Complaint Review: Suntrust Bank - Richmond Virginia

- Suntrust Bank Po Box 85024 Richmond, Virginia U.S.A.

- Phone: 800-SUNTRUST

- Web:

- Category: Banks

Suntrust Bank FCRA, FACTA, TINs AND SSNs ARE DIFFERENT ENTIES Richmond Virginia

*Consumer Suggestion: Social security numbers should be revealed by applicants.

*Consumer Suggestion: This is the Bush inspired Patriot Act

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

COMPLAINT AS FOLLOWS WAS FORWARDED TO SUNTRUST BANK

AND THE IRS OFFICE OF PROFESSIONAL RESPONSIBILITY

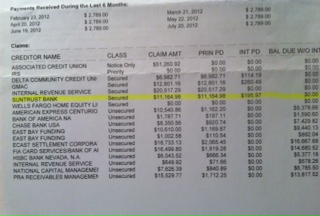

Suntrust Bank

The foregoing complaint is also being forwarded to the

IRS

Office of Professional Responsibility

WA, DC

On October 11, 2007 I applied for private business

services with Suntrust Bank, PO Box 85024, Richmond,

VA 23285-5024

Using an assigned TIN number xxxxxxxxx, assigned by

the Internal Revenue Service, I applied for a checking

account, JOCELYN SHAW, via the online application

service.

The processing report came back stating that I had a

chexsystems report associated with my TIN number which

is inaccurate as of 10/11/2007.

FCRA AND FACTA PROHITS THE DISCLOSURE OR

LIBELOUS DISCLOSURE OF INACCURATE INFORMATION.

JOCELYN S****

CONSTRUCTIVE NOTICE

To: AGENT THEREOF

(Person being served)

Of: SUNTRUST BANK

(Name and address of Institution)

You are being made aware by this Constructive Notice

that it is a violation of Federal Law to refuse to:

(a) Open a non-interest-bearing bank account if the

party wanting to open the account does not provide a

social security account number or a taxpayer

identification number; or

(b) To provide your services to a client or potential

client because the client or potential client does not

provide a social security account number or a taxpayer

identification number.

You personally, and the Institution you represent, may

be liable for damages and attorney's fees.

In accordance with Section 1 of Pub. L. 93-579, also

known as the "Privacy Act of 1974," and Title 5 of

United States Code Annotated 552 (a), also known as

the "Privacy Act," you are being informed of the

following:

"The right to privacy is a personal and fundamental

right protected by the Constitution of the United

States. You may maintain in your records only such

information about an individual as is relevant and

necessary to accomplish a purpose required by statute

or by executive order of the President of the United

States."

Section 7 of the Privacy Act of 1974 specifically

provides that it shall be unlawful for any Federal

State or local government agency to deny to any

individual any right, benefit, or privilege provided

by law because of such individual's refusal to

disclose his social security account number.

"Right of privacy is a personal right designed to

protect persons from unwanted disclosure of personal

information..." CNA Financial Corp. v. Local 743 515

F. Supp. 942.

"In enacting Section 7 (Privacy Act of 1974), Congress

sought to curtail the expanding use of social security

numbers by federal and local agencies and, by so

doing, to eliminate the threat to individual privacy

and confidentiality of information posed by common

numerical identifiers." Doyle v. Wilson; 529 F. Supp.

1343.

"It shall be unlawful for any Federal, State or local

government agency to deny to any individual any right,

benefit, or privilege provided by law because of such

individual's refusal to disclose his social security

number." Doyle v. Wilson; 529 F. Supp. 1343.

An "agency is a relation created by express or implied

contract or by law, whereby one party delegates the

transaction of some lawful business with a more or

less discretionary power to another." State Ex Real.

Cities Service Gas v. Public Service Commission; 85 S

W. 2d 890.

If the Institution you represent is a Bank, you are

advised that if such Bank routinely collects

information and provides such information to Federal,

State or local government agencies, then such bank is

an agency of government.

The 1976 amendment to the Social Security Act,

codified at 42 U.S.C.A., Sec 301 et seq., 405(c)(2)

(i,iii), states that there are only four instances

where social security account numbers may be demanded.

These are:

For tax matters;

To receive public assistance;

To obtain and use a driver's license;

To register a motor vehicle.

You are advised that a non-interest-bearing account

does not pertain to any of the above. Because the

account pays no interest, there is no "need-to-know"

on the part of government.

In accordance with the Privacy Act of 1974, whenever

an agency fails to comply with the law, the party

wronged may bring a civil action in the district court

of the United States against such agency. Should the

court determine that the agency acted in a manner

which was intentional or willful, the agency shall be

liable to the wronged party in an amount equal to the

sum of:

Actual damages sustained, but in no case less than

$1,000; and

The costs of the action together with reasonable

attorney's fees.

Constructive Notice issued by:

JOCELYN

Orlando, Florida

U.S.A.

This report was posted on Ripoff Report on 10/11/2007 10:39 AM and is a permanent record located here: https://www.ripoffreport.com/reports/suntrust-bank/richmond-virginia-23285-5024/suntrust-bank-fcra-facta-tins-and-ssns-are-different-enties-richmond-virginia-278395. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#2 Consumer Suggestion

Social security numbers should be revealed by applicants.

AUTHOR: I Am The Law - (U.S.A.)

SUBMITTED: Friday, March 27, 2009

I love this quote.... "Section 7 of the Privacy Act of 1974 specifically provides that it shall be unlawful for any Federal State or local government agency to deny to any individual any right, benefit, or privilege provided by law because of such individual's refusal to disclose his social security account number."

1974!

Alot's happened in those 35 years, my friend! There have been a lot of changes and this Act is pretty much null and void now. I personally agree with banks and credit agencies forcing people to give social security numbers before accounts are opened. Why?

1. It prevents accounts from being opened up for the wrong person by accident.

2. It catches people who are trying to "fly under the radar" when it comes to tax evasion, non-payment of child support, and garnishments.

3. It helps find people who are establishing accounts for nefarious reasons, such as funding terrorism or drug dealing.

4. It proves that you were indeed the person who wanted the account and opened the account. No more "I didn't open this account so I shouldn't have to pay for any of this.." I'm tired of indirectly paying for people who pull this type of scam.

As far as I'm concerned, the only reason some people make such a fuss about this is because they're trying to get away with something and they know that revealing their SS# on the application will basically get them busted. I guess that's what you meant when you said that your "privacy was being violated".

#1 Consumer Suggestion

This is the Bush inspired Patriot Act

AUTHOR: K_yarb - (U.S.A.)

SUBMITTED: Sunday, January 11, 2009

The Patriot Act actually requires banks to ask for SS# on ALL new accounts, along with valid ID.

Of course, this isn't the only law that it violates in regards to our privacy and rights-- just look at all the constitutional rights it violates.

Advertisers above have met our

strict standards for business conduct.