Complaint Review: BB&T - Glen Allen Virginia

- BB&T www.bbt.com Glen Allen, Virginia U.S.A.

- Phone: 804-968-7948

- Web:

- Category: Attorney Generals

Branch Banking & Trust Company - BB&T Overdraft chages on a CASH deposit!! Glen Allen Virginia

*Consumer Comment: Wow - all these problems

*Consumer Comment: Davy Jonz "moron"

*Consumer Comment: BB&T operates like in the old days

*Consumer Comment: Its not about who made the error, its about if it should be made illegal !!!

*Consumer Suggestion: There already is a law.

*Consumer Suggestion: There already is a law.

*Consumer Suggestion: There already is a law.

*Consumer Suggestion: There already is a law.

*Consumer Comment: Tina, No legislation required, just common sense!

*Consumer Suggestion: apparently you assume too much

*Consumer Comment: I have some help for you

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

Cash is always good...right?! Not according to BB&T! I intentionally went to Suntrust to cash my paycheck so that I could make a cash deposit at BB&T to cover bills, etc. I made the deposit on 8/29/08 at 2:05 p.m. thinking all would be fine...the deposit would be credited to my account since there was no "wait" time on cash. WRONG!! The deposit was not credited to my account until September 2, 2008 causing an INITIAL overdraft charge of $420.00!!!

I immediately called the branch and was told the same old speech about "deposits made after 2:00 p.m. would not be credited until the next business day". I understand that with a check, but CASH!!! I was told that the Manager could not do anything and would get with the Regional Manager for authorization, if any, to refund the fees.

I never heard from anyone that day and low and behold...you guessed it...when I check my account on September 3, 2008 there had been an additional overdraft charge of $385.00 added to the already withdrawn $420.00!!!

I again called the branch, spoke to the manager, this time in tears. Got the same speech..he was waiting to get a call back and would let me know when he heard something. Never heard anything that day either.

Sooooooooooo, I check my balance the NEXT day, September 4, 2008 and OMG!!! another $315.00 had been deducted for overdraft fees!! My husband's entire pay check that had been direct deposited into the account had been totally eaten up! I called the branch again, same story, never heard so I went to the branch. Unbelievably, I got the same story.

Long and short, I sit here right this minute STILL waiting to hear whether or not my life can go on, if I can eat, pay my rent and just have gas to get to work on Monday. I am with ANYBODY and EVERYBODY who would like to start some type of legislation to stop this type of thing from happening to the citizens of the UNITED STATES OF AMERICA!!!!!

Tina D.

Midlothian, Virginia

U.S.A.

This report was posted on Ripoff Report on 09/05/2008 12:07 PM and is a permanent record located here: https://www.ripoffreport.com/reports/bbt/glen-allen-virginia-23059/branch-banking-trust-company-bbt-overdraft-chages-on-a-cash-deposit-glen-allen-virg-370106. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#11 Consumer Comment

Wow - all these problems

AUTHOR: Danielle - (U.S.A.)

SUBMITTED: Saturday, February 21, 2009

Now, I can't say I've never paid an overdraft fee. I have been a customer of BB&T's since I was 16 (9 years), and in that time, I have had to learn the hard way about keeping track of my purchases, ect.

I have had problems with BB&T which were not related to an inadequacy on my part, however, so I don't necessarily like the fact that the same people seem to be jumping all over these individuals posting complaints without even giving them the benefit of a doubt.

For instance, I awoke one morning last year to find my checking account overdrawn by $499. Overnight several pending transactions came through, including 15 overdrafts totalling $525.

Now anyone with a brain can see that if I got 15 overdrafts at $525 total, yet was only overdrawn $499, that I must have been in the positive when the first overdraft was assessed. And, in fact, that was the case. For some reason, "bank error" was the response officially given, the bank assessed a $35 overdraft fee while I was $26 in the positive, which resulted in 14 more overdrafts.

Needless to say, that very morning I went into the bank to talk to a representative. It took the (much older) lady almost 3 hours of adding, subtracting, re-adding and my explaining - over and over - that this was a bank error, for her to finally call the manager over and tell them that there was an issue.

Now, I got all of those fees taken off. But the truth remains that those fees WERE NOT MY FAULT. They were bank error. If I had encountered a truly obstinant representative who refused to help me, and instead posted in this forum, I would certainly hope for less rhetoric and insensitivity, and more careful attention to the circumstances surrounding these instances.

Remember, these companies are our employees. We hire them to safeguard our money, and they are at the mercy of the market which we drive through our demand - they are profit-motivated, and so I wouldn't just assume that they never make mistakes or jip people out of their money simply because they haven't done it to you.

