Complaint Review: SunTrust Bank - Atlanta Georgia

- SunTrust Bank 303 Peachtree Street, NE, Atlanta, Georgia U.S.A.

- Phone:

- Web:

- Category: Banks

SunTrust Bank $4,000 in Overdraft Fees Atlanta Georgia

*Consumer Comment: Good points, Warren

*Author of original report: No Good

*Author of original report: Bank Initiating Response

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

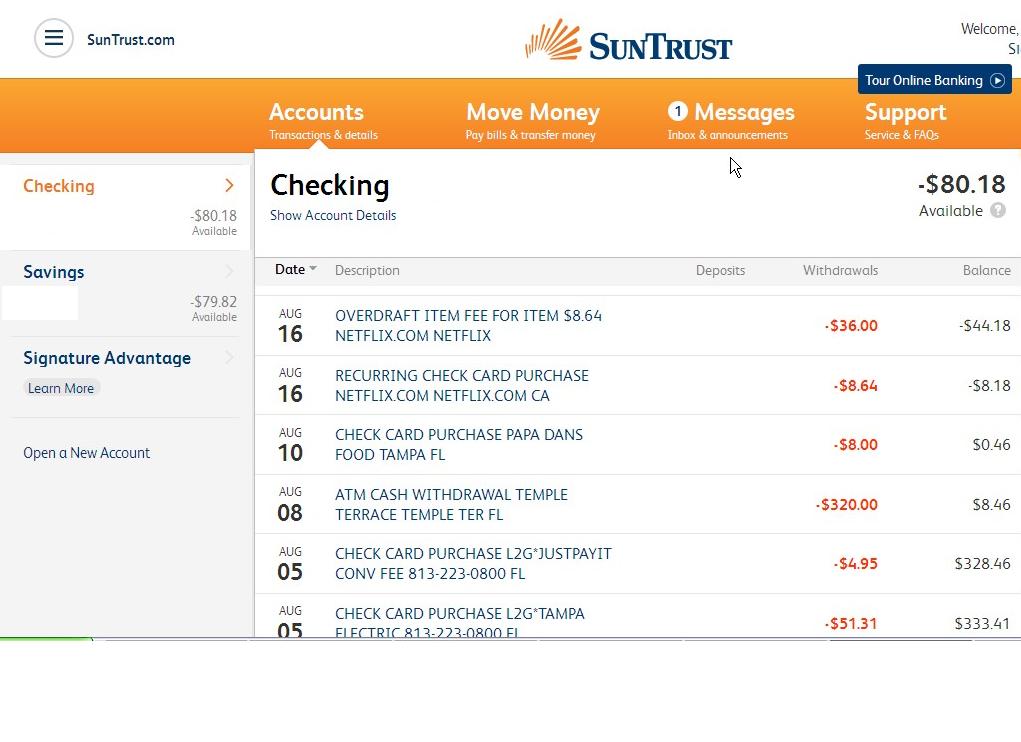

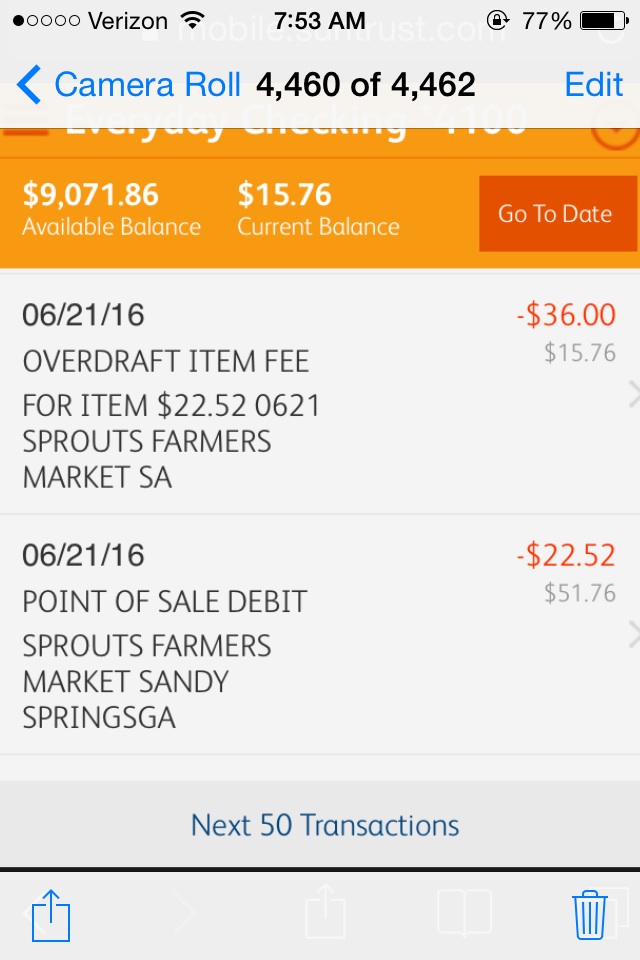

Due to a set of mistakes made starting in February, I was assessed over $500 in overdraft fees. Each overdraft fee put me deeper and deeper in the hole. On top of the overdrafts, I was assessed up to $70/day in overdraft fees everytime my account remained under 0.

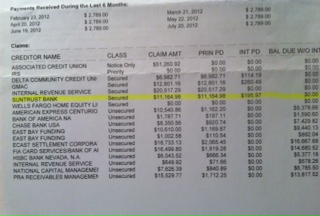

In total, SunTrust has assessed almost $4,000 in overdraft fees to my account. I have written my local branches, e-mailed customer service, and written CEO James Wells at Atlanta headquarters with no response at all.

I have held this account since 1993, when SunTrust was still known as Crestar. They have escalated overdraft fees from $8/instance to $35/instance, with the "bonus" of being hit further when below balance each day.

Though this theft is legal in the United States, it is equivalent of many 1000's of percent interest over the checks and debits I made and was unable to prevent.

If SunTrust reacts positively somehow to my correspondence, I will amend this report. In the meantime, I recommend this bank to NO ONE.

Warren

Springfield, Virginia

U.S.A.

This report was posted on Ripoff Report on 04/23/2008 09:26 AM and is a permanent record located here: https://www.ripoffreport.com/reports/suntrust-bank/atlanta-georgia-30308/suntrust-bank-4000-in-overdraft-fees-atlanta-georgia-328293. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#3 Consumer Comment

Good points, Warren

AUTHOR: Ken - (U.S.A.)

SUBMITTED: Tuesday, April 29, 2008

I would just like to add, rather than using automatic debits from a creditor, set up payments on your own bank's bill pay system. By doing this, you retain control, i.e. you decide when the payment is made, and you can cel an automatic payment if finances don't allow it.

Even more important is the fact that you are not divulging your banking information to a creditor and giving them control over your account.

