Complaint Review: Santander Consumer USA - Fort Worth Texas

- Santander Consumer USA Po Box 961263 Fort Worth, Texas United States

- Phone: (888) 276-7602

- Web: Santanderconsumerusa.com

- Category: Car Financing

Santander Consumer USA They financed and said in 6 months will lower the interest rate wich was high 18%. So they never did refinanced my loan. Fort Worth Texas

*Consumer Comment: The lender can't refi your loan - only you can do that

*Consumer Comment: Alexei i’m going to Try to help you regarding your report that you posted

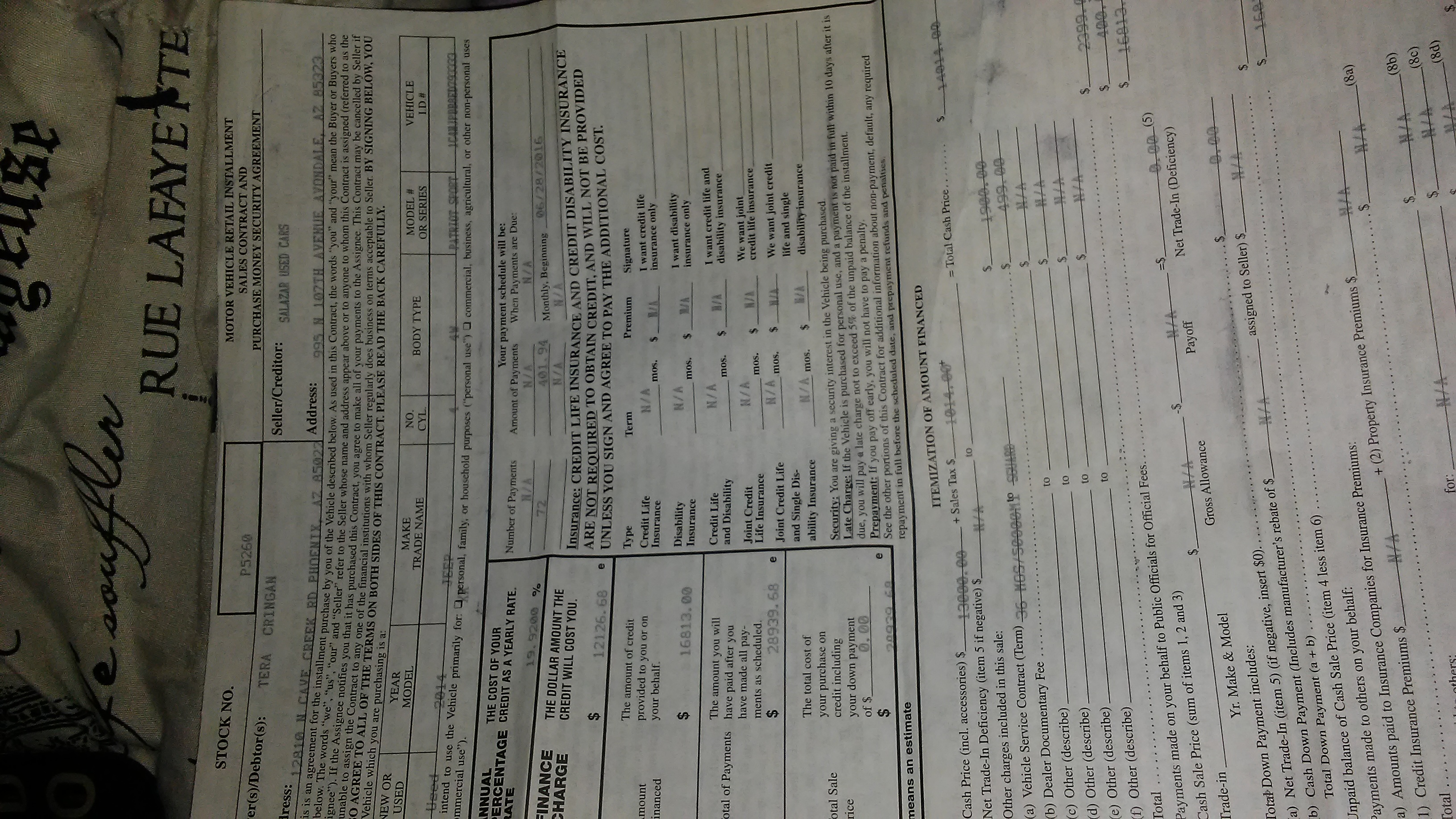

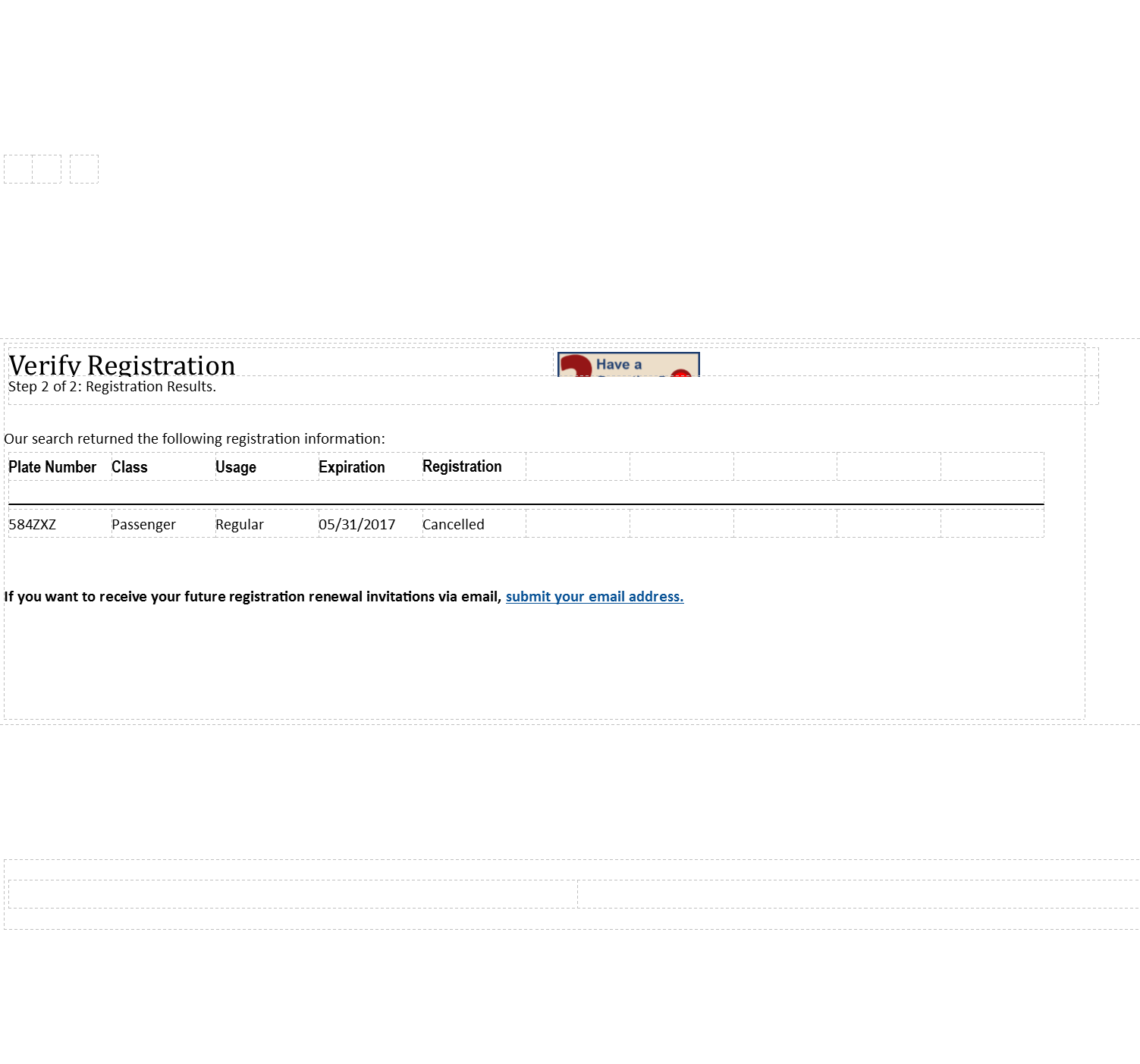

I think they are working together with the Dealer where i purchased my vehicle. They lied to me and charged 3000$ extra, when i realized that was late.

They just push people to get this loans and i was the next victim of this dirty business.

This report was posted on Ripoff Report on 11/30/2017 09:47 PM and is a permanent record located here: https://www.ripoffreport.com/reports/santander-consumer-usa/fort-worth-texas-76161/santander-consumer-usa-they-financed-and-said-in-6-months-will-lower-the-interest-rate-wi-1414436. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#2 Consumer Comment

The lender can't refi your loan - only you can do that

AUTHOR: FloridaNative - (United States)

SUBMITTED: Friday, December 01, 2017

It sounds like you had a very bad experience in the finance office of the dealership where you purchased your vehicle. The finance person makes a commission by adding in high profit items to your contract. Those items are things such as extended warranties, GAP insurance and other items. It is on us, as consumers, to