Complaint Review: Suntrust Bank - Charlottesville Virginia

- Suntrust Bank 303 Peachtree St. NE 30th FL Atlanta GA Charlottesville, Virginia United States of America

- Phone: 615-884-6372

- Web: suntrust.com

- Category: Banks

Suntrust Bank Marsha Walker Lifelong customer singled out and publically interrogated for trying to deposit a foreign check Charlottesville, Virginia

*Consumer Comment: Good move on your part

*Consumer Comment: just a few comments.

*Author of original report: Yes, I am a smart woman

*Consumer Comment: Wow

*Consumer Comment: No I got your point

*Consumer Suggestion: You should have just left, and went to your regular branch

*Author of original report: Missing the Point

*Consumer Comment: Banks can't win

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

I've been a loyal customer of Suntrust for decades, even before it was Suntrust. They have the nicest people working in their branches. I never had a single proglem in all those years, until April 10, 2010. One bad employee introduced me to the hostile, elusive and unresponsive management structure. On that day I went to the drive-through at the Pantops branch, which I rarely use, to deposit a check from Germany. I've done this at least a dozen times over the years and I know there is usually a day or two extra delay for it to clear. After quite a few minutes, however, the teller asked me come inside. I asked why, but just repeated that I should come into the lobby.

The lobby is completely open, with desks on both sides. People coming in and out pass within a few feet of them and there are no walls or screens. You are completely visible and audible. I was met by Chris Gregoria, whose first question was, "Were you expecting this check?" I was taken aback by the stupidity the question assumed and by the intrusive nature of the question. I told him I was expecting it. His next question was "Do you know who sent you this?" Again, I was astounded. Yes, I'm in my mid 50s but it's not like I brought in a Publisher's Clearinghouse "Sample" check. Mind you, this conversation was held in the open lobby, and it was obvious that we were having a not pleasant exchange about a deposit.