#2 Author of original report

No Good

AUTHOR: Warren - (U.S.A.)

SUBMITTED: Monday, April 28, 2008

The Regional Manager refused to help regarding my account. I've had to dig deep into other family funds to pay off this account. I've told him that I plan to move my accounts out in the near future.

I'm hugely pissed off, but whoever reads this please remember:

1) Automated draft - don't use, unless you are certain as to the date and the amount of every account which drafts checking, be that your rent/mortgage, credit card, electricity, cable, etc. These services exist as a convenience to the *biller*, NOT YOU.

2) If you don't have enough funds at draft, you pay *two* sets of penalties each time - one large fee to the bank, one large fee to your biller.

3) If short on funds, it may be better to pay late, and avoid automatic drafts. Don't play with this. I've learned the hard way.

4) My extreme situation came from an out-of-control personal life, where I am very busy caring for my family. The odds of any of you dealing with my level of calamity are very low.

5) Open up an account with your local credit union; if not available, a small local banking firm. There is at least one bank advertised online that charges no overdraft fees, I can't remember the name - you may want to google it.

6) If you have automated drafts - go through the last 2 months of bank statements, and make a list of all the payees and amounts debited by draft. Either make a list of them to yourself and/or stop the automated drafts.

7) If not practical or possible to eliminate the drafts (some monthly subscription services) list them out and put that list in your checkbook.

Make a note every month of the amount of the payee name.

8) Your big bank *does not care* about having you and your business. They make much greater income on large business accounts, with large amounts of cash. Keep this in mind.

Thanks To Any and All Readers

Warren

#1 Author of original report

Bank Initiating Response

AUTHOR: Warren - (U.S.A.)

SUBMITTED: Thursday, April 24, 2008

I've now been told that the branch manager and others will be responding at some point in the near future.

Advertisers above have met our

strict standards for business conduct.