Complaint Review: Santander consumer usa - Fort worth Texas

- Santander consumer usa P.O. Box 961 Fort worth , Texas USA

- Phone:

- Web:

- Category: Banks

Santander consumer usa Vehicle loan Fort worth Texas

*Consumer Comment: Your situation..

*Author of original report: Once again

*Consumer Comment: You Can't Pull That Here!

*Author of original report: Idiot

*Consumer Comment: Here's Why!

Santander has to be the worst bank and rip off you can ever bank with . My car was being paid off by geico and gap insurance leaving remaining balance of 4180 for me to pay . Because they added so much interest and fees on my loan while the car was no longer in my possession . How can you charge and tack fees on a car no longer existing . I wrote a letter to the president of the company Jason klaus in which he did nothing . All the customer service and supervisors all were extremely rude and said they couldn't help . This is ridiculous and this bank needs to be shut down . Not fair to any customer .

This report was posted on Ripoff Report on 01/02/2015 10:59 AM and is a permanent record located here: https://www.ripoffreport.com/reports/santander-consumer-usa/fort-worth-texas-76161/santander-consumer-usa-vehicle-loan-fort-worth-texas-1198924. The posting time indicated is Arizona local time. Arizona does not observe daylight savings so the post time may be Mountain or Pacific depending on the time of year. Ripoff Report has an exclusive license to this report. It may not be copied without the written permission of Ripoff Report. READ: Foreign websites steal our content

If you would like to see more Rip-off Reports on this company/individual, search here:

#5 Consumer Comment

Your situation..

AUTHOR: Robert - ()

SUBMITTED: Wednesday, January 07, 2015

It is always amazing how when someone complains about what they think is a RipOff that when they read facts that they don't agree with all of the sudden one of the standard defaults is to go to the "You don't know my situation".

