Complaint Review: BB&T - Winston-Salem North Carolina

- BB&T 200 W. 2nd St. Winston-Salem, North Carolina U.S.A.

- Phone: 800-226-5228

- Web:

- Category: Banks

BB&T, Branch Banking & Trust Unfair yet Severe Overdraft fees - never informed of drastic policy change Winston-Salem, North Carolina

*Consumer Suggestion: I got my money back!

*Consumer Comment: I understand your frustration

*Consumer Suggestion: ashley

*Consumer Comment: I did read it

*Consumer Comment: ashley

*Consumer Comment: This again?

*Consumer Comment: let's practice active capitalism, shall we?

*Consumer Comment: Steve works for BB&T

*Consumer Suggestion: Donna, READ your funds availability agreement.

*Consumer Comment: It was an error

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

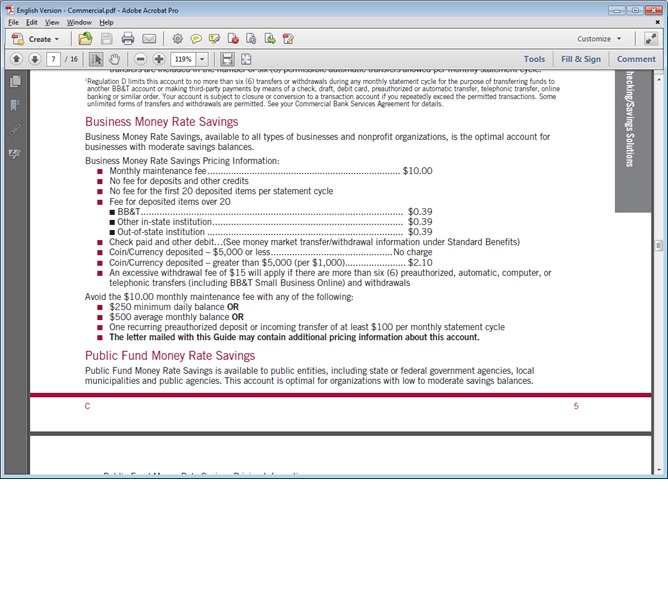

I am actually located in VA, but I put down their corporate address. I was infuriated to find out that debits that posted the same day as $1300 worth of credits were tagged as "overdrafts" and charged me overdraft fees of $35 (plus the debit amount) per transaction. I did not understand how my entire paycheck plus another deposit could be posting the same day as check card purchases (multiple totaling less than $20 combined), were posted to my account after the debits came out. They charged me overdraft fees for these tiny transacations.

I thought to myself this is surely an error. I immediately contacted the phone 24 of BB&T bank to get this corrected. I was told that in 2007 they changed their policy so that if you have multiple transactions posting on the same exact date, the credits no longer posted first (which had been the case forever until that change was made). They then started posting transacations in the order they were received (you just have to take their word for it). I explained that I wasn't made aware of this change, she stated they sent an insert with your statement. I explained myself nor my mother received this supposed insert. Also, with such a big change they should have drawn attention to it, not put it as some little sales insert. She then went to say our refund of fees is computer generated and you are not eligible to receive a refund. When pressed on why I wasn't eligible since they had never refunded me anything prior - she said she didn't know this is the process.

I am outraged at this. Not only are they allowed to charge me $35 for $3.51 check card purchase but now they are allowed to charge me that based on their word alone. You have my paycheck (direct deposit) posting the same day as the transaction, but because they say the check card transactions came through first (still on the same posting date) they are allowed to charge me an unlimited number of fees. Then tell me for some phantom reason I'm not allowed to be refunded. There should be regulation on these practices. They incurred no fees in collecting the money from me. My direct deposit was already there, they didn't even need to contact me. Now I have to scrounge for money just to get gas, so that the rich can get richer.

Donna

Front Royal, Virginia

U.S.A.

This report was posted on Ripoff Report on 03/10/2008 07:30 AM and is a permanent record located here: https://www.ripoffreport.com/reports/bbt/winston-salem-north-carolina-27101/bbt-branch-banking-trust-unfair-yet-severe-overdraft-fees-never-informed-of-drastic-316394. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#10 Consumer Suggestion

I got my money back!

AUTHOR: Sam - (U.S.A.)

SUBMITTED: Friday, May 29, 2009

The system deducted and didn't release the funds i transfered into savings, which means it was a system error.

I got my money back today, and the documented proof to go with it.

#9 Consumer Comment

I understand your frustration

AUTHOR: Ashley - (U.S.A.)

SUBMITTED: Friday, May 29, 2009

but you keep referring to ATM reciepts and online accounting. Neither one of those systems is accurate for tracking your account.

The only was to see for sure what is happening with your account is to request, in writing, from the bank a statement of all the transactions on your account for the time period you are talking about.

Then you take the statement in and ask the bank to explain all the charges. If they cannot explain the charges on the written statement then they will have no choice than to remove them.

#8 Consumer Suggestion

ashley

AUTHOR: Sam - (U.S.A.)

SUBMITTED: Thursday, May 28, 2009

I have the atm receipt that says i was in the positive, and not that this matters but two other transactions posted too so if I was actually in the negative I would have gotten NFS on those too.

While I understand what you mean, please understand I'm frustrated. I feel like I'm screaming into a vacuum when I say my records on my register were all accounted for and positive, each transaction scratched off as I verified each transaction on the online balance, which was also positive.

However if I hadn't gone to the atm to get cash, and saw the low balance and hadn't verified it on the online system, what would have happened? I do use the online system because I want to know when things posts, when they cleared my account so I can stay up to date.

