Complaint Review: Suntrust Bank - Internet

- Suntrust Bank 5305 Windward Parkway West, Alpharetta, GA 30004 Internet United States of America

- Phone: 770-752-5150

- Web: https://www.suntrust.com

- Category: Banks

Suntrust Bank Charged overdraft fee when I no longer have overdraft protection Internet

*Consumer Comment: If this is the case...

*Consumer Comment: Okay then

*Author of original report: Thanx, but your wrong!

*Consumer Comment: one other exception..

*Consumer Comment: But still Robert...

*Consumer Comment: You missed the point

*Consumer Comment: Yep is right..we are just FLOODED with complaints since the changes...

*Consumer Comment: Yep..

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

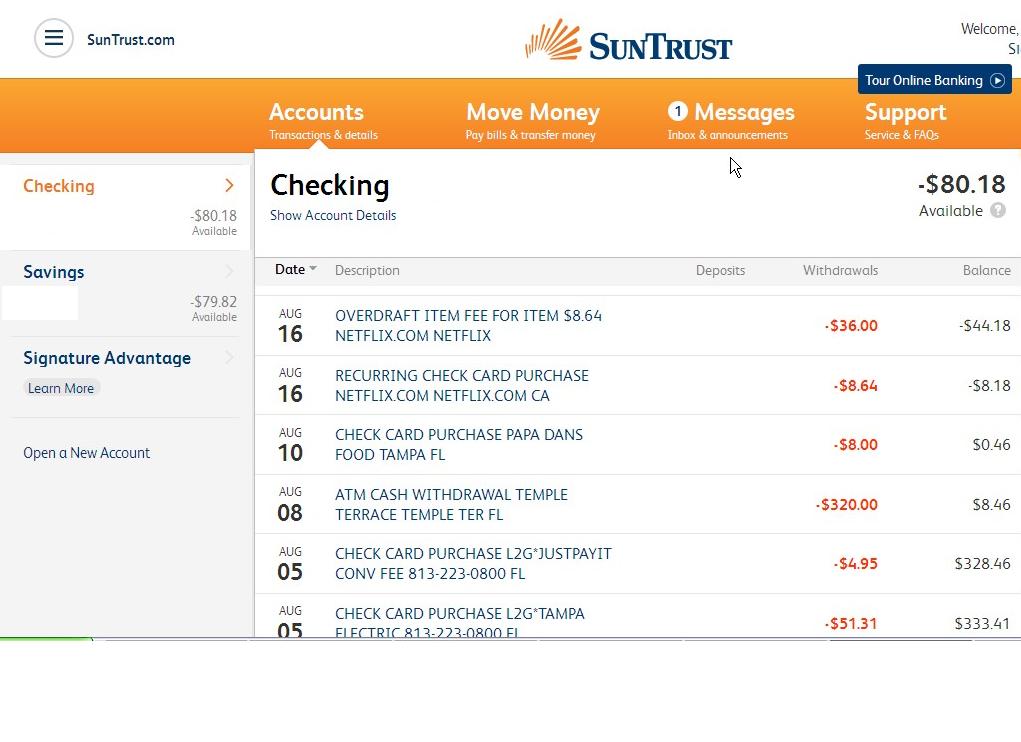

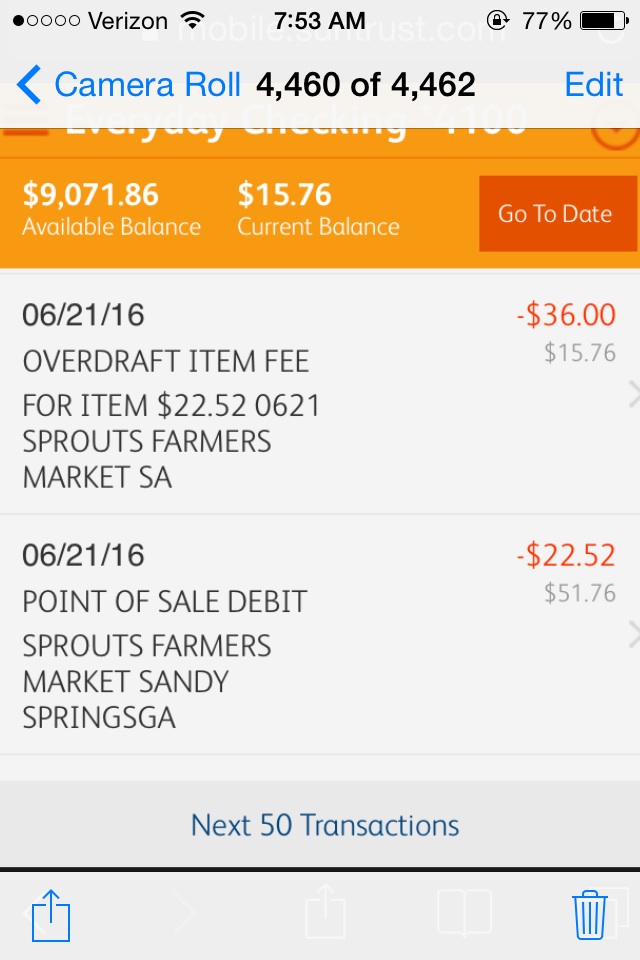

Since the government intervention to banks over charging thier regualr Joe's customers overdraft fees, I received a letter stating that if I didn't notify them by this date that I would no longer be enrolld in he overdraft protection program, this happend in August. So this means that if I don't have enough money to cover a charge then my card gets declined. Now I am just a regular Joe, I don't make a lot of money and I pretty much have to live paycheck to paycheck, with that saying this means my account is usually on the thin side. Here is the story...I paid my rent on Tuesday, on Thursday I check my account and the check still has not posted, Now I know my payroll check is going in at midnight Friday morning. I decided to get some gas because I was really low. I make my purchase with no problem. I check my account the very next day so that I can see what is out there and I what do I see a NSF for $36.00 becaue I went over by $5 and some change. I called the bank and the lady states that the check posted yesterday, and I said then how was able to make a purchase when I am not enrolled in any overdraft program. She states that I had money then but when the check went in it put me in the red. I could not get a straight answer from his women and she definately wasn't any help and kept trying to tell me that the charge was lagit. It isn't, and because my card should have been declined and was not. I know that these banks have special software that helps them maximise on profits. This is not right.

This report was posted on Ripoff Report on 10/08/2010 06:55 AM and is a permanent record located here: https://www.ripoffreport.com/reports/suntrust-bank/internet/suntrust-bank-charged-overdraft-fee-when-i-no-longer-have-overdraft-protection-internet-648795. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#8 Consumer Comment

