Complaint Review: Santander Consumer USA - Fort Worth TX

- Santander Consumer USA P.O. Box 961245 Fort Worth, TX United States

- Phone:

- Web: https://santanderconsumerusa.com

- Category: Car Financing

Santander Consumer USA Santander, Santander USA Won't allow payments to principal Fort Worth TX Texas

*Consumer Comment: Perspective

*Author of original report: Good Advice

*Consumer Comment: There is a work around for this type of issue

listed on other sites?

Those sites steal

Ripoff Report's

content.

We can get those

removed for you!

Find out more here.

Ripoff Report

willing to make a

commitment to

customer satisfaction

Click here now..

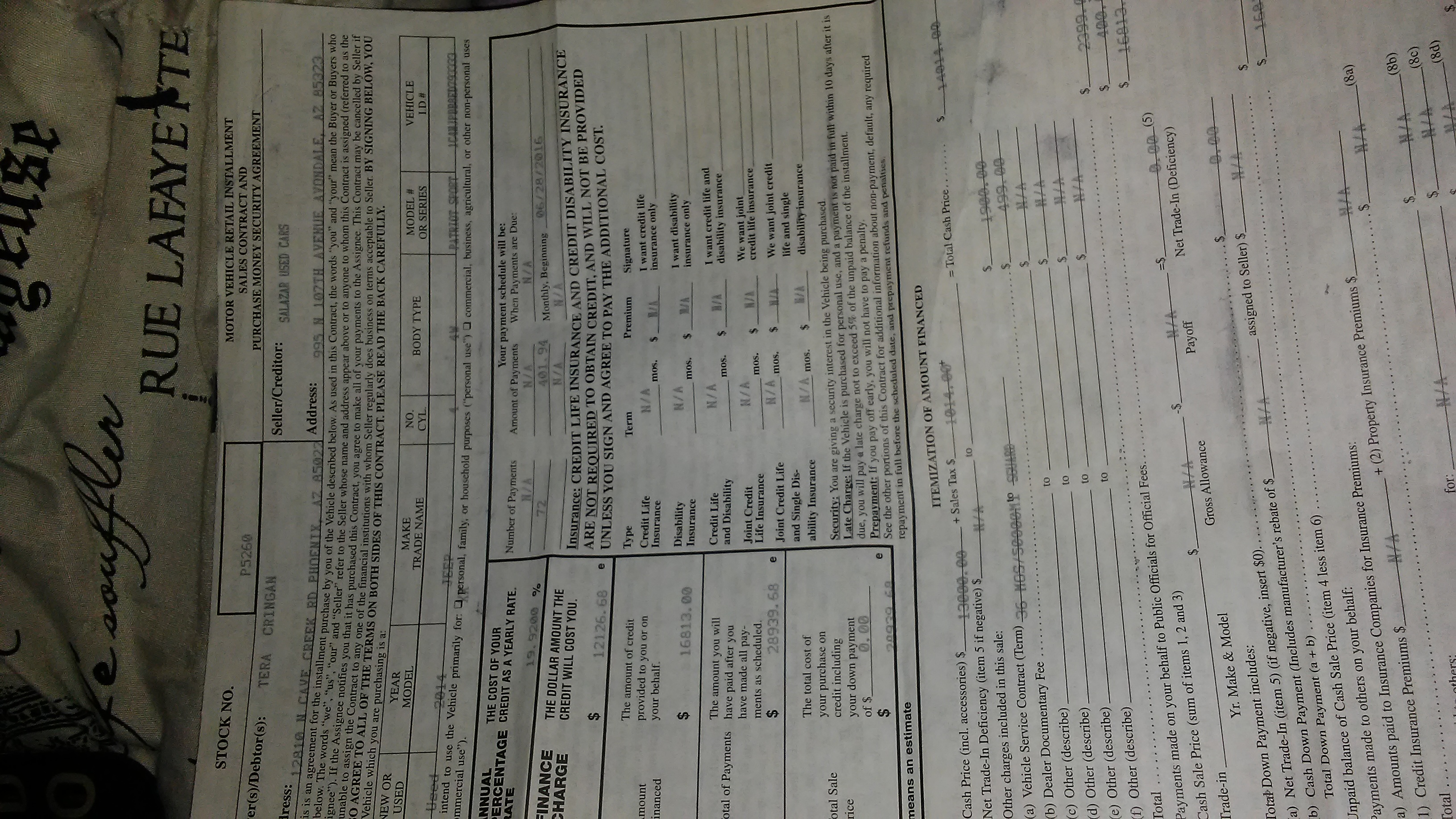

At the time I purchased my auto I had no credit history but was able to get financing through Santander Consumer USA at 25% interest rate. I was told by the dealer that I could refinance in about a year. That was untrue because now I'm upside down in the loan. I contacted Santander to see about making extra monthly payments toward the principal only and was told that they don't accept those type of payments. Any additional payment would be applied toward a monthly payment. I also asked why my principal and interest payments fluctuated so wildly each month and was told it was due to the current interest rate. I feel deceived by both the dealer and Santander and I am totally frustrated by the fact that I can't even pay down my principal early. These people are predators.

This report was posted on Ripoff Report on 06/12/2018 10:27 AM and is a permanent record located here: https://www.ripoffreport.com/reports/santander-consumer-usa/fort-worth-tx-76161/santander-consumer-usa-santander-santander-usa-wont-allow-payments-to-principal-fort-wor-1447138. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#3 Consumer Comment

Perspective

AUTHOR: Robert - (United States)

SUBMITTED: Wednesday, June 13, 2018

The above comment could be good in some situations, but may not be the best in all situations. So while it may be well intentioned it may not be the best solution financially, especially if this would take you more than a month or two to build up your savings.

Your auto loan is accruing interest at a high rate of 25%, the best you will be able to get in a regular savings account is 1-2% on a much lower balance. So depending on your balance this could be costing you a sigificant amount of money every month in interest, that by the time you are able to refiance..you actually wouldn't be better off in the end.