This is something that's clearly the banks error, and they are denying there's a problem. Hell, they even said I was negative even more, but clearly I wasn't.

#7 Consumer Comment

I did read it

AUTHOR: Ashley - (U.S.A.)

SUBMITTED: Thursday, May 28, 2009

You keep referring to ONLINE ACCOUNT BALANCE

This system is completely unreliable and inaccurate. You have 60 days to disputer your account. That's plenty of time to get your bank statement and challenge it. I guarantee that once you look at your real printed bank statement you will see what you have missed. Banks don't "make up" charges and apply them to accounts. They wouldn't stay in business very long that way.

As it was, I am trying to give you a SUGGESTION on what to do. Get your final bank statement for the time period you are talking about. Go to your local branch. Sit down with the branch manage and have them go over your statement with you and explain what has happened. This is how you get your money back if there is an error on their part. ranting on a website does nothing to get your 70$ back. Go do something constructive about it.

#6 Consumer Comment

ashley

AUTHOR: Sam - (U.S.A.)

SUBMITTED: Wednesday, May 27, 2009

1. The printed statement comes once a month, so in your wise opinion, I should wait 30 days and then have them walk me through it? Unless I'm mistaken, I only have a small time frame to file my dispute, and $70 isn't anything to just brush off.

2. If you had read my post (go back and read it again-out loud if you have to) you would see a DETAILED walk through of what happened. Nothing was missed.

3. How, oh how, can I STILL BE IN THE POSITIVE AND OCCUR A NFS? Positive $40 in my account, not negative, POSITIVE as in I have $40 in my account. However in the explanation I was given I was TOLD IN WRITING my account was actually negative -$191.

Not that it's any of your business, but I checked my balance again, and I have over $800 in the account and nowhere does the math add up to -$191. I checked my account Saturday, Sunday, Monday, Tuesday and yes, even today! At no time was it ever -$191, or even in the negative.

Instead of being so flippant in your responses, how about you actually read the posts. I have and for the ones who are being charged because they actually did try to float a check, they're stupid for doing it. It's a risk whether you admit it or not, but I didn't do this, and BB&T is refusing to correct their error, hence I'm letting people know about it.

Businesses that practice this way ought not to be rewarded.

#5 Consumer Comment

This again?

AUTHOR: Ashley - (U.S.A.)

SUBMITTED: Wednesday, May 27, 2009

In modern america, when you spend money you need to assume it is taken from yuor account that second. You cannot deposit money later to cover it. If you made debit card transactions before your deposit hit the bank, then they will process those transactions first. It doesn't matter how big the debit's are, the 35$ fee is the same for any size transaction.

Next time use a check register.

As to the guy above, just go to the bank with your PRINTED STATEMENT they mail yuo after everything has cleared and have them explain it to you. I'm sure you missed something.

#4 Consumer Comment

let's practice active capitalism, shall we?

AUTHOR: Sam - (U.S.A.)

SUBMITTED: Wednesday, May 27, 2009

First chance you get, open a new account and set up your direct deposit to go in there. Second, close your account with BB&T. How is that active capitalism? You're voting with your money who you want to do business with. No money in the BB&T account means BB&T can't have it anymore!!!

As for some toads here who croak out the 'I love BB&T'-you still can't explain how someone who is in the positive can still be charged an overdraft fee.

$500-$300(to savings)=$200.

$200-$56 (insurance) and $7 (grocery store)=What?

A.) $137 B.) $67 C.) -$191

The correct answer is A.) $137, however my bank balance (still in the positive) said B.) $67 and the thorough explanation (which changed from representative to representative) said C.) -$191.

Someone has been drinking the company hooch and sniffing out of the nose candy dish!

#3 Consumer Comment

Steve works for BB&T

AUTHOR: Andy - (U.S.A.)

SUBMITTED: Sunday, March 22, 2009

Please ignore Steve's comments. Go through a bunch of complaints on this website and you will see Steve vigorously defending BB&T. I have never seen someone spend so much time on a consumer website defending one particular company and claim to have no vested interest. The problem is BB&T resequences credits and debits and create artificial overdrafts. If you consent to one overdraft, you better check how many transactions you made prior to that, because you might end up with several overdrafts.

#2 Consumer Suggestion

Donna, READ your funds availability agreement.

AUTHOR: Steve - (U.S.A.)

SUBMITTED: Monday, March 10, 2008

Donna,

Unfortunately, John is 100% correct. There is no ripoff here.

You spent money that was not actually posted to, and available in your account PRIOR to you making the debit transactions.

Regardless of what time during the day any transaction occurs, it is common practice at MOST banks to post checks/charges before deposits/credits.

You were riding the float and got bit. An expensive education, but no rip off.

You should learn how to more accurately and effectively manage your account, and be sure to keep an accurate checkbook register.

Here is a helpful hint to avoid this situation in the future. When you make a deposit either in person or via direct deposit, wait for it to post as available BEFORE writing it in your checkbook register. Just file the deposit reciept in your checkbook register until the time is right.

Another helpful hint. CARRY SOME CASH for small purchases like the little $3 debit transaction that put you over the edge here. Making multiple small debit card transactions is a very bad habit to get in to. Very foolish.

#1 Consumer Comment

It was an error

AUTHOR: John - (U.S.A.)

SUBMITTED: Monday, March 10, 2008

on your part for spending money you did not have. Trying to ride the float bit you in the butt.

Advertisers above have met our

strict standards for business conduct.