If this is the case...

AUTHOR: Ronny g - (USA)

SUBMITTED: Monday, November 22, 2010

Then I have to agree with Robert 100%, and we often do not see eye to eye.

The purpose of disclosing the OD coverage opt out..has nothing to do with checks. It only has to do with debit card usage..as how many use a check for a coffee or gas? A check payment is a COMMITMENT similar to cash, and if the account can not cover the check, as since the beginning of banking probably since my great grandparents used checks, you get a fee.

You see, when the banks were not properly disclosing OD coverage on the debit card usage, or forcing every single customer to have the coverage..it was in a sense an unauthorized "loan" so to speak, at unspeakable interest rates.

Bouncing a check on the other hand..is not a loan. It is common knowledge that it will bounce and you get return fee..or they cover it and you get an NSF fee...no scam or deception in any way shape or form sorry to say. You are stuck with this fee regardless or not choosing the protection regarding your debit card. You messed up if this is the case, not the bank.

#7 Consumer Comment

Okay then

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Monday, November 22, 2010

You wrote a check on Tuesday, got gas on Thursday all BEFORE your payroll check comes in on Friday. You were in fact "opted-out" of the automatic Overdraft Protection, but again that was ONLY for Point-of-Sale transactions and not Checks. The rent CHECK was cashed after you got gas and thus is where the Overdraft fee came from.

Now, if I mis-read your posting and this is not the scenerio that happened then please enlighten us on the "true" scenerio.

#6 Author of original report

Thanx, but your wrong!

AUTHOR: Angie - (USA)

SUBMITTED: Monday, November 22, 2010

Hello Robert,

Nice snario, but that isn't at all what happened, I was being responsible, but it seems you know me better than myself. When I fisrt wrote the report I hadn't even been to the bank yet, and when I did, that teller didn't know what to say, because I was right and they were wrong, but he couldn't do anything for me.

#5 Consumer Comment

one other exception..

AUTHOR: Ronny g - (USA)

SUBMITTED: Monday, October 11, 2010

..those that were foolish enough to sign up for OD coverage. You will still see some complaints by those no doubt from time to time.