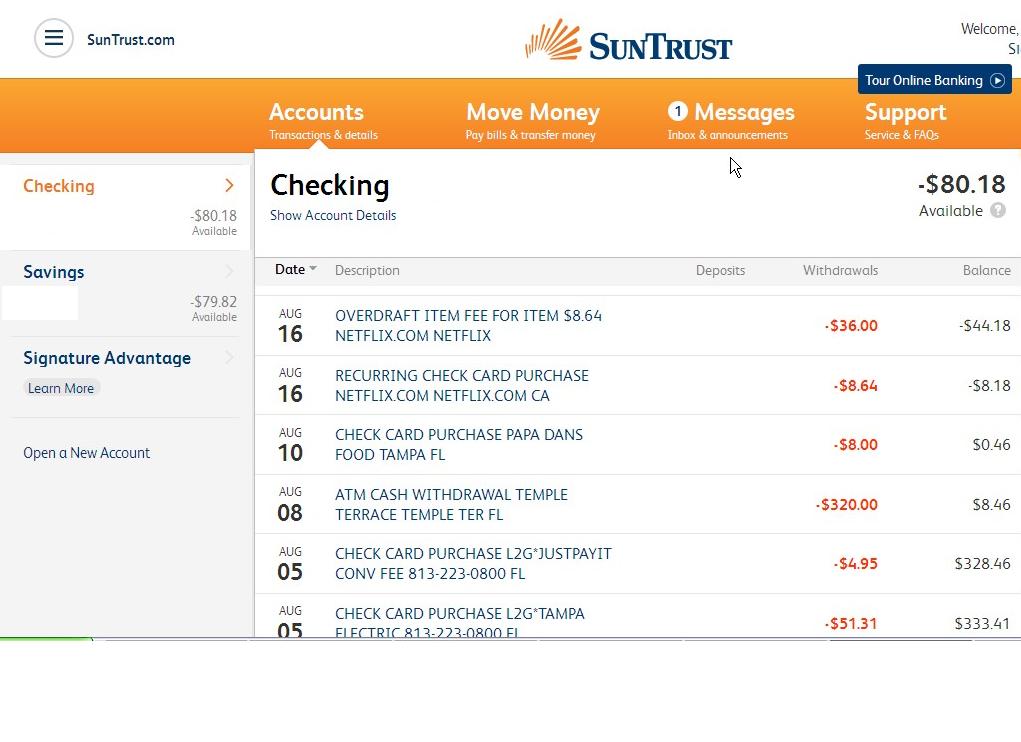

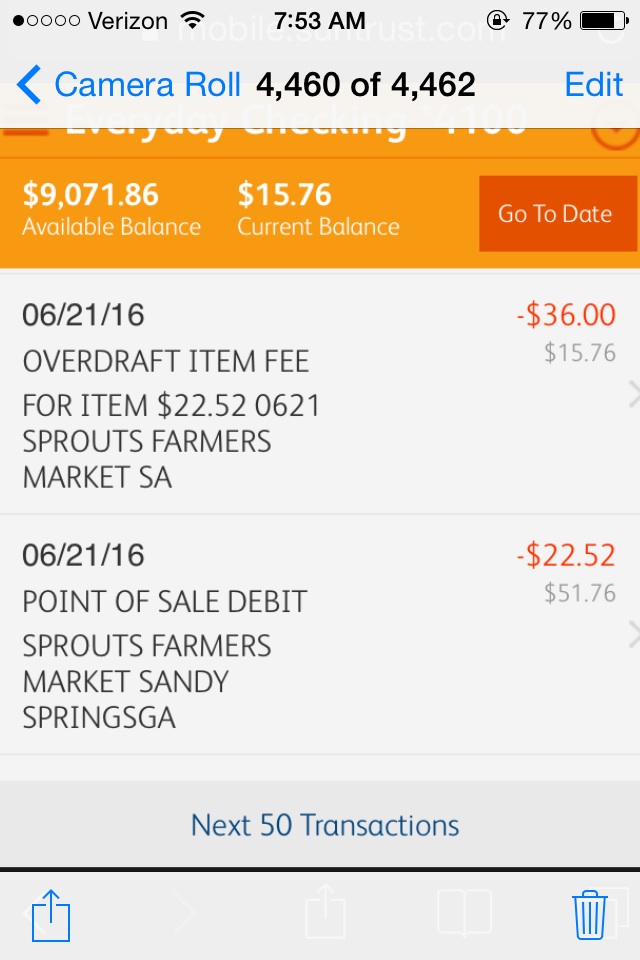

He told me had never seen a foreign check. I told him I had had deposited checks from the same German bank manytimes over the years and it was not a very large amount. He then presented me with a document (see photo) that he had already filled out. The form was stapled to my deposit slip and stated my deposit would not be available for 11 days. The reason? He checked the boxes for "We believe the check you deposited will not be paid for the following reason(s) and the reason he checked was "We are unable to contact/identify "payor bank" for verification." He said there was absolutely nothing he could do about it, and my two options were to take the check elsewhere or wait 11 days.

He had filled out this form before I ever entered the lobby. This is important because of later claims made by the President's Office. I asked if I could speak to the branch manager but was told there was no one there at the moment except him, and he was in charge. I asked if we could call the toll free customer # in Orlando for assistance. He declined. I asked him to check with a branch I typically usedthatmight perhaps have seen a foreign check. He refused but said I could just take the check there and he would cancel the deposit here. I asked him to call or Google the bank and I had their their contact info. He would not; he said he could not and yet the form said "we are unable to contact/identify payor bank"--when by his own statement it was impossible for him to attempt that. I asked him repeatedly why I had been singled out and said it was that the check looked odd to him.I asked him again to call the customer service number (toll free) in Orlandoand he refused again. So I called them on my cell phone while he just sat there at his desk. I told Orlando where I was and explained the problems I was having. After listening and apologizing, they put me on hold and then to my surprise called him. He complained to them about mycall to them and that I had"complained about me right in front of me."

The document he gave me clearly indicated that Suntrust believed this was not a good check and that I was either a criminal or an idiot.I then spent quite a lot of time trying toreach Suntrust's structure. I called Richmond Suntrust, who said they would never have processed the check that way.This helpful person connected me to an area manager back in the Charlottesville area. What I heard for this person was, as it turned out, the official Suntrust position: they had done nothing wrong. The young man was only trying to "protect" me. She seemed annoyed with me.

Eventually I found HQ in Atlanta, mainly by following SEC filings. I emailed Mr. McCoy who was PR Finance, as close as I could get to complaints. He helpfully directed me to Nedia, who was friendly but didn't meet her call back times, causing me to have to follow up to her. We mostly discussed the policies that Suntrust used to decide when a customer is going to be pulled out of line and given an inquisition about a deposit. She said there were policies and criteria and that she would send them to me. That never happened, but it was important because I believed the ignorance of Gregoria, who was not properly trained, and who also had a "big shot" complex; maybe it was because I was a middle-aged woman, or the check was from a foreign country or even in fact from Germany. How was I to know?

