Complaint Review: Suntrust Bank - Homosassa Florida

- Suntrust Bank S Suncoast Blvd Homosassa, Florida USA

- Phone:

- Web: www.suntrust.com

- Category: Banks

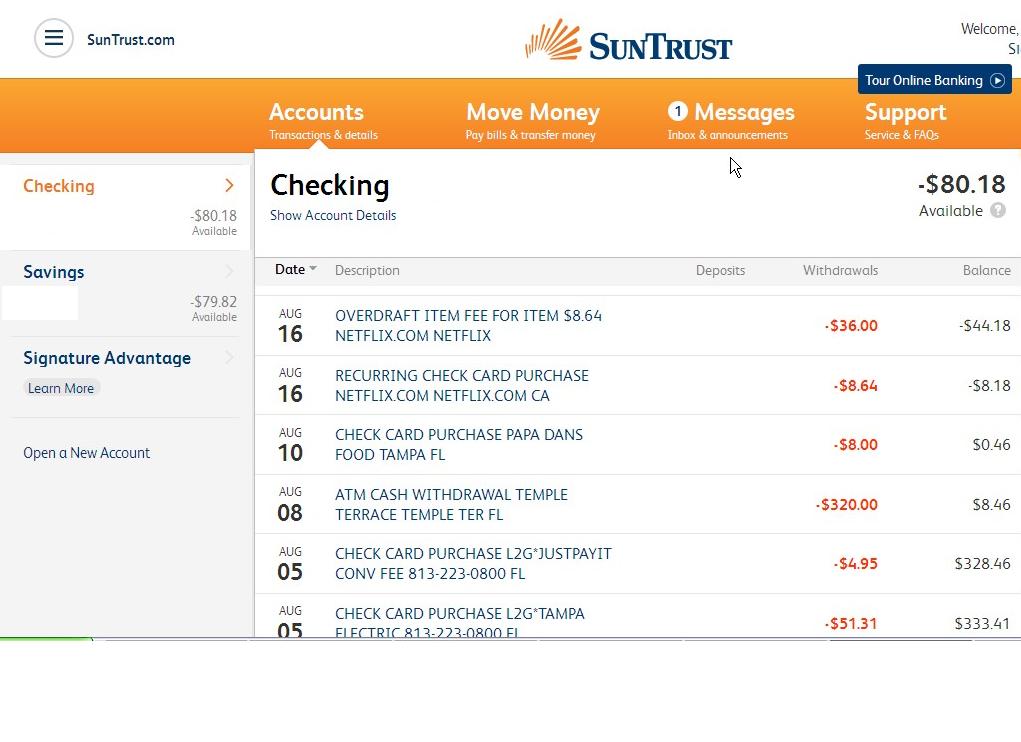

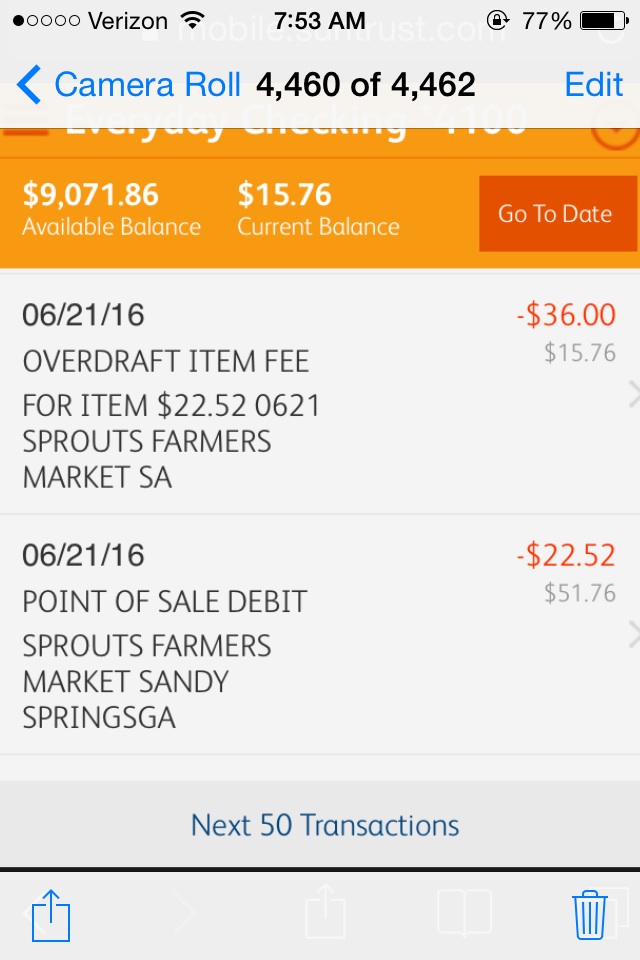

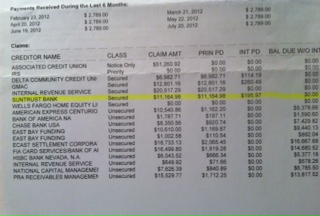

Suntrust Bank Florida Three weeks after closing an account I been charged to overdraft protection fees. After the account was close! It was closed Because of excessive overdraft protection fees and other unexpected fees. Fees that were never concurred when I first became a SunTrust customer. Apparently SunTrust management does not give their representatives any leeway to credit any charge whatsoever. They're extremely hard nose. They're just taking our money because they can. When your money is in an account that other people have access, they just take it. It's greed. SunTrust is a greedy bank & after 15 years I'm sick and tired of it Homosassa Florida

*Consumer Comment: I don't get what you said whatsoever!

*Consumer Comment: You'll Be Sick and Tired At ANY Bank!

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

Closed one of my accounts recently because of excessive fees. Anil is Asian fees. Overdraft protection fees even though my other account had 50 times as much money. I close my account over three weeks ago and I'm still concurring charges (overdraft protection) SunTrust is not give any leeway to their managers to do quick any credit whatsoever. They're very hard nose, they're very greedy. If you give your money to an institution to take care of, and may have access to your money they will take what they can whatever way they can. That's what SunTrust's been doing to me often on for the last three years. I finally decided to stop it almost one month ago and there still taking money from me! SunTrust is greedy! I'm so sick and tired of them

This report was posted on Ripoff Report on 08/12/2013 09:34 AM and is a permanent record located here: https://www.ripoffreport.com/reports/suntrust-bank/homosassa-florida-34446/suntrust-bank-florida-three-weeks-after-closing-an-account-i-been-charged-to-overdraft-pr-1075041. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#2 Consumer Comment

I don't get what you said whatsoever!

AUTHOR: MochaG - ()

SUBMITTED: Monday, August 12, 2013

Anil is Asian fees. Overdraft protection fees even though my other account had 50 times as much money.

