Complaint Review: SunTrust Bank - Internet

- SunTrust Bank www.suntrust.com Internet U.S.A.

- Phone: 800-273-7827

- Web:

- Category: Banks

SunTrust Bank 'Bank Policy' designed to rip off checking account customers Atlanta Georgia Internet

*UPDATE EX-employee responds: Spending money you don't have, or How the South was won

*Consumer Suggestion: the bottom line here is...

*Author of original report: Business as usual

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

My original account was opened with a small local bank called Bay Savings; they were purchased by Tidemark Bank, and aquired by Crestar which became Suntrust.

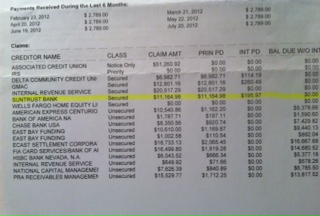

For the most part, I was treated well with each merger and having a small savings account with a few thousand dollars in it, a checking account, and at one time a money market account at SunTrust. It is obvious that they love you if you have money, but if you have a tough period they will the first to suck you dry.

We have had a reduced income for a couple years, higher expenses, and eventually closed the money market account, and then the savings account. My premium checking account then cost me $13.50 a month, and I didn't look into changing that for a little more than a year, unaware I was eligable for a no-fee checking account - shame on me, a couple hundred bucks for SunTrust.