read the contract before we sign. If you don't want those items, just have the finance person remove them. It's not as easy as it sounds because the finance person's income is directly impacted with every removal (or addition) of these items. The finance person is not your friend. They are there to make money for the dealership and themselves, that why you have to check and double check before you sign anything.

The line about "you can refi in 6 months" is an old line that many of those finance people use when charging you high interest. The only person that can refi is you and usually the car is upside down in value due to the high interest rate making it difficult to refi without bringing in substantial funds to get it to a refinanceable level (LTV). Please do some research on refinacing. You are far better off getting rid of Santander and going with a credit union - better rate and better payments.

#1 Consumer Comment

Alexei i’m going to Try to help you regarding your report that you posted

AUTHOR: Consumer - (United States)

SUBMITTED: Friday, December 01, 2017

Alexei i’m going to try to help you out with your issue that you have regarding refinancing I don’t know who told you that they would get your financing refinanced can you tell me that ? Who told you that they would refinance your loan was it somebody from the dealership ?

It’s common practice for a finance manager at a dealership tell you to take this loan and in six months will get you refinanced most of the time that is not true. Let me explain why. If they get you to sign a contract at 18% interest and they get you bought at let’s say 10% interest that means there’s an eight point spread. In other words the difference between the 18% and the 10% would go to the dealership.

That’s called backend profit for the dealership. I’m going to see what I can do to help you out. But you have to stay focused on trading your credit situation into a new direction. That is your job and you need to stay on top of it every day. That’s not the dealerships job and that’s not the finance companies job that’s your job and I expect you to stay on top of that.

If you have a Bank account that you had for any length of time stay with it do not give it up. The longer you stay doing business with any particular bank of your choice you have a long history of a credit trail. A lot of people move from bank to bank to another bank just because of a commercial stay with the current bank that you have do not go anywhere longer you stay with them like I said earlier The more credit history you develop and a better relationship you develop with the bank. Do not use your bank account as a temporary piggy bank

Try to always put more money into your bank account and leave it there. What you were doing is showing the bank that you’re learning to be responsible with your money and you want a substantial savings account money that you put in there and you leave it alone. I know that’s hard when Christmas comes but you know what having better credit is more important Christmas

Most the time people go into financial trouble because of Christmas I don’t believe in doing that.

I’m going to see what I can do to help you but you have to be truthful to yourself about putting your credit in a very priority situation

Advertisers above have met our

strict standards for business conduct.