Complaint Review: Ally Financial - Bloomington Minnesota

- Ally Financial PO Box 380902 Bloomington, Minnesota USA

- Phone: 8889252559

- Web:

- Category: Car Financing

Ally Financial Ally Financial Inc Ally Bank Dishonest, Greedy, Fraudulent Lender. Bloomington Minnesota

*Consumer Comment: Ally Bank bullies wrong Consumers by Sunrise Camping Center Hickory, North Carolina

*General Comment: Banks cover their arses and all about making money

*Consumer Comment: When

*Author of original report: Mind your own business

*Consumer Comment: Responsibility

*Author of original report: Knowingly Misrepresenting Information

*Consumer Comment: How was it fraudulent

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

Ally Financial, the parent company of Ally Bank, forced thru the approval of a Fraudulent Loan Application submitted by one of their dishonest "Business Partners", Koons Ford Of Baltimore on Security Blvd in MD.The applicant, my Cousin, was overextended and could not LEGALLY qualify to buy anything. Koons Ford submitted a Fraudulent Loan Application to lenders and Ally Financial approved the loan when all others denied it. After we contacted Ally Financial by phone and sent them the true financial info, they insisted that it didn't matter because "She Signed the Papers and should have known what she was signing". Ally Reps REFUSED to allow me to speak to their Legal Dept. Stay from Ally Financial, Ally Bank or any Koons Location, especially Koons Ford on Security Blvd in Baltimore, MD.

This report was posted on Ripoff Report on 08/26/2014 09:02 PM and is a permanent record located here: https://www.ripoffreport.com/reports/ally-financial/bloomington-minnesota-55438/ally-financial-ally-financial-inc-ally-bank-dishonest-greedy-fraudulent-lender-bloomin-1172561. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#7 Consumer Comment