You need to review your contract to deterime what type of loan you have. Most likely you have a Simple Interest loan. If that is the case the more you pay off the less interest you pay. So regardless of how they allocate the payment your principal would be going down, and you would get to this same "equality" point to be able to refinance it. The only thing if they refuse to allow a principal only payment is to continue to make the scheduled payment every month even if they say that no payment is required due to your pre-payment. If you have Auto-Pay you may need to still make a manual payment in this case.

Now, as I said it is important to review the loan contract. As if you have a different type of loan, or a pre-payment penalty then neither of these methods would work in the long run. I would also suggest not relying on them telling you that they don't accept principal only payments, I would look in the contract to see what it states about excess payments.

Good Luck

#2 Author of original report

Good Advice

AUTHOR: Kathleen - (United States)

SUBMITTED: Tuesday, June 12, 2018

That's good advice, thank you. Lessons learned. now time to clean up the mess.

#1 Consumer Comment

There is a work around for this type of issue

AUTHOR: FloridaNative - (United States)

SUBMITTED: Tuesday, June 12, 2018

I am a consumer and have nothing to do with Santander at all.

To work around this issue, take the funds you were going to use to pay extra toward your principal balance and put them in your savings account. Continue to pay your car loan on time each and every month. Track the value of your vehicle by using the various vehicle valuation websites. Once you have enough savings to pay the difference, go to a credit union and refinance your current vehicle loan. Be prepared to pay down extra to meet the difference between the new amount financed and the old amount that needs to be paid off. That is where your savings will be handy.

By the way, the line used with you (come back in a year to refi) is one of the oldest lines around used by car dealers everywhere. They know you can't refi out of the deal unless you had put down a very large down payment or have extra cash to put down at the time of the refi. Besides that, car sales reps don't refi car loans, they trade you out from the old into a newer vehicle and that is one of the ways to make a bad situation worse.

The best thing to do is to refi with a credit union as soon as you can do so. Good Luck.

Advertisers above have met our

strict standards for business conduct.