Complaint Review: Ally Financial - Internet

- Ally Financial Internet USA

- Phone: 8889252559

- Web: Ally auto.com

- Category: Car Financing

Ally Financial The company is over charging me and claiming that I owe more money on my loan Bloomington Minnesota

*Author of original report: Car finance information

*Consumer Comment: That is not the way it works

*Author of original report: 74 payments

*Consumer Comment: Did you have a simple interest loan with them?

The company has sent me different notices stating that I owe more money on my auto loan. However, I made the last payment In May 2017. The company took over my loan and begin to misplace my payments stating that they never received them. When the checks cleared in my bank account. They called and said I owed them $500, a month later $600 and after that $998.18. Ally auto is a complete ripoff.

This report was posted on Ripoff Report on 08/21/2017 06:02 PM and is a permanent record located here: https://www.ripoffreport.com/reports/ally-financial/internet/ally-financial-the-company-is-over-charging-me-and-claiming-that-i-owe-more-money-on-my-l-1394455. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#4 Author of original report

Car finance information

AUTHOR: - ()

SUBMITTED: Saturday, October 14, 2017

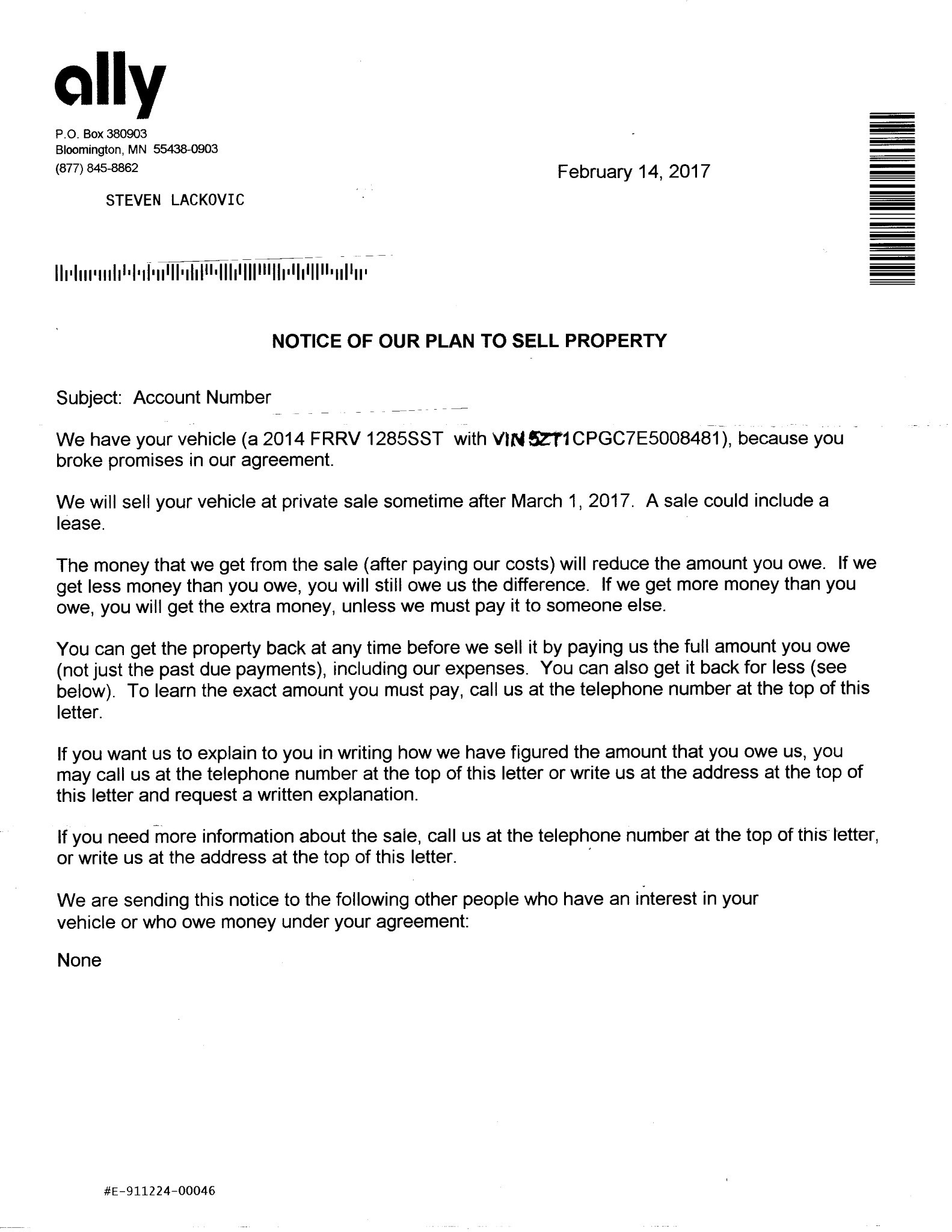

My interest is only 9.94%. There is no way that I still owe this company $1000 please view documents attached to this rebuttal.

#3 Consumer Comment

That is not the way it works

AUTHOR: FloridaNative - (USA)

SUBMITTED: Friday, October 13, 2017

You state that you paid 74 payments and that you should be paid off. That is not the way it works. In financing (anything) if you have a simple interest loan the funds are applied to late fees first (if applicable), interest, and then principal. If you paid even within the grace period but after the due date, additional interest will be due.

It's possible that they are charging you too much interest but it is not possible to determine that without seeing an original amortization schedule and then your schedule of actual payments made and calculate the difference. If you have that documentation and it shows that the $1000 is too much, contact the CFPB and file a complaint so they can help you get your title. But saying that you paid 74 payments is not enough evidence to show they are collecting too much interest. You have to show the actual monthly payments made against the outstanding balance due.

#2 Author of original report

74 payments

AUTHOR: - ()

SUBMITTED: Tuesday, September 19, 2017

I disagree that I owe them anything extra because I paid them every month before the 16th which was my payments due date. I had one late payment and that was because they lost my payment. I had to resend it. I've also paid them $377 but they would process my payments as two separate payments. The company went through a lawsuit and they were ripping other customers off. I believe that they are also trying to rip me off. They are now sending me a bill for $1000. Is there anything else that I can do to show you that this company is manipulating my payments and trying to get more than just late fees. I should have to pay any interests since I paid them 74 payments. I should be receiving my title.

#1 Consumer Comment

Did you have a simple interest loan with them?

AUTHOR: FloridaNative - (USA)

SUBMITTED: Tuesday, September 19, 2017

Based on your very brief post, it looks like you had a simple interest loan with them and did not make all of the payments on time. Not that you were very late, but even if you paid late by one day for each payment you would owe additional funds for the extra interest due on each payment made beyond the due date. You can calculate this yourself or ask the lender for an itemized breakdown of the remaining balance. Contact them. Pay the remaining balance due. It would be a shame to lose the car over a dispute of a few hundred dollars. Read your finance contract first so you have a firm handle on what is owed and when it is owed. The amortization schedule makes an assumption that you pay on time each and every time.

Advertisers above have met our

strict standards for business conduct.