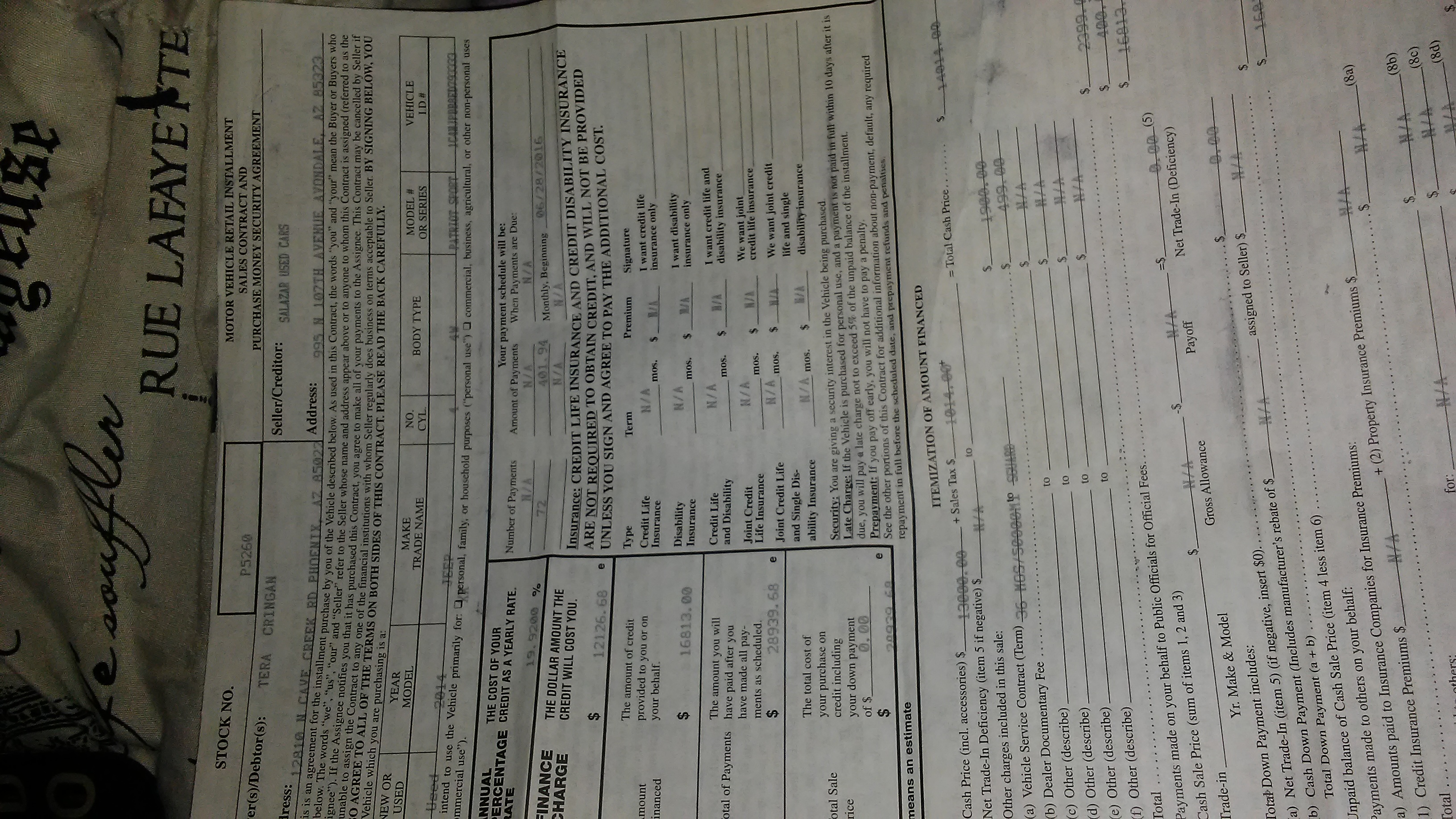

If the ONLY reason(per your update) you are claiming fraud is because you claim you didn't know you still had to pay for a car you didn't have, your claim is the one that is fradulent. As when you signed your original loan agreement there were terms in there that in effect say that you are responsible for the loan payments even if you no longer have posession of the car. The fact that you failed to read what you were signing is NOT fraud.

Taking out any insurance. Do you really think that if your car just disappeared one day either by theft, accident, or aliens that you wouldn't be required to continue paying on the car? Of course not..you would still owe the payments. So this is NO different. Perhaps your complaint should be against Geico or the GAP insurance company for taking 4 months to pay it off.

But just based on what you have posted and your "situation", it isn't just this time lapse causing the balance. If it was just these 4 late payments unless you have a huge monthly payment you are not going to get to a balance of over $4,000. You have apparently had at least two deferrments and probably while you don't admit it a few other late payments.

So what you will also find is that the gap insurance will ONLY pay based on you making your payments on-time. So again if for a simple example you had a remaining balance before gap of $10,000 but that includes 1 late fee of $50 gap will only pay off $9,950...leaving you to pay the remaining $50.

I really just hope that this "attorney" you have looking at it is a relative or friend who isn't charging you. Because if they are I can imagine that as soon as you find out you have no claim that you will be posting a RipOff report on the attorney as well.

#4 Consumer Comment

You Can't Pull That Here!

AUTHOR: Jim - ()

SUBMITTED: Friday, January 02, 2015

Yes, Carmax does offer this SUBPRIME LENDER as ONE of their lenders. They also offer a major bank or two which will finance people of good credit with much lower interest rates. I guess you requested a subprime lender because you are so generous! You say you pay on-time. Then the NEXT sentence you say you were late and had these deferred payments. I guess that never happened that way either, right? Although you may not like what I say, there is no fraud here. Either the insurance company plus the gap insurance did not pay the contracted amount because of limitations in their policies which you agreed to or most likely, as I said earlier, you've generated the extra amounts due to late fees, extra earned interest, fees related to collections etc. Of course, if you have this credit score of 9,999,999 then contact an attorney who would have no problem representing you on a contingent basis because as you claim they are nothing but pure fraud. You won't do that...because you can't!

#3 Author of original report

Once again

AUTHOR: Nikki - ()

SUBMITTED: Friday, January 02, 2015

you might know a thing or two about Finance and Santander but you don't on my situation . Why I said they are fraud was because they were charging me monthly payments on a car I didn't have . And interest on that . I wasn't informed I was supposed to still make payments after my car wasmy no longer in my possession for four months while geico and gap handled their portion . Makes no sense to pay for something I didn't have . So once again it's fraud and I do have an attorney working on it . Thanks ;)

#2 Author of original report

Idiot

AUTHOR: Nikki - ()

SUBMITTED: Friday, January 02, 2015

I made all my payments on time first off . And the deferred payment happend twice and they offered it to me . Second I have good credit it was the bank that Carmax works with . So before you open your mouth know wtf your talking about :)

#1 Consumer Comment

Here's Why!

AUTHOR: Jim - ()

SUBMITTED: Friday, January 02, 2015

This company is a SUBPRIME (deadbeat) lender which you were PLACED with because no bank wanted to do business with you because you gave yourself a reputation of NOT paying your bills on time. Their interest rate is high because many of their SUBPRIME BORROWERS never grow up, never take on responsibility and continue to pay late or not at all. You say there's an additional $4600 owed and your premise is out of the clear blue sky they just picked on you. Anytime a deadbeat borrower is late making payments or gets multiple deferments that same borrower causes the interest clock to continue to run thus earning more interest and late fees. Judging from the amount, over $4000 you have been late repeatedly. There's no fraud or deception here. Just another SUBPRIME BORROWER who simply won't learn to make payments on time. And oh yes, the payments on the contract continue until the contractual amount is fully satisfied.

Let me save you the effort...don't bother with the "you must work for them" song and dance...because I don't!

Advertisers above have met our

strict standards for business conduct.