#10 Consumer Comment

Davy Jonz "moron"

AUTHOR: D - (U.S.A.)

SUBMITTED: Wednesday, January 07, 2009

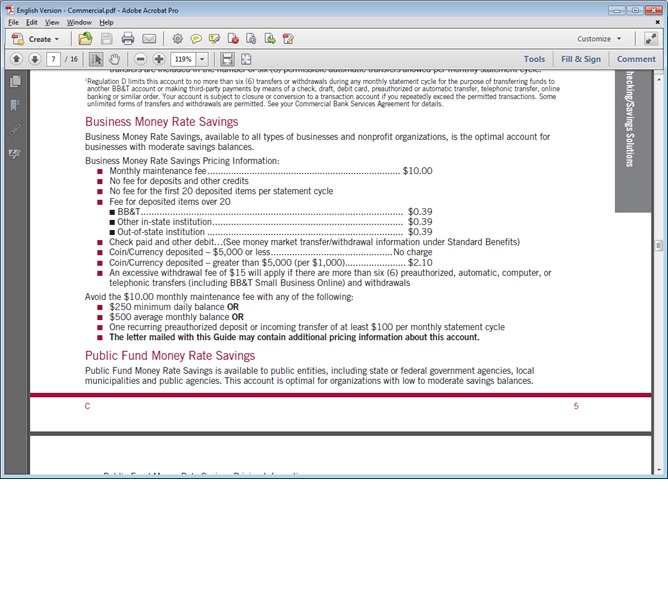

Davy, Davy, Davy, always the victim... If something doesn't go in your favor you want to file a lawsuit because it's not your fault, right? Yes, you open a bank acct., agree to the terms and sign the document however, you cannot spell much less manage your money. Why would you blame a corporation for your mistakes? You approached them for a service and they provided the service. It's not personal, it's business! You were given the Pricing Guide of the fees that could be charged if you failed to manage YOUR account appropriately. That means, don't spend your money before you have it in the bank.

#9 Consumer Comment

BB&T operates like in the old days

AUTHOR: Sassysandy - (U.S.A.)

SUBMITTED: Tuesday, December 30, 2008

I recently switched from a credit union to BB&T. I asked all the questions. You can't assume they are like the banks that have updated their procedures. I learned from the beginning that deposits are not credited until the next business day.

I make sure my deposits are showing in my account before I use my debit card and I check my account on line often to make sure there are no mistakes. Every time I shop I go back to my account and see my transacations pending.

Using direct deposit will make a big difference. My old bank made deposits available the minute you made it unless it was a large check, then they wait 3-5 days for that check to clear before being added.

I have read alot of the complaints about this bank, and I am not saying that they are all right or all wrong. I'm just saying that they operated differently and it's important to ask all these questions before you start making transactions.

I have had not problems since I check my account before paying my bills. I make sure on line that the balance in the top right hand corner is correct, if not my deposit has not been added yet. Hope this helps

#8 Consumer Comment

Its not about who made the error, its about if it should be made illegal !!!

AUTHOR: Davy Jonz - (U.S.A.)

SUBMITTED: Friday, October 10, 2008

It never ceases to amaze me that people think that because you sign something that says you agree to be victimized, means its ethically or legally ok. These banks use procedures to increase the possibilty of overdrafts and maximize the fees. There are loan sharking laws that prevent such abuse, even if you sign a contract that you agree to pay 900% interest, its stills is immorral and illegal under these laws. Banks get away with it because they hide under the "fees" defence. These fees are unjust and cause familys heartache and banks dont care. Do they even relize that its our money that they use to run there business. If everyone pulled there money out these banks would go under (at least until the fat cats in washington pass a 700 billion dollar bailout)

Yes, people are human and make mistakes, does that mean the banks can use this mistake to "financially rape" you. Call your congress reps and tell them to vote for laws to stop this criminal activity!!!

vote Davy Jonz for president !!

I'll put a stop to this travisty!!

Banking Dictionary: Loan Shark

Lender, who makes a business of lending money at rates above legally permitted interest rates. For example, a $5 loan on Monday to be repaid Friday for $6-an annual percentage rate of 1040%, not including interest compounding. Loan-sharking was a pervasive activity through much of the nineteenth century, leading to the formation of cooperative associations, such as mutual savings banks and credit unions, to arrange small loans at reasonable interest rates. State small loan laws generally prohibit loan-sharking, although state laws differ on what is, or is not, an excessive rate of interest.

#7 Consumer Suggestion

There already is a law.

AUTHOR: J G Shrugged - (U.S.A.)

