FDCPA as a "cease and desist".

The EXACT verbage directly from the FDCPA is "cease communication". Proper terminology is essential if you would have gone to court on this. Improper terminology can cost you the case.

Robert, I am speaking from years of experience on this. Any time you contact a collection agency for the first time, the amount of contact you get from them will increase. Guaranteed. You have validated the contact info, and given the collections a higher priority.

Accounts that do not get any response at all, either get resold or forgotten about.

I walked away from 34 unsecured accounts in 2002. As of today, not one has collected a dime from me and there are no judgements against me.

The fact is, MOST bottomfeeders WILL NOT sue.

Also, lets be clear in the difference between a 1st party collection attempt and a 3rd party collection attempt. There is no reason to ever respond to a 3rd party debt collector. NONE.

#22 Consumer Comment

Actually, Kin....

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Monday, January 14, 2008

Checking YOUR OWN report will not lower your FICO report.

You score will lower, however, when the collection agencies check your report!

#21 Consumer Comment

Actually, Kin....

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Monday, January 14, 2008

Checking YOUR OWN report will not lower your FICO report.

You score will lower, however, when the collection agencies check your report!

#20 Consumer Comment

Actually, Kin....

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Monday, January 14, 2008

Checking YOUR OWN report will not lower your FICO report.

You score will lower, however, when the collection agencies check your report!

#19 Author of original report

Account closed!

AUTHOR: Kim - (U.S.A.)

SUBMITTED: Sunday, January 13, 2008

In response to my last rebuttle, the letter said the account is closed with their office. That means they cannot add it to my credit report. It never existed. Hopefully they dont sell off this "false" account to another collection agency. Being they could'nt get a dime out of me! I will keep an eye out, but at the same time checking your credit report out, lowers your score. Thanks for all your advice..

#18 Consumer Comment

thats great Kim....

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Thursday, January 10, 2008

For those who have received the same letters, send NCO a letter demanding they provide validation of the debt. They are required, by law, to stop attempting to collect the debt, including adding it to your credit report, until they validate. They can't validate a debt that doesn't exist.

Regardless if "Steve" believes it or not, NCO sent me a letter telling me the account is closed.

Kim, I would keep an eye on your credit report and make sure they didn't add it.

#17 Author of original report

Finally, that "fake" Chase account is closed! Thanks to someone on here..

AUTHOR: Kim - (U.S.A.)

SUBMITTED: Thursday, January 10, 2008

I received a letter in todays mail, stating that the account above, chase assignee of providence is closed! Funny though, I never had that credit card and they knew it!

It was the cease and desist letter that I sent wanting proof that I owed that account!

To the person who I copied and pasted that cease and desist letter from ripofreport.com. I cannot thank you enough for your knowledge and your legal expertise. Thank god for the internet!

to anyone that is having problems with NCO Financial, send a certified cease and desist letter to them!

Kim

Levittown,NY

#16 Consumer Comment

Steve...

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Thursday, January 10, 2008

Steve, Ignoring the first letter can lead to the second, next thing you know you're getting summoned to court. You don't respond, you loose. Best defense is a good offense.

As far as the debt validation letter. As I said in my post, google Debt Validation letter. (http://www.google.com/search?q=debt+validation+letter&ie=utf-8&oe=utf-8&aq=t&rls=org.mozilla:en-US:official&client=firefox-a) and you will get plenty of examples of letters to send requesting a validation of the debt.

As for the response letter from NCO, when I can figure out how to scan the d**n thing, I will be happy to post it.

Basically states:

Thank you for your inquiry regarding the account listed above. Please be advised that this account is closed in our office.

According to our records, we have not reported the account to a credit bureau. Please be advised that NCO Financial Systems, Inc. cannot effect a change as to how any other company may have listed the account on your credit profile. We appreciate the opportunity to respond to your inquiry.

But then, being the cynic you are, you will believe what you want.

#15 Author of original report

Thanks for your help

AUTHOR: Kim - (U.S.A.)

SUBMITTED: Thursday, January 10, 2008

Robert,

I did send a couple of "cease and desist" letters out certified. They signed for them last week and havent heard nothing yet.

I have another cease and desist letter I got from goggling it I may send out to the Corporate Attorney of NCO.