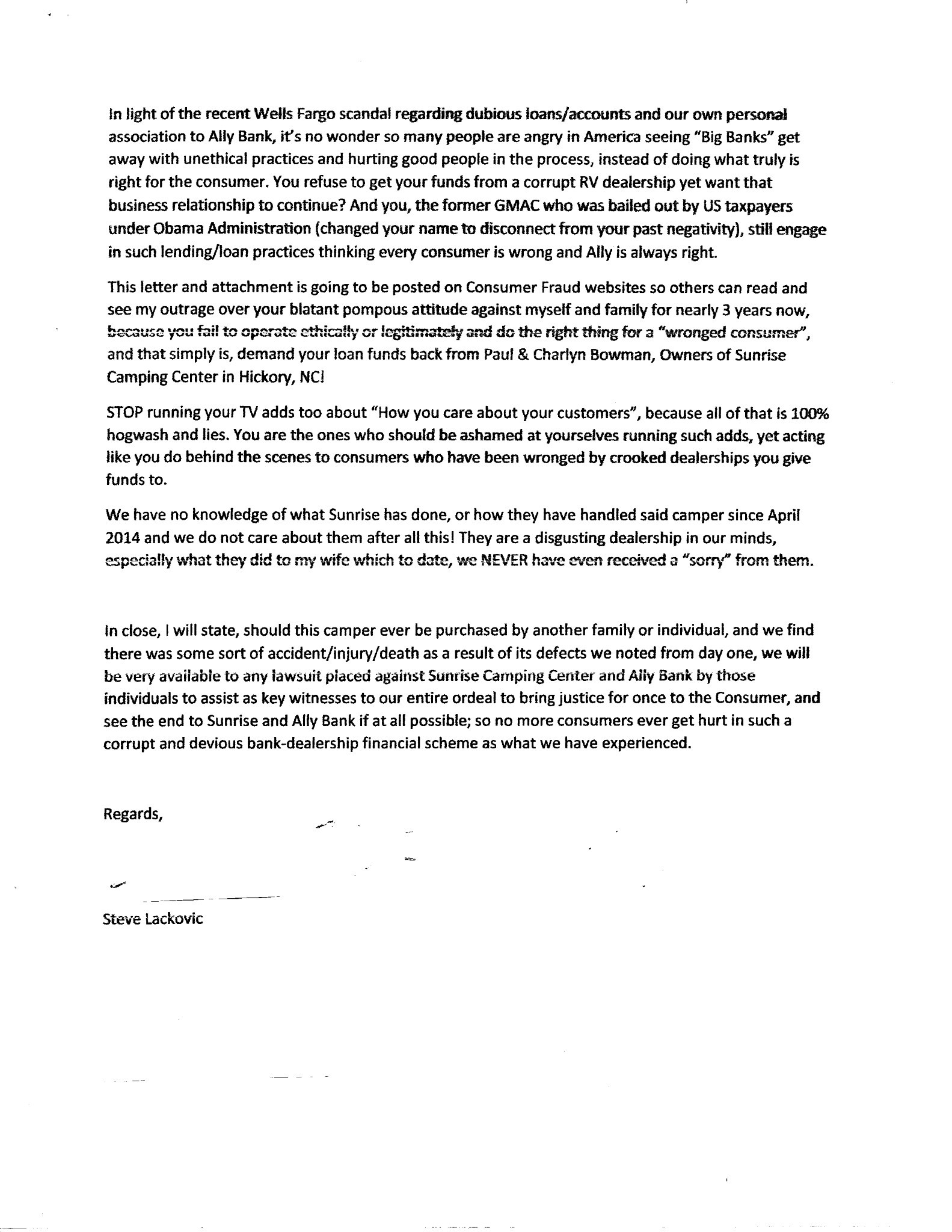

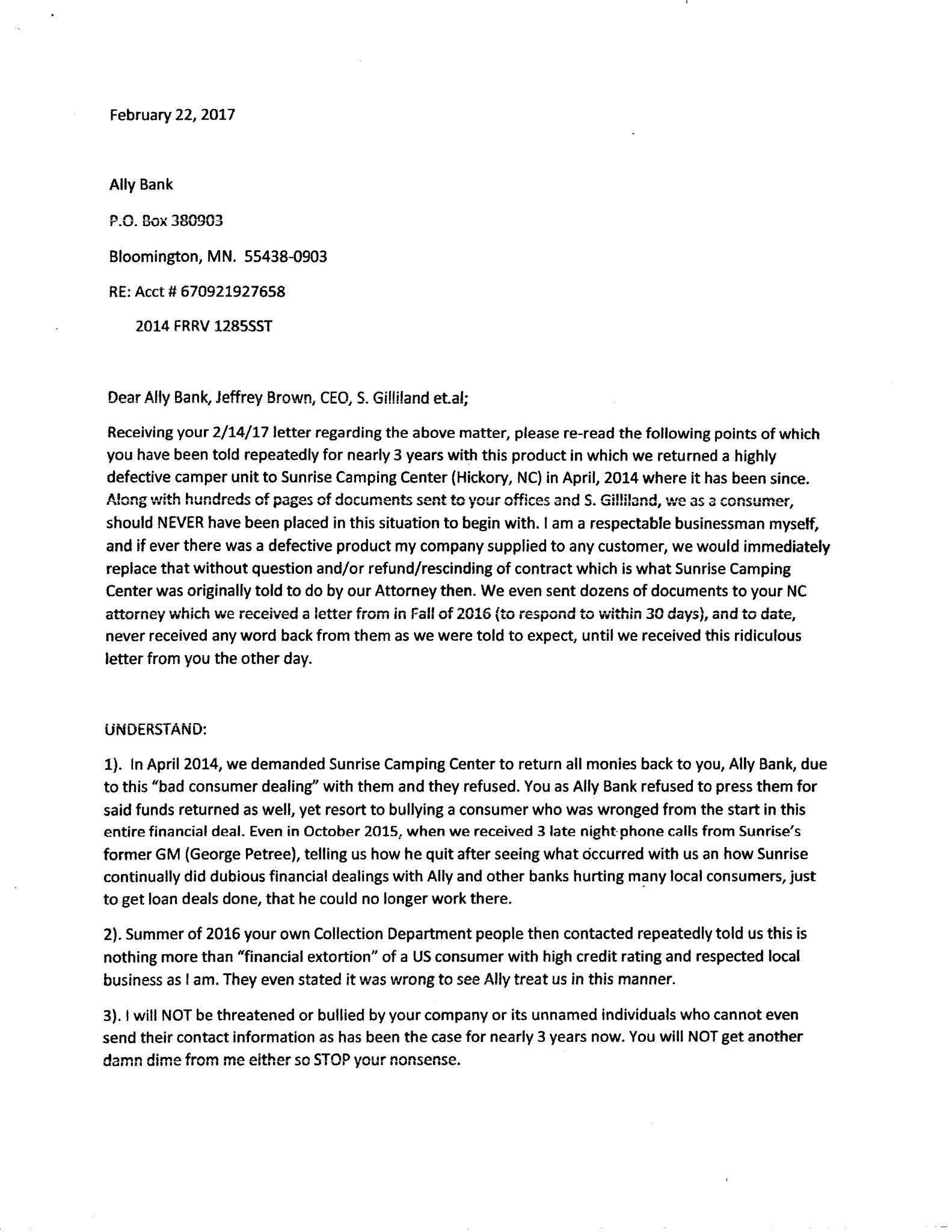

Ally Bank bullies wrong Consumers by Sunrise Camping Center Hickory, North Carolina

AUTHOR: Steve & Tammy Lackovic - (USA)

SUBMITTED: Friday, February 24, 2017

As continued awareness to other Consumers who suspect shady and/or dubious financial loan transactions by/through Ally Bank and between Sunrise Camping Center (or other dealerships), we are attaching this for further details how Ally Bank simply does not care about Consumers, will never admit to any wrongdoings, and always act like they can do no wrong, hiding their correspondences and contact people through a series of what immigration lawyers call "Chinese Walls", so you never can get directly to anyone who can make sound decisions to any Consumer complaint.

They ought to STOP running their TV adds saying "We care about our Customers", as it is so far from the truth...

#6 General Comment

Banks cover their arses and all about making money

AUTHOR: Steve & Tammy Lackovic - (USA)