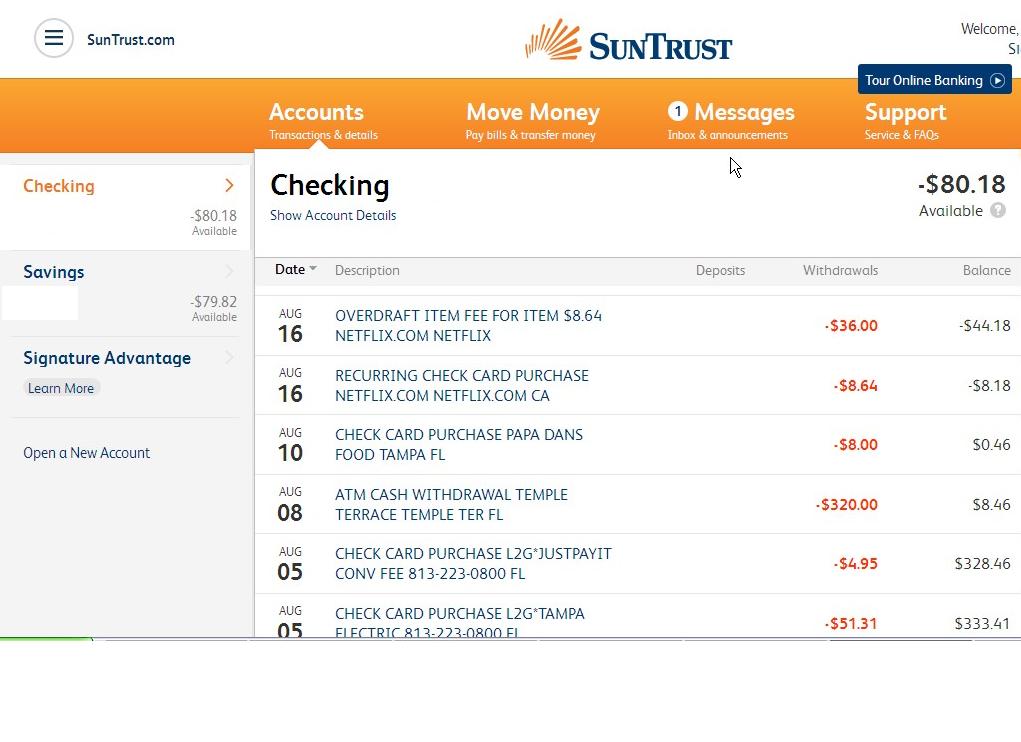

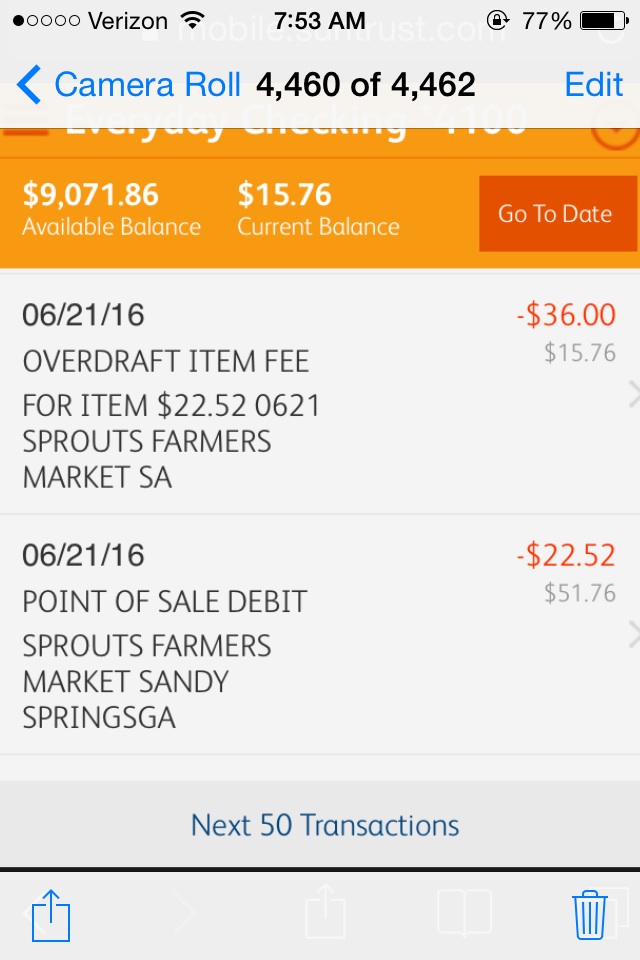

Then I had a few problems where a pre-authorized debit to the account that quite frankly I didn't deduct caused an overdraft; when I called the 800 number and pointed out that several pending transactions did not post for nearly five days until the larger amount overdrew the account, the rep explained that though they were pending and not part of my availible amount, they weren't actually paid. Now, the check that caused my account to be overdrawn? It was actually paid, and SunTrust charged me an NSF fee ($35). I could live with that, except they went on to pay all the pending items too, and charged me $35 for each of those, to the tune of $175, including one that was a monthly subscription via PayPal for $1. RIDICULOUS. I managed to get two of these charges refunded, but I was told that the 'POLICY' was to attempt to pay the larger amounts FIRST (they did, by the way) because those presumed to be the most 'IMPORTANT.' Not the ones pending from days prior to that, oh no.

Here's how this works out. Rather than pay all the smaller balances that WOULD clear the account and charge for the ONE check that wouldn't, or heck, go ahead and return it and let the customer deal with the person they wrote it to, (by the way $35 is TOO MUCH to charge for this sort of thing) SunTrust essentially LOANSHARKS the customer by charging the MAXIMUM number of fees it can. After all, they PAID the charges I made! But they collected on ME instead of simply saying 'oh, the money isn't here, sorry it can't be paid' and decline the payment. They certainly can determine the money is or isn't there if I can come home from Walgreens and see the charge I just made in my pending transactions on line.

NO EXCUSE. I would rather pay them $35 ONCE and pay a returned fee to the company I bounced the check on (usually $25-40) and still be out HALF of what I am out because of SunTrust's self-serving policy.

The real shame is that when we were trying to refinance our house years ago, I actually asked SunTrust to call us and set up an appointment to discuss handling our mortgage. They never (well, over the course of a month) called us back, and I found another financial institution to take care of us. Maybe that's a good thing after all.