SUBMITTED: Monday, September 29, 2008

From the Federal Reserve, Regulation CC:

(a) Cash deposits. (1) A bank shall make funds deposited in an account by cash available for withdrawal not later than the business day after the banking day on which the cash is deposited, if the deposit is made in person to an employee of the depositary bank.

(2) A bank shall make funds deposited in an account by cash available for withdrawal not later than the second business day after the banking day on which the cash is deposited, if the deposit is not made in person to an employee of the depositary bank.

Basically says that the cash has to available the next business day if you deposit it in person - since they will actually post the deposit to your account late that night, after all the other withdrawals have been posted.

#6 Consumer Suggestion

There already is a law.

AUTHOR: J G Shrugged - (U.S.A.)

SUBMITTED: Monday, September 29, 2008

From the Federal Reserve, Regulation CC:

(a) Cash deposits. (1) A bank shall make funds deposited in an account by cash available for withdrawal not later than the business day after the banking day on which the cash is deposited, if the deposit is made in person to an employee of the depositary bank.

(2) A bank shall make funds deposited in an account by cash available for withdrawal not later than the second business day after the banking day on which the cash is deposited, if the deposit is not made in person to an employee of the depositary bank.

Basically says that the cash has to available the next business day if you deposit it in person - since they will actually post the deposit to your account late that night, after all the other withdrawals have been posted.

#5 Consumer Suggestion

There already is a law.

AUTHOR: J G Shrugged - (U.S.A.)

SUBMITTED: Monday, September 29, 2008

From the Federal Reserve, Regulation CC:

(a) Cash deposits. (1) A bank shall make funds deposited in an account by cash available for withdrawal not later than the business day after the banking day on which the cash is deposited, if the deposit is made in person to an employee of the depositary bank.

(2) A bank shall make funds deposited in an account by cash available for withdrawal not later than the second business day after the banking day on which the cash is deposited, if the deposit is not made in person to an employee of the depositary bank.

Basically says that the cash has to available the next business day if you deposit it in person - since they will actually post the deposit to your account late that night, after all the other withdrawals have been posted.

#4 Consumer Suggestion

There already is a law.

AUTHOR: J G Shrugged - (U.S.A.)

SUBMITTED: Monday, September 29, 2008

From the Federal Reserve, Regulation CC:

(a) Cash deposits. (1) A bank shall make funds deposited in an account by cash available for withdrawal not later than the business day after the banking day on which the cash is deposited, if the deposit is made in person to an employee of the depositary bank.

(2) A bank shall make funds deposited in an account by cash available for withdrawal not later than the second business day after the banking day on which the cash is deposited, if the deposit is not made in person to an employee of the depositary bank.

Basically says that the cash has to available the next business day if you deposit it in person - since they will actually post the deposit to your account late that night, after all the other withdrawals have been posted.

#3 Consumer Comment

Tina, No legislation required, just common sense!

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Sunday, September 28, 2008

Tina,

The bottom line is that you spent money before it was actually in your account and available for use. Very simple, no rip off.

It appears that you are attempting to "live on the float". This can no longer be done.

You MUST have the money in your account AND available for use BEFORE making any transactions against that money.

This is all spelled out in your terms and conditions that you signed for when you opened the account. All you have to do is READ, not assume.

And, keeping an accurate checkbook register is absolutely imperative in order to avoid NSF fees. Not optional.

Hint:

Do not record deposits in your checkbook register at the time you make them, instead, hold the deposit reciept until you see that the funds are available for use, and then write the deposit in your register, as you can now use it.

And, be sure to write all checks, debtit/atm transactions and fees in your register immediately when they occur. This will always tell you what your available balance is. No guesswork.

This system has worked for me for 30 years and I have never paid an nsf fee.

#2 Consumer Suggestion

apparently you assume too much

AUTHOR: Nancy - (U.S.A.)

SUBMITTED: Saturday, September 27, 2008

When you deposit a check, or cash in the bank it is NOT posted immediatly. ALl the bank transactions are NOT processed until after closing.

#1 Consumer Comment

I have some help for you

AUTHOR: Anonymous - (U.S.A.)

SUBMITTED: Friday, September 26, 2008

Keep a checkbook register. And for your information, Saturdays, Sundays, and Holidays are NOT business days. And did you not read your brochures when you got the account opened? Reading might help instead of ASSUMING things. Do you know what the first 3 letters in assume spell out? You have to take responsiblities for your actions. You can't expect a bank to "babysit" your account. Can you imagine how many people bank there? Probably not. Okay enough said. I sure hope this helps. Have a blessed day.

Advertisers above have met our

strict standards for business conduct.