SUBMITTED: Tuesday, March 15, 2016

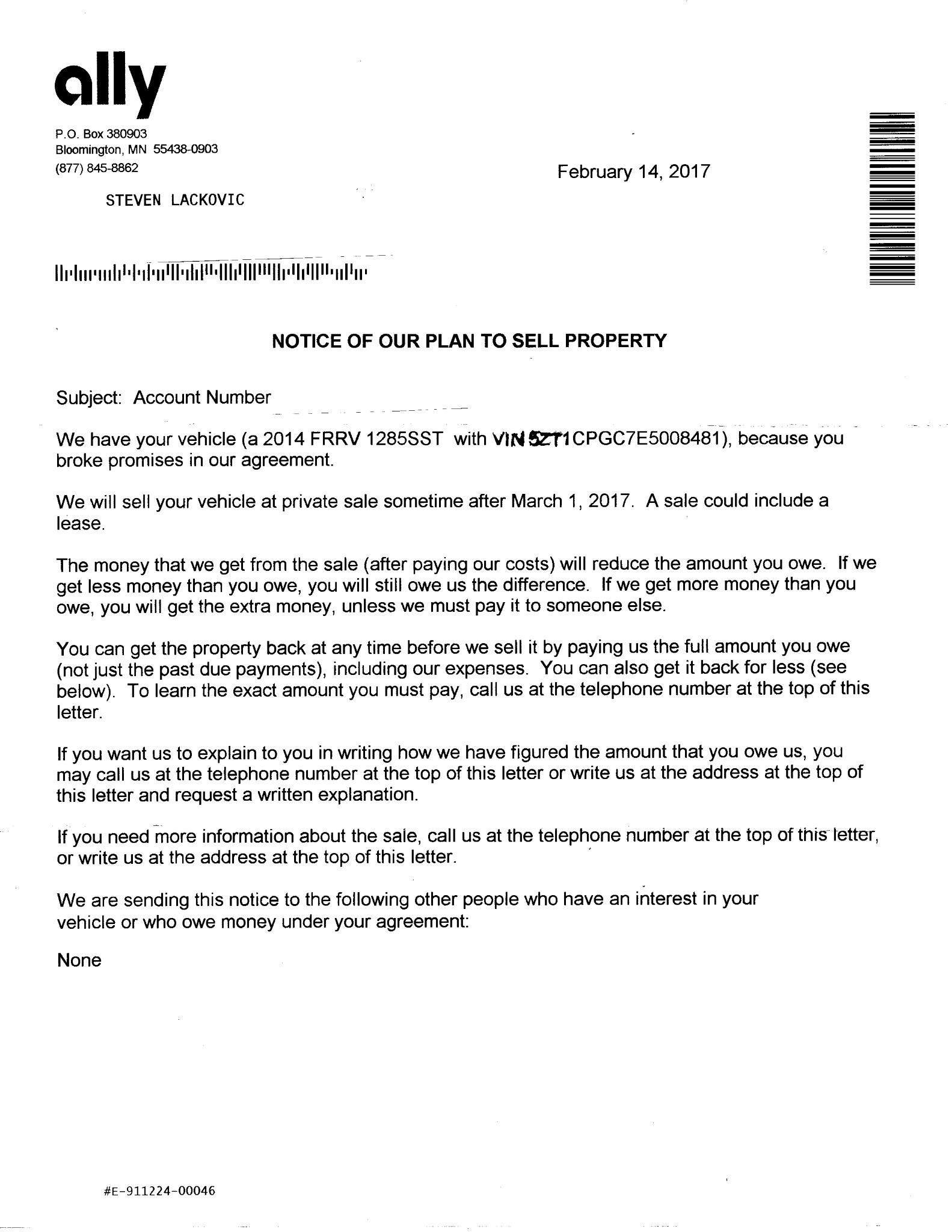

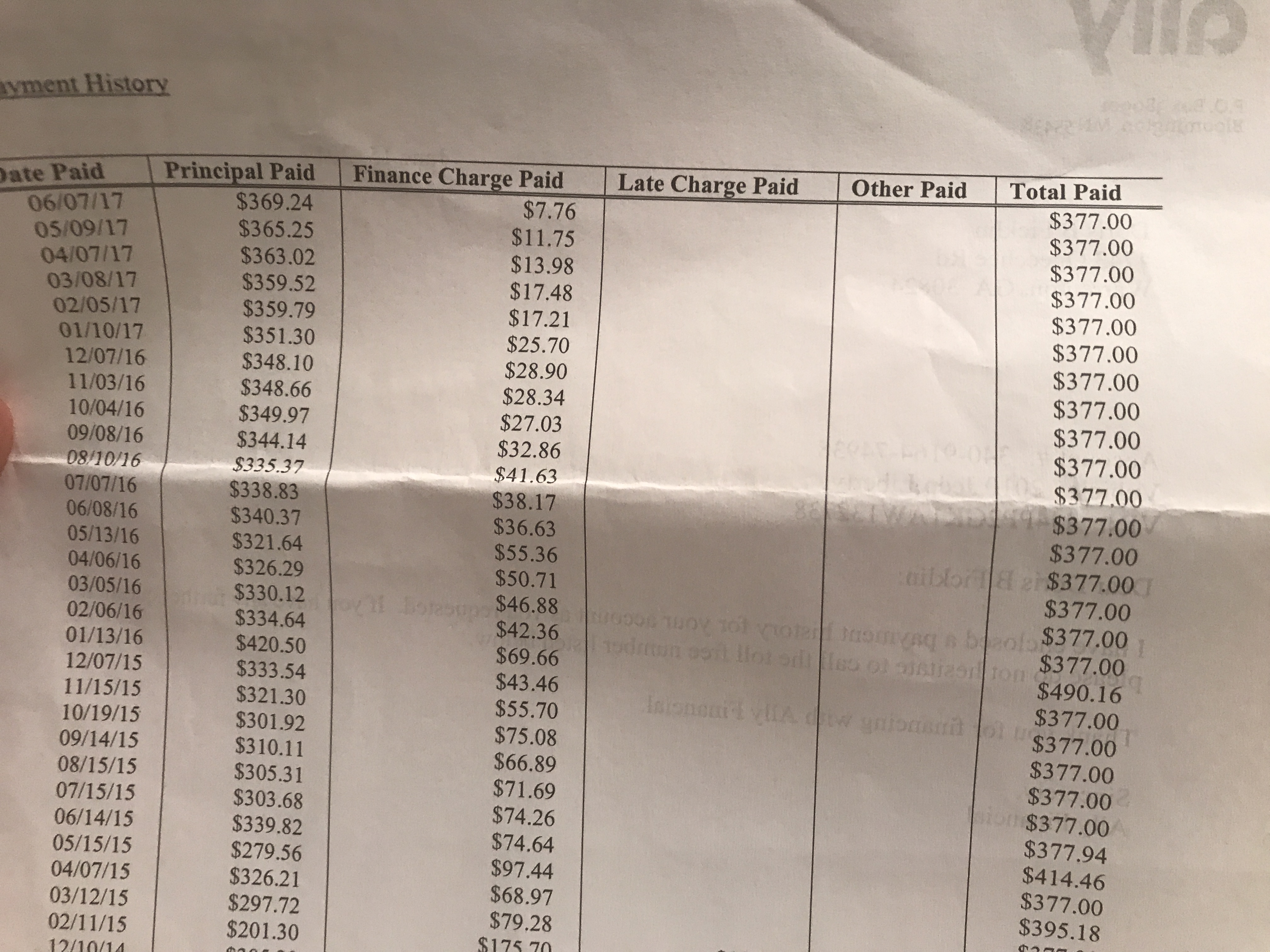

We had to respond to this, as not only was Ally fined by regulators for like $90million a few years ago regarding dubious financing dealings, but we ourselves are being held "captive" by Ally Bank for 24 months now on a loan for a highly defective camper we returned to Sunrise Camping Center in Hickory, NC within days of signing the loan papers. We could have been killed on the highway by this camper had I not caught major defects right away and returned to dealership demanding they give fudns back to Ally and cancel deal- they refused.

We issued a Cease & Desist with this RV dealership, and even had to hire a local lawyer and eventually had a mediation, and then lawyer walked out on us and left us hanging; and all this time now, we still are held to making monthly loan payments on that camper we do not want just to protect my high credit score. Dealerhsip refuses to return fund or buy-back that loan as it is called. Even 18 months later, the former General Mgr of that dealership called us one night going on how he quit after our mediation because his conscience bothered him so much how we were treated and he felt bad for us and wanted to help our case, and stated that dealership and with Ally Bank, have done a lot of bad financial things to good people and he could no longer continue working there....

That RV dealership is plagued with many dubious financial dealings and BBB reports and other copnsumer complaints, yet nobody does anything about it. Ally whom we have contacted several times in last 23 months tell us they did their own "internal investigation to dealership" and sent letter saying owner of that dealership said there is no problem and everything was resolved they were set with that comment...??? it is a LIE pure & simple !

It is a legalized financial/lending scheme and cycle from many dealerships and the lenders they are conencted to (to introduce loan business too) in a business all about making money at any cost. So many run such a thin gray line of ethics and morality that in the end, they will use tactics to close any deal because "Money is their God" at the end of any given business day.