But, I can not have near as much compassion or sympathy in that case. I can only suggest as always, to keep better track of the account, and for their own good to get to the bank ASAP and cancel the enrollment of the coverage, unless they enjoy an honest mistake costing them a considerable amount of money.

Now there may be certain cases where a customer believes the OD coverage can do good in an emergency (and this is what many banks are telling their customers to encourage enrollment, among other things), and to that I say..beware. It would be much wiser to have another card that is kept for emergency or another account. But not everyone can afford this. So they must ask themselves..can they afford the fee(s)..even in an emergency? Can they be so careful to keep track with every little thing they use the card for, to know for a fact they will never have fee(s)? Can they afford these fees in the event?

Can they afford that if a merchant places an unknown hold on the account, that transactions will be covered if overdrawn and they will not be aware they are incurring fees? Can they afford if any unauthorized use causes fees, and the bank tells them it could take up to 30 days or longer to "investigate" and in the meantime not only are they wiped clean, but the fees will be taken regardless..possibly from the next paycheck if direct deposit is used? This decision should not be taken lightly and the bank not only does not car about any hardship this may cause, but encourages it using any tactics they can think of. All should be considered.

#4 Consumer Comment

But still Robert...

AUTHOR: Ronny g - (USA)

SUBMITTED: Monday, October 11, 2010

..when was it ever not the point that a customer take responsibility?

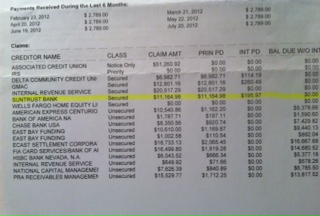

The point of the lawsuits, complaints, regulation changes etc, were to protect the banking customers from the banks tactics that were causing one legitimate overdraft fee to become as many as ten, and to stop the practice of the bank forcing and auto enrolling customers into OD coverage with the debit card.

Where did the FDIC report find most of these transactions took place? At small point of sale transactions, and ATM machines. And mostly by lower income segments.

The fact that the banks can no longer force enrollment into OD protection..has seemed to stop 100% of the complaints regarding debit card overdrafts due to small POS and ATM. The exception being the gas pump scenario which is being looked into, and those that think the regulation change means they can float checks. (Other then Chase I do not know of any other banks that will allow this)

You can look for yourself in the reports under banks and see there was a time when a few reports a day were coming in. Now..zero.

So..yes..customers did not suddenly become any more or less responsible then they ever were, the only difference is the banks can no longer swindle loyal customers for making an honest mistake.

I would say that in itself..is a very good point.

I was never happy there are lawsuits..but what else is there to do to fight these giants who were fleecing the poor and others less fortunate?

It did NOT have to come to this. The banks decided on their own they were going to use these questionable tactics even admitting so at the risk of lawsuit and customer disapproval.

A copy of the Court's order can be found here.Why when I was proved 100% right in the past debates you would want to open this can of worms again is beyond me..but sometimes right wins out. Sure I agree..and never have disagreed that the customer need to keep a register and be responsible for the account. (I have requested time and time again to present evidence and no one has)But once it was discovered the banks were doing something shady, that as well needed investigation. And what was determined? That the banks AS WELL, must take responsibility for their actions. A register did nothing to prevent one legitimate overdraft from turning into as many as 10, and did nothing to warn a customer that an error would still allow the debit card to be approved even after the account was depleted. That as well..is simply the point.

Perhaps I have used the term "evil" banks..I do not recall specifically..but if what they were doing is not quintessentially evil, I do not know what is.

I have stated that once the changes take place I would actually defend the banks on related complaints that were lodged. And in some cases, I certainly have done so. Fair is fair, but to be a one sided person going through life with blinders on, helps no one. It does not hurt to see both sides. That is also a good point.

#3 Consumer Comment

You missed the point

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Sunday, October 10, 2010

The point was that even after these regulations(and any future regulations) are put into place. NOTHING can replace the account holder taking PERSONAL RESPONSIBILITY over THEIR account.

Are there less complaints about overdrafts..yes. There were several per week, but not per day..again exageration does not help any point you were trying to make. Remember these regulations went into effect in August and it did take a while for the first ones to "pop up", I don't remember any the first month or so. But there have been a couple in a fairly short time. How come? Are you saying that in that few weeks everyone was "perfect" in managing their account?