When Nedia failed to produce, I spoke with Marsha Walker, who is "Officer" in the Office of the President. I told the story again and said that given that I had to call Orlando on my cell and burn my minutes, given that I had been getting the run around, the least they could do, besides giving me those policies, would be a token of eventen bucks for my time and effort and expense with these long distance calls. She said they only did that when money had been lost. She also indicated that Suntrust reserved the right to question any person making any transaction. Of course, if you don't know the criteria for that, they can profile or discriminate or just hassle you because they feel like it. She also told me that "Legal" was reviewing this, whichcould only mean that they had cause for concern and that quite possibly Gregoria's conduct was actionable.

On May 22, 2010 Marsha wrote me a letter (see picture 2) stating "Because deposited checks drawn on foreign banks require special handling for processing, our representative invited you to come into the branch to see if he could assist you in having the collection of the deposited funds expedited for you." This is a lie; he had already filled out the form showing that far from being expedited, this check was going to be extra delayed.

She continued, "He also wanted to help verify the authenticity of the check in an effort to make sure that you were not a victim of a possible scam." A second lie; he made no effort to verify the authenticity of the check. In fact, he refused to do so. He brought me in because he thought I was trying to pass a bad check or I had been given a fake check and was too stupid to know it. Pre-screening deposits? Really? After all, if the check had been worthless, I would be the one to lose out and they would no doubt collect fees and make money from that.

Walker's letter, though brief, repeats those two points. She also said they made NO error, so no ten bucks for you but she assured me that Gregoria's actions were "not to imply any criminal actions on your part." Clearly, we disagree on the meaning of "assistance," which in Suntrust's lexicon means, challenging you and questioning you about a deposit because you or the check might be a scam"--but why was I selected for suchassistance? No, it was not "assistance"--Gregoria's form clearly meant "bad check."

It's also clear that Walker is psychic, because she is privy to Gregoria's thoughts and intentions. Clearly, she spun a story to make his actions defensible--and isn't it interesting that the Office of the President would thrown down over this lowly branch non-manager, maybe assistant manager, who knows? That even an inexperienced andvery poorly trained(especially in customer service) individual is protected at the highest levels? This can only mean they were worried and stonewalling.

Note too that there is no apology in her letter. Of course not, they investigated themselves and found they had donenothing wrong. Instead she writes "I am sorry that you felt this situation was mishandled and regret any misunderstanding that occurred." So this translates, in stonewalling as "I'm sorry your subjective--and completely wrong--"feeling" did not match the facts. I'm sorry you are so stupid." She also looks forward to serving me for many more years.

Of course Icanceled with Suntrust as soon as the last item cleared in my account. Suprisingly, the troublesome check actually cleared OVERNIGHT--so I guess that rule is a little slippery too.I hope Suntrust found it worth protecting anemployee like Georgia;I'm just one lifelong customer,after all. Butpeople should know whether there is an evil empire behind the smiling and truly nice people at the counters. You should also know if the bank has a policy of yanking you aside for a public, embarrassing series of accusations, all because, for example, a new guy has never seen a foreign check and has an attitude issue. But people like him cannot thrive without people like Walker to cover up his mistakes and protect him.

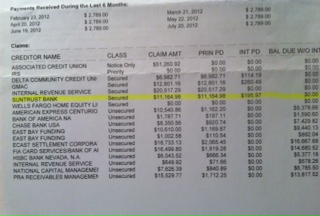

Speaking of knowing about banks,I was proud of Suntrust for not being in the news for accepting or needing bailout money. But I went to the SEC filings and guess what, they did. And I also thought they were just a bank. But the "bank" is just a branch of a holding company, SunTrust Banks, Inc. The holding company got special permission to do what an actual national bank can't:hold synthetic leases. They double dipped TARP funds and bucked their own shareholders --and TARP--to avoid restricting executive compensation. (source: WestLaw Business).

But what do I know, I'm just a middle aged stupid woman with criminal tendencies.

This report was posted on Ripoff Report on 01/04/2011 02:49 PM and is a permanent record located here: https://www.ripoffreport.com/reports/suntrust-bank/charlottesville-virginia-22901/suntrust-bank-marsha-walker-lifelong-customer-singled-out-and-publically-interrogated-for-678605. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#8 Consumer Comment

Good move on your part

AUTHOR: Anon. - (United States of America)

SUBMITTED: Sunday, August 19, 2012

Suntrust Bank is a bank with a troubled real estate portfolio, bad management, and poorly paid non-management ranked workers, making for a bad brew for customers. I imagine it's especially bad in a place like Charlottesville, Virginia where traditions, good breeding, manners, professional work, and money combine to hopefully insulate oneself from the horrors of the vice-versa. I worked at the Medical School of the University of Virginia for a number of years before moving South. You did the exact right thing. You tried to get satisfaction and failing that, you moved your account to another bank or credit union. Each of these banks must learn that they are NOT indispensable.