Our situation right now is frustrating, and we listed our consumer complaint here on ROR in April 2014, and to date, we do not know what to do because all parties cover for each other, and getting proper legal council is hard, especially if you were in a legal process as we were, and lawyer walked out, you will find it impossible to get any lawyer willing to come in and pick up matters no matter how much money you can afford to pay them.

We have been involved with Federal Agencies now who now requested all our loan docs, e-mails and legal filings as did the NC State Bar Association to go back, as only the Bar itself can go back on any Judge's order and reopen a case to be retried again. The FTC right now is accumulating information against All parties in our case regarding Sunrise Camping Center & Ally Bank and what has happened to us and the tricks that dealership's ;awyer did to us without us having legal representation and a local "good old boy" Judge refused to give us time to secure a replacement attorney which made no sense hearing... Basically sweeping everything enatly under a rug.

#5 Consumer Comment

When

AUTHOR: Robert - ()

SUBMITTED: Saturday, August 30, 2014

When you post on a PUBLIC web site..the PUBLIC may respond and contrary to what you may think these comments may not always agree to your view and as much as you may not like it may bring out points that show how you are incorrect.

She, being my Cousin, gives me full power to handle the injustice done to her (because of medical reasons on her part) by a greedy car dealer (Koons Ford of Baltimore), the inhuman treatment of her at their dealer

and their intentional efforts to "Close that deal" with no regards to her as a person.

- Once again YOU were not even there when she bought the car. Do you have a court order or power of attorney showing you can act on her behalf? What specifically inhuman treatments did they do to your cousin, and what specific intentional efforts did they do to close the deal? Oh and just how do you know all of this if you were not there. Did your Cousin tell you this? Because perhaps your Cousin isn't exactly being totally truthful about the situation.

You continually use the term "overextended" and that they provided "incomplete" information. Being out of work is not a case of being overextended in credit...it is a lack of income. So did your cousin lie about her income? Did she somehow forge paystubs to show she was earning a salary. But wait..you said "incomplete" information...that would have been fradulent information..so that can't be it.

Well then it must be her credit obligations...Did they forge or fake her credit report? Did they somehow remove debt from the report that she legitimatly owes...oh wait that is fraud again not "incomplete".

So it must be some debts she owes that are not on her credit. But she doesn't owe you money...so where is this mystery oblgiation coming from causing her to be overextended.

#4 Author of original report

Mind your own business

AUTHOR: Dale King - ()

SUBMITTED: Thursday, August 28, 2014

I put info out there that is true without malice and no, she doesn't owe me money. I was not aware she went to the dealer for help until it was too late. She is overextended because she like many others have become unemployed by no fault of her own. I am not going to respond to incorrect personal info you are digging for because again, it's none of YOUR business. She, being my Cousin, gives me full power to handle the injustice done to her (because of medical reasons on her part) by a greedy car dealer (Koons Ford of Baltimore), the inhuman treatment of her at their dealer and their intentional efforts to "Close that deal" with no regards to her as a person. Ally knowingly pushed the loan thru because they are just as greedy. Right now, executives at both companies are personally looking into this situation and neither have indicated that they concur with what has taken place. I will post the results of THEIR investigations when something is resolved. In the mean time, go back to your little cubicle and keep closing your deals. I am sure your parasite family and envious friends will be be very appreciative. MYOFB

#3 Consumer Comment

Responsibility

AUTHOR: Robert - ()

SUBMITTED: Wednesday, August 27, 2014

Thanks Mr Unknown for your comment about a situation you were not involved in.

- That statement says actually quite a bit. Why you ask? Okay...just how much were YOU involved in this. Did you go to the dealer with your cousin? If so why did you let your cousin give "incomplete" information? Why did you let your cousin sign the credit application if you knew it was wrong? Why did you let your cousin sign the credit application if you knew they were "over extended"?

Because if you were there and did let your cousin do any of this where was YOUR "fuduciary responsibility" to your cousin?