The lack of reports is probably a combination of things. The new regulations, which I am not going to deny has most likely cut down on overdraft fees. But all of the notices the bank sent out trying to get people to "opt-in" had people being reminded that they need to keep an eye on their balances. Also, these reports are being spread out in other areas, such as complaints on increased bank fees or having their accounts closed..yes there have been quite a few of those as well, especially right around the start of the new regulations. So I suspect that we will start to see more of these types of reports as people go back to their "old ways". Will it ever be the several per week..probably not. That is until people start to realize that they are paying fees for things that used to be free.

Oh and of course I don't like people getting overdraft fees. If I did I would not be telling people to manage their account. If one might say, they could say that you were the one who actually enjoyed people getting OD fees. Because until recently your "montra" was mostly "Banks Evil..Not your fault..Class Action Lawsuit".

#2 Consumer Comment

Yep is right..we are just FLOODED with complaints since the changes...

AUTHOR: Ronny g - (USA)

SUBMITTED: Saturday, October 09, 2010

Well not really..I counted 2 regarding the gas pump since the regulation changes.

But everything Robert stated is accurate. He did fail to mention that if you were to use your debit card as a DEBIT card and not a credit card at the pump, it will hold 50-75 dollars. Which means if the account can not cover it, it will be declined and you can go pay inside or use a different means. NO FEE. But bounce a check and all bets are off.

The new regulations have stopped ALL complaints so far on this site regarding overdraft issues with the debit card POS and ATM. And those that do not realize that an electronic payment is subject to ACH regulations and overdraft fees, they will learn soon enough. And as ALWAYS..bouncing a check will get you a fee. No one ever debated that..but granted...some will not understand, and can not manage an account. I have never seen anyone with any sense debate that.

I guess Robert is glad some people still manage to overdraft and get fees even when opted out...I mean it was getting a bit quiet in here. But one thing can not be denied..the regulation changes have prevented a lot more customers...good and bad..from being charged unjustly..and that to me is good news. I simply found other subjects to reply on since the overdraft reports are virtually gone..compared to the how many per DAY we used to see here before the regulation changes? Exactly as predicted..maybe I should claim to be psychic like Karl? JUST KIDDING!!!! I did not predict anything, I just posted the blatantly obvious.

#1 Consumer Comment

Yep..

AUTHOR: Robert - (U.S.A.)

SUBMITTED: Friday, October 08, 2010

I've said it before and I'll say it again. No matter what regulations or rules are put in place, these regulations will not protect people from themselves if they do not take RESPONSIBILITY over their account. The new regulations DO NOT guarantee you will never get an overdraft fee. All they do is if you CURRENTLY do not have enough money in your account they will decline your Debit/ATM transaction at the Point of Sale. The new rules do not apply to Checks or ACH transactions.

Here is what happened in your case.

You wrote a check and it was not cashed yet. Now, the bank has NO..that is ZERO..ZIP..NADA..ZILCH idea that you wrote the check. So as far as they are concerned you had the money in the account. You tried to rely on the "float", that is hoping that the check gets posted after your deposit comes in. If you haven't figured it out..that DOES NOT WORK.

So you decided to buy gas because you "thought" you had the money. But here are a couple of things you need to know. First if you pay at the pump they only authorize $1. As long as you had $1 in your account it would be allowed. Now, when they finalize the sale they will actually debit the real amount. That transaction must be paid because it was authorized..even if that new amount puts you into overdraft. Second, as far as the bank was concerned you still had the money because the rent check wasn't submited yet.

Now, the check got submited overnight, after your purchase, and this put you into overdraft. The gas must be paid for because it was an authorized transaction. But they have an option with the check. They can pay the check which will put you into overdraft, then charge you an overdraft fee for that. The other thing they can do is return the check unpaid, and still charge you a NSF fee. But if they do that you now have to deal with the landlord because you gave them a "bad" check. So you now will have returned check fees and late fees due to them as well. So you better verify if they paid or returned the check, and hope that they paid it.

It is very simple how to avoid this in the future. You MUST keep a written register. That is when ever you write a check, use an ATM, make an on-line payment or use your debit card. Write down the amount and deduct it from your available balance. The second and in your case a more important point. Never spend more than you currently have available. That is NEVER rely on the float.

Advertisers above have met our

strict standards for business conduct.