I don't get it. What is "Anil" and why would it be associated with "Asian"? This is an odd report.

Also, the bank representative should have asked you whether or not you want overdraft protection service when you open/change your account. If they did not, they you may blame it on the representative. If they did and you accepted it without understanding or asking for its fee clarification, then it is yours.

Anyway, 2 different accounts are NOT related when it comes to fees even though they both are under the same name. They (and any bank) are NOT going to do the extra work to pull money out from a different bank account because it could create another problem. I guess you do NOT know or want to know the scenario, but I will give it out here anyway. What if a person has 1 checking and 1 saving account. The person has tons of money in his saving but very little in his checking. Let's say he has already reach the number of withdrawal limitation (usually maximum is 2 times a month) from his saving account for that month. During the month, he overdraft the money from his checking account. Now tell me what happens if the bank automatically pulls the money from his saving account even though the account still has tons of money? Of course, instead of NFS fee is incurred, the over maximum limitation fee will be in place instead.

No bank will implement the system you are expecting (automatically withdraw from another account). It is user's authority to do so and banks have no business with. If you overdraft it, you pay for it.

That said, where does your overdraft come from? Is it from another overdraft or is it from auto-payment you set up? If it is from either of those, it is your responsibility. Closing an account does NOT stop the charge because you are responsible to pay in full and/or cancel the auto-payment before you close it.

#1 Consumer Comment

You'll Be Sick and Tired At ANY Bank!

AUTHOR: Jim - ()

SUBMITTED: Monday, August 12, 2013

People GIVE THEMSELVES overdraft fees because they don't keep wrtitten records and a running balance but keep writing checks/using an ATM card without having the slightest clue as to what they have in the account. So be prepared to be sick and tired of any other bank. If you can't/won't keep a check register and a running balance, you'll be overdrafting there too!

Advertisers above have met our

strict standards for business conduct.