Thanks for making me feel like I'm not alone in this issue..

Kim NY

#14 Author of original report

Thanks for your help

AUTHOR: Kim - (U.S.A.)

SUBMITTED: Thursday, January 10, 2008

Robert,

I did send a couple of "cease and desist" letters out certified. They signed for them last week and havent heard nothing yet.

I have another cease and desist letter I got from goggling it I may send out to the Corporate Attorney of NCO.

Thanks for making me feel like I'm not alone in this issue..

Kim NY

#13 Author of original report

Thanks for your help

AUTHOR: Kim - (U.S.A.)

SUBMITTED: Thursday, January 10, 2008

Robert,

I did send a couple of "cease and desist" letters out certified. They signed for them last week and havent heard nothing yet.

I have another cease and desist letter I got from goggling it I may send out to the Corporate Attorney of NCO.

Thanks for making me feel like I'm not alone in this issue..

Kim NY

#12 Author of original report

Thanks for your help

AUTHOR: Kim - (U.S.A.)

SUBMITTED: Thursday, January 10, 2008

Robert,

I did send a couple of "cease and desist" letters out certified. They signed for them last week and havent heard nothing yet.

I have another cease and desist letter I got from goggling it I may send out to the Corporate Attorney of NCO.

Thanks for making me feel like I'm not alone in this issue..

Kim NY

#11 Consumer Suggestion

Robert, you are absolutely wrong!

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Thursday, January 10, 2008

Robert,

Ignoring a collection letter CANNOT cause a "win by default". Ignoring a SUMMONS may result in a default judgement being granted. However, no lawsuit has been initiated here, and no summons has been served.

Therefore, ignoring the letters is the best policy. As soon as you respond, the priority on the collection account just got elevated as "contact" has been made. Collection efforts will now be increased.

And, be careful of how you word things. Advising the OP to send a "debt validation letter" is the improper terminology and could actually validate the debt!

What they want to send is a "REQUEST for debt validation".

I seriously doubt that you got a response from NCO on a debt validation request, as it is thier standard policy not to respond.

>>

Robert

Rochester, New York

U.S.A.

Kim, you are not alone.

A lot of us have received this letter...

Just a few words of advice.

NEVER just ignore it. If you ignore it, they will win by default.

NEVER talk to them on the phone. Do everything by mail (CM/RRR)

Send them a Debt Validation Letter (do a google search, there are plenty of examples)

By law, they are required to validate the debt. They are also required to cease all collection activities until they do).

I sent them a DV letter and received a letter back today stating they have closed the issue. In other words, they couldn't prove the debt was valid.

These are bottom feeders. Stand up to them and they will go away.

>>

#10 Consumer Comment

I would also recommend....

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Wednesday, January 09, 2008

anyone being contacted by a credit collection agency or bill collector get a copy of the

Fair Debt Collection Practices Act (FDCPA) and the Fair Credit Reporting Act (FCRA).

These can both be found in a PDF format by googling them. Download, print them and READ THEM. It is important to know your rights and these spell out exacty what bill collectors and credit reporting agencies are NOT allowed to do.

and the best advice; DO NOT TALK TO THEM ON THE PHONE!!! Only communicate with them by mail.

#9 Consumer Comment

I would also recommend....

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Wednesday, January 09, 2008

anyone being contacted by a credit collection agency or bill collector get a copy of the

Fair Debt Collection Practices Act (FDCPA) and the Fair Credit Reporting Act (FCRA).

These can both be found in a PDF format by googling them. Download, print them and READ THEM. It is important to know your rights and these spell out exacty what bill collectors and credit reporting agencies are NOT allowed to do.

and the best advice; DO NOT TALK TO THEM ON THE PHONE!!! Only communicate with them by mail.

#8 Consumer Comment

I would also recommend....

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Wednesday, January 09, 2008

anyone being contacted by a credit collection agency or bill collector get a copy of the

Fair Debt Collection Practices Act (FDCPA) and the Fair Credit Reporting Act (FCRA).

These can both be found in a PDF format by googling them. Download, print them and READ THEM. It is important to know your rights and these spell out exacty what bill collectors and credit reporting agencies are NOT allowed to do.

and the best advice; DO NOT TALK TO THEM ON THE PHONE!!! Only communicate with them by mail.