John

Hampton, Virginia

U.S.A.

This report was posted on Ripoff Report on 12/12/2008 09:41 PM and is a permanent record located here: https://www.ripoffreport.com/reports/suntrust-bank/internet/suntrust-bank-bank-policy-designed-to-rip-off-checking-account-customers-atlanta-georgia-400882. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#3 UPDATE EX-employee responds

Spending money you don't have, or How the South was won

AUTHOR: Edgarfigaro - (U.S.A.)

SUBMITTED: Friday, February 20, 2009

First off you have to realize what country you live in. It's a capitalistic economy that we live in. It's not fair. It was never intended to be such. As a result businesses have the right (in the fine print you signed) to function under their own rules while still adhering to both state and federal guidelines.

Overdraft is common. It's very common. To the tune of millions of dollars a month common. Let's say you start with $100 you have two debit card transactions on a particular day $10 and $65 leaving you with a $25 available balance. Those charges can be on hold for as long as the merchant you purchased from want's them to be on hold. Normal time to post is 3-5 business days. In the time I spent with SunTrust I've seen them last several weeks too. Now if something else posts onto the account first for $30 then you have a -$5 available balance, and those two debit transactions will be charged a $35 Unavailable Funds (UAF) fee. Regardless. Yes that fee is high, but most of the larger banks are all charging in the same price range. You signed a contract with them that allowed them to do that. And yes, even if you overdraw your account by $0.01 you will be charged that fee. I know it's ridiculous, but again, good luck finding a bank that doesn't do that. Remember that word I used up top? "Capitalistic?"

All banks process the most important items first, and by that I mean the largest items. It makes logical sense. If your housing payment is due wouldn't you want that to pay rather than have that returned back because they allowed other, smaller, charges to go through first?

In these instances the branch managers have limited ability to refund charges, and in most cases they won't anyway because the bank has to make money. Plain and simple. In order to get a charge over a certain limit taken off that has to go one or two steps higher, and honestly even then its incredibly difficult to have done when it is clearly your fault.

Realize though that everyone at the branch level wants to help you. That's their entire purpose for being there, but they cannot protect you from bad spending habits, they can only offer advise. SunTrust is a great bank. If this were any other bank I wouldn't even bother writing this, but you cannot blame the bank for your financial difficulties and you cannot expect them to bend over backwards when they are not at fault. Item processing is standard everywhere, it's designed to help the company make money while at the same time make sure that your larger purchases are not sent back forcing you out of your home or causing you to lose a method of transportation. And the same goes for not flat out refusing to process the debit. If your car broke down in the middle of nowhere and you needed $100 to get back home, but only had $5 in the bank, wouldn't it be worth it to have a debit card that will allow you to do that, or would you rather be without help?

And yes, I had to give a speech similar to this several times a day every day I worked at SunTrust because people just can't seem to understand NSF fees.

#2 Consumer Suggestion

the bottom line here is...

AUTHOR: D K - (U.S.A.)

SUBMITTED: Friday, January 16, 2009

YOU spent money that YOU did not have available in YOUR account. That is YOUR fault, not the banks. It is common practice that when several charges/checks come in at the same time, they post from largest amount to smallest. Is this nice? NO. Are they within their rights, Yes. Dont spend money you don't have.

#1 Author of original report

Business as usual

AUTHOR: John d - (U.S.A.)

SUBMITTED: Thursday, January 15, 2009

Suntrust hasn't bothered to respond to this report. I think they are overwhelmed with all the other headlines in Ripoff Report. Plus, there is no disputing my claims. They had offered to stop my monthly maintenance fees because my wifes' employer is a major customer of theirs and has an employee program. Well, I had to call again because they never stopped billing us the $13 a month. Refunded (supposedly) one month's fees. Suntrust is definately not suffering in this economy and doesn't deserve any bailout, ever!!!!

Advertisers above have met our

strict standards for business conduct.