#7 Consumer Comment

just a few comments.

AUTHOR: Just a normal guy - (United States of America)

SUBMITTED: Monday, January 10, 2011

While I don't think this gentleman you initially dealt with inside the branch was as good at providing service as we'd like, understand a few things.

I don't work for Suntrust, but I do work in banking. He was probably new and had never personally seen what you deposited before. Should he have looked? Probably. However, in essence he did the right thing. One thing consumers rarely realize (why would they if they haven't been bankers) is that bad checks are held against the branch, and, often, the employee that deposited them if they come back bad and the employee didn't follow guidelines. A guideline might say "hold XXX types of check deposits for 11 days." Now, a manager CAN override that, however, if it DID turn out bad, he could be repirimanded, or fired, for going outside of policy. That is true even if he "called to verify" the check, since a person's statement on the phone of a bank across the Atlantic Ocean can't be easily verified.

It's true that YOU'd be out the money, however, if it were a situation where your account went negative and you never paid it back, THEY'D be out the money too.

He could have used some common sense, but in and of itself, he didn't do anything wrong. What he did wrong was not offer to call the other branch himself, or at least offer to take you into a private area (all branches have SOMEWHERE you can go) to discuss it. He seemed to be a bit too green to handle the situation but let's face it, ALL of us were new at our jobs once.

To your later bolded comments: It didn't "clear" overnight. They made it AVAILABLE overnight. Big difference. Let me offer you a secret - check clearing is done on an exception basis - banks are only notified when a check DOESN'T clear, they have no way of knowing automatically or through any sort of system that an individual check you've deposited has cleared the financial institution it was drawn on. The only way to know a check HAS cleared is to contact the other bank, and even that's not foolproof as it could still be disputed for fraud or improper endorsement after that fact.

Oh, and #3 comment - the ATM deposit is still handled by an individual the next day, they still could have asked her to come in or put a hold on it.

#6 Author of original report

Yes, I am a smart woman

AUTHOR: MJ - (United States of America)

SUBMITTED: Wednesday, January 05, 2011

I have a PhD and do sophisticated, real-world work. You seem far more interested in analyzing my psyche than looking at facts. This public inquisition was embarrassing and had I not pursued it, I would not have discovered the true nature of the corporate entity I use dealing with. And as one of the commenters below points out, and you would have seen if you read closely, I knew from prior experience this was not a fake check.

#5 Consumer Comment

Wow

AUTHOR: Hollie - (U.S.A.)

SUBMITTED: Wednesday, January 05, 2011

I have to say I too feel that you probably took this a bit far with all the calls and complaining, however saying that I guess I too would have been a little upset had this happened to me, however as someone else said I would have simply taken the check back and gone to my regular branch where I was known.

Now having said that, I must also say to the person who is basically saying your an idiot that considering you knew who this check was from and had acepted checks from them in the past that you knew this not to be a fraudulant check, not to mention most of these check scams involve the victim to deposit and cash the fake check the same day they recieve it, then turn around and western union the excess funds back to the scammer, being a breeder of cats I see this all the time and in my 13 years of breeding I have recieved my fair share of these fake checks with the instructions to cash the check as soon as I recieved it and although the kitty they were buying was only $1,200.00 the check was for $5,000.00 so I was then to turn around and western union the excess funds to their shipper because after all they couldn't just cut them a seperate check, that would after all be stupid!

Unfortantly over the years I have had many people fall for these scams and loose thousands of dollars because after all the customer of the bank is on the hook for the bad or fake check, therefor the person claiming the bank looses and never recovers their money is wrong because most people who have this happen to them are honest people therefor they do pay the bank back. I had a very close friend have her daughter fall for a scam like this, the only difference was they were money orders and the person sending the money orders didn't ask for any of the money, therfor their main concern was just to hurt someone and the bank allowed this girl to open a brand new account with these 4 $800.00 money orders, deposit only 1 and cash 3 of them, then 10 days later the girl is notified that the money orders were in fact fake and now she is on the hook for $2,400.00 and if she doesn't pay them back she will go to jail and the police were notified and she had to set up payment arrangements with the bank to pay them that money back. Now this would have been the perfect chance for the bank to ask those all important questions, such as do you know the person who sent these to you and the answer would have been, not really and a red flag would have went up. I was even surprised when I learned of this considering she opened a new account just to cash them, it wasn't like she had been a long time customer with the bank or anything, that alone should have given the bank cause for caution.