#7 Consumer Comment

I would also recommend....

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Wednesday, January 09, 2008

anyone being contacted by a credit collection agency or bill collector get a copy of the

Fair Debt Collection Practices Act (FDCPA) and the Fair Credit Reporting Act (FCRA).

These can both be found in a PDF format by googling them. Download, print them and READ THEM. It is important to know your rights and these spell out exacty what bill collectors and credit reporting agencies are NOT allowed to do.

and the best advice; DO NOT TALK TO THEM ON THE PHONE!!! Only communicate with them by mail.

#6 Consumer Comment

Kim, you are not alone.

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Wednesday, January 09, 2008

A lot of us have received this letter...

Just a few words of advice.

NEVER just ignore it. If you ignore it, they will win by default.

NEVER talk to them on the phone. Do everything by mail (CM/RRR)

Send them a Debt Validation Letter (do a google search, there are plenty of examples)

By law, they are required to validate the debt. They are also required to cease all collection activities until they do).

I sent them a DV letter and received a letter back today stating they have closed the issue. In other words, they couldn't prove the debt was valid.

These are bottom feeders. Stand up to them and they will go away.

#5 Author of original report

My response back to the two rebuttles about this report....

AUTHOR: Kim - (U.S.A.)

SUBMITTED: Saturday, January 05, 2008

I understand there is a statue of limitations. But, also, I am fighting this because this is a non-valid debt! I never had this credit card. I would remember, even that far back that I had a c/c with 5,600. on it!

I had to file bankruptcy around that time for a hardship, that so called Chase/assignee of Providence MasterCard was not a card that I had. I had a visa with 1,100. on it. I was always on top of my bills and paid them up to my bankruptcy and after that. If they had some more proof of this card that it was mine, I would'nt have an issue, but they cannot come up with anything else, that the last payment was in July of 1992! I told them, I'm not going to go and fork over that much money for a card I do not recognize, they need to have more proof than that! This is why I feel this was a "false" statement sent to me. NCO should be investigated.

I called my local newspaper and their suppose to do a column on it soon.

Too many years have passed since this so called account is due, no previous contact was ever made in sending me this "outstanding" bill. No phone calls, no other letters.

I feel NCO wants to see who will "break" and pay, and who will not! I'll never give in.

To stacey and michael, thanks for your comments, they really helped alot.

Kim, NY

#4 Consumer Comment

NCO junk debt buyers

AUTHOR: Stacey - (U.S.A.)

SUBMITTED: Thursday, December 27, 2007

DO NOT talk to them on the phone and do not return their phone calls - let voice mail pick that up

I have dealt with these bottom feeders who were trying to collect a debt from the company I work for

The responder had good advice - www.budhibbs.com

He is a good man and has great advice

Stacey

#3 Consumer Comment

NCO junk debt buyers

AUTHOR: Stacey - (U.S.A.)

SUBMITTED: Thursday, December 27, 2007

DO NOT talk to them on the phone and do not return their phone calls - let voice mail pick that up

I have dealt with these bottom feeders who were trying to collect a debt from the company I work for

The responder had good advice - www.budhibbs.com

He is a good man and has great advice

Stacey

#2 Consumer Comment

NCO junk debt buyers

AUTHOR: Stacey - (U.S.A.)

SUBMITTED: Thursday, December 27, 2007

DO NOT talk to them on the phone and do not return their phone calls - let voice mail pick that up

I have dealt with these bottom feeders who were trying to collect a debt from the company I work for

The responder had good advice - www.budhibbs.com

He is a good man and has great advice

Stacey

#1 Consumer Comment

rere

AUTHOR: Michael - (U.S.A.)

SUBMITTED: Thursday, December 27, 2007

NCO can TRY to collect all they want. No law against that. However, your alleged debt is no doubt way past the Statute of Limitations and therefore unenforceable. If you don't want to pay the debt there is nothing NCO can do about it. Just tell them to leave you alone.

Go to BudHibbs and debtorboards for ways to deal with NCO and many other junk debt buyers (JDB's).

Fight back!!

Advertisers above have met our

strict standards for business conduct.