Now, if you weren't there...well.....

You haven't exactly been clear on how you are involved in all of this and why you not only knew she was getting a loan, but had several declines, as well as that the application was "incomplete". If you weren't at the dealer, just how do you know that your cousin may have just "forgotten" to tell them some of her financial responsibilities? These people are not detectives, they are not going to hook someone up to a lie detector to make sure they aren't hiding anything.

You also haven't been very clear as to why if this is one huge scam would they go through the effort of submiting applications to other banks knowing they would be declined? Did they by some reason send different information to Ally? And of course if you answer yes, you have proof of that..right?

Ally Financial was advised before Final Approval that this person was overextended and also had a fuduciary responsibility to the applicant to deny the loan.

- Why? Just because as far as they are concerned you might be an "ex" something and just want to cause trouble by trying to get them to decline the loan. Unless you have some proof such as a court order showing she owes money or a current credit report that shows she owes more than she stated...they aren't going to even give you a second thought.

You never really explained why she is "over extended".

Here is my guess, oh and feel free to correct anything I have wrong. You are probably owed quite a sum of money from your cousin. Perhaps they are living under your roof for free and you dislike that they bought a new car. Perhaps they borrowed some money to get by when times were tough and failed to pay it back. Now, none of those would be reported on a credit report and could obviously be "missed" if your cousin didn't let them know.

You used the word "incomplete"..not fradulent when you talked about what was reported. So one can figure that she didn't lie about her income. One can also figure that they used her real credit report, and perhaps there are things you know about that are not on the credit report that change how "extended" she is.

Oh as an FYI just because one bank declines a credit app, it does not automatically make it a crime if another bank approves it.

#2 Author of original report

Knowingly Misrepresenting Information

AUTHOR: Dale King - ()

SUBMITTED: Wednesday, August 27, 2014

Thanks Mr Unknown for your comment about a situation you were not involved in. For a MD Licensed Dealer to Knowingly Submit incomplete Financial Info on someone's behalf just to "Close A Deal" is fradulent because they, Koons Ford , had a fuduciary responsibility to their customers.Ally Financial was advised before Final Approval that this person was overextended and also had a fuduciary responsibility to the applicant to deny the loan. Everyone else who received to solicitation from Koon Ford denied her application. I have the correspondence from them. Ally pushed the Final Approval thru because they are no better than Koons Ford. Birds of a feather not only flock together, they do "Business" together. Let's see how this plays out on it's own. After all, the only thing that matters to Ally Financial and Koons Ford is making money, no matter how they do it or to who. All I did was present the details. It's on Ally and Koons Ford -THEY wrote the script.

#1 Consumer Comment

How was it fraudulent

AUTHOR: Robert - ()

SUBMITTED: Tuesday, August 26, 2014

I guess I missed something in your "RipOff".

my Cousin, was overextended and could not LEGALLY qualify to buy anything

- She couldn't "LEGALLY" qualify?

Perhaps you can post the specific section of law you are refering to. Because as far as I am aware there is NO "legal" credit requirements. A lender can basically make up their own requirements, as long as they are uniform. That's right if they want to approve someone with a 475 credit score and maxed out on all of their credit cards they have every LEGAL right to do that.

So if you are saying that your cousin isn't 18..then you have a valid claim.

If you are claiming that she didn't use her legal information such as her name/SSN..etc then you have an Identity Theft case..on your Cousin.

If you are saying they lied about her income...well that is may be fraud, but if she signed it knowing they did this she is as much as a part of it as they are. Oh and unfortunatly they are right...she signed the papers and can(and will) be legally held to it.

But in any other case...she is a legal adult and can make her own decisions...even if those decisions are not the smartest thing in the world to do.

FYI, since she is probably a legal adult..the legal department(or anyone else there for that matter) is going to talk to you unless you get your cousin to give their approval first.

Advertisers above have met our

strict standards for business conduct.