I do believe this guy who handled this woman the way he did was very unprofessional and he should have taken her to a closed office to discuse the issue, no one wants their business out there for anyone walking by to hear and I disagree that those walking by listening was just more in her head then reality because people can't help but to listen to situations like this so I do believe everyone who came in and heard the conversation being a bit hostile did tune in. Do I believe the bank owes her for used cell phone minutes or long distance calls? No because as already pointed out she could have handled the situation differently and simply taken her check back and gone to her normal branch and problem probably would have been solved, but I don't think anyone has the right to treat another as a criminal for no good reason.

I'm sorry to hear that this happend to anyone but I am also glad to know that you have severed your relationship with this bank and have found another youare more comfortable with.

#4 Consumer Comment

No I got your point

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Wednesday, January 05, 2011

You think because you are a middle aged woman you are so smart that you could NEVER fall for any of these check scams, and as such you don't ever want to be asked any questions. Okay well let's hope you never do become a victim of a scam. But if you do I would be willing to bet that the first thing you would do is to blame the bank that they should have done more to protect you.

Could the manager have been more "tactful"..possibly. But I think that you inferring that because people were passingby you that they were listening to the converstation was more "in your head" then "in reality".

If the other branch didn't give you any problems, why didn't you just go back there? After all even the "manager" gave you that option to take the check back.

It would be great if there were not scammers out there, and there were no bad checks. But that is not the case. You basically "went off the deep end" and probably shouldtake a step back. In that everytime someone asks you a couple of simple questions they are not accusing youofbeing some major criminal.

#3 Consumer Suggestion

You should have just left, and went to your regular branch

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Wednesday, January 05, 2011

I think you put way too much time and effort into this. Even I would have just snatched the check and the paperwork out of that punks hand and just went to my own branch.

Or, you should have walked out the door and done an ATM deposit! Then they would have to take it and just deal with it, no paperwork!

The problem here is that this punk obviously was too young and inexperienced to be left "in charge". And, most banks don't pay anything so they cannot attract the smartest people in the world. This kid was obviously just a robot.

And, banks will NEVER admit wrongdoing of any kind as it opens the door for lawsuits. They are taught to never admit fault.

This kid just didn't have any common sense, or business "tact". He should find another line of work.

#2 Author of original report

Missing the Point

AUTHOR: MJ - (United States of America)

SUBMITTED: Tuesday, January 04, 2011

Sir, you are missing the point. This checks have always been handled routinely by other branches. This was one employee who behaved inappropriately. So yeah, "the banks can't win" -- when they have poorly trained employees who have never seen a foreign check and have zero interest in customer care.

#1 Consumer Comment

Banks can't win

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Tuesday, January 04, 2011

I'm in my mid 50s but it's not like I brought in a Publisher's Clearinghouse "Sample" check.

- Since you are a middle aged woman(a fact you mention several times), you know that was not the problem. Because all they would have had to say in that case is "Do you know it is not a real check". In fact if the bank did try to deposit it, you would have a very valid complaint that they are clueless.

He brought me in because he thought I was trying to pass a bad check or I had been given a fake check and was too stupid to know it. Pre-screening deposits? Really? After all, if the check had been worthless, I would be the one to lose out and they would no doubt collect fees and make money from that.

-Wow...When banksdeposit checks that are scams, by people who are "too stupid to know it", the banks get accused of doing that just to gain overdraft fees.Yet whenthey actually ask some questions then otherpeople complain that they don't want to be asked, and are more than willing(they say) to accept the consequences.

Oh and if you actually did research on thesescams you would realize that quite often it is the bank who looses. Because part of the scam is to send money by a Money Gram to a FOREIGN COUNTRY. But by the time it is discovered it is a scam, the money is gone from their account and the person is left owing the bank anywhere from a couple hundred to a few thousand dollars. With a high probability that the bank will never recover that money.

These scamsinvolve checks that appear very real. Why? Because they are very often real checks that have been stolen, or high quality counterfeits. So as much as you don't want to hear it those were very logical questions and IF in fact it was a fradulent checkyou would probably be very thankful.

Based on your reaction to this, I'd hate to be the person who tells you left your car headlights on. You would probably think that was some covert attempt to accuse you of stealing a car.

Advertisers above have met our

strict standards for business conduct.